The Market Reaction to Powell’s Jackson Hole Speech

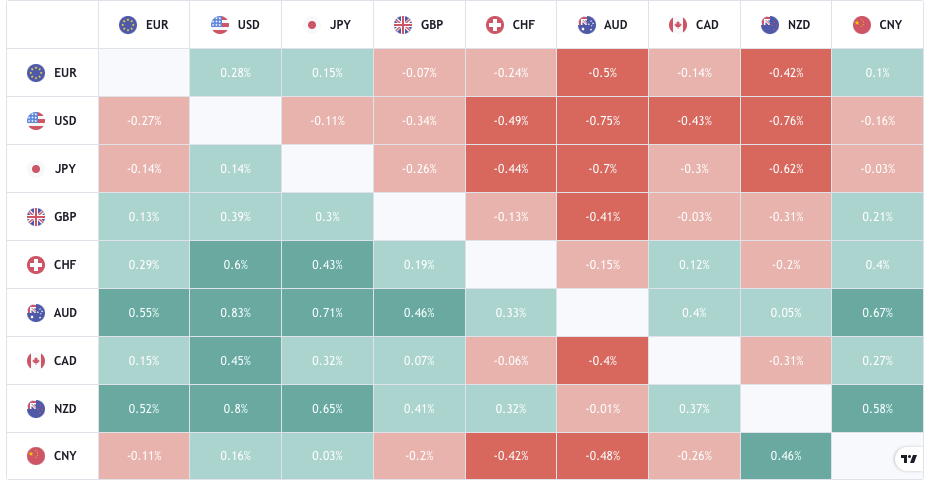

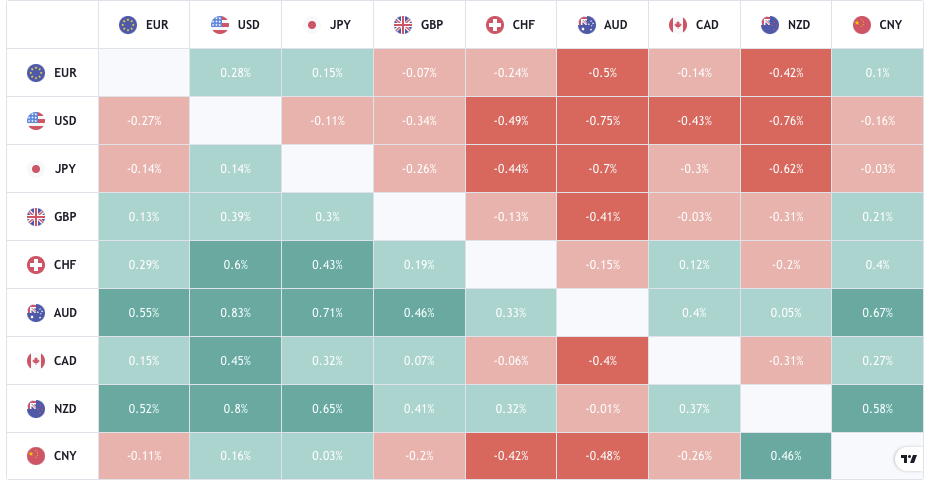

The quickest way to explain the market reaction to the Fed Chair Powell speech from the Jackson Hole Symposium is to address the forex markets positioning at the London close today. The US dollar has been sold off aggressively, which is great news for the commodity pairs like the Canadian dollar, Australian dollar, and New Zealand dollar.

In summary of the macroeconomics nothing new was delivered today and so we have waited for essentially zero new information from the one person who could have delivered a policy announcement. We have heard from other members of the Federal Reserve who are in favour of a tapering of asset purchases this year.

Currently the Effective Feds Fund Rate is sat at 0.10%, the Fed’s asset purchases are a minimum of $120bln per month of which $40bln are made up of Mortgage-Backed Securities (MBS).

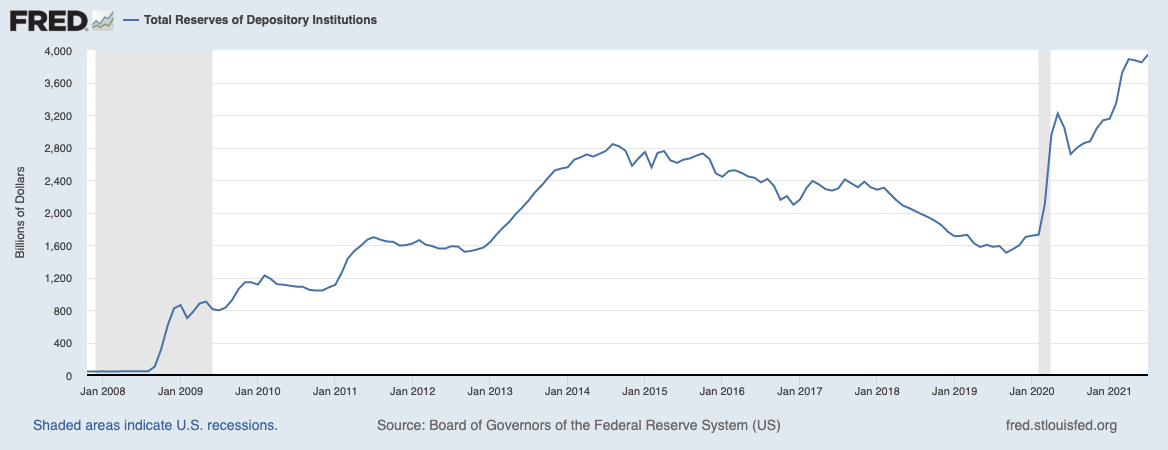

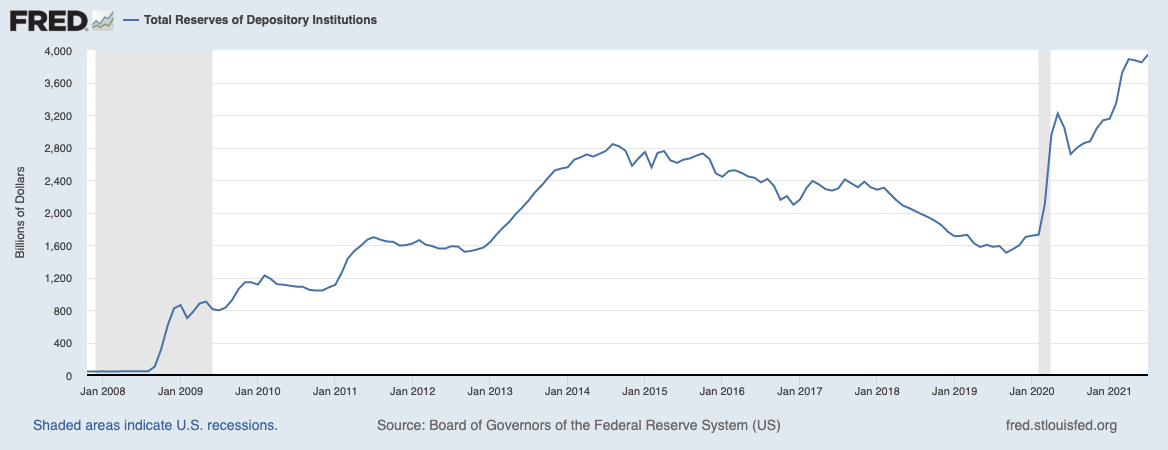

In the latest Fed H.4.1 weekly release the amount on the reserve balance has increased for the 8th consecutive week by $692bln with total reserves sat at $4.20trln. The Fed is also conducting a standing Reverse Repo Facility where it takes cash out of the banks and replaces some of the collateral that is needed, and that figure has risen to $1.4trln. Without that RRF reserves would be near $6trln and you would have thought rates would be zero or negative.

In the speech from Fed Chair Powell, he commented on the pace of the recovery from 17 months ago and how in an anomalous fashion personal aggregate income had increased in that downturn. Hinting at the way people have had more cash in their pockets to go out and buy stuff. The coronavirus has obviously disrupted supply chains and supply within a narrow group of durable goods and materials is not meeting demand. It is part of the Feds dual mandate to keep prices stable alongside creating economic conditions that support full employment, so seeing rising inflationary pressures is a concern for the Fed, and one which they are monitoring closely. Wage increases are welcome if they do not exceed productivity and profitability for the companies, as there is a higher probability that the companies would pass on the added costs to the customers.

The available cash chasing fewer goods has meant that durable goods for the first time in decades have seen inflationary pressures, as spending on big ticket items that include white goods and cars has risen 20% above pre-pandemic levels. For autos the prices may have stabilised and as there are only a certain number of cars that you can buy prices should start to fall as demand demises. What is needed is for the supply chain bottlenecks to ease so new cars and parts can allow manufacturers and dealers to meet upcoming demand.

The labour market outlook is brighter and there is evidence to suggest that companies are hiring faster than at previous times. The rapid re-opening of the economy is helping to bring people back to work, but it is also putting pressure on the supply chains. The increase in inflation due to the re-opening in the Feds assessment is also seen as temporary. They are looking for the rapid acceleration in prices and wages to flatten off as the data within the 12-month lookback window drops out from those early days post major lockdown, so sometime in Q2 of 2022 all that messy data should be out of the readings and a true assessment of inflation can be made.

Fed Chair Powell reiterated that inflation is anchored at 2%, that the current policy is well positioned and that the FOMC are prepared to adjust policy if necessary to achieve their goals. They are of the view that substantial progress has been met for their inflation test and that clear progress is being made towards maximum employment. He also said that he agreed with others at the July FOMC meeting that it could be appropriate to taper asset purchases, though the unknowns surrounding the delta variant of COVID-19 is a concern. Because there is still slack in the jobs data, they will keep the FFR on hold and won’t budge on that until the economy reaches conditions consistent with max employment and inflation at or slightly above 2% for a prolonged period.

Due to the lack of interest rate hike and no tapering the US dollar dropped in step with the benchmark US 10-year yields.

The ActivTrader sentiment indicator for the US dollar index at the London close was at an extreme bearish reading of 85%, so it will be interesting to see if there is a snap back next week in price.

See real-time quotes provided by our partner.

The initial spike on the release of Chair Powell’s speech probably trapped a lot of traders looking for higher yields and the dollar, with the range carved out around Mondays lows being broken and then tested as resistance. $92.50 would appear to be the next logical place for the US dollar index to visit but it is rare for the mass of retail traders to be on the correct side of the trade.

See real-time quotes provided by our partner.

The drop in the US dollar and the drop in US 10-year yields is good news today for the holders of gold who saw a spike lower on the initial release before making higher highs today. If the Fed were to raise rates in September that would be very bearish for Gold initially and if there had been some definitive announcement of tapering today, that would also likely be bearish for the precious metals.

See real-time quotes provided by our partner.

The 20-year Bond ETF tracked in the TLT contract shows how the fixed income market is enjoying the no taper no hike rate speech. There is a shortage of collateral and investors will no doubt be piling into the bonds and equities for some time.

See real-time quotes provided by our partner.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |