Morning Brief: 09/04/2021

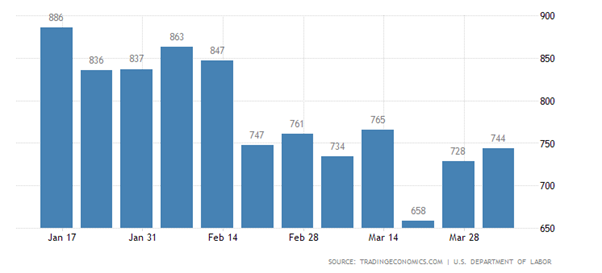

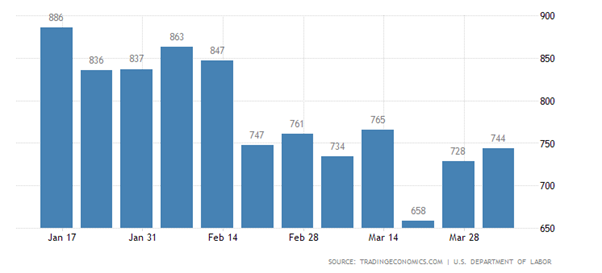

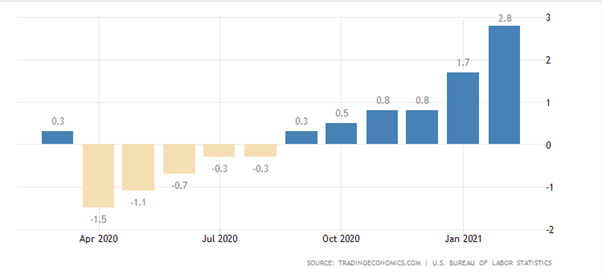

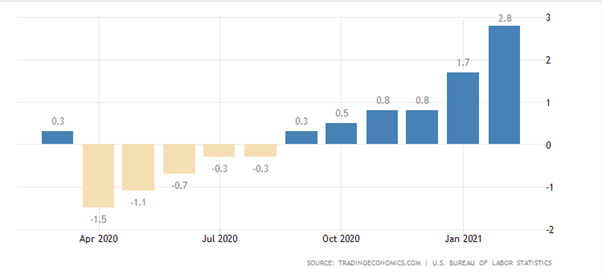

The market tone is mixed on Friday, following a second straight weekly increase in US jobless claims on Thursday. Asian stock markets remained choppy going into the weekend, largely because US jobless claims rose to 744,000.

Markets are now trying to factor in that the US jobs market is not as strong as anticipated, following the recent extremely strong ADP, Non-farm payrolls, and JOLTS job openings data points last week.

US Federal Reserve Chair Jerome Powell also signalled on Thursday that the US central bank was far from ready to pullback on supporting the US economy. FED Chair Powell, speaking at an IMF event, noted that economic momentum could stall, and inflation will remain muted.

Traders moved back into technology stocks on Wall Street in reaction to the soft jobs data and the downbeat assessment from Chair Powell. US treasury yields have also been ticking down, while the greenback remains pressured as the European session gets going.

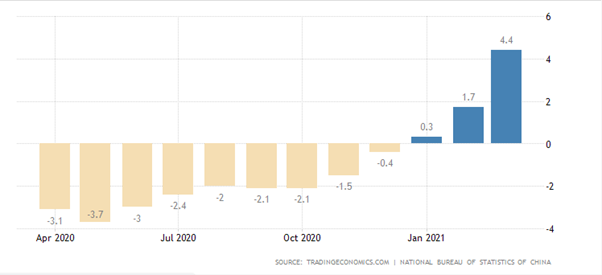

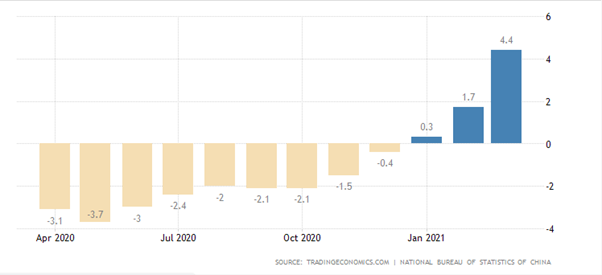

In terms of data releases this morning, China’s PPI came in at 4.4 percent, which was the fastest increase producer price inflation since July 2018. The strong PPI number was seen as an indication that Chinese manufacturing sector is strengthening.

Sticking with the theme of Asia, data today showed that Japan and South Korea are still struggling with COVID-19 infections, however, this has not affected Asian bourses too much, as the Nikkei 225 trades higher, while the KOPSI 200 closed slightly in red.

Gold is on many traders watch list today, after the yellow metal gained close to $20.00 yesterday. The follow through above the March 1st swing-high has so been lacking as bulls and bears battle around the $1,756 level.

Bitcoin has recovered yet again, with the top coin testing towards the February 2021 trading high, around the $58,300 level. Optimism over the coming Coinbase IPO on the Nasdaq is helping to drive buying interest towards the top coin and other cryptos on Friday.

Data Watch

The economic calendar in the European session is United Kingdom centric, as the Bank of England releases its Quarterly Bulletin report, and the release of Rightmove house price data. These releases are typically not considered to be major market movers.

During the United States trading session the release of the March US Producer Price Index headlines the US economic calendar. A 0.2 percent monthly increase is being predicted from the previous month.

The Canadian monthly jobs report is the main event this afternoon, with economists expecting that the Canadian economy created 100,000 jobs, and the nation’s unemployment rate will fall to 8.0 percent.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |