Market Brief

Our weeks of central bank commentary and rate decisions are ending. This morning, the SNB as expected delivered its rate decision without altering monetary policy. In their statement they said that the CHF is classified as highly valued and that they would be willing to intervene in the foreign exchange markets as necessary to counter upward pressure on the franc.

See real-time quotes provided by our partner.

The USDCHF has found support from the daily 20-period EMA and with the SNB’s willingness to depreciate the franc, when necessary, traders may take this test of support as a buy the dip opportunity. The Weekly 200-period EMA is sat at 0.9400 and was acting as a resistance level last week. A second test could have a better chance of a continuation higher as sell orders would probably have been fully removed or weaker sellers would pull their orders.

With the SNB aside we can now concentrate on the flash March PMI data, which will provide the first indication of how the Ukrainian crisis has affected the UK, US, and Eurozone economies. German Flash data came in better than expected and now we’re waiting on the wider euro area data.

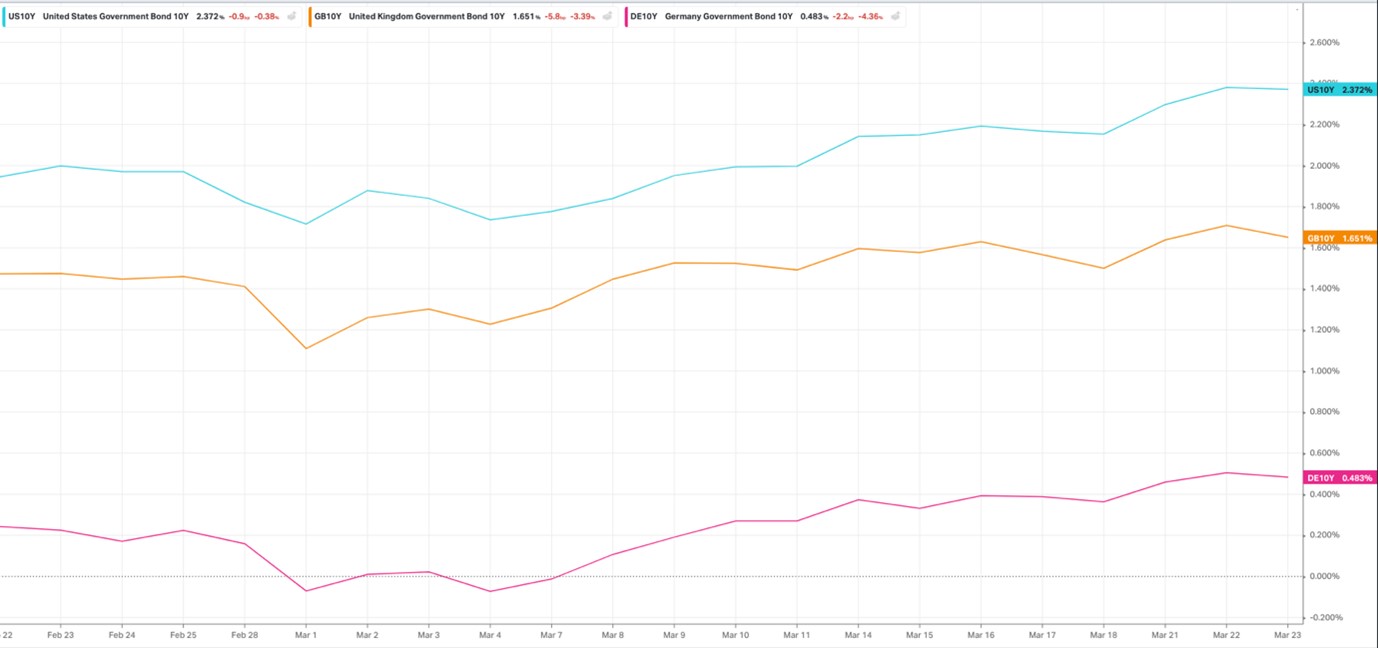

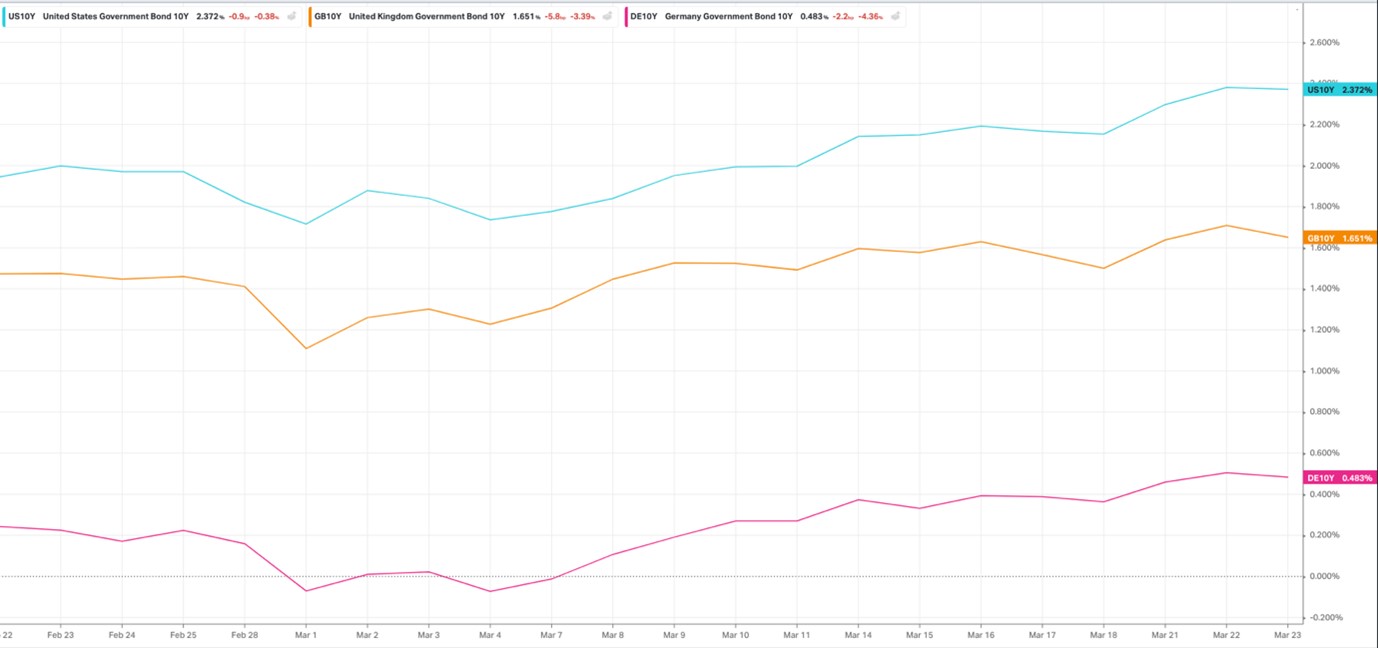

Treasury bond yields are still up on the week, despite yesterday’s modest rally in the benchmark bonds as traders move into safe-havens and commodities. Meanwhile, UK gilts continue to slide following the dovish rate hike from the Bank of England a week ago. The pound sterling is up against the euro but down versus the US dollar overnight. UK consumer confidence has fallen sharply and the outlook from the chancellor shows things are set to get worse for UK consumers before they get better. The Office of Budget Responsibility said that the chancellor’s measures to help households will likely only mitigate about half of the further pressures caused by rising prices of essential goods and services.

See real-time quotes provided by our partner.

The GBPUSD could be staging a counter-trend rally after yesterday’s pullback into an area of balance failed to take out the previous day’s lows. If this price action is signalling a bullish change, we could see GBPUSD back up to the daily 200-period EMA and the 1.3500 level. According to analysts, the manufacturing and service PMIs in the UK will decline and if so the sentiment towards the pound could change on that data point or we could at least see a spike lower, so it would be best to wait for the data to be released before initiating a trade. Currently, the UK consumer spending outlook is particularly uncertain given the impact of rising inflation on real household spending power.

Analysts anticipate steep declines in the Eurozone for both service and manufacturing too. It should be noted that in all cases if the PMIs remain above the 50-level, this is signalling expansion, but the monthly trend lower will be of concern to the markets. On the flip side if the decline is less severe this will be seen as a positive and so we could see a relief rally. It seems likely that the US economy will be less directly impacted by the crisis, and they may actually be a net beneficiary if Europe looks to the US after turning its back on Russia.

See real-time quotes provided by our partner.

Expect more hawkish rhetoric from the Federal Reserve. Markets will be watching for indications that a 50-basis point rate hike is more likely at the next meeting, considering the likelihood of several more interest rate hikes this year. If EU PMIs all come out better than expected or if we have a shift in the news coming out of Ukraine, the euro could catch a bid for the rest of the day, and this would put downward pressure on the US dollar index. Currently, 99.00 is acting as significant resistance and the rising channel is likely to break to the downside. Because the price action has basically gone sideways for the month of March trading the greenback is becoming harder.

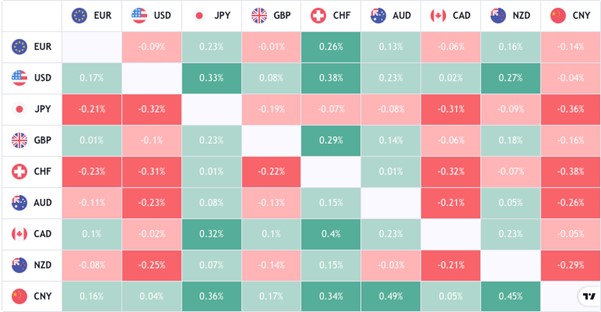

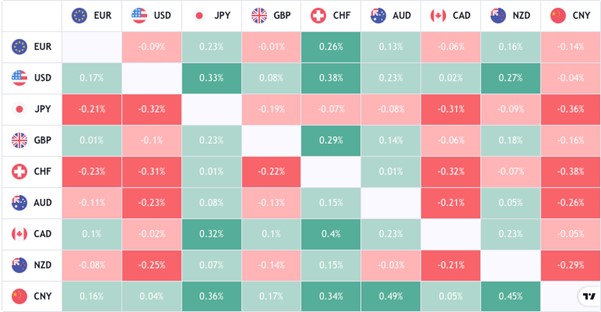

The forex heatmap also offers no clues to which way the overall sentiment is going, so trading safe haven weakness against US dollar relative strength or Canadian dollar positive flows is about the best we can decipher at the London open.

Macro views in a nutshell. While markets fell overnight, they began the session in London off their lows. President Biden will address NATO leaders about Ukraine today. A US-EU deal is reportedly close to lowering Europe’s dependence on Russian energy.

See real-time quotes provided by our partner.

See real-time quotes provided by our partner.

The FTSE100 and German DAX40 are in a consolidation pattern, though the DAX is up against dynamic resistance from the daily 50-period EMA and the FTSE is above the averages. If anything, a break of yesterday’s high in the FTSE could lead to an easier long trade than trying to fight resistance levels on the DAX.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |