Forex Analysis

There are indications that the Japanese yen may be bottoming out and in an accumulation phase, which could cause the USDJPY and other yen crosses to fall. Additionally, the Australian data have been good recently, and the Reserve Bank of Australia has signalled that they are tightening monetary policy, which could also boost the Australian dollar. But if global demand for commodities were to dimmish due to things like Chinese COVID lockdowns, the Aussie would fall hard. Since the FOMC and other central bank decisions around rate hikes etc., there have been many forex moves based on geopolitical and global macro sentiment. The AUDJPY is a forex proxy to risk sentiment and therefore a key leading indicator that can support the recent moves seen in the equity space or signal a divergence.

See real-time quotes provided by our partner.

As global equity markets came back under renewed selling pressures over the last few trading sessions, the tentative improvement in investor sentiment at the start of the week, proved to be short-lived. It was the US equity market and particularly the S&P500 and the NASDAQ that suffered the greatest losses. They have lost the gains recorded in the previous four trading sessions & yesterday’s drop in the S&P 500 was the biggest daily sell-off seen since June 2020.

Over the past year, CTAs have represented a large share of the market participants, and with rules-based, algorithmic trading strategies, they have become the clear winners, as they are those who shorted bonds and equities and remained long commodities and the dollar. Recent data indicates their signals are now reversing as other investors shift their positions to the “contractionary” side of the economic cycle. It is now a battle of those that buy at the lows and sell at the highs, versus, those that sell at the lows to buy lower.

