Biden signs stimulus bill into law

Please login to join discussion

Morning Brief: 12/03/2021

The US dollar has started to firm in early-Friday trade after United States President Joe Biden finally signed the $1.9 trillion economic relief bill into law. yesterday The US government has released a statement saying that eligible American will start receiving $1,400 stimulus checks into their bank accounts as soon as this weekend.

US government workers will also be getting an extra $300 per week as part of the package, and the bill will also extend benefits for millions of affected American through to September this year.

Markets now look to infrastructure spending as part of the bill and President Biden’s pledge to open mass COVID-19 vaccination centres across the United States by May 1st this year. This is a boon for market sentiment as traders appear to like the idea of vaccinations, which could help re-open the American economy quicker.

Since the bill was signed into law the EURUSD pair has pulled back after yesterday’s dovish ECB meeting, while the British pound has been rejected from the 1.4000 handle. The culprit appears to be US dollar strength.

The USDCAD pair is bucking the early theme of US dollar strength and continues to take a hammering after the OPEC monthly report said that oil demand should go back to normal levels during the second quarter of this year.

Speculation mounts that some of the $1,400 stimulus checks will be headed into stocks and cryptos. Bitcoin was a big beneficiary of the previous stimulus package under the Trump administration. The top crypto moved within a few hundred US dollars of its all-time as the bill was signed into law.

In terms of market reaction in the major indices, the Nasdaq is slumping ahead of the Wall Street opening, while the S&P 500 has pulled back on the futures market after setting a new all-time high during yesterday’s US session.

European bourses are also set to open in the green. The CAC40 and GER30 have been surging higher this week after weeks of consolidating. The ITA40 and ESP35 also look to open higher.

Data Watch

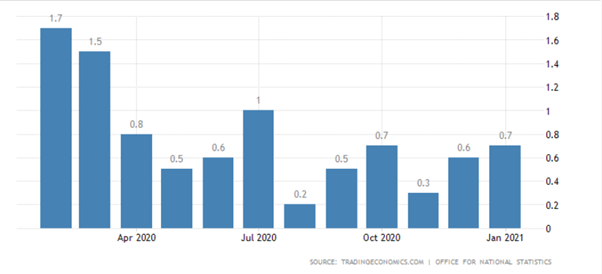

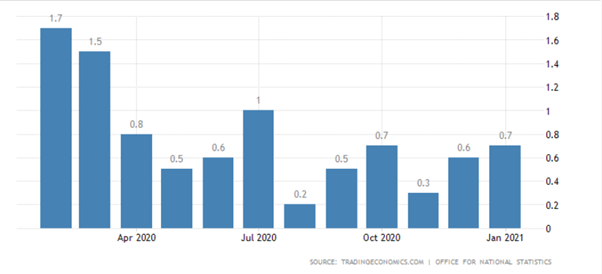

UK manufacturing and industrial production data has come in weaker-than-expected this morning. Sterling traders now look the release of the United Kingdom Consumer Price Index report from February, and upcoming UK GDP estimates.

US PPI inflation and the Michigan consumer sentiment are the big releases to watch during the US trading session. If the PPI number fails to come in on the high side, then we could see a resumption of US dollar selling.

The releases of the Canadian monthly jobs report should be a big market mover for the USDCAD pair later today. Expectations are high, with most economists expecting that the Canadian economy created around 75,000 jobs last month.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |