Weekly Investment Idea

Exxon Mobil (XOM) is one of the biggest oil companies in the US and is listed among the most profitable in US History. The company has existed for more than a century, providing oil and gas for the global market. Exxon indicated in its Friday filings that rising oil and gas prices will see its Q2 profit surging attracting buyers in the near term.

Exxon Mobil surged by +2.23% on Friday 1st of July, as a rebound in energy prices caused a broad rally in energy-related stocks. The OPEC+ meeting revealed that oil output is shrinking as Libya and other oil producers reduced their output targets as political conflicts loom.

See real-time quotes provided by our partner.

US oil rallied by +2.45% from $104.50 near-term support on Friday closing at $106.67. Brent soared by +2.03% as Russia’s invasion of Ukraine continues to tighten oil markets, fuelling decades-high inflation across the globe.

A filing released last week indicated that Exxon Mobil expects at least $2.5 billion in the second quarter of 2022 from rising prices for oil and gas. Comparing the S&P 500 chart and Exxon Mobil in 2022, the Exxon mobile rallied by +44.14% YTD while the S&P 500 plunged by -19.89% signalling a windfall profit for the energy sector, amidst burdened consumers.

In the Q1 report released on April 29th, 2022, earnings and revenues indicated strong figures for the company. Revenue rose to $90.50B from an expected $82.84B leaving a 9.25% surprise surge in Q1 for 2022. The earnings were downbeat as figures dropped from 2.23 expected to 2.07, which is a -7.17% drop.

However, the pressure US President Joe Biden is applying on “Big Oil” producers to lower oil pump prices could be a major headwind for Exxon Mobil in the near term. A drop in oil prices will undermine Exxon Mobil’s strength and could potentially cut the forecast in the July 29th, 2022, report.

A strengthening dollar remains a major threat to the global stock markets as indicated by the broader market sell-off. Investors are pricing in the possibility of 75bps in July 2022 and 50bps in September 2022. Aggressive tightening has triggered recession fears and could weaken the commodity markets in the near term.

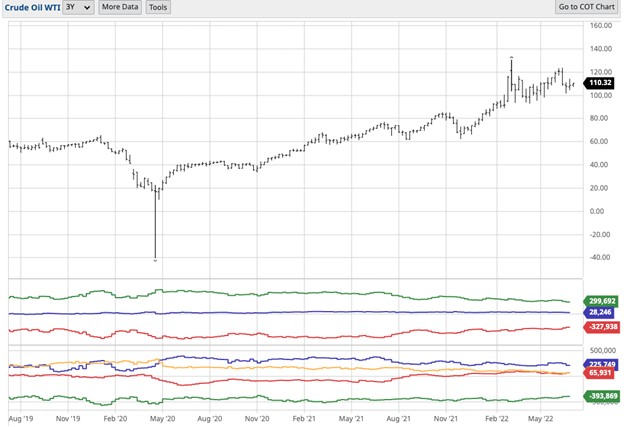

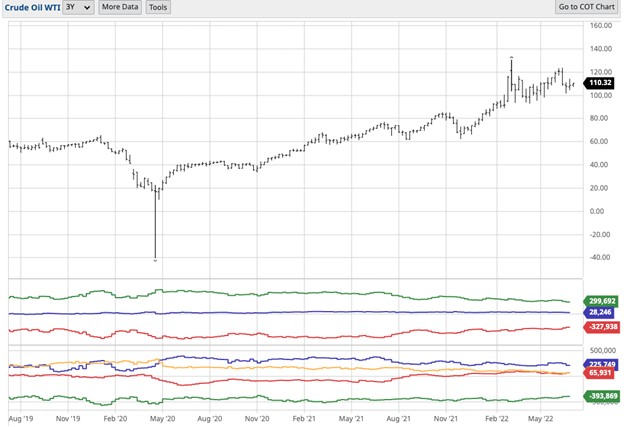

Traders should pay attention to the FOMC meeting minutes this coming Wednesday and the Non-Farm Payroll report on Friday to draw Fed tightening guidance. Traders should also keep an eye on the Commitment of Traders reports which show the oil futures markets divided by its active participants. Currently the commercials which consist of the producers, merchants, processors swap dealers are lifting their short position hedge, which alludes to them betting on higher prices to come. They have had net longs on the disaggregated report since late 2021. When this report looks like they are locking in prices and hedging in a meaningful way, prices are likely to be on their way down and won’t return to the highs for some time.

Daily Chart Analysis

See real-time quotes provided by our partner.

Exxon Mobil bulls closed positively after 2-days of a major selloff. The price bounced off a 2-month low at $84.00 and bulls could target the $91.00 levels in the near term. Upside gains are capped by the $91.00 resistance, coinciding with the Bollinger Band baseline (yellow) and a break above that level could see bulls attempting to break above the $105.00 & 7-year high.

However, looking at the MACD indicator suggests the stock price is currently capped by a bearish outlook as the reading remains below the 0.00 base line. A break below the $84.00 support level could invalidate the price correction to the upside in the near term. Bearish momentum will be renewed and the next critical target to watch out for is the $76.00 level, tallying with the 200-day moving average.

H4 Chart Analysis

See real-time quotes provided by our partner.

Exxon Mobil is trapped inside a range between the $91.00 resistance and $84.00 support. The accumulation within that range suggests impending volatility if the price manages to break outside of that range. The Stochastic RSI reading is below the 20.00 level suggesting an oversold level and the price could therefore retrace in the near term.

However, a critical barrier to gains to the upside is 91.00 and if bulls fail to break that high, further selling could be experienced in the near term. The next bearish target would be the $76.000 level and $70.00 psychological support. The 50-day moving average is capped against upside gains.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |