The US dollar has been weakening below the 109.00 level against the Japanese yen currency this week as the pair pauses its multi-week move higher due to a correction in the Nikkei225 and risk-off sentiment in financial markets.

Traders are also starting to reassess the recent up move in the USDJPY pair, following the policy action taken by the Japanese central bank last week, which gave the Bank of Japan more flexibility in the bond market.

Many analysts believe that this could the first step for the Bank of Japan before it starts to taper its massive QE program. So far, the correction in the USDJPY pair has been relatively limited, which could suggest that traders and investors have only grown slightly more bullish towards the Japanese yen currency since last week.

Some other considerations traders need to make before turning bearish towards the Japanese yen currency against the US dollar are US economic data and the emerging strength in the US dollar index.

Better-than-expected US data could cause more demand for the US dollar, and cause traders to believe that the FED will be the first central bank to reduce QE purchases. Traders should also consider Japan’s almost snail-like inflation.

The United States is almost certainly going to outpace Japan in terms of inflation. The recent round of $1,400 stimulus checks is currently being rolled out in the United States, and just this week it was announced that the Biden administration is considering a massive $3 trillion infrastructure spending bill.

In terms of technicals, the USDJPY pair may need to head lower before it heads higher again in order to attract fresh buying interest from much better. This may also be the case with the Nikkei225, which has a strong price correlation with the yen.

As mentioned earlier, the losses in the USDJPY pair are fairly muted at the moment, making the 107.50 to 107.30 area a potential buy zone for medium-term USDJPY bulls.

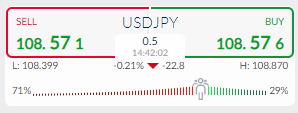

According to the ActivTrader Market Sentiment tool some 71% of traders are bearish towards the pair. If bearish sentiment continues to rise while the price eases lower, I would expect that the USDJPY pair would soon start to find a meaningful price floor and start to reverse. Caution is advised if retail traders continue to pile into the short trade.

USDJPY Short-Term Technical Analysis

Technical analysis on the four-hour time frame shows that USDJPY pair will invalidate a bullish reversal pattern if they move the price below the 108.40 support level this week.

According to the overall size of the reversal pattern, the USDJPY pair could take a near one-hundred tumble if the 108.40 level is breached.

I would expect the potential down move to increase selling momentum and cause the USDJPY pair to quickly head towards the 107.30 to 107.50 price zone. Buyers may very well be lurking around this area.

See real-time quotes provided by our partner.

USDJPY Medium-Term Technical Analysis

The daily time frame continues to show that the USDJPY pair failed to breach a huge long-term trendline last week, around the 109.40 level. This key trendline on the higher time frame has been capping rallies since 2016.

Therefore, we could expect a major move higher in the USDJPY pair if this trendline is broken this year. Traders should expect the 115.00 to 120.00 area to be the long-term target if bulls can get above this important trendline.

See real-time quotes provided by our partner.