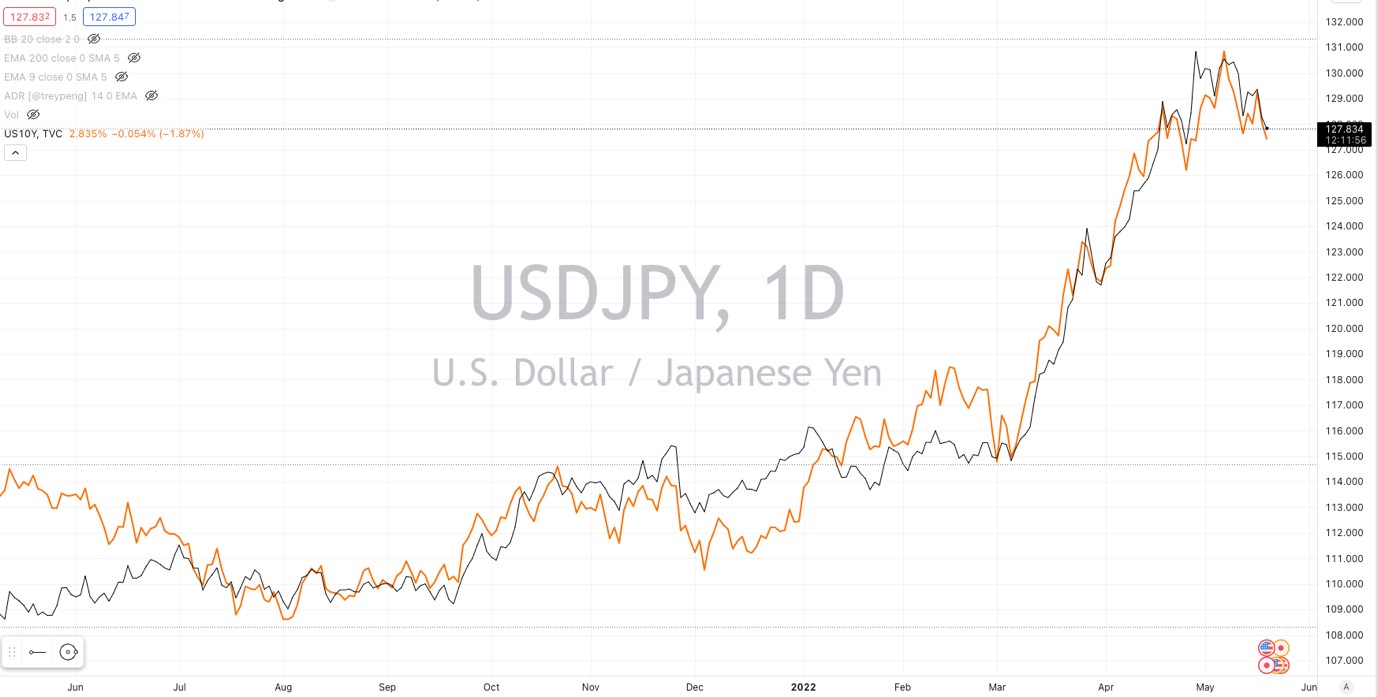

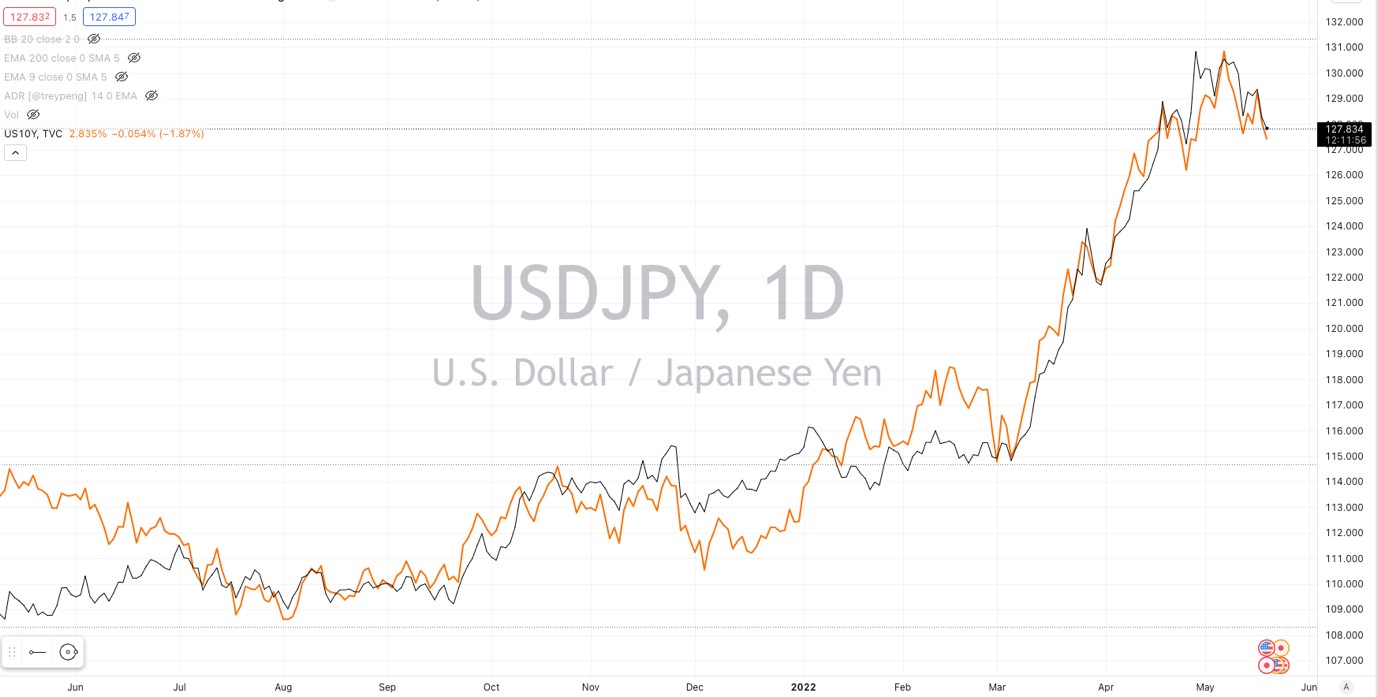

The USDJPY correlation with the 10yr UST remains tight. USDJPY is likely to remain neutral over the week, but a run-up to 135 and then 150 remains on the cards whilst we’re technically in a bull trend and should short sellers be trapped, and more selling occur in US fixed income before the next FOMC meeting. As the USDJPY is the major cross, the AUDJPY will follow its lead.

See real-time quotes provided by our partner.

The daily chart for the AUDJPY gave a technical signal to go long this week at the close on Tuesday. Currently that position would be underwater as the AUDJPY continues to correct the previous impulsive move. If the AUDJPY were to stop traders out with a sweep of last week’s lows, there is still the daily 200-period ema which is resting at the 61.8% Fib level to act as support and possible provide a buy signal.

The fact that the AUDJPY bounced previously off the 50% level and signalled a buy, gives me hope that this signal has merit, and we get a decent continuation higher. The previous buy signal came at the end of April but the 94.00 level proved to be where the sell orders overwhelmed the late comers to the bull trend. Therefore, getting above that swing high from the 5th of May is my target.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |