Weekly Index Idea

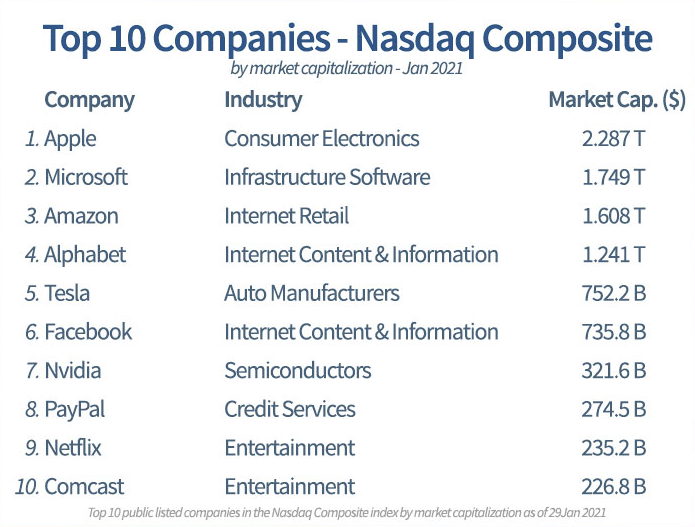

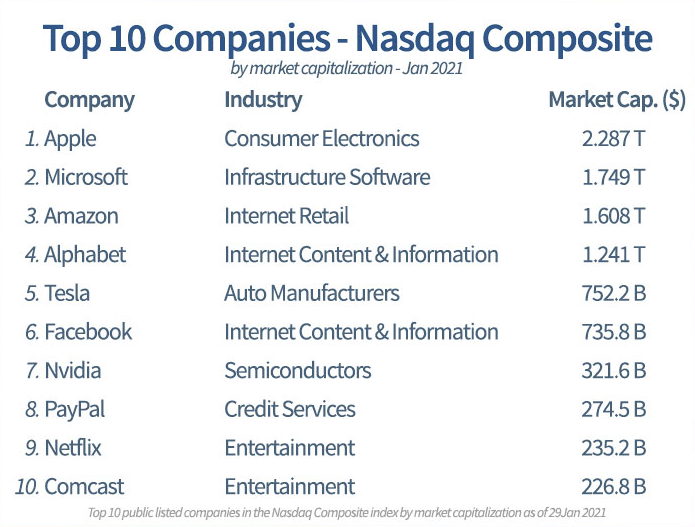

There are 3 regular US trading sessions left to get the Nasdaq 100 index back above the monthly opening price of 13881 and into the green for the 4th consecutive month. Currently of the 6 top companies within the index, Apple is trading lower for May, as are Tesla, Microsoft and Amazon, while Facebook and Google are currently trading positive for the month.

There had been a serious concern that ‘Sell in May and Go Away’ could occur but given the strong rebound in the US tech stock space we may get another push higher as inflation fears start to dissipate. The month of May has been a 900-point range which bottomed on the 13th of May following on from the previous day’s inflation data.

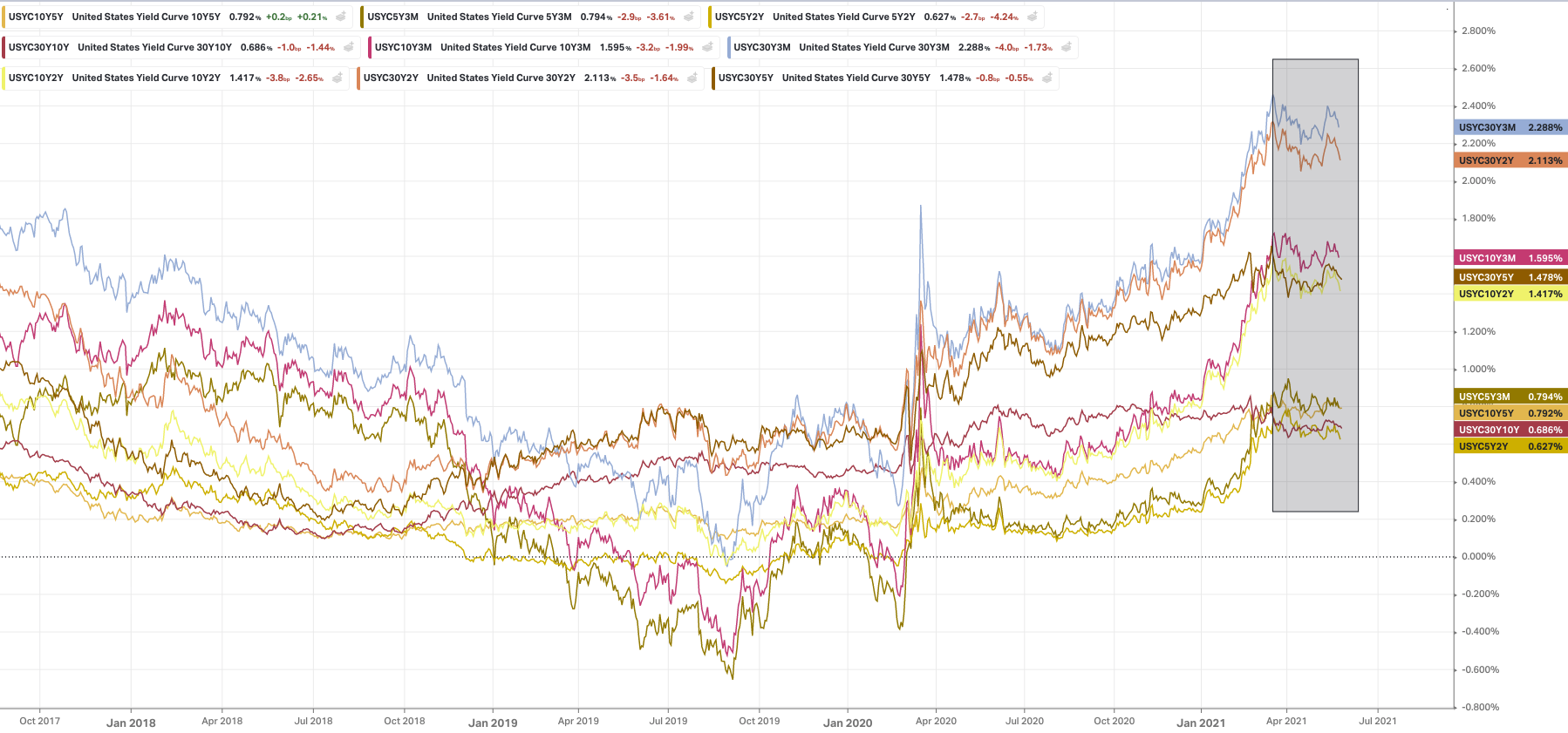

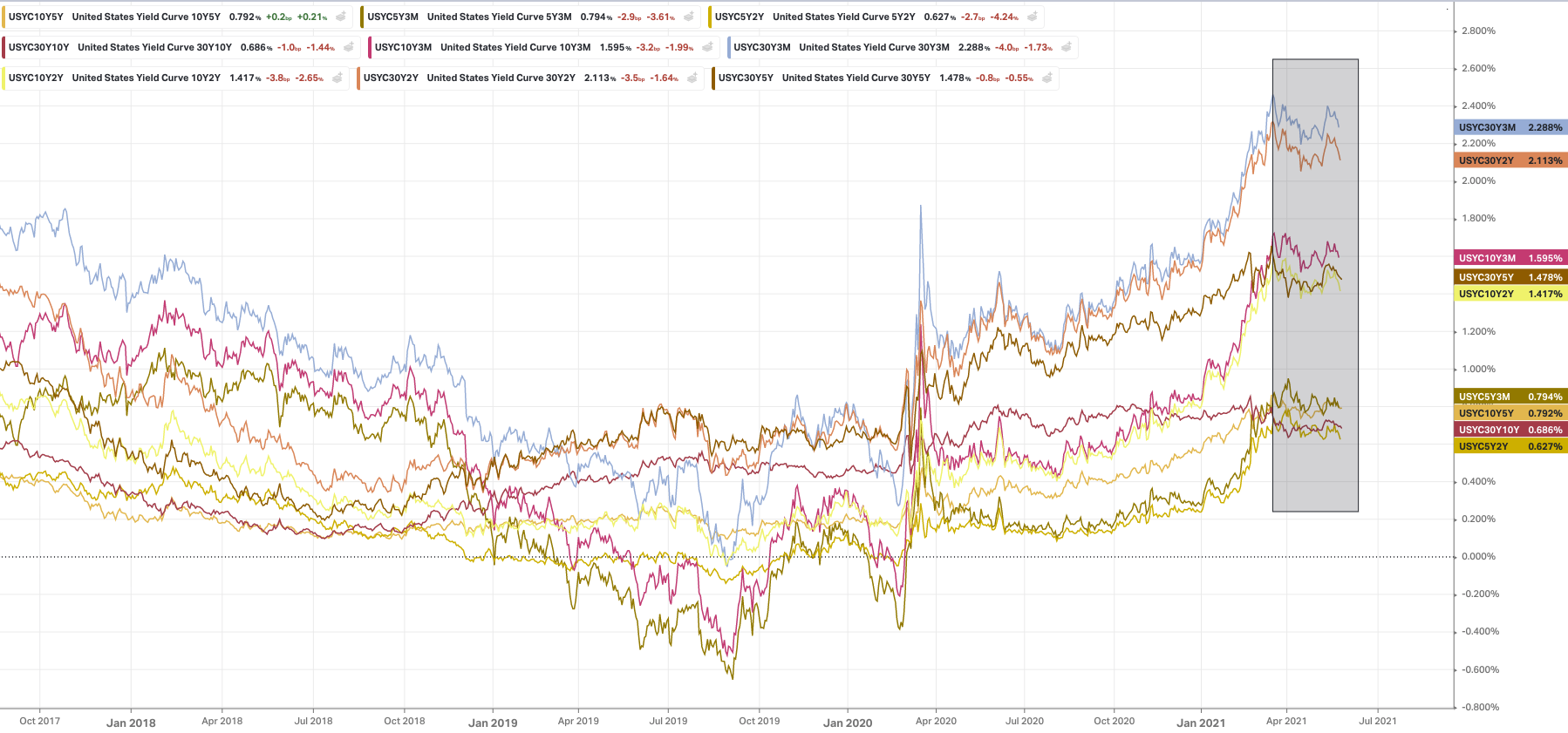

The year-on-year inflation rate spiked to 4.2%, with core inflation up at 3% and the quickest rise in inflation month-on-month with a reading of 0.8%. This got the media and market talkers amped up for inflation and Fed policy changes, but a week later, the Fed Chair Powell once again re-iterated that they would not move on the policy until the data told them to.

The data being referred to is from the employment statistics and Personal Consumption Expenditure (PCE), of which we receive the latter this week.

From their peak in March the steepening yield curves that analysts said where a signal of impending interest rate hikes have flattened off through April and May, with the benchmark 10 year now trading back towards 1.500 having topped out at 1.750 towards the very end of March.

It is not just the inflation expectations that has been weighing in on big tech, there are also disruptions coming from court battles, like the one Apple is having with Epic Games, or the privacy issue updates Apple will make that could disrupt Facebook’s advertising revenue model, or even Amazon v’s Washington D.C. court case on antitrust issues. The Biden Administration did run on a campaign which said it would look into new regulation for these powerful companies and that he was not necessarily in bed with Silicon Valley as President Obama may have been.

See real-time quotes provided by our partner.

Apple is the largest constituent within the Nasdaq and therefore can be responsible for moving the market. The share price for APPL is currently under the years opening price and that level held as recently as the end of April when the share price tested the $133 level for several weeks. The fact that the level stayed as resistance, does not bode well for a continuation higher, so the hope is that 99 other companies can mitigate any problems APPL is going through. After all, a rising tide lifts all boats.

See real-time quotes provided by our partner.

The momentum in the Nasdaq has severely slowed as can be seen by the daily 20 and 50 exponential moving averages. As these pinches together it shows a significant amount of price correction and sideways action. Markets do not necessarily have to correct in price, they can do so over time, and that is what currently looks most likely, as the Feb ’21 to Mar’21 decline was more prices driven. The magnitude of this recent price decline is roughly 2/3rds of what the early correction was but as the daily 200 ema starts to flatten off, we have to consider the possibility that this price action is demonstrating a distribution pattern.

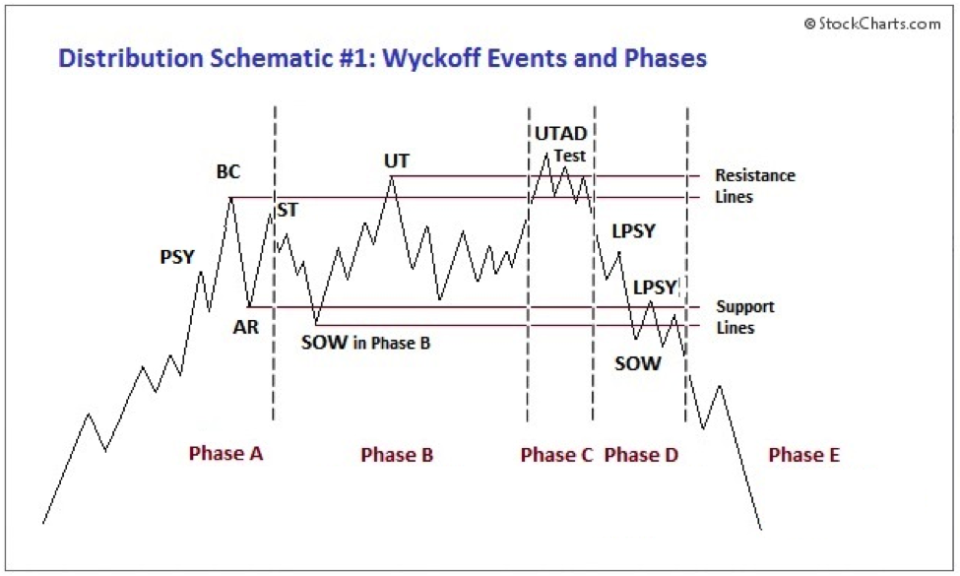

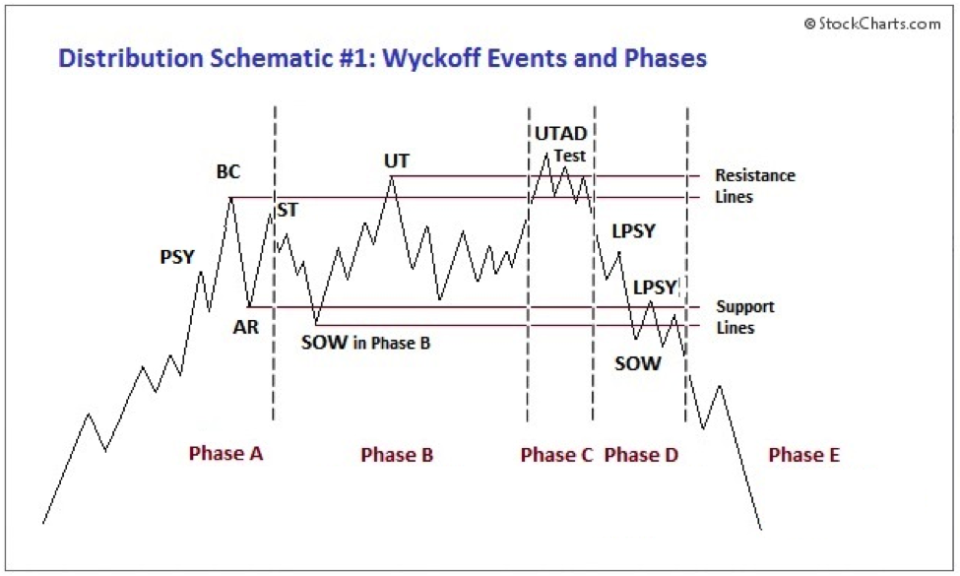

Traders should pay attention to all possibilities and try and anticipate where the price action could go, assuming the fundamentals continue to stack against the bull trend. A good Bull understands the Bears agenda, therefore can understand where the Bull narrative has been proven wrong. Richard Wycoff provides traders with a set of analysis tools to help describe the distribution and accumulation phases, which traders can then use as a basis for their own technical analysis. Using a Wycoff distribution schematic we could assume that there could still be one upthrust or blow off top to come. This would assume that the peak in February 2021 was a buying climax and that April’s peak was an Up Thrust in Phase B following on from the sign of weakness we printed at the swing low in early March.

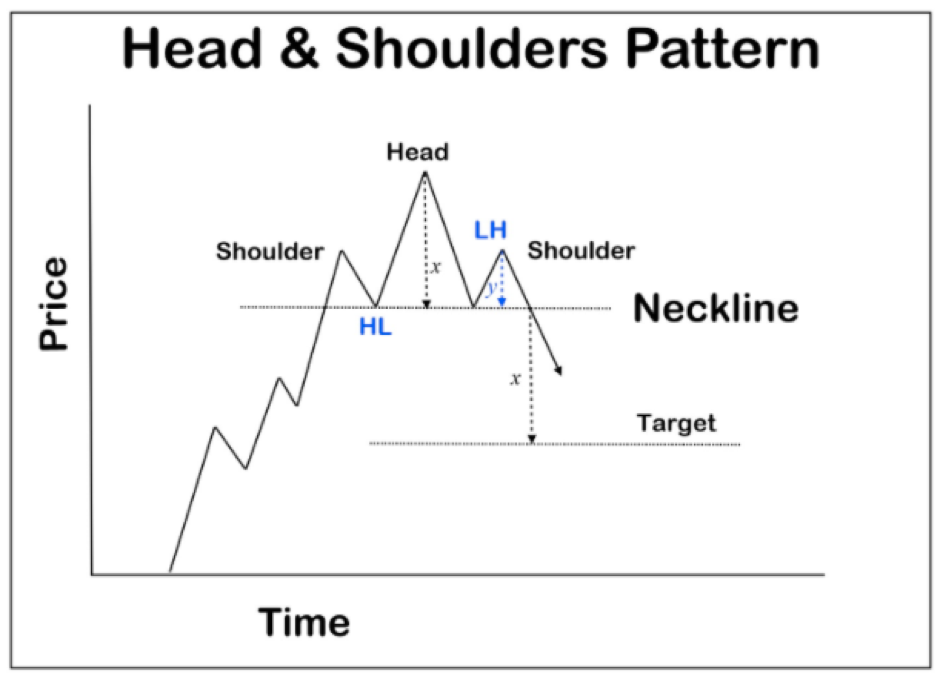

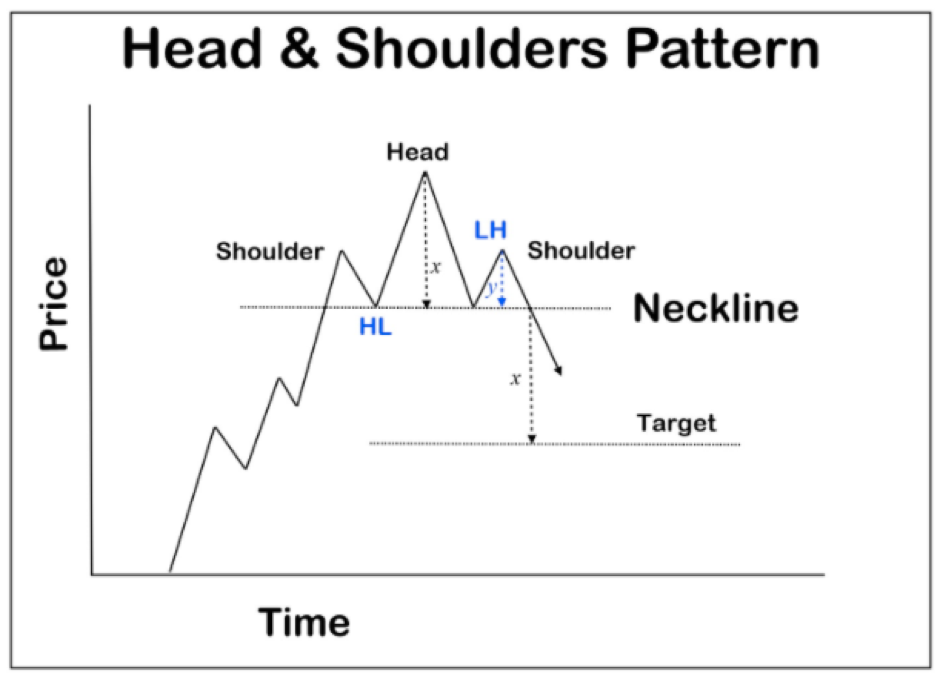

Another possibility is that we are halfway through forming a major Head and Shoulders pattern, which is also a volatile distribution pattern, where the attempts to take out the All Time High would once again fail after a test of the March 2021 lows first.

The bulls are still in control and ‘Buy The Dip’ is still very much the order of the day, but we do need all 6 major companies in the Nasdaq to start pushing higher if the exuberance towards the next big level of 15,000 is to occur. The fiscal flows are still very much supporting the Indices, and infrastructure stimulus is still in the pipeline. If we get a failed H&S pattern or if the price action does not create a meaningful distribution pattern in the near future, we are likely to get acceleration through the weekly swing highs as that is where traders generally keep their stops when they are short. The longer the moving averages can stay positively stacked, the more likely this happens though I am wrong when a close in price below the 200 daily ema signals to traders they should be looking for further downside prices.

To the downside there are high probability targets such as the gaps between the US sessions previous close to the following days open. These gaps are generally filled, but if the price action is particularly impulsive, the gaps get left behind.

See real-time quotes provided by our partner.

On the NDX which trades during the US session only we can see two recent gaps which I am assuming will get filled as the month of May has been very good at filling in all of the price action, as yesterday closed a gap from the beginning of the month. The second reason for this thesis is that I believe the end of month rebalancing after such a tumultuous month in other risk assets will give traders more reason to take some profits ahead of the summer doldrums. When we have filled these gaps and or broken back into April’s trading range, we can start looking for continuation patterns to the upside. For now Buy The Dip at decent structure and control the risk to the downside.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |