Towards the end of the FOMC press conference, Chair Powell told the virtual meeting attendees that “Strong data is ahead of us, it’s coming”.

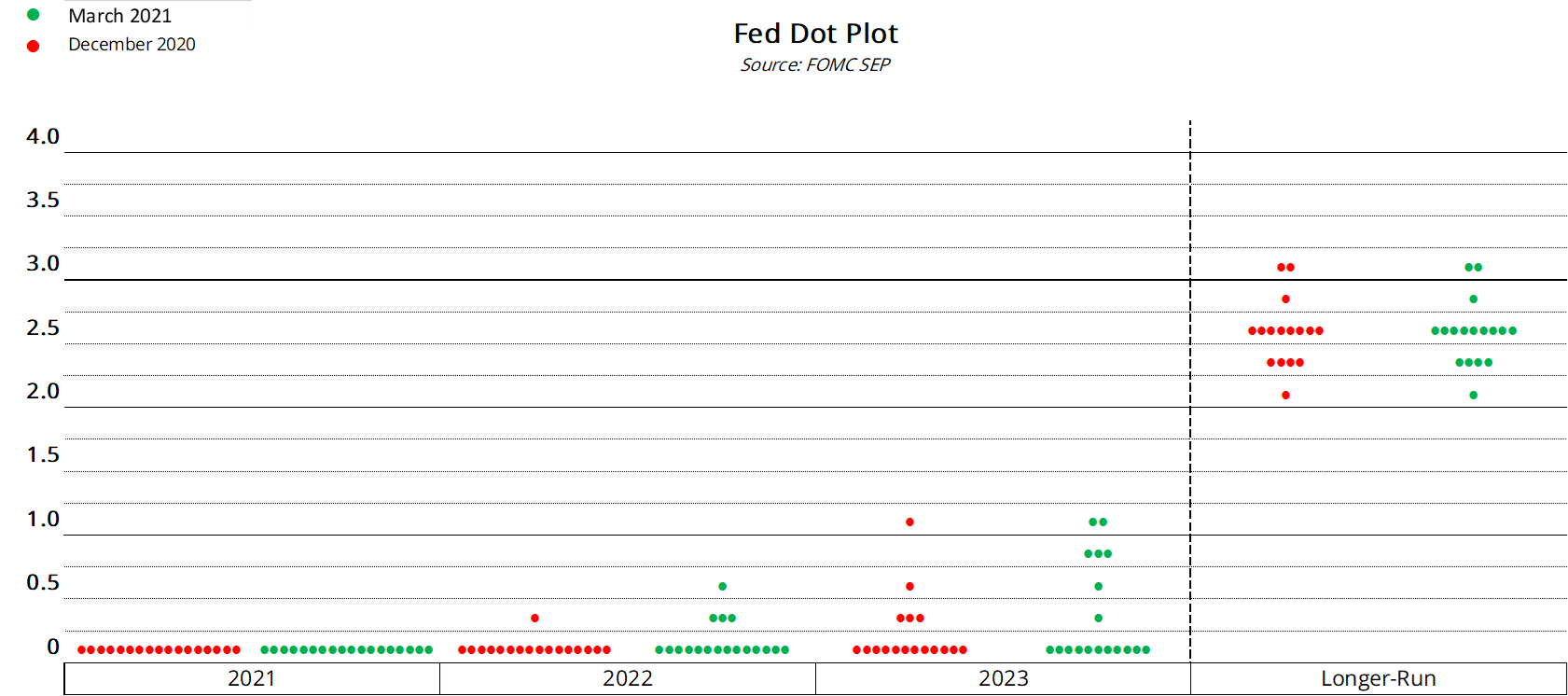

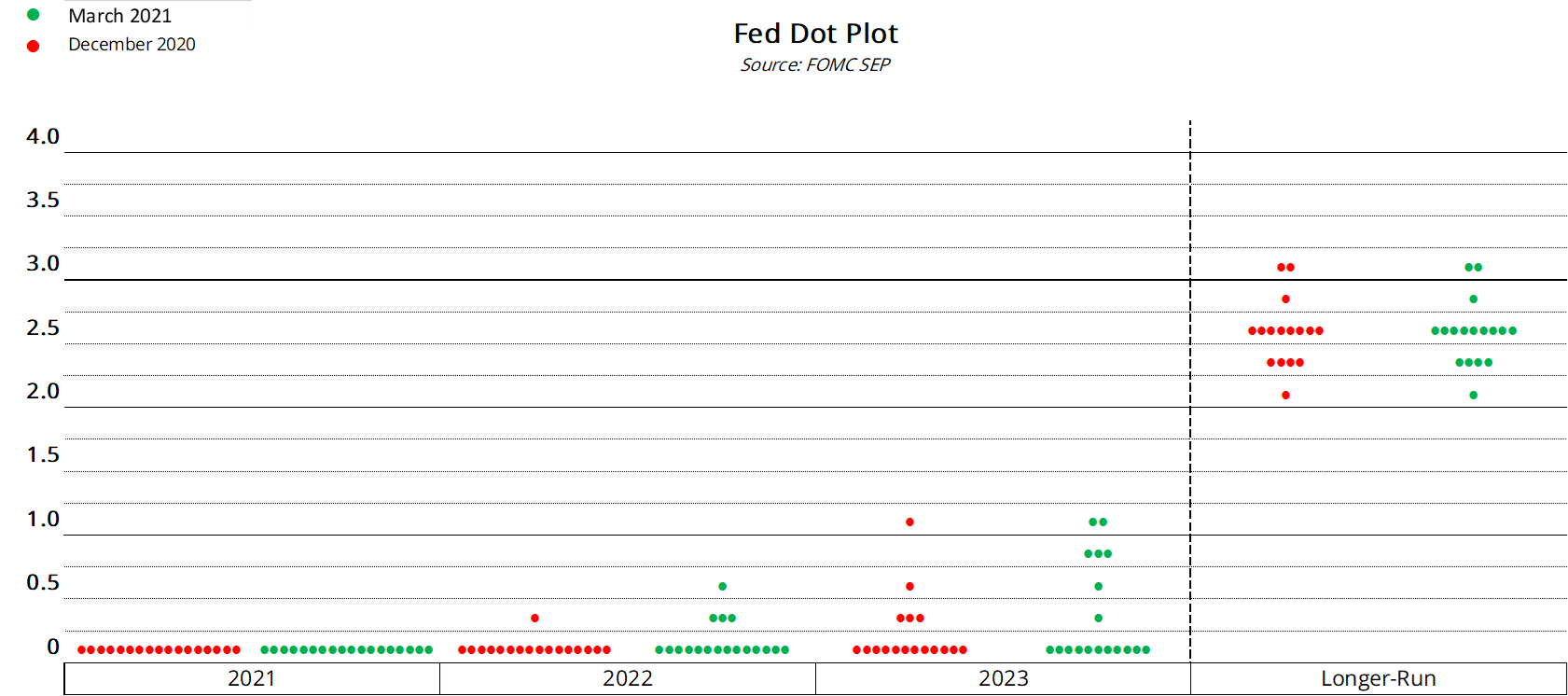

Judging by the FOMC rate decision the strong data is not imminent and if you go by their dot plot for rates, the stronger data is not likely to materialise before 2023. So, for the next 2 years, at least, the sovereign rate setter is keeping things unchanged. Which for some market participants will sound like folly, and it is they who will continue to sell US Treasuries in an attempt to push the yields higher, in an attempt to force the Fed to change course. The saying is “don’t fight the Fed”, so it will make for an interesting battle in the coming months.

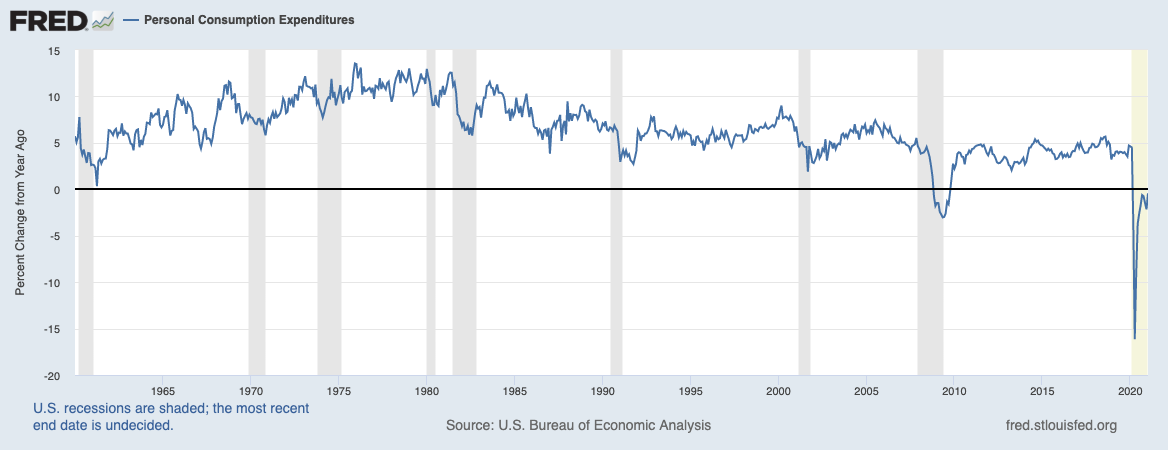

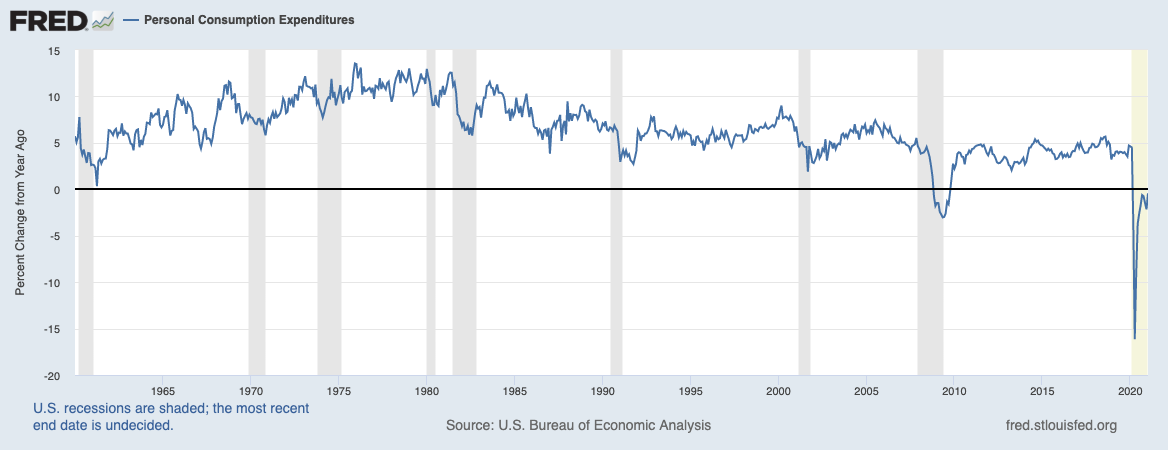

The overall Fed themes are Dovish, so the expectations if you follow that line is, that the US dollar will weaken, inflationary pressures may arise, but the year-on-year data from March through April 2020 is about to fall out of that dataset, so the rise in recorded inflation will normalise again, having come from such a low base due to the economic shutdown.

The Fed is taking a more pragmatic stance, in that they are no longer just going to pay lip service to the 2% inflation target, they actually want to see it and then have inflation moderately sustain at those levels. Until they can make the judgment call on what ‘Substantial Progress’ is within the inflation and seemingly more importantly employment data, they will do whatever is necessary to support the economy, using all of their toolboxes.

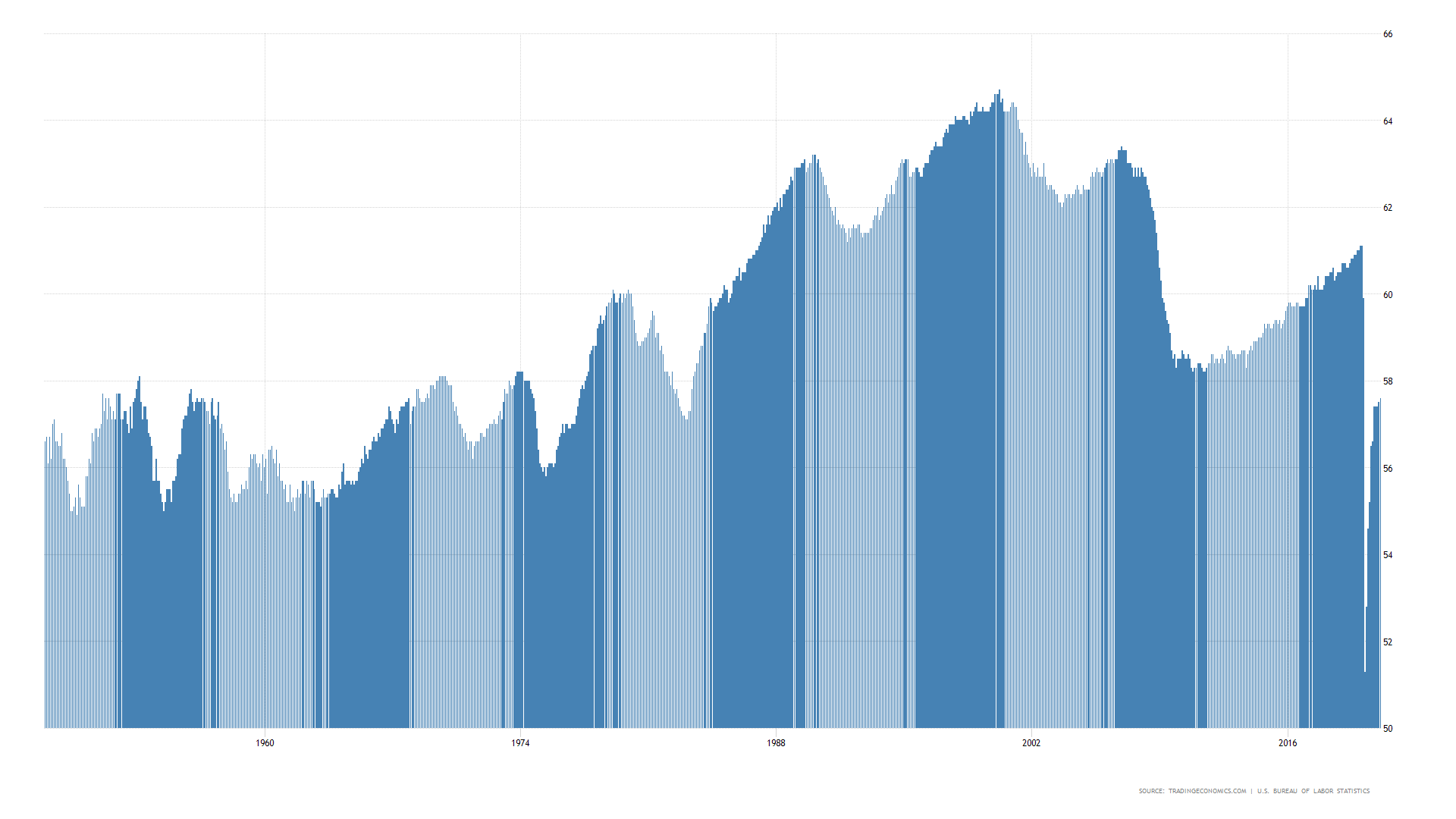

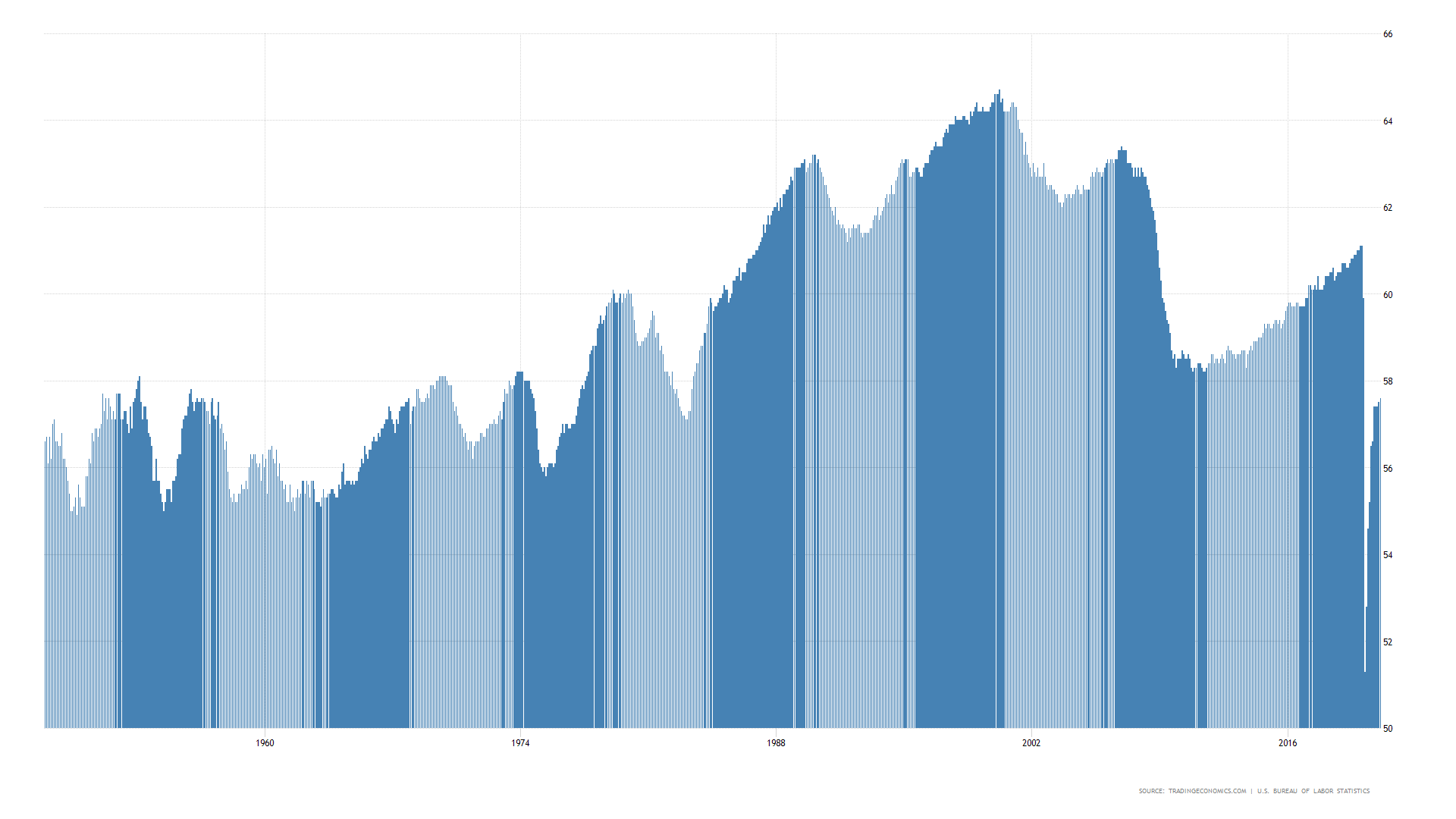

The US employment rate peaked around 2001 and after the massive drop-off in 2020, the rate has recovered several percentage points but is still below late 2019 levels and is similar to the rate of employment in the mid-1970s. Fed Chair Powell seemed happy with the way things were going pre-covid so I am going to make an assumption that ‘Substantial Progress’ in the jobs data will be when the data points to a continuation of the trend seen from 2010 to late 2019. He pointed out that the drop in unemployment did not now mean there would be a pick-up in inflation as that relationship had long disconnected. Pointing out that in 2016-2019 when jobs data was good and getting better, inflation was not running high.

See real-time quotes provided by our partner.

See real-time quotes provided by our partner.

Looking at the charts, the hourly candle for EURUSD following on from the rate decision shows how dovish the market was for the US dollar going forward. The rise of 80 pips and a close at the day’s highs, suggests that there is more upside to come as the markets reprice and unwind their bullish US dollar bets. 1.2035 to 1.2050 will be a significant target and marks the halfway point from the EURUSD high in late February 2021 to the recent March 2021 swing low. In the middle of that range is a lot of market structure that had acted as support for the most part of 2021, and I am sure it will now act as significant resistance.

If the price does close above last week’s price range, we will have formed a weekly swing low and more importantly will be trading back inside the price action of the major breakout candle from the last week in November 2019. We will have also held the mid-point of the impulsive run-up from November 2020 to the January 2021 high. This would also add to my bullish thesis and give me confidence that when we get above the lower time frame resistance areas, we can start looking for pullbacks to get long.

See real-time quotes provided by our partner.

The USDCAD over the last couple of weeks has been bearish as the price of energy is rising. At 1.24000 the Loonie finds itself at an area of technical support and previous weekly demand but that is not to say it can bounce from here. A weaker US dollar will only add fuel to the bearish sentiment for this pair, so we could be targeting the 1.2000 big figure in the coming months. The ActivTrader sentiment indicator shows that 90% of the retail traders are bullish on the USDCAD.

See real-time quotes provided by our partner.

Today we have the Bank of England and their policy announcement. Following the current themes from the central banks, no policy changes are expected and although yields are rising, they will not react yet. Trader sentiment is mildly bearish the GBPUSD, which to me means we are more likely to test the highs above the current trading range and start trading into the 1.40** price levels again.

Later on, today we have the US jobless claims report and market expectations are for initial claims to again be above 700k, which would add another data point to the longest sustained period at these elevated levels, as we approach a full year since the start of the coronavirus pandemic and the economic shutdown that ensued.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |