Market Wrap

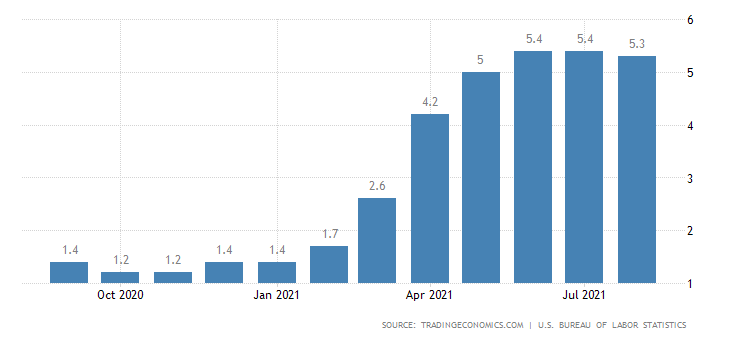

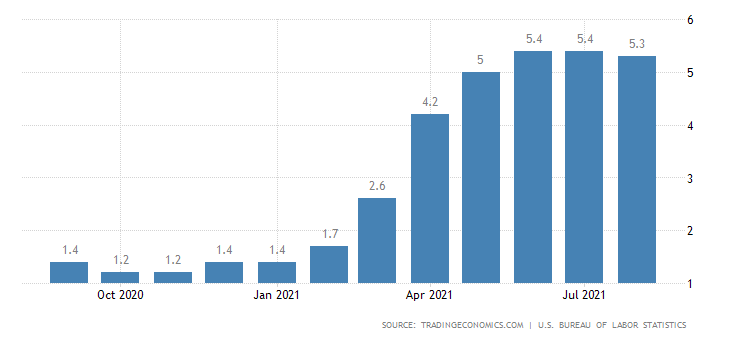

According to the US Bureau of Labour Statistics data, the Consumer Price Index (CPI) for all items in the country grew 5.3% year-on-year in August. Month-on-month the index was 0.3% higher. This month’s CPI came in under expectations and will cast doubt on the FOMC taper probabilities in the coming weeks.

Once again energy contributed the most to the monthly increase, rising 2.0%, mainly due to a 2.8% growth in gasoline prices. The index for food climbed 0.4%. These two parts to the inflation data are what US consumers are worried about as weekly shopping and living expenses are rapidly rising.

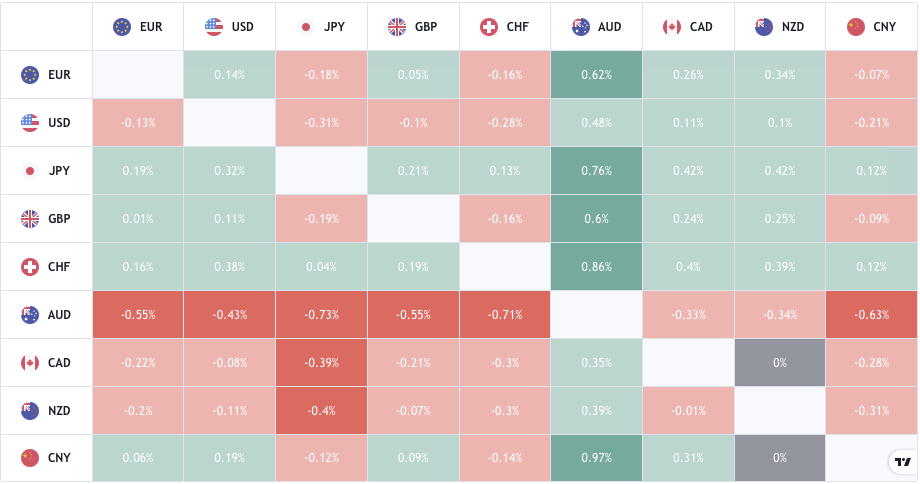

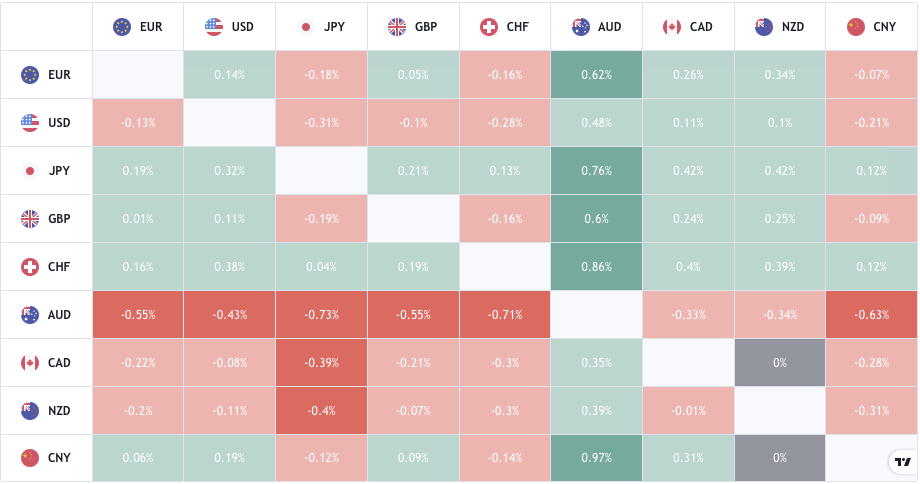

The forex heatmap shifted from risk on to risk-off with commodity pairs at the London close fully in the red with the Australian dollar the weakest of the currencies. The yen and Swiss franc caught a bid as did the fixed income markets in the US.

See real-time quotes provided by our partner.

The US dollar dropped below a rising trend line and took out the previous swing low, which for me indicates we are now most likely to travel back into the low $90 range without any mention of Taper from the FOMC.

See real-time quotes provided by our partner.

A weaker US dollar is also good for the EURUSD which had found support from a previous swing high market structure. The draw for the EURUSD is going to be the double top at 1.9085 and possibly the 1.2100 if the European rates rise against the US interest rates in the coming weeks. Earlier today news of a new fiscal stimulus into the euro area emerged with The European Commission approving a French plan for a €3 billion fund “that will invest through debt, hybrid and equity instruments in companies affected by the coronavirus outbreak.” The fund will be available to companies in all sectors apart from the financial, “which were viable prior to the coronavirus outbreak and have demonstrated the long-term sustainability of their business model.”

See real-time quotes provided by our partner.

Gold caught a bid today, but it appears to be all to do with the US dollar weakness and a move into safe haven assets.

See real-time quotes provided by our partner.

Later on, we hear from Apple as they host their virtual product event “California Streaming”. The latest iPhone 13 along with Apple Watch 7 and updates to a host of products and services will be revealed. Currently the Apple Inc. share price is hovering near previous balance areas, so any disappointment or an underwhelmed sentiment from this event could push the price lower and back into the January 2021 price range. A surprise to the upside and we could be at all-time highs and the Nasdaq etc. could be ripping higher.

See real-time quotes provided by our partner.

The Nasdaq in the hour before the US session started reacted favourably to the US CPI data as tech companies will suffer from a monetary policy change that includes rate hikes. Something the higher inflation could lead to. As it is the price action took out the buy side stops and sell side stops in the first couple of hours and is now currently looking for lower prices. If the buy the rumour sell the news occurs today, I am looking for a price target to the downside of 15,350 and then depending on the close will see whether the buyers stepped in there or not.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |