AUDJPY signalling continued upside

Please login to join discussion

AUDJPY Forex Analysis

The Australian dollar, the commodity sector, and the US dollar are closely tied, as their underlying macro moves paint a picture of the state of global trade and economic prosperity. The yen is considered a safe haven for money to flow towards when the markets fear or find uncertainty with flashpoints that lead to greater market turmoil.

Of late the US dollar has been finding itself bid up, even though the coronavirus vaccinations across the major economies is underway, and for the most part, the economies are trying to open up more. The main drag is due to Europe suffering their 3rd wave on the back of what can only be described as a vaccine nightmare. However, assuming they can get back on top of the disease they will be back on track within the next couple of months.

China is still the main driver for commodity flows and they are still looking to keep GDP annual growth around 6%, and today’s economic data showing industrial firms annual profits surging has boosted the Shanghai Composite. A surge in profits a year on from the pandemic beginnings is to be expected as we are starting from a very low base, so continued expansion will be the real market mover.

The rising dollar can be attributed to the pandemic uncertainties pushing traders to the safe haven of the global currency, you also have the rising yields, which themselves would be a carry trade for the likes of yen and euro with their yields a lot lower. The reflation trade is also bullish the US dollar as commodities are priced in the USD, so a country needs the greenbacks if they want to purchase their oil etc. A shortage in the Eurodollar market and the US dollar and bonds could rise. Keeping an eye on the Eurodollar yield curves would be the signal that a US dollar shortage is becoming a problem. There is also a massive stimulus and generally low-interest rates with a lot of unemployed people in America, so how long this bear market rally can continue will be interesting, and currently, that is a trader’s problem. There are too many reasons for and against, so there is no clear directional trade unless of course you hold your nose and stay short the US dollar and just take the pain as it rises above the 200 ema.

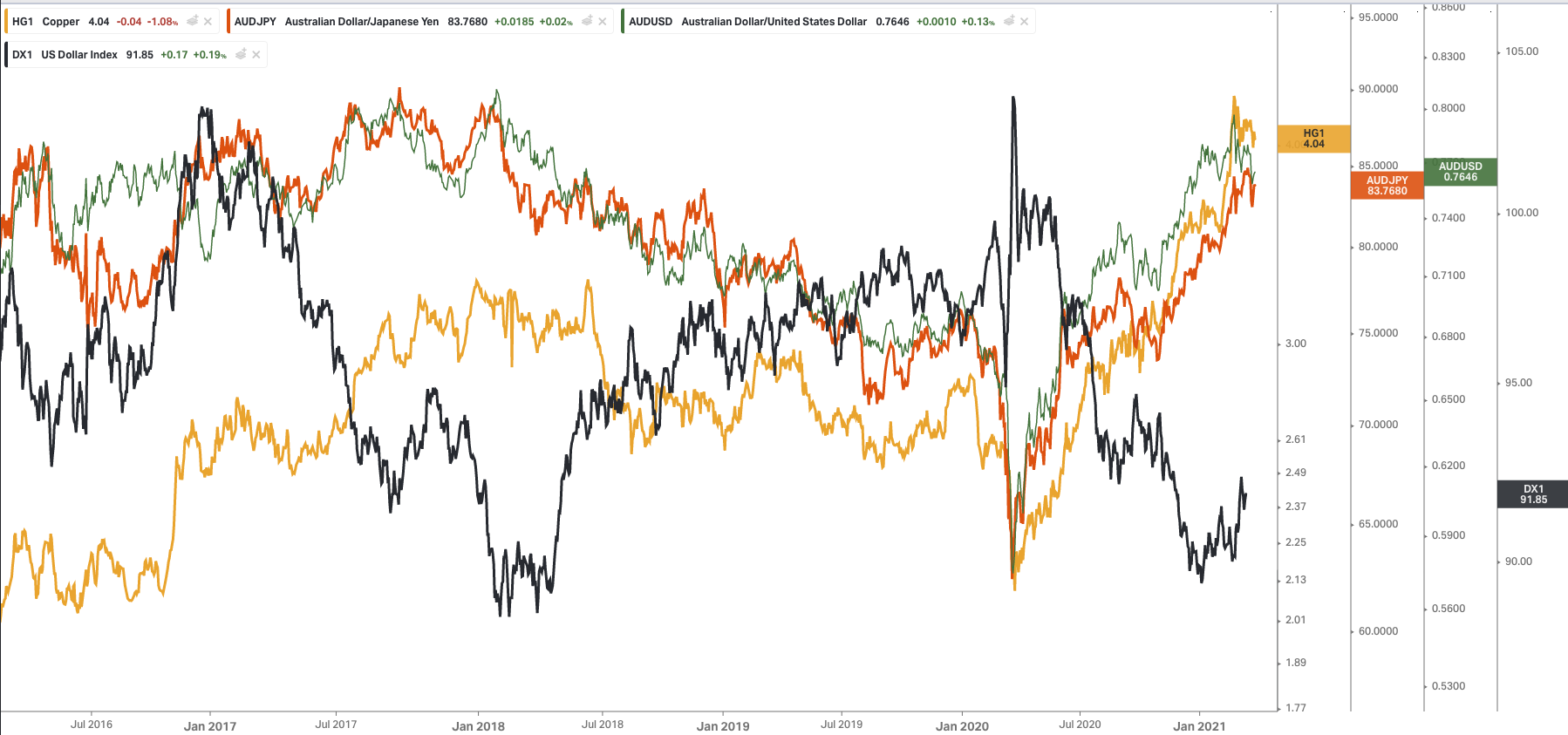

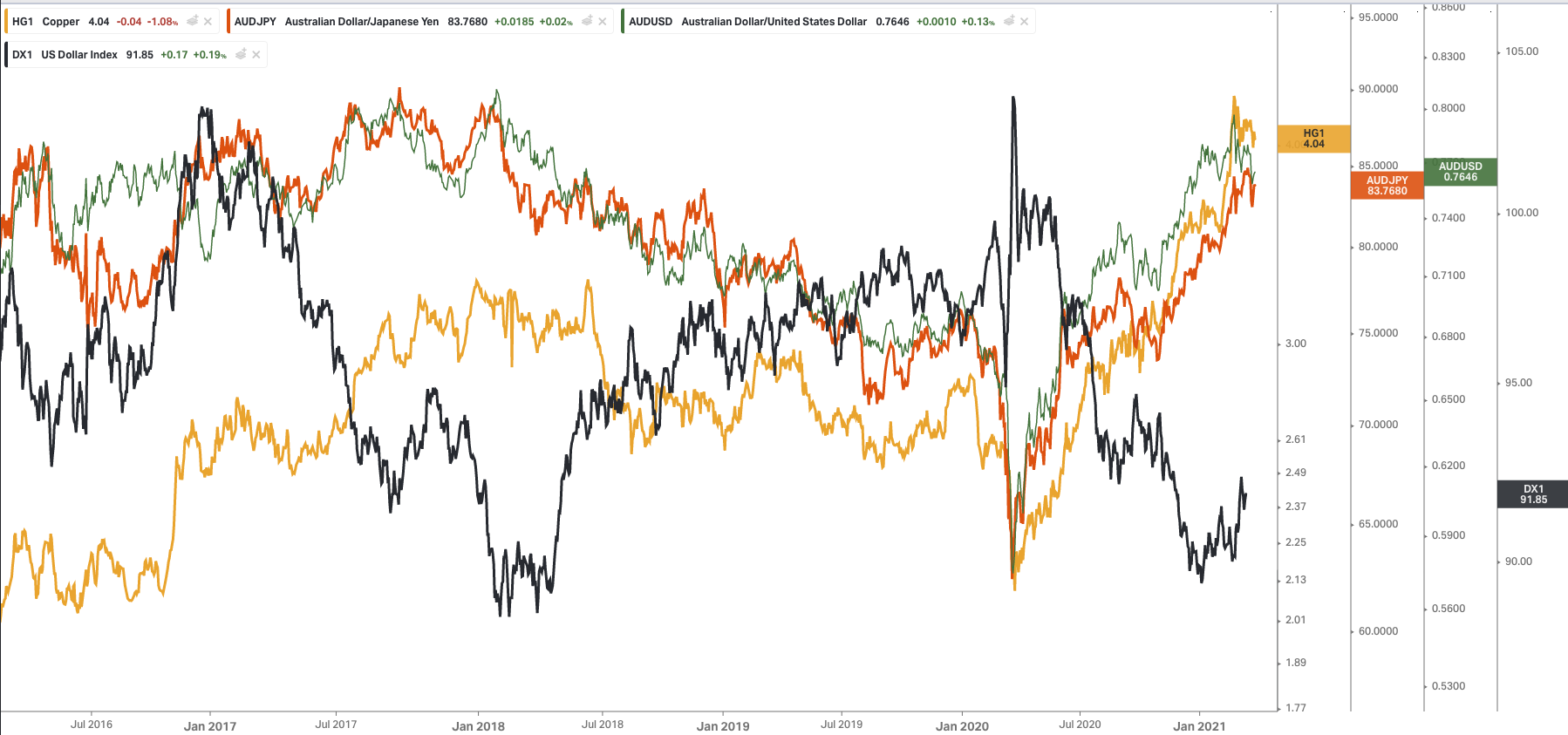

An easier trade then is the Australian dollar versus the Japanese yen. The relationship of this pair and copper this last year has been one of tied at the hip. If copper goes up the AUDJPY goes up, and the volatility is pretty much matched, whereas if you go the AUDUSD route, you have the US dollar currently weighing down on the Aussie moves.

The AUDJPY and the copper charts were even able to rise at the start of the US dollar uptick from February and only as the US dollar approached the daily 200 ema did the copper and AUDJPY charts signal their own corrective move. This with the steepening US yield curves and coronavirus worries are the probable catalysts to a weakening copper price but looking at the daily chart we can define a distinctive corrective pattern within a strong bull move, so a move and close higher out of this triangle and we could be pushing the highs again very quickly. Which would then lead me to look for buying opportunities in the AUDJPY again.

See real-time quotes provided by our partner.

See real-time quotes provided by our partner.

The daily 50 ema acted as support for the first time it was tested this year and the rapid rise away from this support shows good bullish momentum.

See real-time quotes provided by our partner.

The ActivTrader sentiment indicator shows that 79% of retail traders feel the bull trade is coming to an end as they try and get short. Therefore a contrarian trade is to go against these traders and stick with the trend.

Where would I be wrong?

The price action for AUDJPY has been above the daily Ichimoku cloud since December 2020 and indicates where support can be expected to be found. We are very far away from the daily 200 ema so the worst-case scenario for traders looking for a continuation is that we grind sideways until the 200 ema comes up to meet price action, but the main idea is something similar to what happened in 2012-2013 where the blow-off top was the signal for a reversal. Whichever way it happens the Ichimoku cloud will give us a fair warning if the trend is changing in the coming weeks.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |