Market Wrap

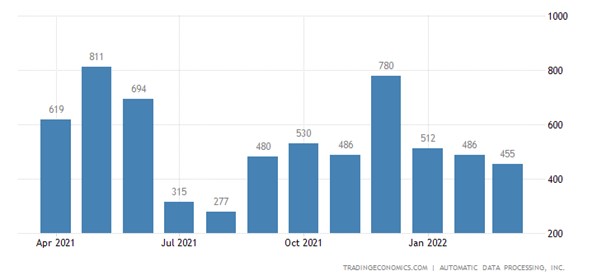

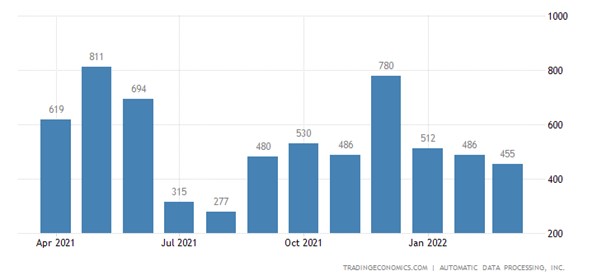

The US ADP National Employment report released this afternoon, showed that the private sector added 455,000 jobs in March. The rise was slightly larger than analysts anticipated (450k). Businesses of medium size added the most positions, 188,000. Meanwhile, jobs in large businesses were up by 177,000 and small businesses added 90,000 jobs. The service sector which was hit hardest during the pandemic came back very strong. From these jobs report the market will now be pricing in an NFP that should come in around expectations, so we may get fireworks if there is a big discrepancy to what is delivered versus what is expected.

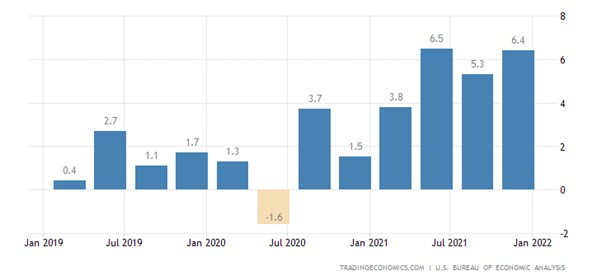

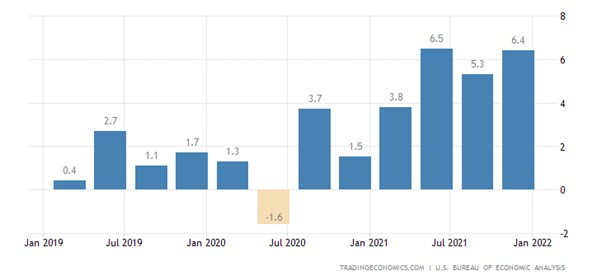

A report from the US Bureau of Economic Analysis (BEA) revealed that the Personal consumption expenditures (PCE) price index in the United States significantly increased during the fourth quarter of the fiscal year 2021 by 6.4%. This measure of inflation is one of the Feds preferred metrics for judging their monetary policy reaction to deliver stable prices. Today’s figure is up from the 5.3% growth in the third quarter. The Core PCE price index rose by 5.0% (excluding food and energy), another rise from 4.6% in the prior quarter.

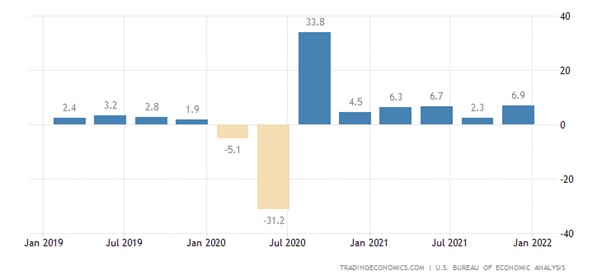

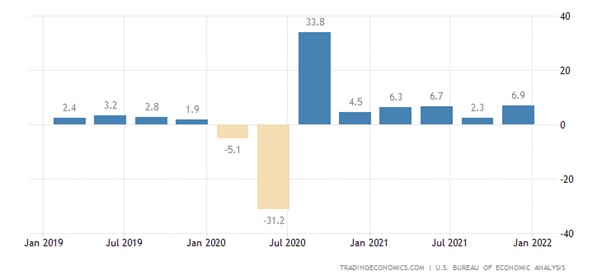

The BEA is also responsible for collating GDP data. US gross domestic product (GDP) increased by 6.9% yearly in the fourth quarter of 2021. The previous estimate for US economic growth was 7%. The Atlanta Fed has a model showing the end of 2022 GDP coming in at around 1% as the US economy no longer has the direct injection of cash from large stimulus packages.

See real-time quotes provided by our partner.

US crude oil inventories excluding those in the SPR decreased by 3.4 million barrels to 409.9 million barrels in the week ending March 25, according to the latest US Energy Information Administration report. On average, crude oil refineries processed 15.91 million barrels of crude oil per day, up 35,000 barrels per day from a week prior. Meanwhile, refineries operated at 92.1% of their capacity. During the same period, gasoline production dropped by 9.1 million barrels per day, while distillate fuel production increased by 5.1 million barrels per day.

Brent popped on the news of a draw on stocks as that shows decent demand. But then the news came out that Russia is preparing to escalate activities in Ukraine again and that the peace talks hadn’t amounted to any firm deals. The G7 and especially Germany spoke with Russian President Putin and said that they will be paying in the agreed euros and dollars and not roubles, as per the contracts that they had signed. The euros and dollars will not go into the Russian Central Bank but be converted into Roubles after deposits are made in the Gazprom-bank. If oil and gas keep flowing into Germany there could come a time when they have to decide whether they want to risk economic ruin or leaving NATO?

See real-time quotes provided by our partner.

Yesterday I highlighted a possible H&S chart pattern on the EURGBP. Today the price action came down to test the neckline and rejected it. This could be setting up for a bigger push higher now. Especially as 82% of traders on the ActivTrader platform are still short the pair.

See real-time quotes provided by our partner.

With US economic data coming out today and another night of BoJ buying the JGBs, I decided to step out of the UJ long that I had made a video about this morning. The momentum was slow and rather than wait for a stop out at BE or let a winner turn to a loss, I decided that I would look for a trade elsewhere.

See real-time quotes provided by our partner.

I am now waiting for the US dollar index to come down and test the lower bounds of this flag chart pattern to see if any buyers step in to take the index back towards the $100 or whether the rising strength in the euro has undone that trade idea completely now.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |