Sentiment towards a number of the major global indices is changing fast after the even heavy sell-off in tech stocks amidst a raft of deleveraging of existing trades due to fears of more Fed tightening. Now is a great time to check out how traders feel about some of the major indices, as they look for contrarian trading signals via sentiment readings.

Trading sentiment is most effective when retail traders are running counter trend, meaning that they are heavily leaning against established market trends and in increasingly large numbers. Additionally, once big sentiment skews build it can be a powerful sign that the retail crowd are being too one-sided.

Typically, market sentiment readings for an instrument that has reached around 75 to 80 percent is considered to be at an extreme level, while market sentiment readings over 80 to 95 percent is often a strong indication that the trade could be topping or about to reverse at any time.

I will now look at some the strongest sentiment bias amongst the retail crowd right now. Some of the sentiment skews suggest that current price trends in FX, stocks, and precious metals are breaking point and big moves may be nearing.

Nasdaq – Tech Crushed

According to the ActivTrader Market Sentiment tool the majority of traders are still very bullish towards the tech-heavy Nasdaq, despite the index crashing through the 12,800-support area last week.

The ActivTrader Market Sentiment tool shows that 8 1percent of traders are expecting more upside in the Nasdaq. Given the bullish bias, sentiment is basically warning that more downside is coming.

It should be noted that sentiment has got worse since last week. I think that retail is probably very wrong about the direction of stocks, and they are undergoing an extended period of pain right now.

UK100 – One To Watch

The ActivTrader market sentiment tool shows that 57 percent of traders are bullish towards the UK100. This is a drop since last week, which is not surprising considering the 400 points over recent weeks.

Traders are in the majority, still expecting more gains, which I tend to agree with. Given that retail traders are typically on the wrong side of the trade, this could mean that the time is still not for a large rebound.

In order for the bulls to be right, we really need to see the UK100 recover towards the 7,400 area, which would probably signal that the worst is over for the single in the short to medium-term.

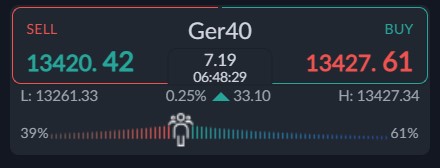

GER40 – Still Bullish

Market sentiment towards the Ger40 is still very bearish, which is not very surprising given that the index has staged a huge decline over recent weeks and is now in a technical bear market below its 200-day MA.

The ActivTrader market sentiment tool showing that some 61 percent of traders currently bullish towards Germany’s leading index, meaning that retail is convinced that German stock are heading lower.

I think that the current sentiment is concerning, especially if we consider that tech stocks are breaking lower and the US stocks are plunging, and the Chinese economy is on the brink of contracting this quarter.