Market Wrap

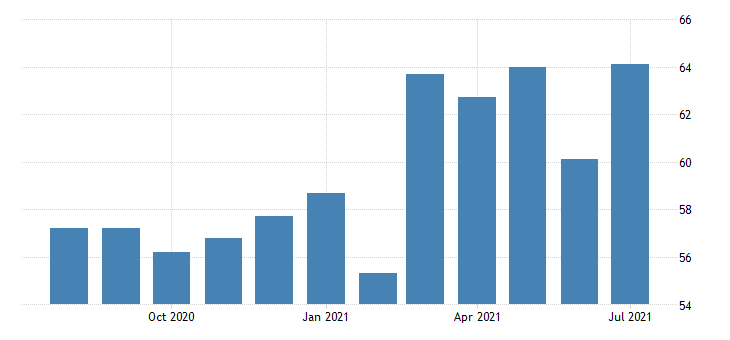

The US ISM non-Manufacturing PMI for July beat expectations of 60.5 and came in higher than the highest guestimate of those analysts that were surveyed. In July, the Services PMI registered a 4%-point increase coming in at 64.1. This is the highest reading since the inception of the Services PMI in 2008 and indicates the services sector has grown for 14 consecutive months.

The final Business Activity Index printed 59.9 in July, though that was above the expectations and previous reading. The release noted that inflationary pressures in the US have eased but still remained “historically strong.”

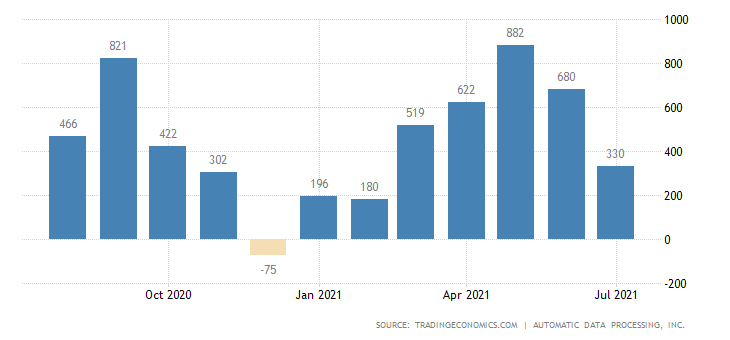

The ADP national employment report showed the number of jobs in the US private sector rose by 330,000 in July, coming in almost half of what was expected and really disappointing the markets.

Commenting on the data, ADP chief economist Nela Richardson said that “the labour market recovery continues to exhibit uneven progress, but progress nonetheless.” Richardson added that “bottlenecks in hiring continue to hold back stronger gains, particularly in light of new COVID-19 concerns tied to viral variants.”

Fed Clarida who has a vote within the FOMC said today after the ADP number that he can certainly see the Fed announcing tapering later this year and would support announcing a moderation in asset purchases in 2021. He then went on to parrot Fed Chair Powell saying the economy has made progress toward goals since setting a substantial further progress bar for tapering of asset purchases. His personal view is core inflation hits 3% this year, and that he would consider it much more than a moderate overshoot of the Fed’s goal.

See real-time quotes provided by our partner.

The US EIA weekly crude stocks came in higher than expectations with a build rather than a draw, which would be seen as dovish for the WTI contract. There was however a larger draw than expected on gasoline, indicating driving season is here as expected which is seasonally good news. The oil chart is now at a 10-day low and is clearly extending losses looking to test the recent daily swing low and perhaps the daily 200 ema. The rising infections of the Delta variant of the COVID-19 in America and China is going to weigh on demand and put pressure on energy prices. However, the drop in oil is being pushed harder by the rise in the US dollar which in the following chart shows that the daily 20 ema is capping the greenback.

See real-time quotes provided by our partner.

The better-than-expected PMI data today was the catalyst for a higher US dollar along with the Hawkish tones from Fed’s Clarida. These daily ema’s are trapping the price action so far and a close above or below either the 20 or 50 daily ema would be my next directional signal. If the US dollar goes higher, $92.50-$92.80 looks like the resistance that could halt further rises. If we close lower than the 50 ema, $90 is back on the cards. Friday’s NFP is likely to be the deciding factor.

See real-time quotes provided by our partner.

I wrote a piece today on the power of the Initial Balance range breakout and I am happy to say that the target was met, which if nothing else gives me some hope that higher prices are still possible. The fact that we’re still withing a larger range makes me more cautious ahead of the next set of Tier-1 data as a big disappointment could reveal this trading range to be a distribution pattern, with some targets below which would include 14,500 to 14,000.

See real-time quotes provided by our partner.

Tomorrow is a big day for the British pound as we receive the latest monetary policy decisions from the Bank of England.

A reading of 64% bearish on the ActivTrader sentiment indicator makes me think that cable rises tomorrow, if only to squeeze these traders out of their short positions. If the BoE are not as Hawkish as the market is expecting, we could see a longer-term lower price correction for GBPUSD, but a lot depends on the price action of the US dollar too.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |