Market Brief

See real-time quotes provided by our partner.

This morning at the start of the London session we’re seeing some strength come back into the equity markets, but this is still a bear trend, and without a significant rise with new swing highs and higher swing lows forming, we’re still looking to sell the rips. Last Fridays low is now significant resistance, so this is where I am expecting the bears to step back in. If they don’t, for whatever reason, that signals to the bulls that a sweep above the recent FOMC high is the next logical target. The percentage of companies within the S&P500 above their 200-day moving average is around 30% and the lowest since the summer of 2020. This signals continued weakness in the benchmark index.

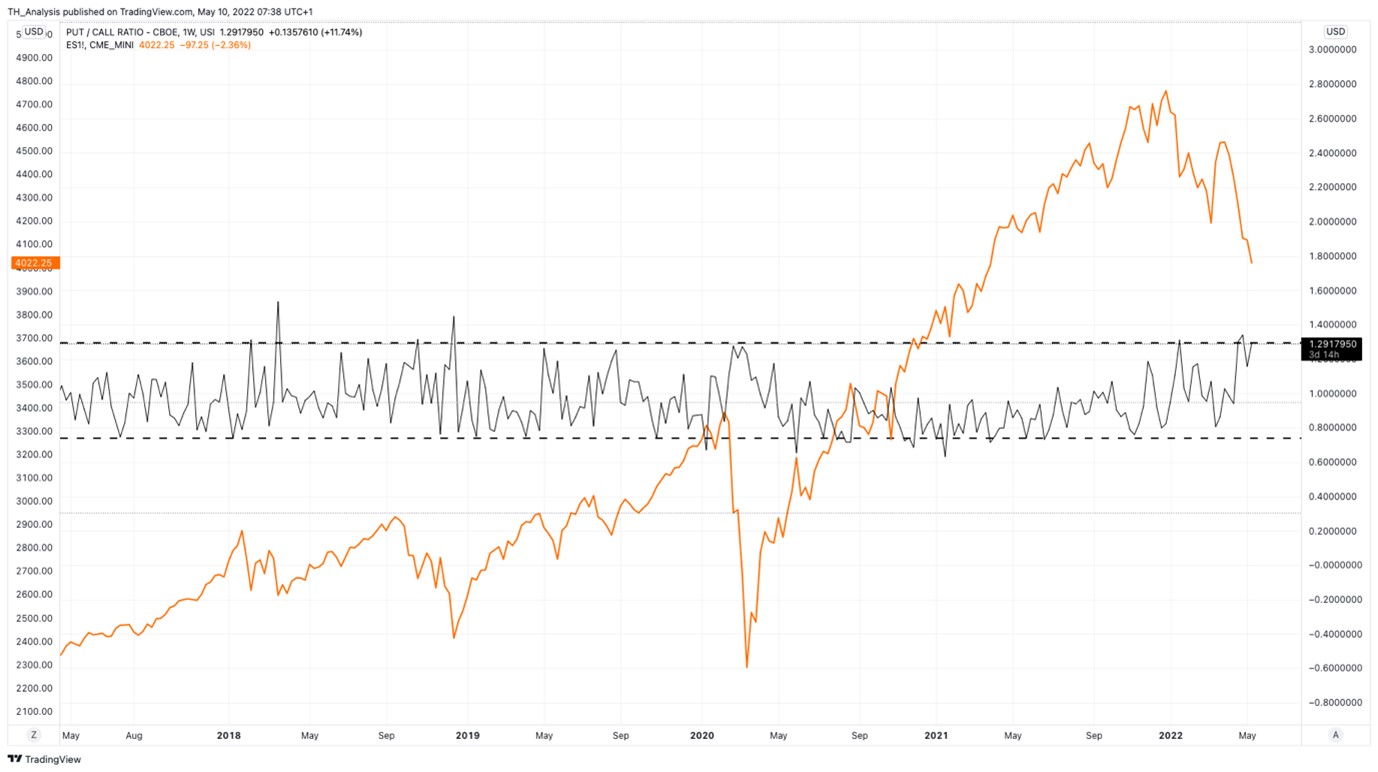

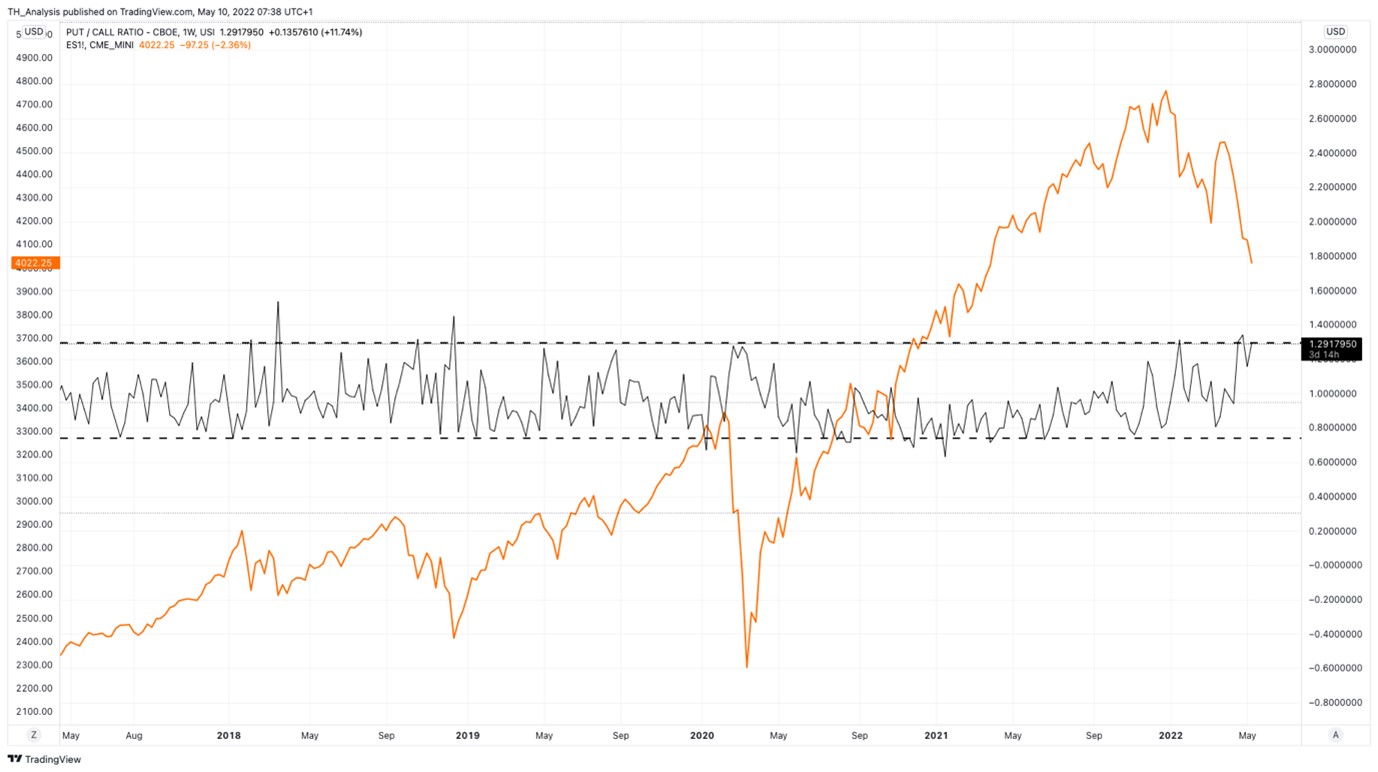

Somewhat interestingly though, is that implied volatility in the out of the money calls rose slightly more than the puts yesterday in the Nasdaq. The Nasdaq had been leasing the large cap stocks lower. Rising call options could signal a shift in sentiment back to the buy side, but we would need to see them skew in favour of calls. This is going to take some time. The S&P500 Put/Call ratio is at relative highs and oftentimes, when we see stocks sell off, we see the Puts bid relative to the Calls. When this ratio turns back lower it may then signal a bottom in this market sell off.

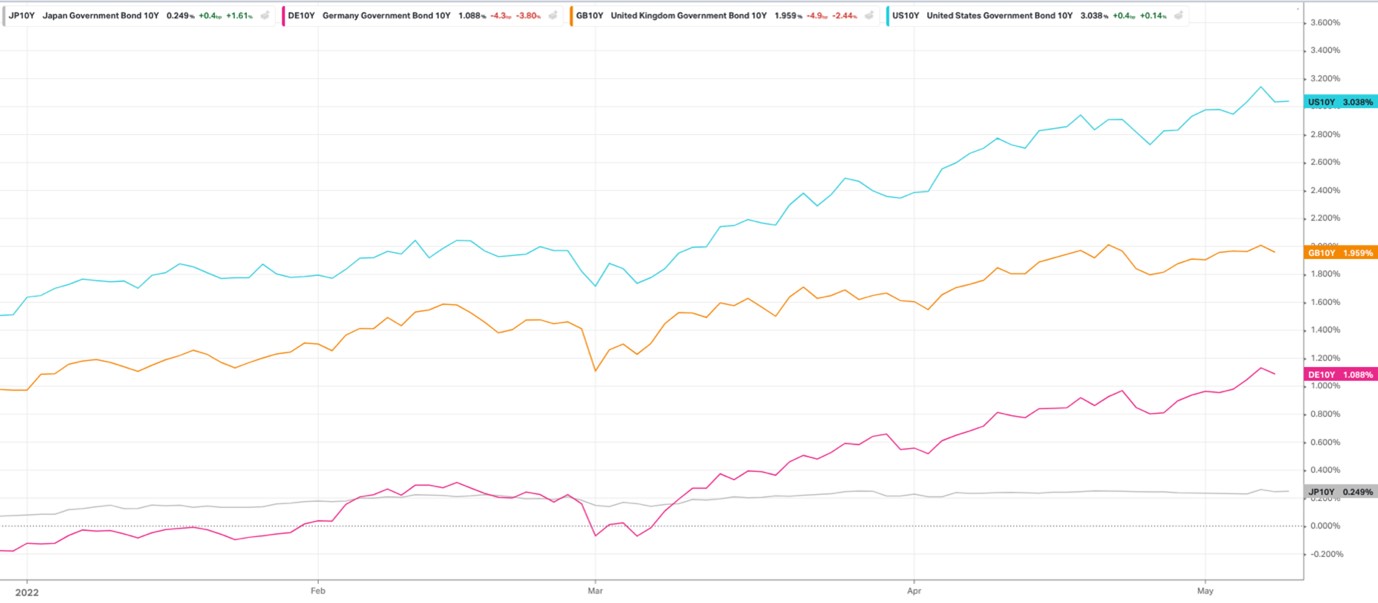

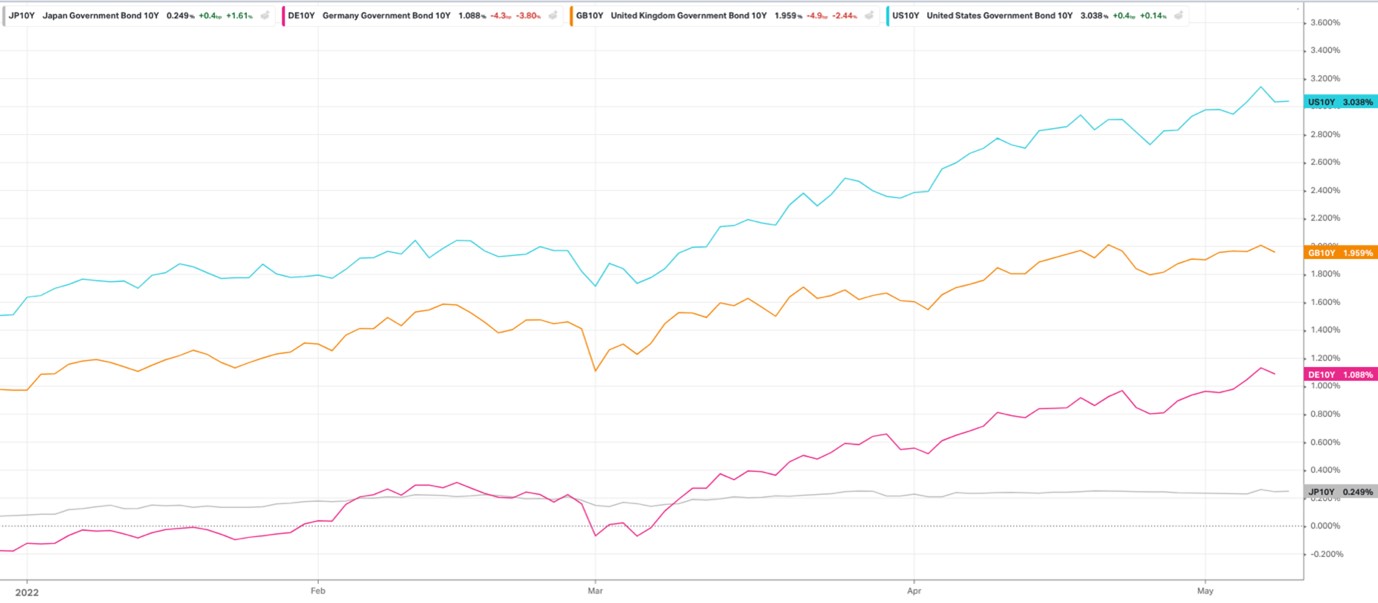

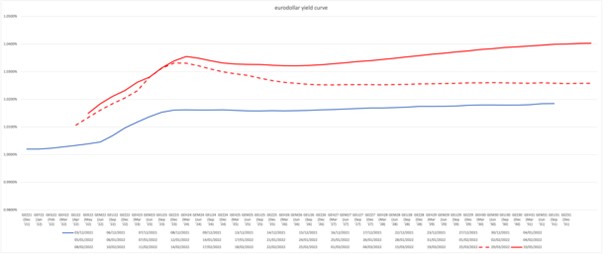

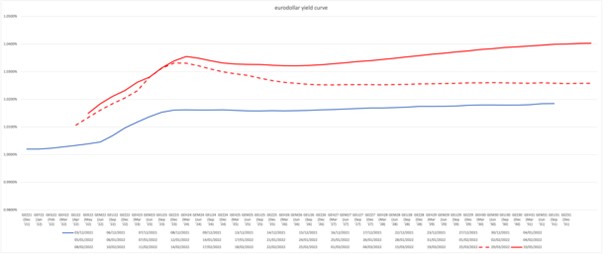

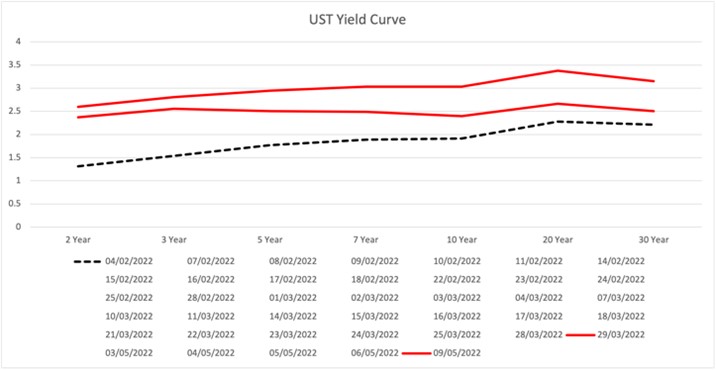

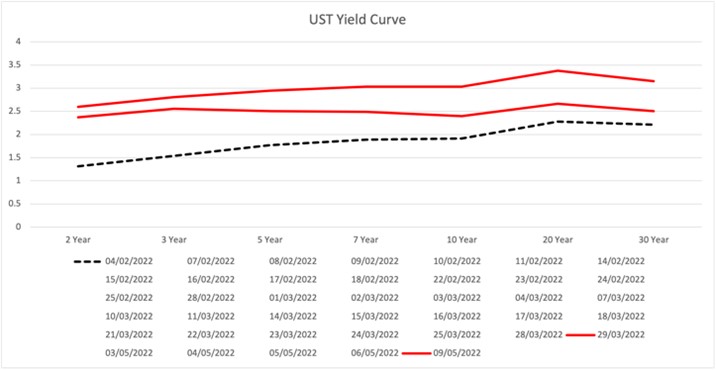

The US Treasury is removing more money from the financial system than it is putting in, so the current fiscal flows show a surplus of $38,643 billion. When the US economy is running a deficit that means the non-government are receiving more money from the government that what is being taxed out. Which translates to corporate profits and personal savings. A deficit is generally what has allowed the US stock markets to keep rising. US benchmark yields are still above 3% and inflation expectations over 10-years are somewhere between 3% and 8% depending on who you ask, or which graph you look at. The Fed is seeing 10-year inflation being priced around 3% so that is what I am using. This means the market has pushed the interest rates possibly up to the terminal point, but no one is sure. If the natural rate is higher, stocks are too expensive and this repricing we’re seeing in the markets is bringing the stocks lower, because investors don’t believe the companies will be as profitable in the future. The Eurodollar yield curve is inverted in the period 2023 to 2025 but then the markets become more optimistic, as seen in the sloping upward curve into the future. The US yield curve is flattening off, which is not an optimistic signal. These yield curves signal a couple of years of uncertainty is being priced in by the largest money markets, which commentators are saying will result in a recession induced by the removal of stimulus and hawkish rate hikes.

See real-time quotes provided by our partner.

The US dollar is compressing under the $104.00 level and the longer this occurs, the more I am expecting a pop higher, supported by rising interest rates and yields. There are several Federal Reserve, BoE and ECB members talking today, so I am also expecting a lot of volatility on any comment that mentions rate hikes. The US dollar could also rise on the back of a weaker euro if the ZEW sentiment reports this morning come out worse than expected.

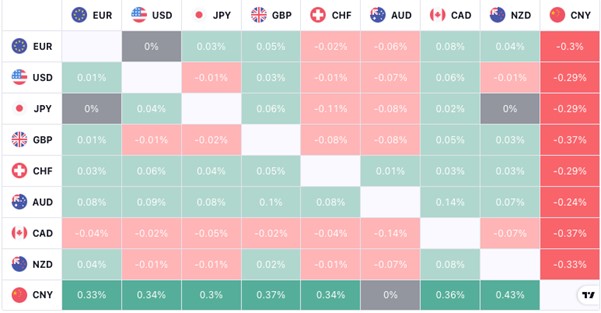

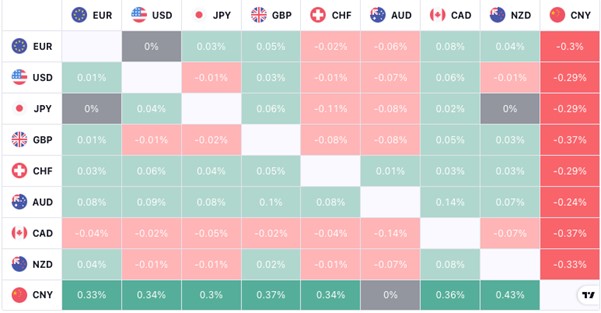

The forex heatmap is not shedding any light on the direction of the market other than the Chinese yuan is the strongest currency which is also helping the Aussie to recover some of its losses from yesterday. Australian retail sales came in better than expected at 1.2% though the previous reading was revised down to 7.9% from 8.2%. China announced that they will be doing mass testing for COVID but that there will be additional help for small, medium and micro-enterprises that face difficulties.

See real-time quotes provided by our partner.

The ActivTrader sentiment indicator shows that 66% of traders are still bullish the EURUSD as the major forex pair bounces between 1.0500 and 1.0600. This price action is within the previous weeks range, which itself was within the week prior’s range. A break lower than 1.0470 will be a significant blow to the bulls.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |