Market Brief

It is FOMC day today, which may be the most important day of the year, barring the upcoming mid-term presidential elections, as the Federal Reserve gives forward guidance regarding how hawkish it really is. Assuming the results come in as expected, the market has already factored in the changes. If they do not meet expectations, the US dollar, US benchmark yields and inflation-sensitive assets will reverse their current trends. The Federal Reserve is expected to announce its second consecutive rate hike, but this time by 50 basis points. Additionally, the market anticipates more of the same for the coming months, and the IMF has warned that to combat the escalating inflation, interest rates may need to be raised to 5%. This would be unusually aggressive, but many Fed policymakers have signalled their support for at least 100 basis points over the coming months, with a rhetorical target of 2.75%, so any movement back from their aggressive position would be more surprising. The London session has seen an increase in volume following the Asia-Pacific session with many Asian equity markets closed for holidays.

See real-time quotes provided by our partner.

According to the latest New Zealand jobs report, businesses are reporting difficulty recruiting. This may be eased by the reopening of the borders. The NZDUSD has been particularly hit by the strength in the US dollar but is currently compressing below the 0.6500 level with 0.6400 possibly major support. April’s close was below the Bollinger band so I am expecting further downside, towards the 0.6000 big figure but would rather get in higher around the 0.6700-0.6800 zone.

The economic calendar has already had quite a lot of data points and the rest of the day will see more economic releases, but we should be mindful that any moves will be subject to a mean reversion ahead of the Fed. Despite higher inflation and interest rates, UK March money supply and lending data will show a decline in the money supply. It remains to be seen if individuals can obtain credit under these circumstances.

See real-time quotes provided by our partner.

The monthly GBPUSD clearly closed below the lower bond of the Bollinger band, so again, I am expecting further long-term weakness but would rather take that short trade from the 1.3000 level or the March low, should it act as resistance. The Bank of England announce their rate decision tomorrow, so we could either add to the directional moves that occur after the Fed today or reverse them. Which is a long way to say, it’s better to wait until we have all the info next week.

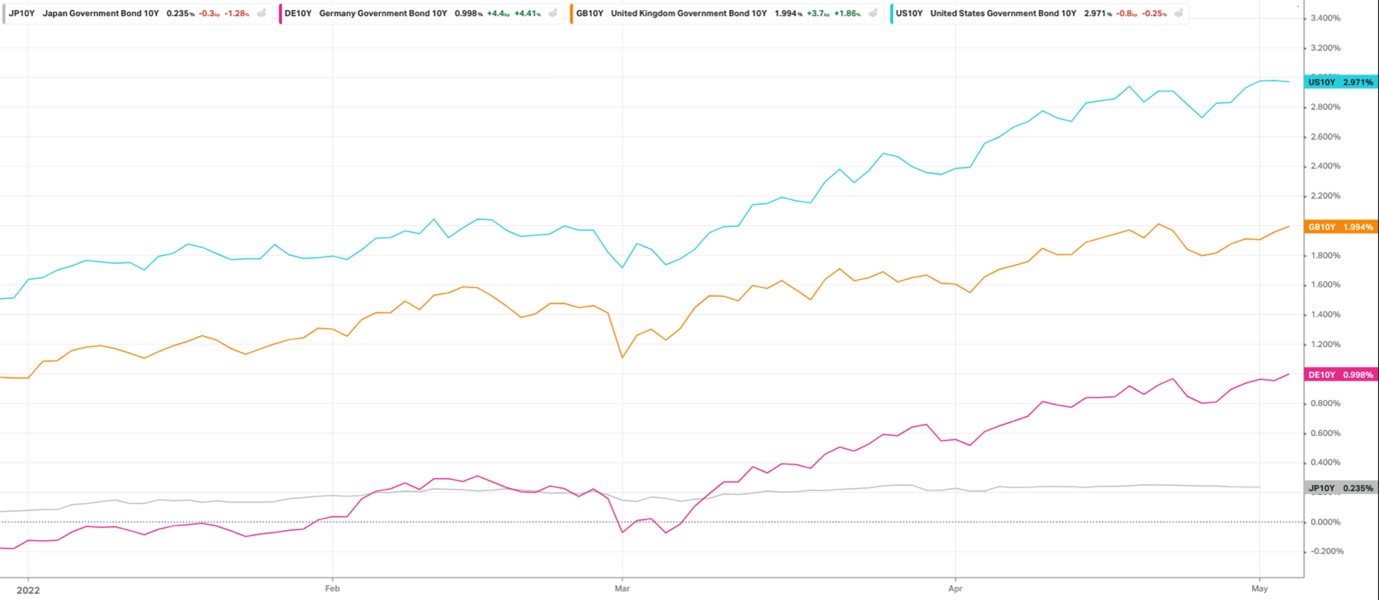

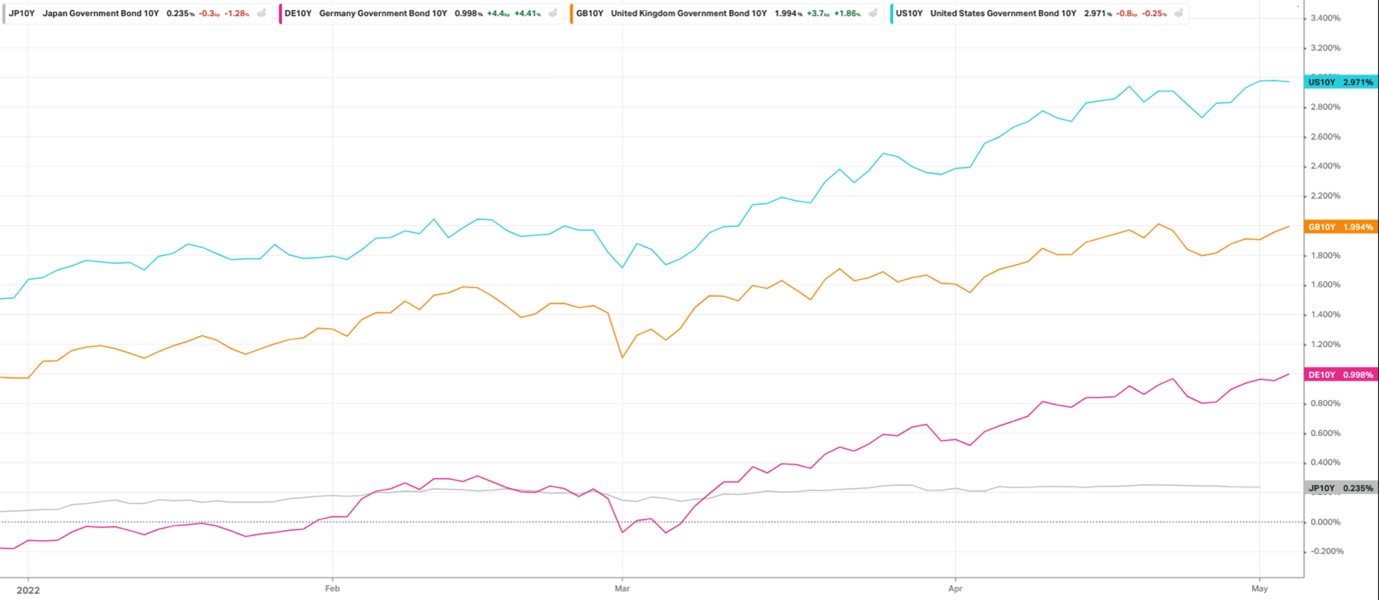

Yesterday, US government bond yields rose, with 10-year yields touching 3% at one point. Major currency market crosses were little changed on the day with the US dollar holding close to recent highs versus the euro and sterling. The price action on the charts was frustrating, as we kept taking out intraday swing highs and lows before reverting back into the trading ranges, but no real trending moves occurred as the US dollar kept hugging its recent highs. The ranges over the last few days have compressed, so I am expecting initially a false breakout, and then for a trending move to occur.

We have NFP to also look forward to this week on Friday, with today’s US ADP figure hopefully able to shed some light on what we can expect.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |