Morning Brief

The FOMC rate decision and meeting minutes gave the markets a better indication that the Fed are taking this rising inflation more seriously now, and that they are most likely to raise interest rates earlier than first believed. The projections suggest that there could be 2 rate hikes in 2023. They have had the talk about talking, about changing monetary policy, but have made no decisions or discussed further, based on the data that they have received so far. Which means they are still going to remove at least $120 billion of the highest-grade collateral out of the market, even though the commercial banks are desperate for it.

Fed Chair Powell in his Press Conference made it quite clear that at subsequent meetings from now on the topic of tapering will be considered more and should at some point the Fed feel it necessary to start a rate hike cycle, they will announce it well into the future and look to mitigate the need for a Taper tantrum. The FOMC have a dual mandate to maximise employment and maintain stable prices, so with employment well below pre-pandemic levels and CPI/PPI/PCE all rising faster, the evidence would suggest that the policies are slow to work at best or failing at worst.

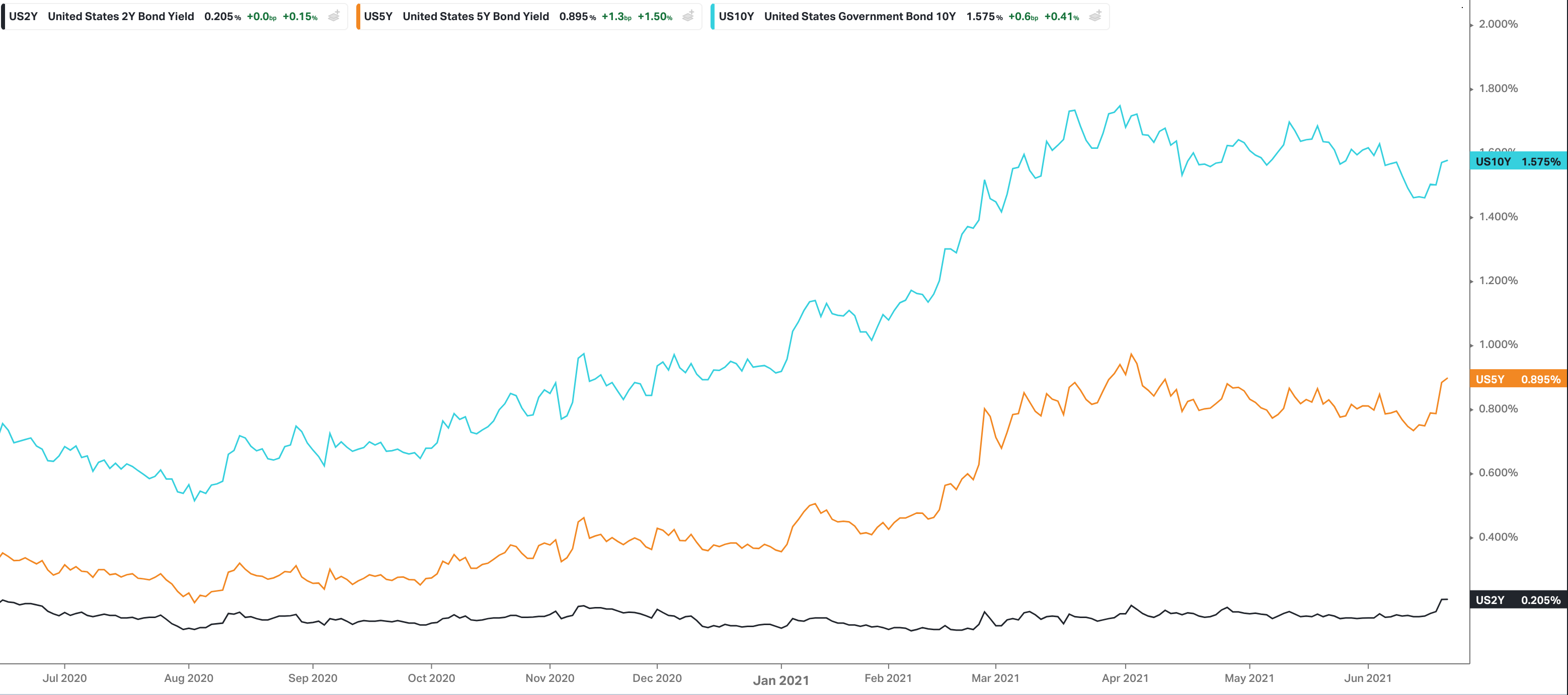

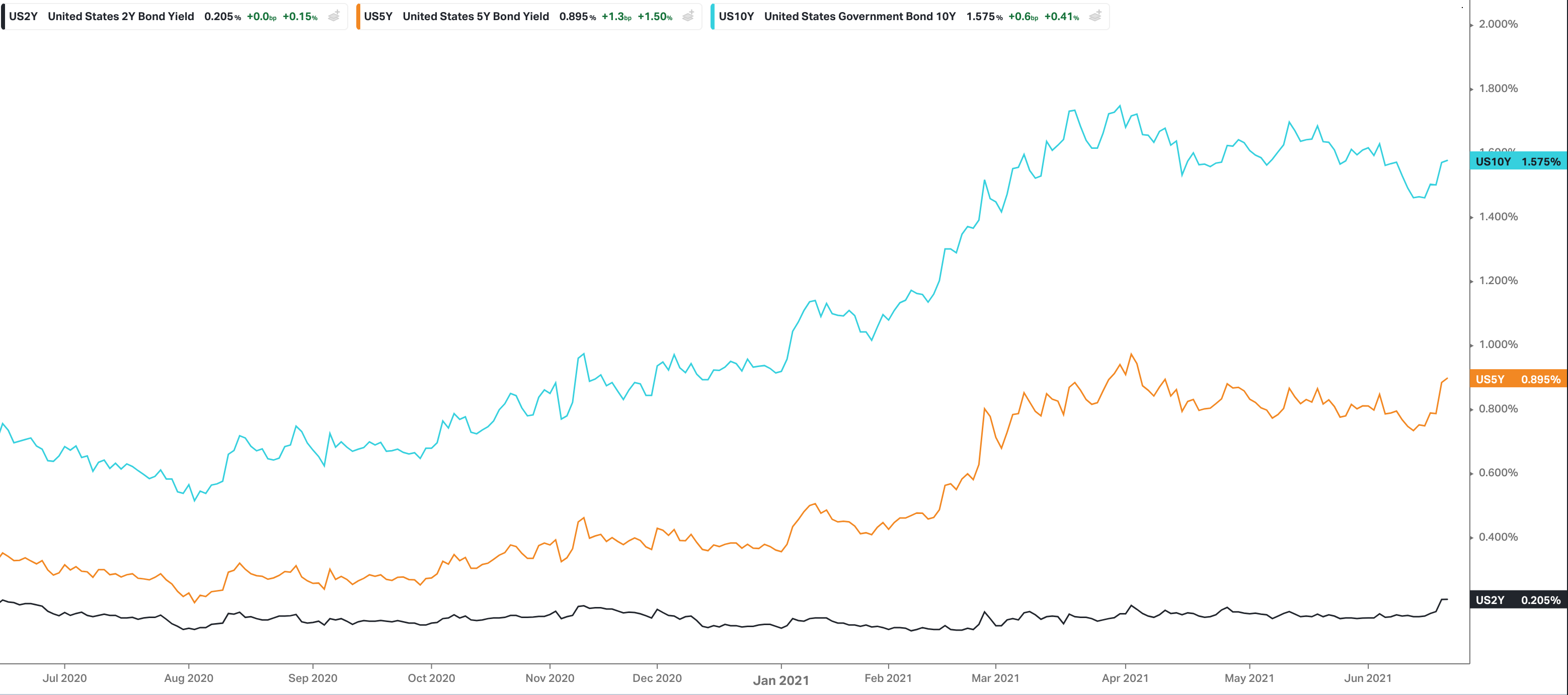

Benchmark bond yields rose on the release of the FOMC announcement, as did the US dollar index. But I am expecting yesterday’s move to be unwound in entirety as nothing has changed in policy and Chair Powell said explicitly to not take the dot plots and projections as gospel as no economists have any precedent to make accurate forecasts.

The FOMC have increased their inflation forecasts for the year. It now sees inflation running to 3.4% this year, above its previous estimate of 2.4%. The central bank also slightly hiked its PCE inflation estimates for 2022 and 2023. There were questions around transitory inflation affects as Lumber was mentioned as a case study of what can happen after a supply shock, increases costs on increasing demand, for the market to then rebalance and prices drop as demand disappears. The price of lumber will have to come back down to value before companies can buy with confidence and pass on the costs. Also, as supply came on stream timber merchants and building merchants will be awash with new supply and maybe excess. Again, forcing the prices of lumber further down.

When asked about the economic growth projections slowing down into the future, Chair Powell said that the committee would welcome a >3% GDP rate and that this year’s base effects will be distorting the current high levels of GDP and that over the course of the next couple of years increasing GDP figures are unlikely, but a growing economy is.

So how did the markets behave during all of this?

Initially the dot plot projections for rate hikes in 2023 were translated into risk-off and equities dropped, yields rose, and the US dollar appreciated. After the comments about taking these projections with a ‘Big Grain of Salt’ the risk markets moved off their day’s lows but yields closed at their days high.

See real-time quotes provided by our partner.

The US dollar index ripped higher up to $91.385 where it hung out into the start of todays London session. The move in the DXY from the swing high on 29th March 2021 to the 24th of May 2021 swing low has been corrected 50% now. $91.50 is basically the mid-point so based on that alone we could have sellers enter back in as nothing has fundamentally changed, but technically the price of US dollars is maybe high enough now. The price action from mid-April formed a little balance area and for today I am expecting that to hold as resistance. If the DXY trades above $91.80 that will open up prices $92 initially and then the $93’s. So, if you do go short the US dollar today, keep an eye on $91.80 as a possible invalidation of that idea.

See real-time quotes provided by our partner.

The EURUSD traded down to the 1.2000 psych level before pausing ahead of the London open this morning. The market structure that formed in mid-March did not act as support as it was previous resistance, and prices are now under the daily 200 ema. 1.1865 on the EURUSD is my mental stop should I find a good entry today at the 61.8% Fibonacci retracement, to go long.

See real-time quotes provided by our partner.

WTI nearly touched $73 per barrel yesterday but closed at the day’s lows and below its opening price. If the US dollar were to appreciate further today this commodity would fall back down to $66-$68 and the top of the previous range highs. The USDCAD on the stronger greenback traded higher and has now retested the trend line that formed between the 2015 – 2017 swing lows on the monthly chart. This was mentioned at the start of the week as being a great place to look for a retest of the breakout, in preparation for a continuation to the downside.

See real-time quotes provided by our partner.

The Aussie is struggling against the strengthening in the US dollar even though employment data release by the Australian Bureau of Statistics showed a really positive increase in employment change and a sizeable drop in the unemployment rate. Governor Lowe delivered a speech yesterday titles “From Recovery to Expansion” where he outlines how well the Australian economy was doing. He notes that the economy is still in the recovery phase but certain metrics like unemployment are at pre-pandemic levels now. Australia’s antipodean neighbour New Zealand posted expansionary GDP figures today. GDP beat expectations and rose 1.6% in the three months to March 2021, following a revised 1.0% contraction in the previous period.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |