Risk aversion comes back to financial markets

Please login to join discussion

Asian markets have taken their cue from the previous US trading session and turned heavily into the red on Thursday. Technology related stocks continue to bleed lower, and this was very evident with Nasdaq and S&P500 futures at things stand.

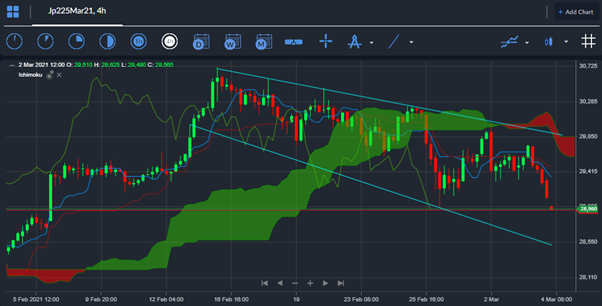

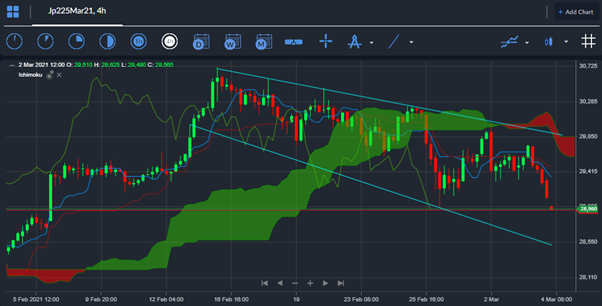

Hong Kong’s Hang Seng index traded down by over -2% during the Asian session, while the Nikkei 225 is suffering similar losses intraday. Chinese stocks are also taking a big beating, and this is best highlighted by the Chinese CSI 300, which has traded down by around -3% this morning.

US stocks started to turn in the red yesterday, following the weak ADP jobs report from the US economy, and a rise in US bond yields. FED Chair Jerome Powell is speaking later today, and he may well need to jawbone US yields lower to ease market fears, which are starting to spiral out of control.

The Australian dollar has been a big mover during the Asian session and has managed to buck the trend of US dollar strength, which has been so prevalent since Wednesday’s US trading session.

Better-than-expected trade surplus data painted an extremely bullish picture of the Australian economy. The Australian economy officially posted its largest ever trade surplus for the month of January, send the Aussie higher. This was the result of a major resource export boom.

A number of commodities prevalent in Australia have risen sharply in value since January, when the trade balance was taken. This is very bullish for the Australian economy, as markets are forward looking, hence why the Aussie is rising today.

The US dollar index is notably stronger against the euro, pound, yen, and Canadian dollar. Oil and gold are both consolidating around the lows of the trading session, following the big move lower in stocks.

Oil traders are waiting for the upshot of the OPEC meeting later today. The call between Saudi Arabia and Russia could very well set the overall trend for oil markets in the months to come.

Bitcoin has lost close to $3,000 from the highs of the day, as its implied correlation between US tech stocks starts to pick-up. This is noteworthy as the top crypto has been decoupling from broader financial market since the US election last year.

Data Watch

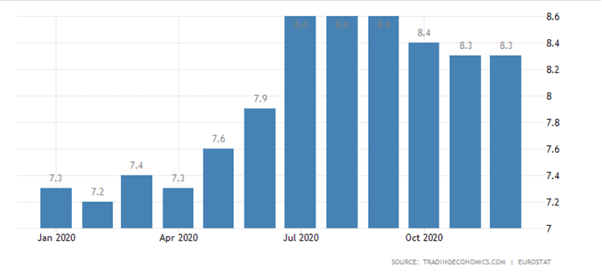

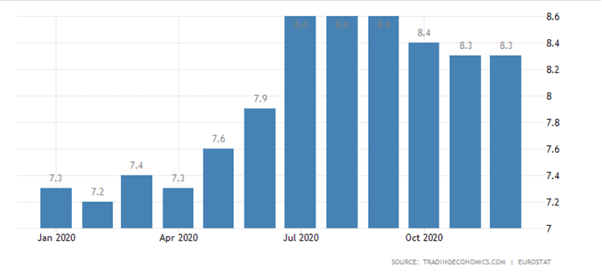

The economic calendar during the European session is once again very busy, with the ECB monthly bulletin, eurozone retail sales and the official eurozone unemployment rate all set to be released this morning. The UK Construction PMI is also set for release, and the much-awaited OPEC meeting is also due in the EU session.

Moving into the US session, weekly jobs data and a scheduled speech from FED Chair Powell are the main market movers. Market sentiment is very fragile so Chair Powell will need to tread very carefully not to exacerbate the ongoing tantrum in the bond market.

It is also noteworthy that the release of the US monthly jobs report is also set for tomorrow. Watch out for plenty of volatility going into the main, especially with Chair Powell in the mix today.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |