Weekly Index Analysis

See real-time quotes provided by our partner.

Technically the S&P500 is in a massive bull trend. Since April 2020 the index has risen from 2571 to the recent all-time high of 4718, which is a whopping 83.5% in 18 months. Since 1926 the average yearly return is around 10%. The stock markets are a function of growth, advances in technology and humans doing better generally. Only the best companies survive in the indices, so the overall trend is for indices to go higher. Stonks only go up! Lots of firms will not short the S&P500 because of this. They do, however, buy the dips.

See real-time quotes provided by our partner.

After 5 straight up weeks, the S&P500 is frothy and due a decent pullback with the 20-period moving average and the 4405 level a decent initial target to the downside for those trying to catch the top. The weekly momentum as seen through the 20, 50 and 200-period EMA’s is clearly to the upside and price usually follows momentum. As they are saying goes, “the trend is your friend until the bend at the end.”

Sentiment

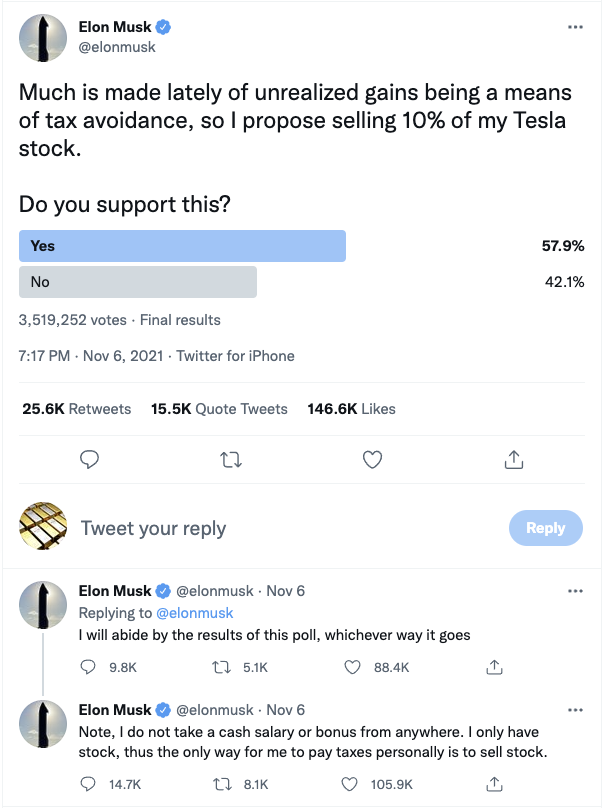

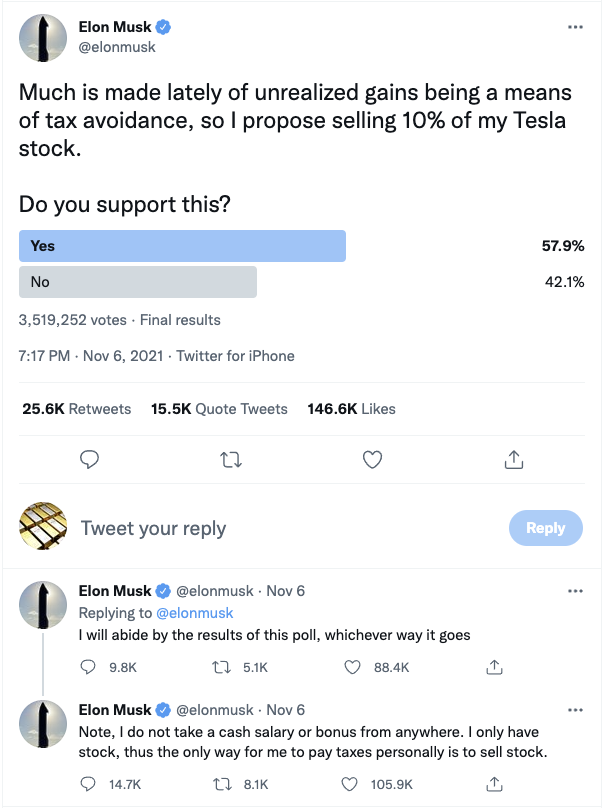

When the world’s richest man can afford to lose $50 billion on a Twitter poll, that’s a sign that an asset is getting frothy. Tesla had just surpassed a trillion-dollar market cap and was a bigger company than the top 5, maybe ten energy companies in the United States. Following this tweet, the share price dropped 38%, which is a good level for most investors looking to buy dips.

See real-time quotes provided by our partner.

However, if the overall index that the stock is trading in is to come down some more % points itself, it will be hard for Tesla share prices to stick at these levels. Value investors will be wanting a good 50% reduction from the most significant swing low to the all-time high.

See real-time quotes provided by our partner.

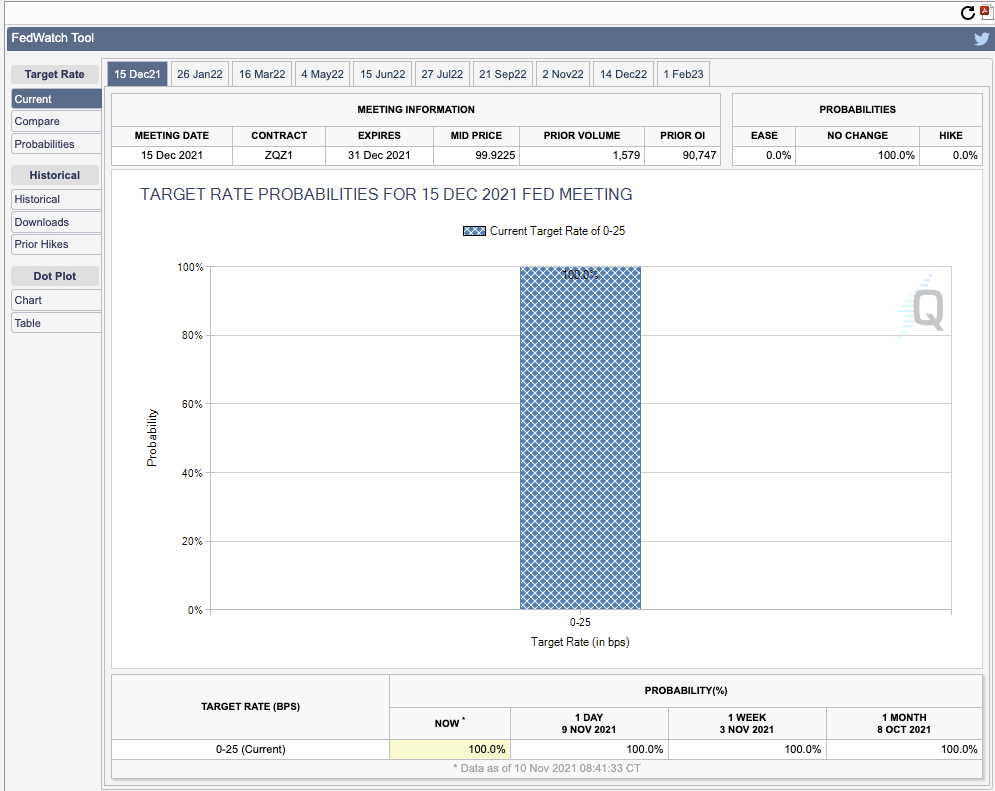

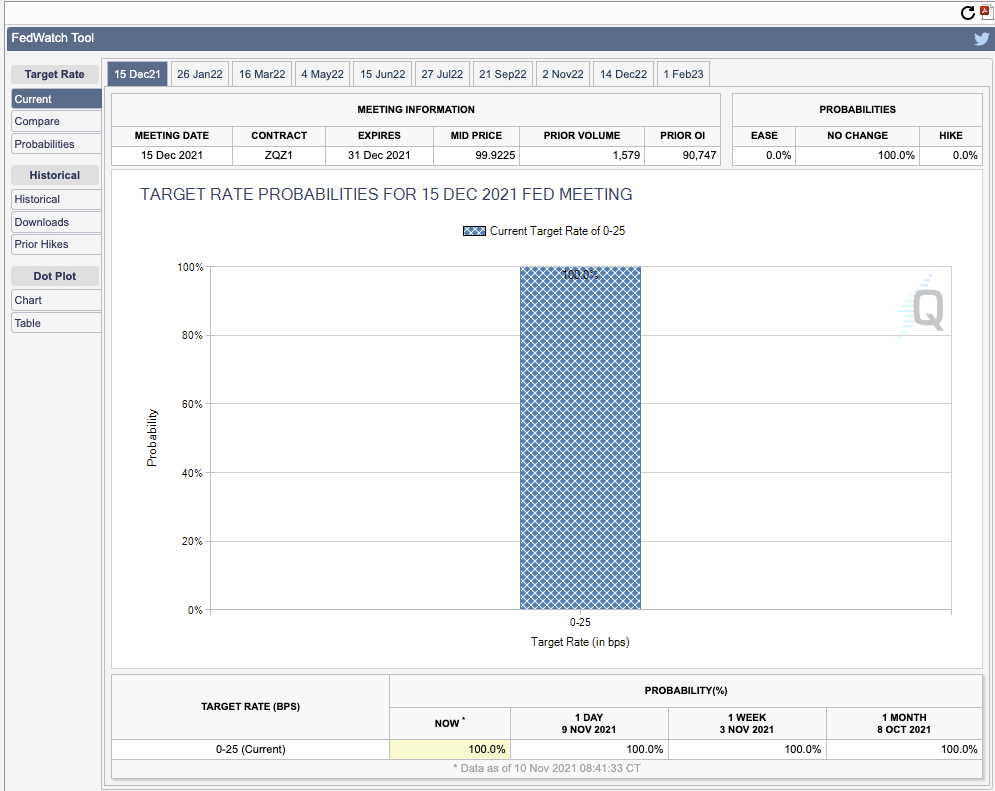

Other problems facing the Nasdaq and S&P500 are the current moves in the US Treasury markets. Yesterday’s 10-year and todays 30-year auctions were disappointing. The knee jerk reaction to today’s auction dropped Treasuries, lifted yields, and boosted the US dollar. The S&P500 on this auction alone dropped 10 points instantly and has since dropped a further 10 points at the time of writing. Usually when there is a move out of the safe haven of the Bonds, money goes into the higher yielding risk assets, like the equities markets. The fear for risk assets is that the move out of Treasuries is a signal that the market is pricing in a rate hike from the Fed to combat inflation after the CPI today hit 6%.

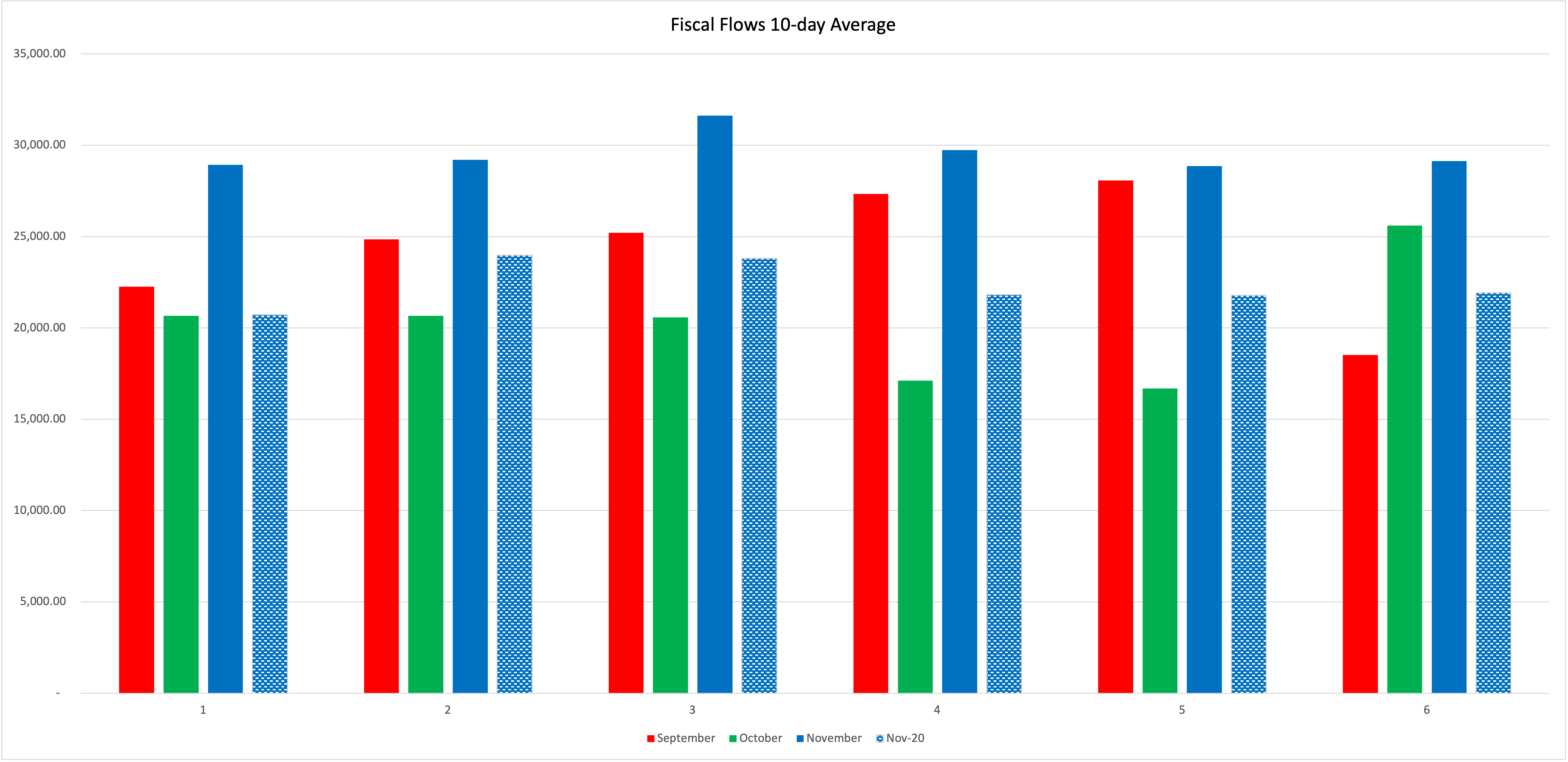

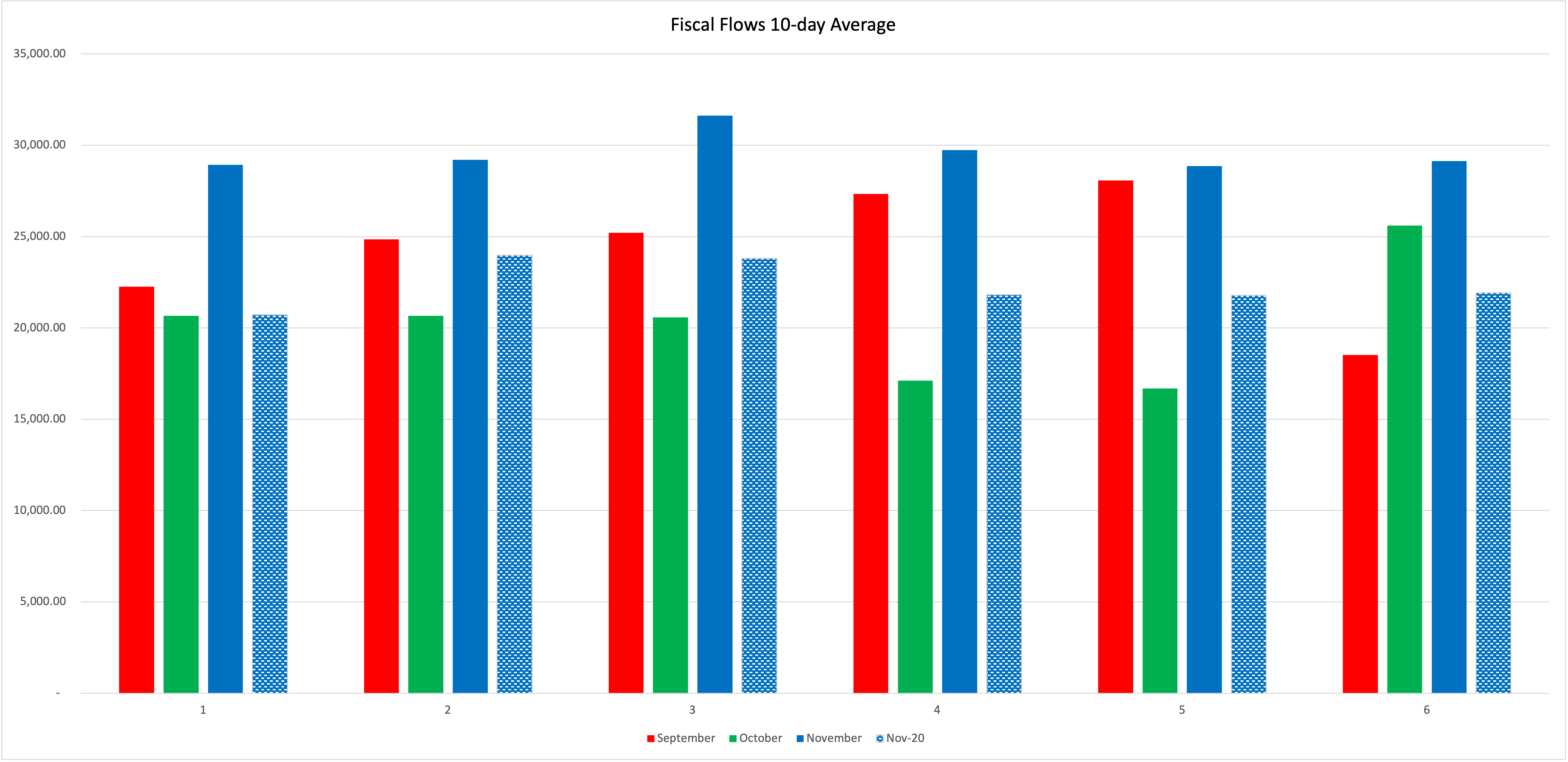

In the previous fiscal year of 2020/2021, the US government spent $7.744 trillion into the economy. The largest amount of spending ever this has been getting larger and larger each year for many years now. At the end of September 2021, the monthly Federal statement shows that $576.830 billion was spent into the economy from the US government. Compared to the near $1 trillion spent in March 2021, this seems a massive reduction, but as it turns out it is $100 billion more on average than pre-pandemic levels. By the end of October 2021 fiscal flows came in at $517.953 billion and year-over-year that was nearly $32 billion more, showing that flows are rising and remaining high. We could be on for an $8 trillion plus budget spending in 2021/2022, carried on by President Bidens ‘Build Back Better’ plans.

Current daily average flows in November 2021 are around $29.14 billion a day, which is $10 billion a day more on average than this time in September and $4 billion more than this time is October. In 2020 November average flows were $21.93 billion by this date.

The point I am trying to make is that there is more money flowing into the non-government from the US government year on year. This is what I believe helps support the equities and none of this is Quantitative Easing. This is spending on Social Security, Medicare, Medicaid, Defence, and all things the Federal Government is responsible for.

The Federal Reserve oversees keeping prices stable and maximising employment. Today was a typical Fed day, as we had both inflation data and jobs data.

US Initial Jobless Claims 267k vs Exp 265k. previous week revised higher to 271k and US CPI MM Oct 0.9% v’s Exp 0.6%. Previous 0.4%

Interestingly in the last FOMC press conference Fed Chair Powell mentioned that the FOMC view the rate of earnings increases as an indicator of whether inflation is moving out of the durable goods into the wider economy and today US Real weekly earnings MoM for October were down -0.9%, previous 0.8%. Currently wages are not accelerating past CPI inflation.

Treasury Secretary Yellen suggested on Monday that the Fed would not allow a repeat of 1970’s which some took as a sign we should have been expecting an inflation rise and that there would be a knee jerk reaction with a Hawkish pricing of the FOMC rate trajectory. This goes someway to explain the rising yields after this week’s Treasury auctions but it goes against the words of the Fed. After the Bank of England basically re-negotiated their forward guidance when they failed to raise rates a week or so ago, it is probably better to just wait for the Central Bank to tell you that they are doing something, rather than betting they will.

So far for me the underlying macro is suggesting there is a large amount of support under these markets and that any pullback should be a signal to buy into value.

There is one clear fundamental risk event on the horizon and that is the debt ceiling negotiations. The current work around ceases on December 3rd, 2021, and the central planners and law makers need to raise the debt ceiling once again so that Bidens fiscal plans can come to fruition. There is a serious consequence if they don’t raise the debt ceiling and that is in the form of not only a government shutdown but also the possibility of a default on the debt. There is no need not to raise the debt ceiling or suspend it all together, it is just political will.

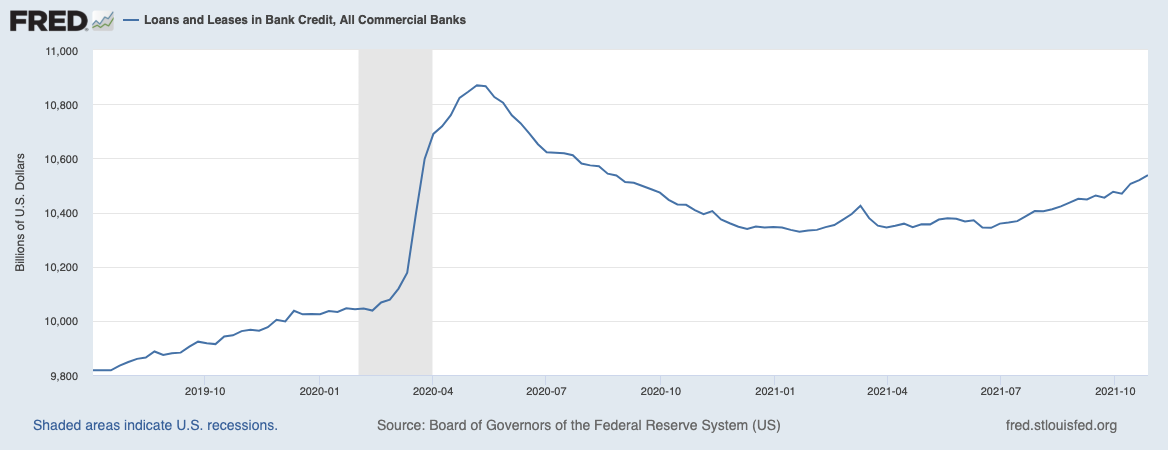

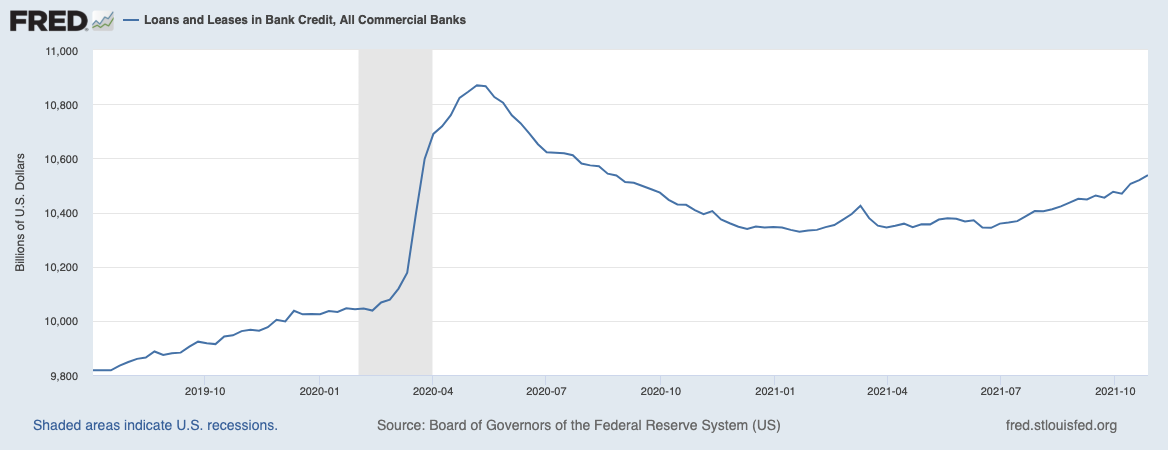

Other signs of positivity are coming from the credit creation and lending levels out of the commercial banks. We are seeing as steady pick up in loans and leases and we could be bottoming out on lending for commercial and industrial loans.

With the rising government spending and the increasing credit from the commercial banks there is a consensus that US GDP will grow in Q4, which will be a further boost for the US economy as foreign investment will flow towards strength.

Technicals

The daily chart shows that the price action is currently above the 20, 50 and 200-period moving averages and we have already established that this is in line with the higher time frames. A pull back into the 20 and 50 EMA’s has traditionally been a great signal to start looking for a buy entry setup. 4590 and 4515 therefor are the downside targets for those looking to buy into value, and assuming the macro underlying elements to this market don’t change drastically, I am convinced this will work out again. The MACD is currently positive and a cross over below the signal line may induce more selling from trend following CTA’s. 4464 is their current trigger level.

See real-time quotes provided by our partner.

Assuming the CTA’s don’t get net short above the 4464-trigger level, the daily 50 EMA looks like the best place to test a speculative long trade, with a more conservative entry being on a confirmation that the dynamic support level holds. Market structure from the swing high printed at the beginning of September 2021, would be a great confluence with old resistance becoming support. Failing that the balance area which formed when price went sideways during late September to mid-October would be another zone, I would be keen to see a bounce from.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |