Market Wrap

See real-time quotes provided by our partner.

Following on from the US scheduled economic release around inflation today, the precious metals markets surged higher. Looking at an intraday chart, there is a negative divergence occurring on the RSI versus the price action, which has made a higher high, so I will be watching for a possible reversal. This would assume that the retail traders have been sucked into a long trade and trapping them. However, if there is not a sharp reversal in the coming sessions, I will have to concede that there is a possibility that precious metals are going higher as inflation is likely to stay higher for longer and traders use precious metals as an inflation hedge at times.

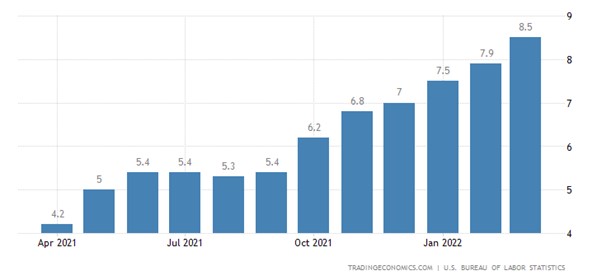

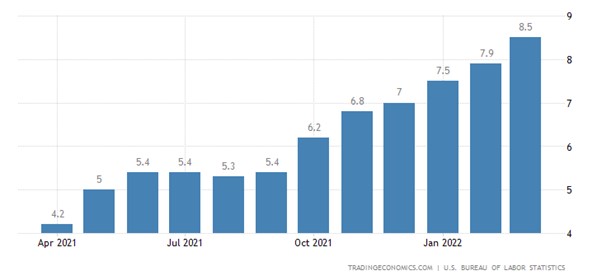

The annual CPI figure from the United States reached a new record high of 8.5% before seasonal adjustment, according to the Bureau of Labour Statistics. The monthly inflation hit market estimates at 1.2%. The largest contributors to inflation were increases in gasoline, shelter, and food prices. The price of energy increased by 11% last month, bringing the annual inflation rate to its highest level since December 1981. Monthly Core inflation came in under market expectations which are the first positive for people worried about inflation and this could be down to the drop in energy prices since the Ukraine invasion spike.

See real-time quotes provided by our partner.

Brent spiked higher earlier today and has reached into a daily low, resistance level, that I have been monitoring. The intraday RSI is also over bought, so now I am looking for an intraday reversal pattern for a move back to the $100 level.

The Organization of the Petroleum Exporting Countries (OPEC) came out with a report detailing the global growth forecast for crude demand will be less by 0.5 million barrels per day (bpd) at 3.7 million bpd compared to its previous update. Less demand should also help prices of energy come down, especially as there is now an SPR release scheduled for the rest of the year.

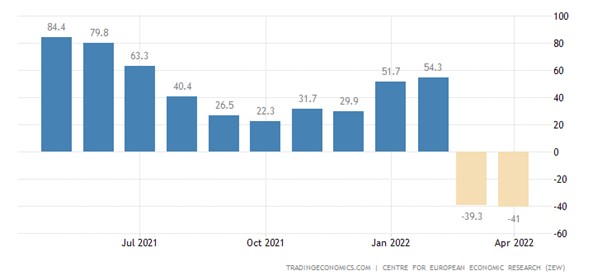

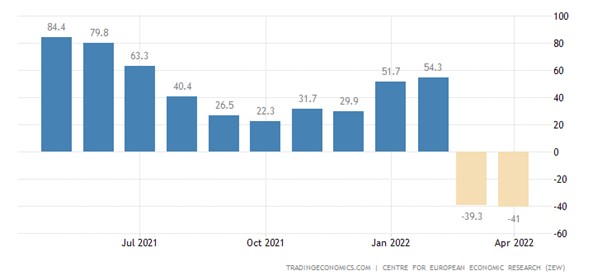

According to the ZEW economic sentiment index, Germany’s economic performance worsened further in April compared with March, with the key index declining less than expected to -41 points. The economic outlook for the next six months remains pessimistic with experts predicting it will continue to deteriorate and lead to stagflation. For the same period, the Eurozone survey expectations showed the index tumbled to -43 points, slightly below market estimates.

See real-time quotes provided by our partner.

The EURUSD also found resistance at a previous day’s low price and made a significant rejection move lower at the start of the US session. The US dollar index is holding around 100 and the economic news out of Europe is not supporting the single currency, so I am still expecting to see lower lows in the coming sessions, with a possible pause or reversal ahead of the ECB this week.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |