Gold Technical Analysis – Back on the ropes

Please login to join discussion

The price of gold has fallen back towards the yearly lows, as rising 10 and 5-year US bond yields caused traders to dump the yellow-metal and move into riskier asset classes and industrial metals, such as copper.

Gold briefly recovered above the $1,800 level this week but generally suffered from a lack of demand. The move higher from $1,860 was clearly seen as technical, as traders may have been retesting some important levels and supply and demand spots.

Better-than expected US economic data on Thursday also helped intensify the price drop in gold. The general consensus is that the United States and global economy is starting to exit the darkest months of the pandemic.

Looking more deeply at the ongoing rally in commodities, it is unclear how gold fits into this dynamic. Gold could suffer severely if the Federal Reserve hint that they may stop QE purchases this year, while other metals, like copper, may benefit.

Non-yielding metals, with very little use in domestic appliances and goods, could get crushed in the reflation trade. Tension is certainly building towards gold as the metal faces its weakest period of price activity since March last year.

The saving grace for the metal in the near-term could be the US stimulus package. A key vote on the proposed $1.9 stimulus bill is set for tomorrow. The metal could receive a nudge higher if the bill is passed into law.

Additionally, the FED may need to step in to cool the bond market yield rise. They could have bullish implications for gold if markets believe that the Federal Reserve will be unable to withdraw its bond-buying programme.

Traders and investors will also be factoring in where the stimulus checks will be going. Will American citizens be buying Bitcoin or gold? I suspect we could see a bit of both, and this could be supportive for the metal in the near-term as well.

According to the ActivTrader Market Sentiment tool traders are still overly bullish towards gold with sentiment nearly 72 percent positive. I have concerned that traders are still complacent about the recent price decline and are blindly buying the dip.

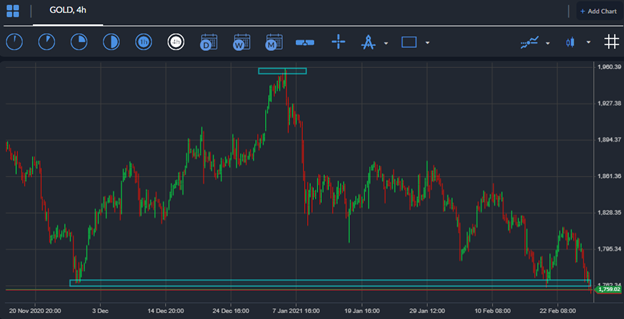

Gold short-term Technical Analysis

The short-term technicals for gold show that a large head and shoulders pattern continues to unfold, with the latest bounce towards the $1,815 level helped to form the final right-hand shoulder to complete the pattern.

Traders will be closely watching the $1,760 level as it is the neckline of the bearish pattern. Weakness under the $1,760 level could the final nail in the coffin for gold, with the $1,700 and $1,660 levels then coming into focus.

Source by ActivTrader.

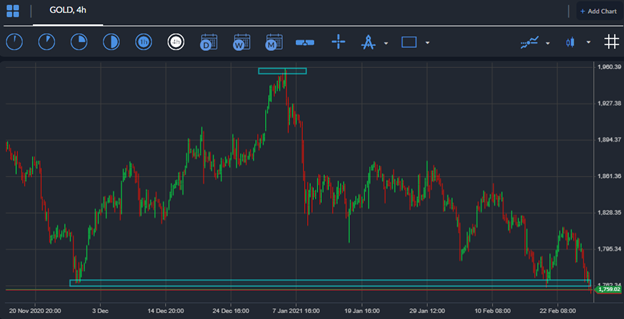

Gold Medium-term Technical Analysis

According to the daily time frame now may not be the time to buy gold. The yellow metal is still trapped inside a falling price channel, between the $1,845 and $1,650 levels, with bears targeting the bottom of the channel

We could see buyers step in towards the bottom of the price channel, around the $1,650 level. Weakness under the $1,760 level could be another major signal that bears are indeed going to target the bottom of the channel.

Source by ActivTrader.

Something else to note is the bearish death-cross is currently underway. A death-cross takes place when the 50-day moving average crosses over the 200-day moving average. This is a very negative sign.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |