GER30 Technical Analysis – Flying High

Please login to join discussion

The Ger30 has rallied to a fresh all-time trading high as European traders cheer the prospect of upcoming US stimulus and the announcement from Deutsche Bank surrounding a buyback program.

Following weeks of consolidation and sideways trading action around the 14,000 area, the index finally broke higher. Traders and investors pondered whether the index had the gas in the tank rally to a new all-time high, and now the move higher has taken place, bulls have answered the call to action.

The recent US stimulus announcement and the news that Deutsche Bank will be launching a share buyback program of over $1 billion and a dividend program, ahead of the release of its 2020 results, answered those doubt, and helped propelled the index towards the 14,600 level.

European bourses have been gaining traction over recent weeks as investors move out of the top tech heavyweights in the United States and look for value stocks abroad, largely found in the eurozone retail, banking, and energy sectors.

An extremely large bullish price pattern has now been lit-up, following the breach of the former all-time high, just below the 14,200 level. With the German DAX approaching a 400-point weekly gain, the up move could just be getting warmed up.

The notion that the United States consumer will soon be getting $1,400 stimulus checks is being seen as bullish for the German Manufacturing sector. Quality goods and hardware from the top eurozone manufacturer could be in high demand.

Additionally, the recent pullback in the euro currency against the British pound and the US dollar is seen as being a boon for the European economy, and specifically German manufacturers. The upcoming ECB meeting will also be another big event for the euro currency and the German DAX.

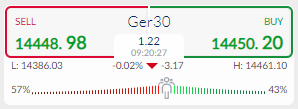

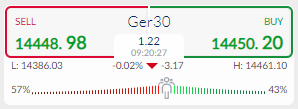

The ActivTarder Market sentiment tool currently shows that GER30 traders are slightly bearish, with some 57 percent of market participants holding a negative bias towards the leading German index. Expect further losses in the index if sentiment worsens and the GER30 continues to hold onto its gains and heads higher.

GER30 Short-Term Technical Analysis

The four-hour time frame shows that a large head and shoulders pattern has recently been activated, following the recent advance above the 14,200-resistance level.

According to technical analysis, the measured upside target of the inverted head of the pattern is found around the 14,800 level. This could mean that the index could continue to rally by a further 220 points from current levels.

Source By ActivTrader.

GER30 Medium-Term Technical Analysis

Looking at the daily time chart, the breakout to new all-time high has further triggered an extremely large, inverted head and shoulders pattern on the daily, weekly, and monthly time frames.

The overall size of the bullish price pattern is suggesting that the long-term target for the GER30 is 18,500. However, an overextension towards the 19,000-resistance level is also possible.

Source By ActivTrader.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |