Market Wrap

See real-time quotes provided by our partner.

Gold shorts that targeted the $1800/oz level may have cut their trade short if they closed out today. Based on the price action, some short covering took place at the big figure. The people who have been following my analysis know I am open to a test a lot lower, but it should be pointed out that when we break below the 61.8% Fibonacci retracement level, there is very little support left in these markets. We’ve seen it in the equities, and now we’re seeing it in precious metals. There is much uncertainty in the world and investors are using the news releases to get in at levels of value or creating narratives to train traders to think one way, only to go against them later. In my opinion we at the very minimum sweep the lows of the last impulsive move, then as traders puke their longs, we accelerate to demand or sweep the range lows and the double bottom from March 2021 to April 2021.

See real-time quotes provided by our partner.

Equities around the world had a relatively bullish close for the day but remain bearish over the last month. We are seeing weekly closes in the green in some indices, which is a sign that maybe the worst is over or that we are going to get one of those bear markets rips, to sucker more people into thinking we are going higher. Currently, there is little reason for new highs to be expected as the world is in a worse off shape than what we started a month ago.

See real-time quotes provided by our partner.

The USDCAD dropped -0.85% today as the energy markets ripped higher and the US dollar softened against its peers. 1.3000 has been an important level in the past and it is currently acting as resistance. The pullback to the 38.2% retracement level should it hold, indicates to technical analysts that the downtrend has strong momentum and an acceleration lower should be expected. Getting through the recent range is still going to be tricky IMHO, with 1.2600 literally a red line that needs to be crossed on this chart if the USDCAD is to come lower.

See real-time quotes provided by our partner.

The Canadian dollar is being supported against the US dollar by a rise in Brent crude oil prices today. According to sources, Russia has stopped supplying gas to Finland due to the country’s NATO membership plans. The easiest and most efficient alternative to gas is oil, so energy users will have to switch to oil or alternative energy. In addition, we’re experiencing a reduction in global supply as well. With more demand and less supply, energy prices will rise. Which is exactly not what the central bankers and politicians need to help reduce inflationary pressures.

See real-time quotes provided by our partner.

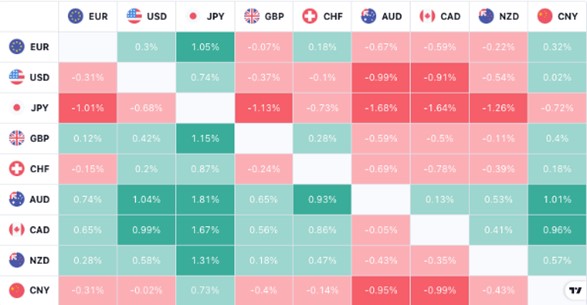

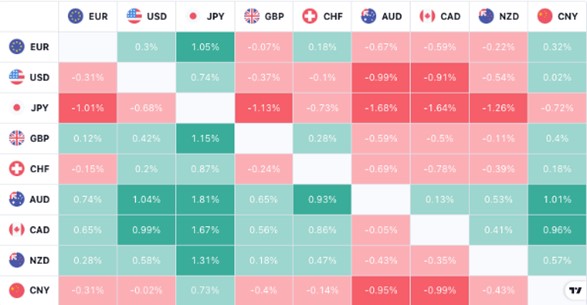

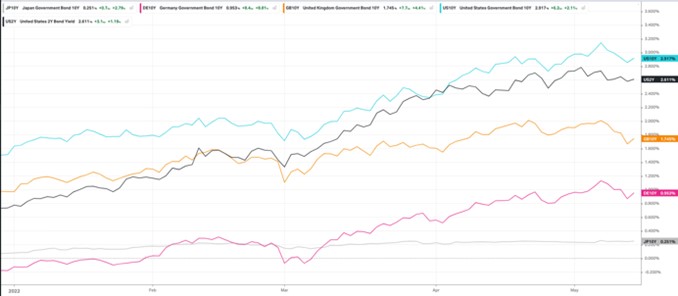

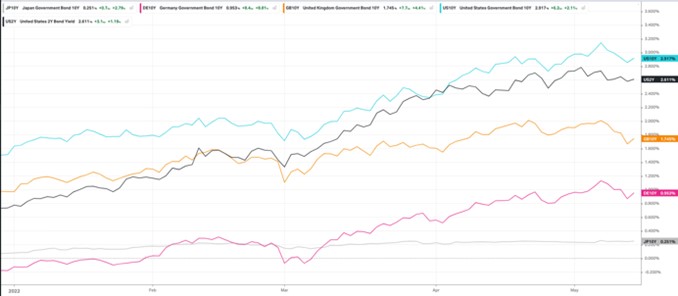

The USDJPY rose today after the extremely bearish candle that printed yesterday. Getting back into the range in an uptrend is not something I am going to suggest is a buy signal just yet. I am going to wait to see if it breaks out of the top of the range, comes back inside to find the mean, before buying the continuation higher. Today’s price action may be a reaction to what happened yesterday, which could be the bulls selling out of their massive, long position. In which case a rip higher will entice late comers to buy and if there is not volume to back it up, the bears will step in and start selling hard. Which is my biggest worry about buying today’s action. The forex heatmap showed the yen as being the weakest currency relative to the other majors. Plus, the USDJPY has been following along with the US 2-year yields which also happened to bounce today after selling off for a week.

See real-time quotes provided by our partner.

The pound is also still firmly in its trend to the downside and today’s green candle is still a new lower low and currently a lower high on the daily timeframe, with little volume to back this up as a reversal level. We need to see some serious structural changes with larger swing highs and swing lows forming before getting bullish this pair.

See real-time quotes provided by our partner.

The EURUSD sentiment dropped from being 75% bullish down to 67% bullish which is a step in the right direction and shows quite a few traders stopped out of their longs at the sweep of yesterdays low. We’re still hovering above the 2016/17 major swing low, and I am expecting that to be the catalyst which reverses this bullish sentiment and possibly sets us up for a bear market rally.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |