Nasdaq Weekly Analysis

The regular trading hours today started very much like the London open in the Globex session. With the initial move being a sell off towards yesterday’s lows. There is a feeling that the house of cards that the Nasdaq is built on, doesn’t have very good foundations. The run up to this last 7 days of sideways action was on low volume and price melted up with large day ranges and small consolidations. Should we get below the 15550 level the levels of support are few and far between, with several open gaps in price from the open, occurring on multiple days before at low prices.

It may be a coincidence, but I happened to be looking at the Eurodollar futures just before the US open when the continuous contract suddenly dropped like a rock. Yesterday I was talking about how I was worried about a contagion of bad credit coming over from China. Today we learned that Treasury Secretary Yellen sent a letter to the US House of Representatives. In the letter it states that:

After the debt limit was reinstated on August 1, Treasury began employing certain extraordinary measures to continue to finance the government on a temporary basis. These measures, which are authorized by law and have been used in previous debt limit impasses, include a suspension of certain investments in the Civil Service Retirement and Disability Fund, the Postal Service Retiree Health Benefits Fund, and the Government Securities Investment Fund of the Federal Employees’ Retirement System Thrift Savings Plan. Once all available measures and cash on hand are fully exhausted, the United States of America would be unable to meet its obligations for the first time in our history.

This means that within the next couple of months the US may default on its liabilities. There is no reason for it to do so as the debt ceiling is a political gesture to supposedly keep spending under control.

See real-time quotes provided by our partner.

The Nasdaq moves fast, and it is hard to keep up with it and write, so I will just describe the price action up until the time of writing. As price arrived at the Globex lows there was enough demand to halt the waterfalling that had occurred straight off the opening bell as traders digested the possibilities of a default. The m5 candles show a couple of bullish engulfing candles and these were the buyers defending the day’s lows. My thoughts on why they would want to do that are:

Turns out it was idea 2.

There is no reason for the US Treasury to default and we have seen the US government shutdown in the past. It is not the end of the world, but it is politically damaging and something President Biden won’t want on his watch. So, assuming that traders are using this “Bad News” to get a better entry, the question becomes where are everyone’s stops?

See real-time quotes provided by our partner.

I always mark-up double bottom chart patterns as I believe retail traders see this as a sign of support and place their stops there. As you can see from the chart above there were a couple of double bottoms formed in the last week of trading and in today’s price action in relation to yesterday’s low. The nearest doble bottom offered no support, so my attention turns to the area further away that formed at the beginning of Septembers trading.

See real-time quotes provided by our partner.

Now that the stops have been run those that are long have a couple of choices to make. Hold on for new all-time highs and the 16,000 level at least. Or cash out at the old support levels which now become resistance.

See real-time quotes provided by our partner.

The trend at the start of the day and at the time of writing is to the upside with the daily 20, 50 and 200 exponential moving averages all pointing higher. Momentum is on the side of the bulls. Daily price action is on the side of the bulls too, as major support is a long way below around 15,200 with a couple of balance areas in-between where we are and the blue horizontal line on the chart. The circle on the daily chart is the June FOMC meeting to highlight that the Nasdaq traders have not been concerned with possible rate hikes, appreciating US dollar prices or possible tapering. They may start to consider that in the future, but the point is that they haven’t noticed a lot of the market commentary around the Fed for a couple of months now.

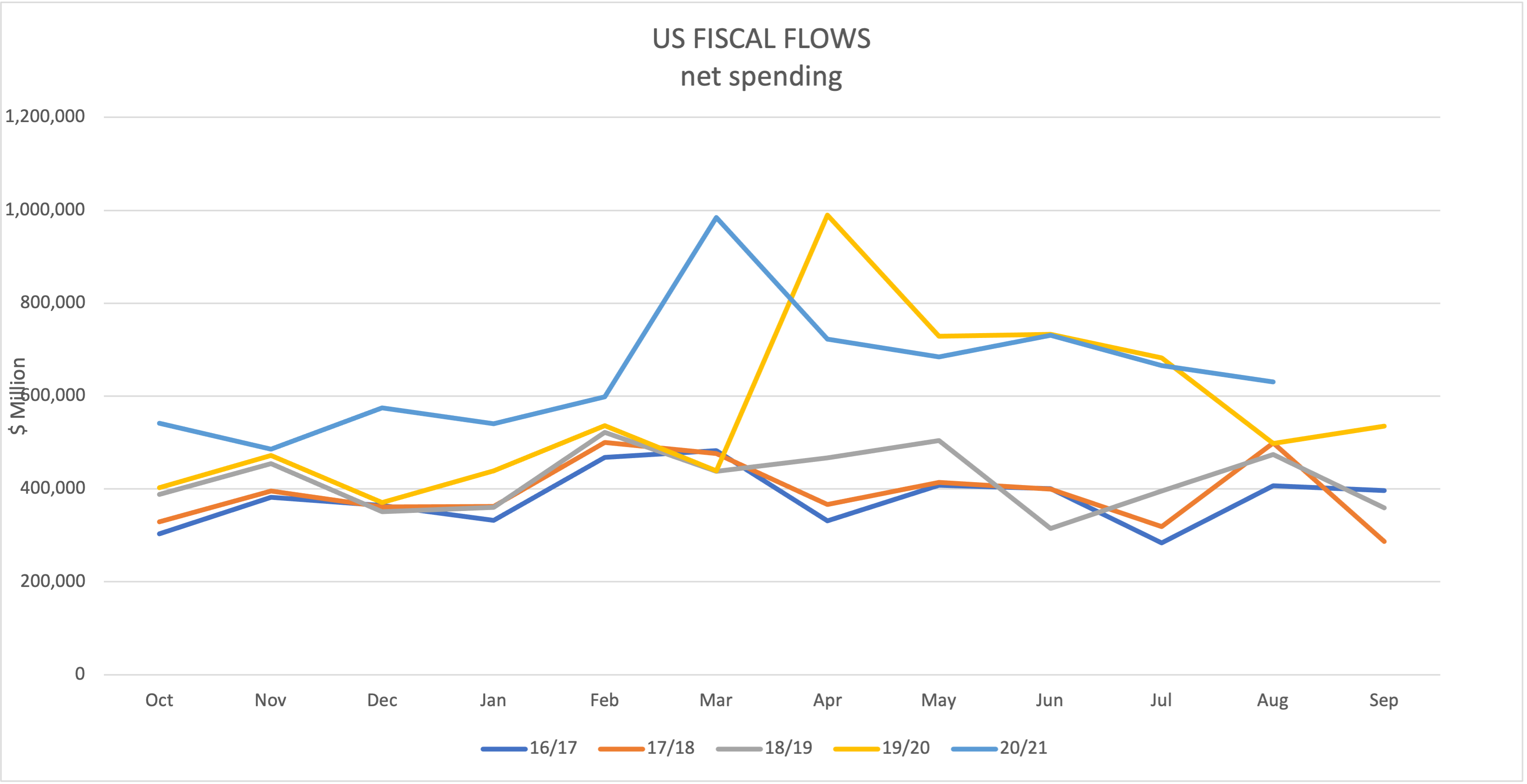

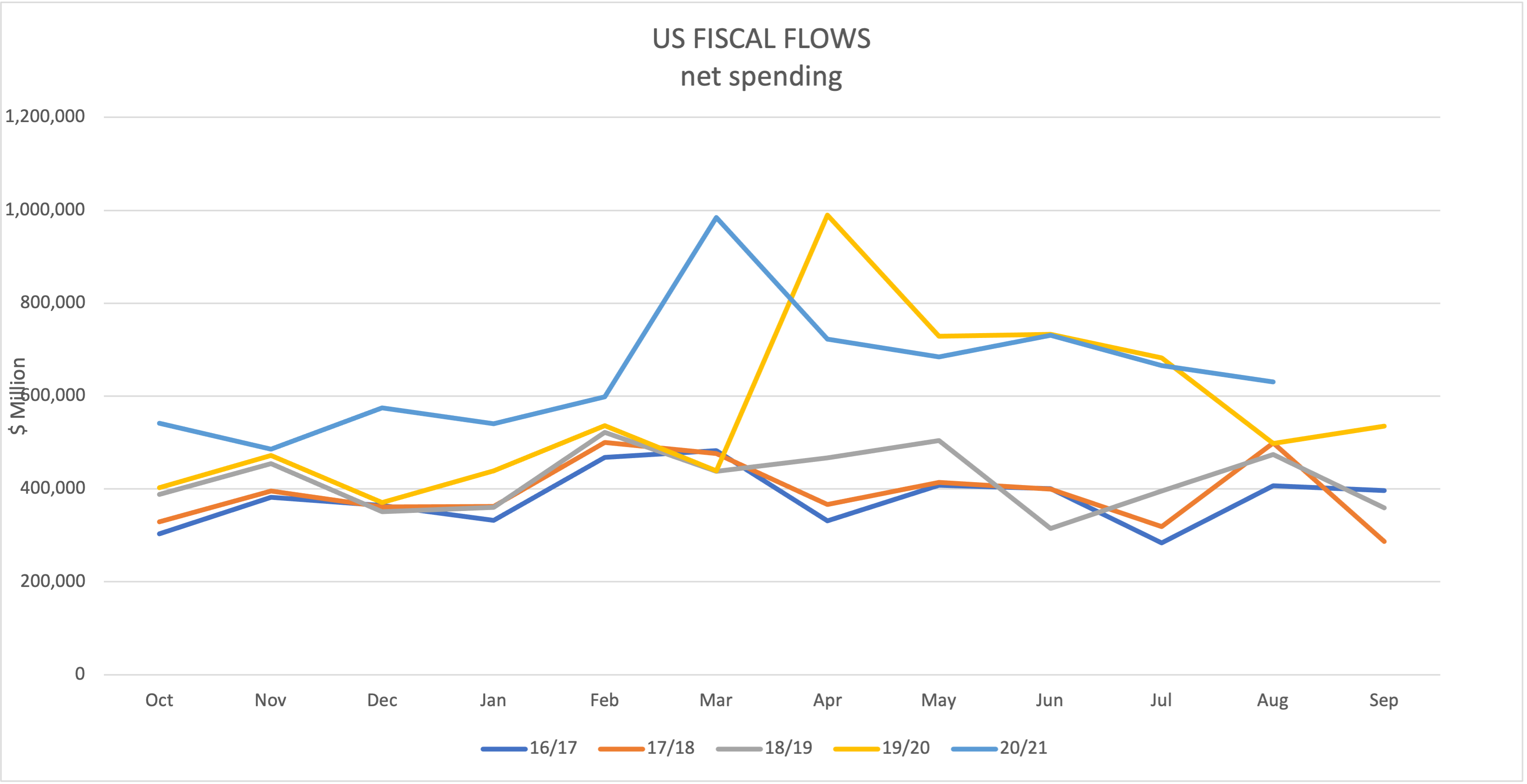

The net fiscal flows from the US Treasury have been elevated and are currently coming in each month around $600billion, which is 50% more than pre-pandemic levels and look likely to be net higher than the actual pandemic response. This money flowing into the US economy will find the Nasdaq traders as it has the S&P500, Dow Jones Industrial Average etc. If the debt ceiling is capped but fiscal spending remains elevated the indices should not falter. If the debt ceiling is capped or reduced and spending comes back down towards $400billion, the indices have a long way back towards the pre-pandemic levels. Why would the fall? Firstly, there would be less money in the system than there is now. Secondly, corporate profits would suffer and any slight miss across most of the corporates would be enough to topple the markets. Whether the Eurodollar futures give us a clue to which way everything is heading remains to be seen, but I will keep my eye on them and include it in my analysis when I work out any relationships developing.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |