Cotton – Commodity Analysis

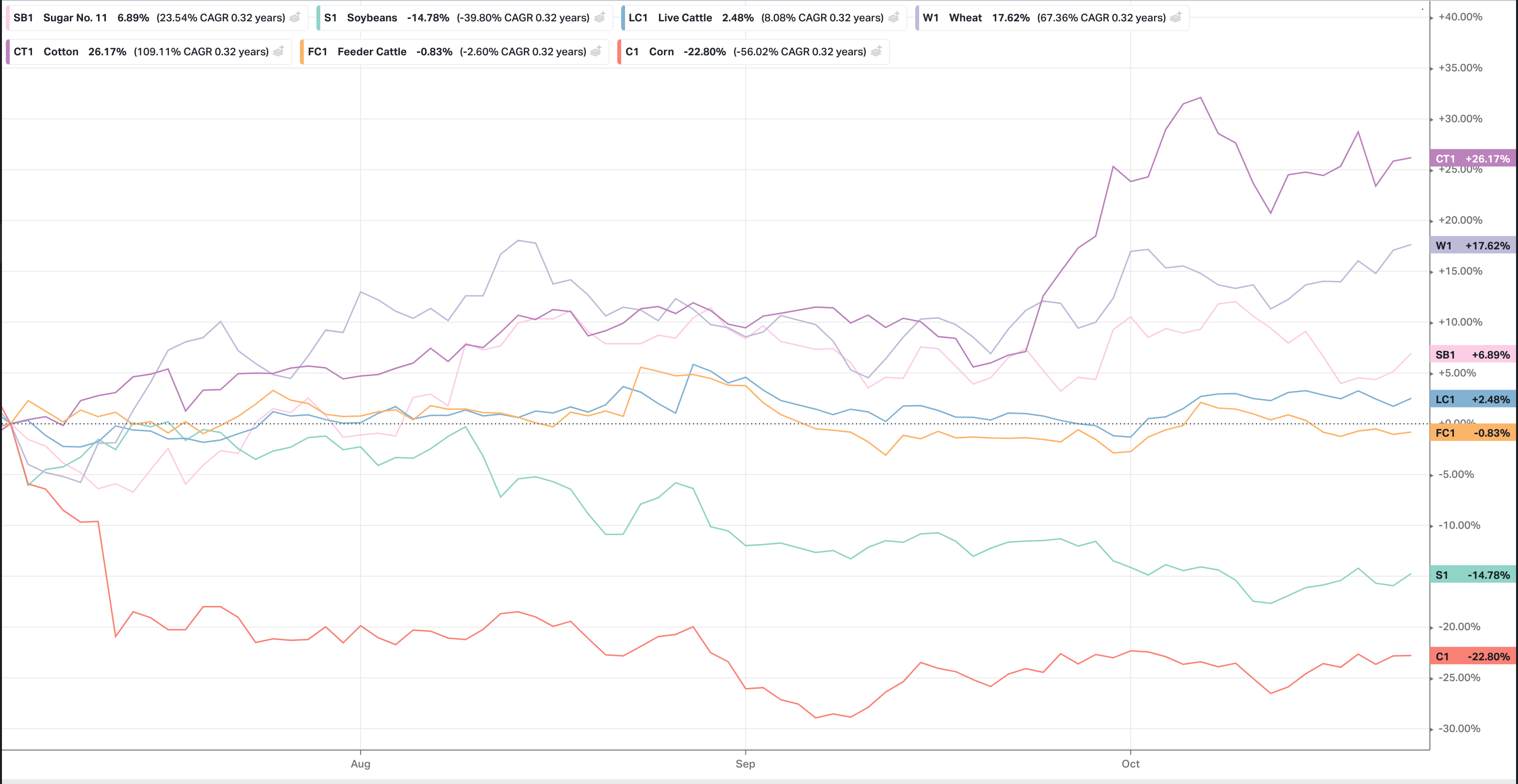

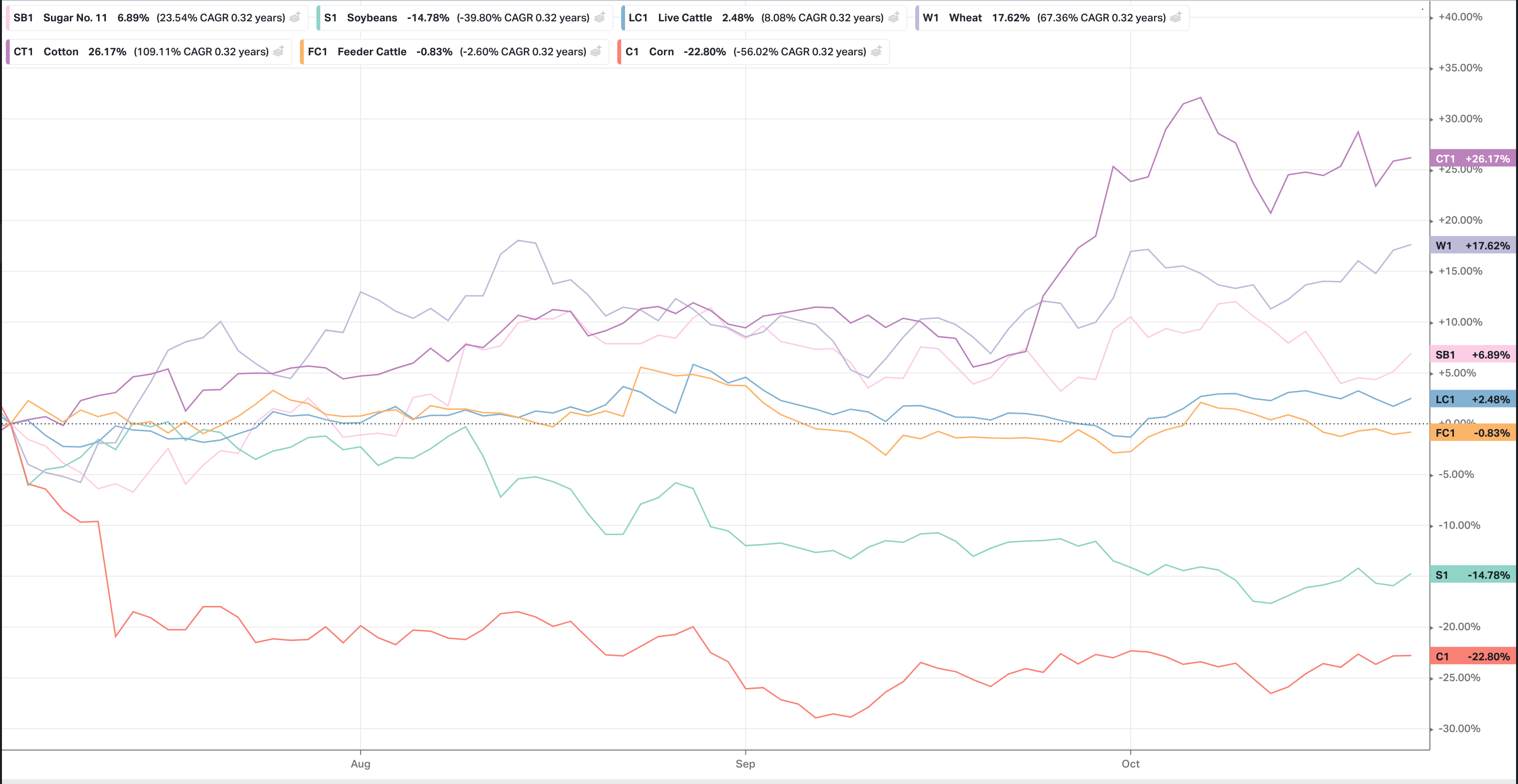

Cotton futures are seeing some of their biggest surges in years, and that could mean higher clothing prices in the months to come. It’s currently the latest surge in the raw materials market and follows price swings in commodities like lumber. Sugar and Wheat are also on the rise and could be the next to peak.

The price of lumber saw a big spike this spring, nearly quadrupling before returning to normal levels in the summer. The ramifications of a price spike in a commodity like lumber goes all the way to things like house prices, which were up 30% due to increased material costs. The pandemic is still affecting the supply side of a lot of commodities with a shortage of labour and bottlenecks in supply chains causing prices to inflate, and according to the Fed Chair Powell, these higher levels of inflation are set to remain longer than expected. The bearish cross for lumber occurred when prices found a lower low and the daily 50 sma crossed below the daily 200 sma. The 200-period moving average is now likely to cap lumber prices from rising further.

Cotton has a large global appeal and is particularly vulnerable to unforeseen events both natural and man-made. This year heatwaves are affecting crops in the United States, which is the biggest exporter of the raw product.

Cotton is a seasonal and produces one crop a year and, in the US, the 2021 grow is being harvested right now. The US Department of Agriculture, reports states 62% of the crop is rated good or excellent this year, compared to 40% a year ago. Whereas in India, which is another major cotton exporter, expectations are for lower production due to pink bollworm infestations, excess rain in some places, and a smaller planting area overall.

This season’s price run-up in part reflects diminished expectations about the 2021 crop, but it won’t be confirmed until the process wraps up in November. A rebound in global harvested area and a forecasted record yield is expected to contribute to a rise in cotton production of 120.3 million bales in 2021/22 and a higher yield could cap the prices and stop them from reaching $2.00 per pound like in 2011.

See real-time quotes provided by our partner.

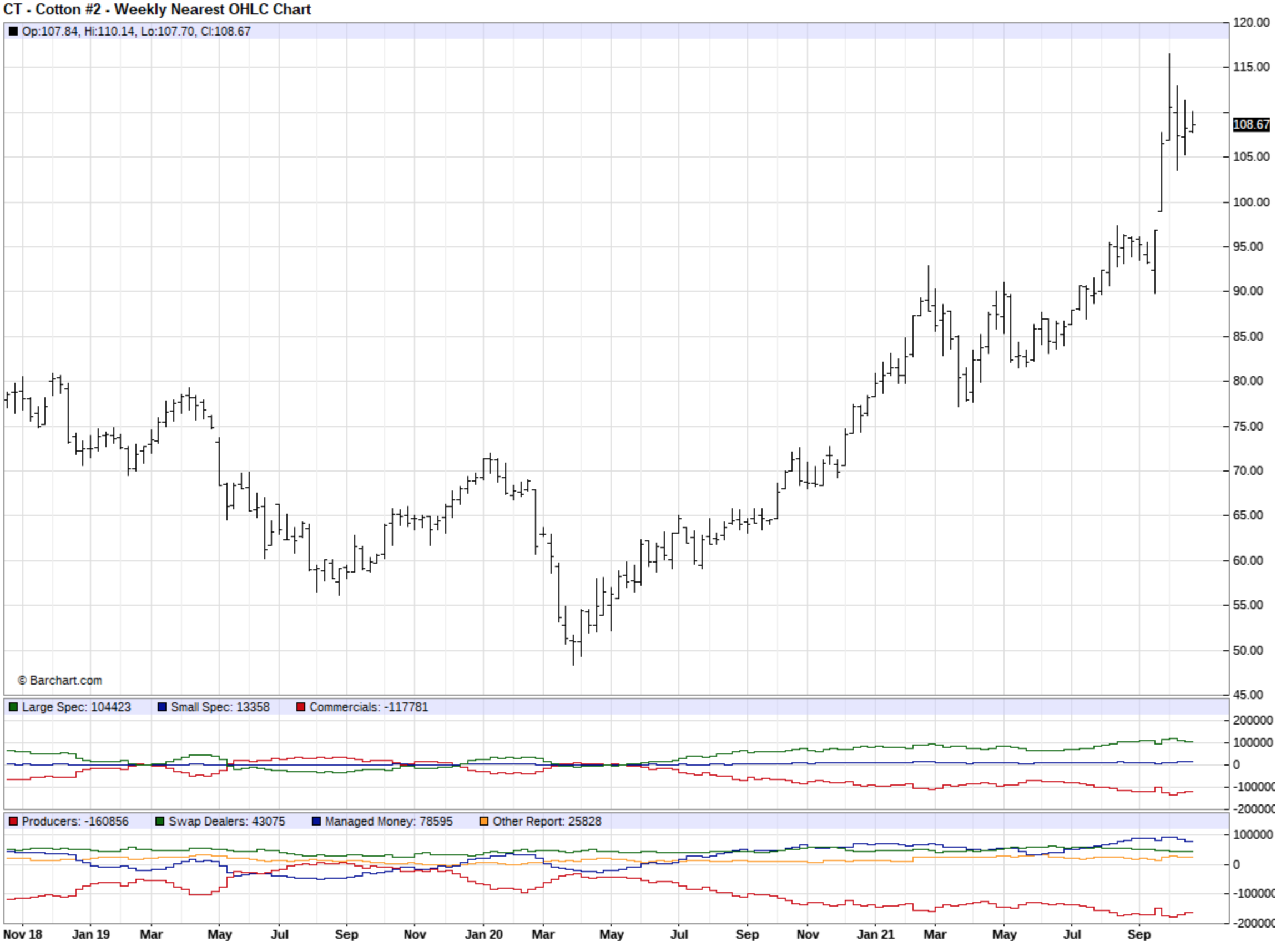

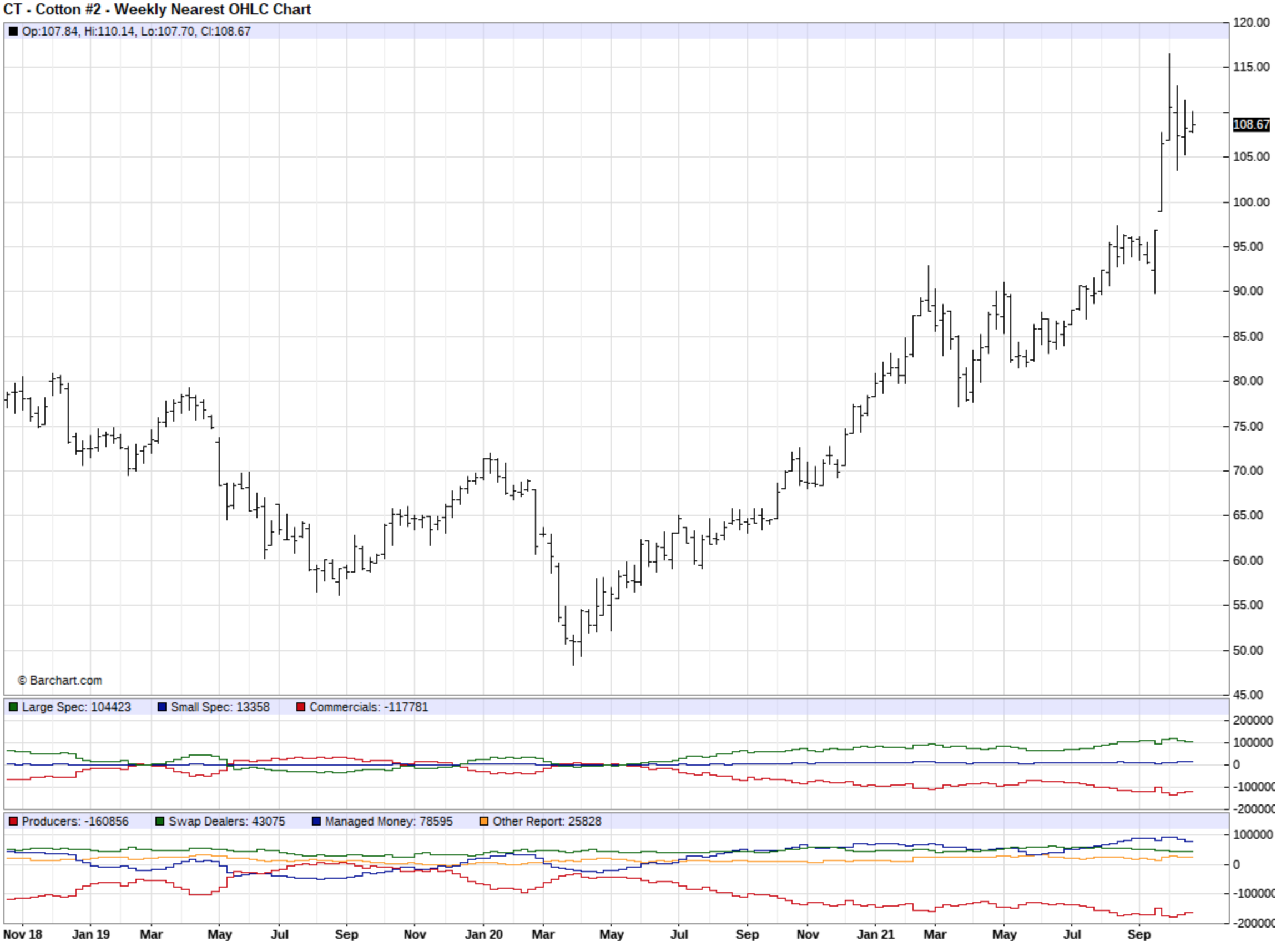

The chart above for cotton shows that price action has been pushing higher making impulsive moves since September and with the 20, 50 and 200 moving averages all pointing higher there is a chance we get another higher high, as momentum often leads price. As per the lumber chart, if we were to see the price action collapse below the rising trend line, this could be a signal of a much deeper correction about to occur. With a measured move to the downside coming in around $0.80 per pound.

The Dec’21 ICE cotton futures were mostly sideways for the week ending Friday, October 22, with a big swing occurring on Thursday. In last Friday’s settlement, the price per pound was 108.26.

The Commitment of Traders (COT) data shows a 48% increase in net long speculative positions between September and October this year. Three weeks ago, managed money open interest was increasing but last week’s levels were down more than 50%. With hedge funds withdrawing it appears that current levels are seeing the speculative longs booking profits and commercial shorts seeking to lock in prices.

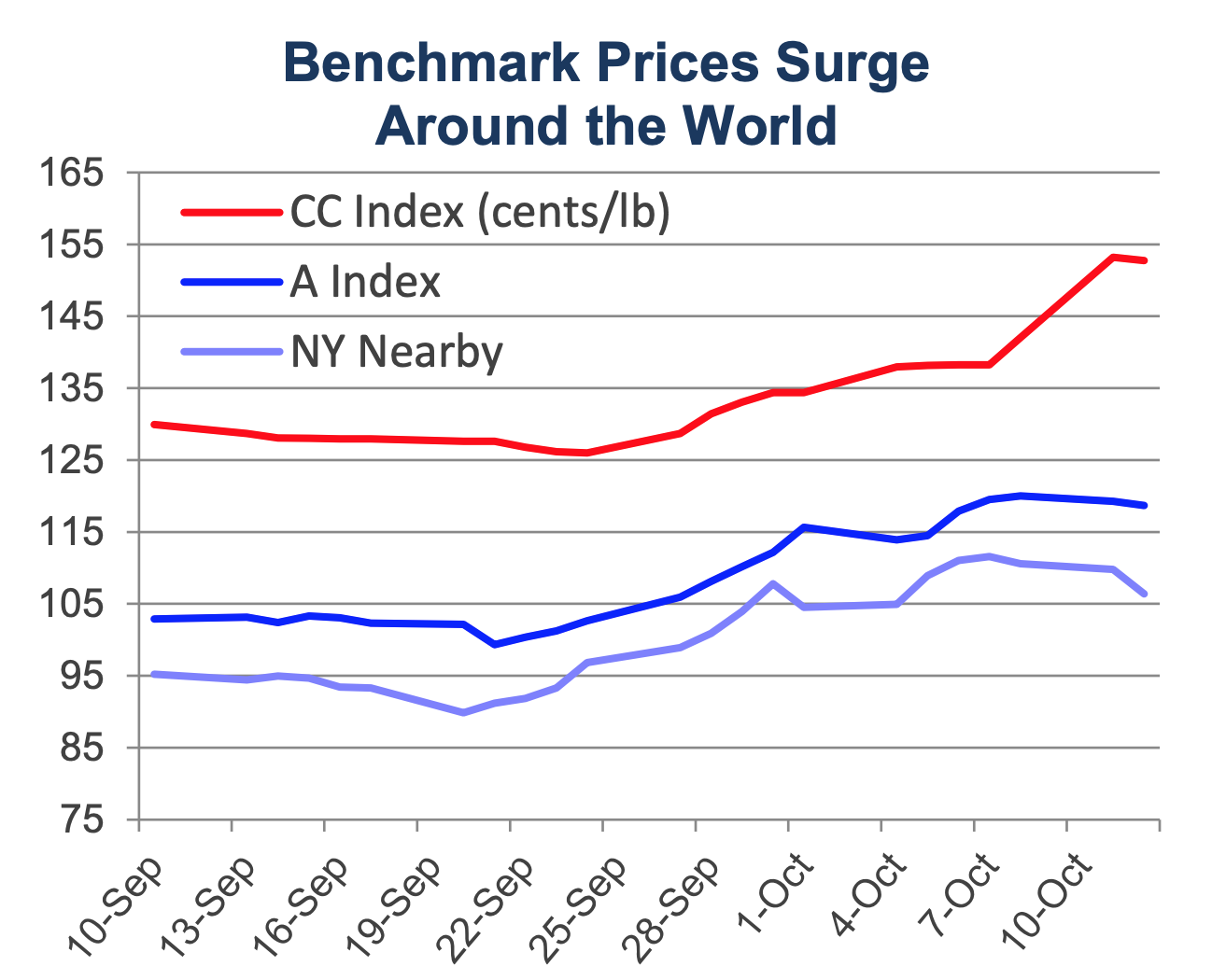

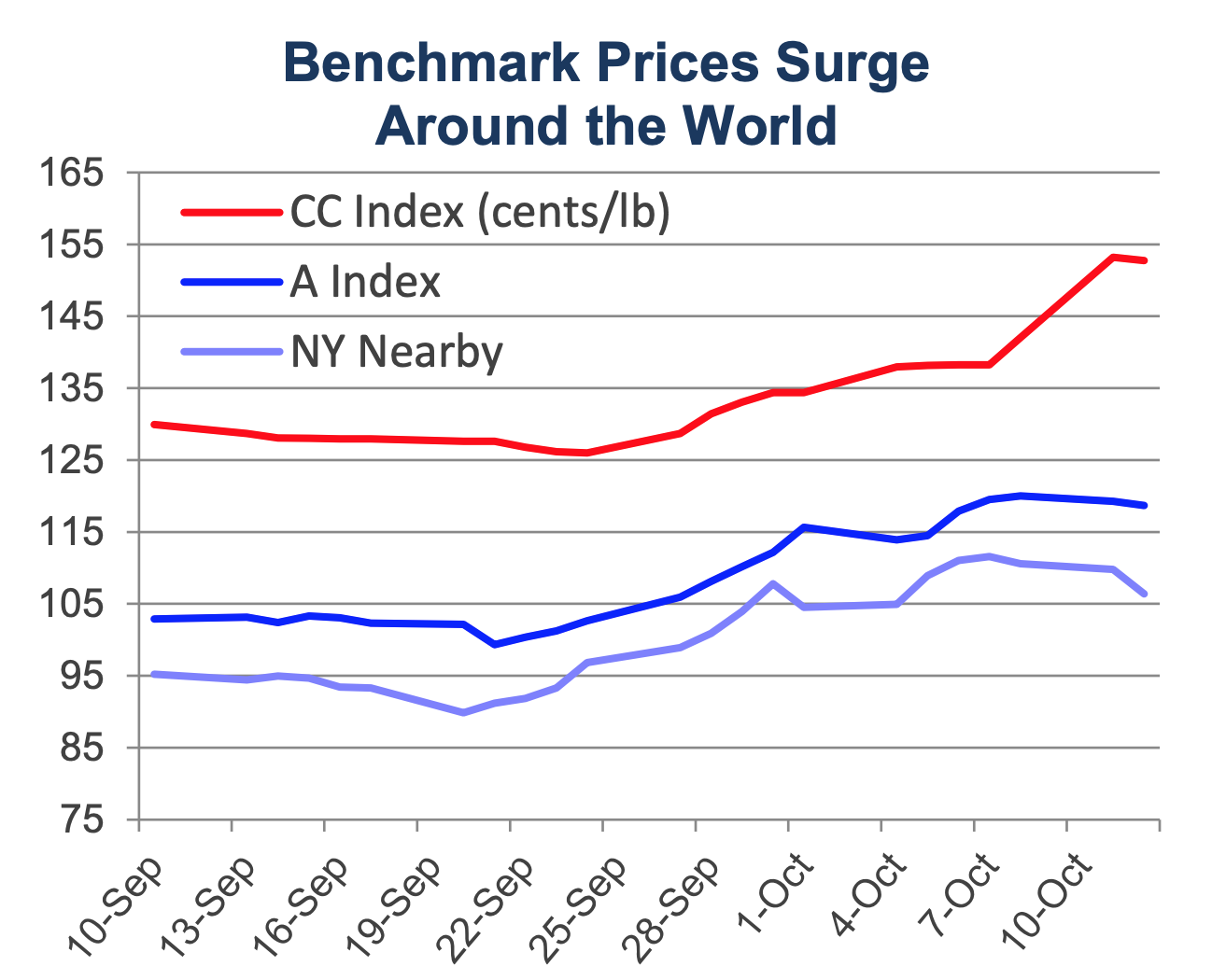

Cotton fundamentals remain strong with the high internal cotton prices in China and their inventory replacement policy following on from strong cotton auctions, continuing to stimulate large US export sales to China. The high CC Index price is a signal for the Chinese authorities to start cashing in on some of their reserves. Due to the strength of demand, auctions were extended through the end of November.

As part of former President Donald Trump’s trade embargo with China, US companies are not allowed to import clothing and other products made of cotton from the Xinjiang region, which is where most of the country’s cotton comes from, due to concerns over how the country was treating its Uyghur minority population. President Joe Biden has continued the policy so as a workaround, plants there have been buying US grown cotton, making goods, then sending them back to the US.

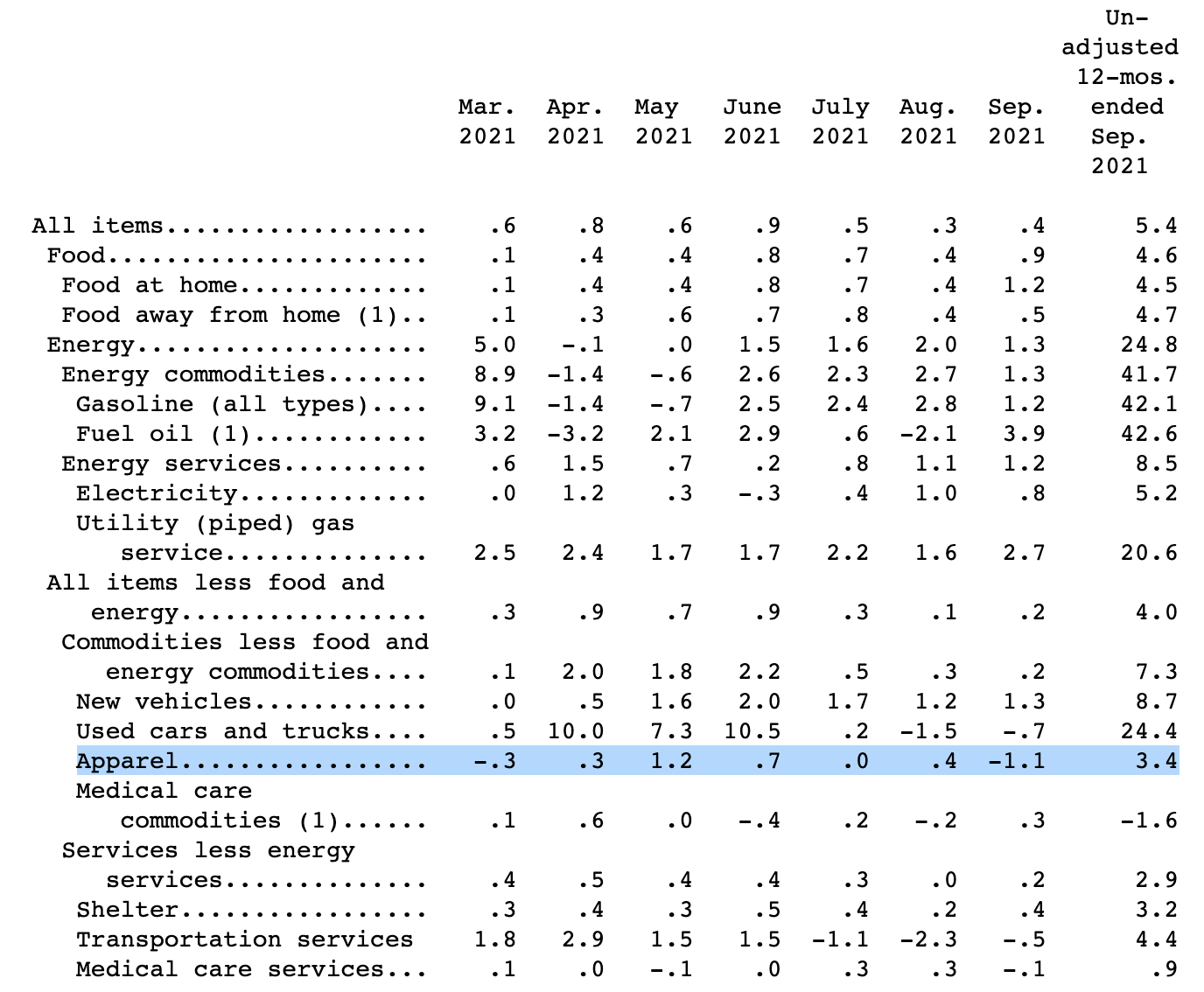

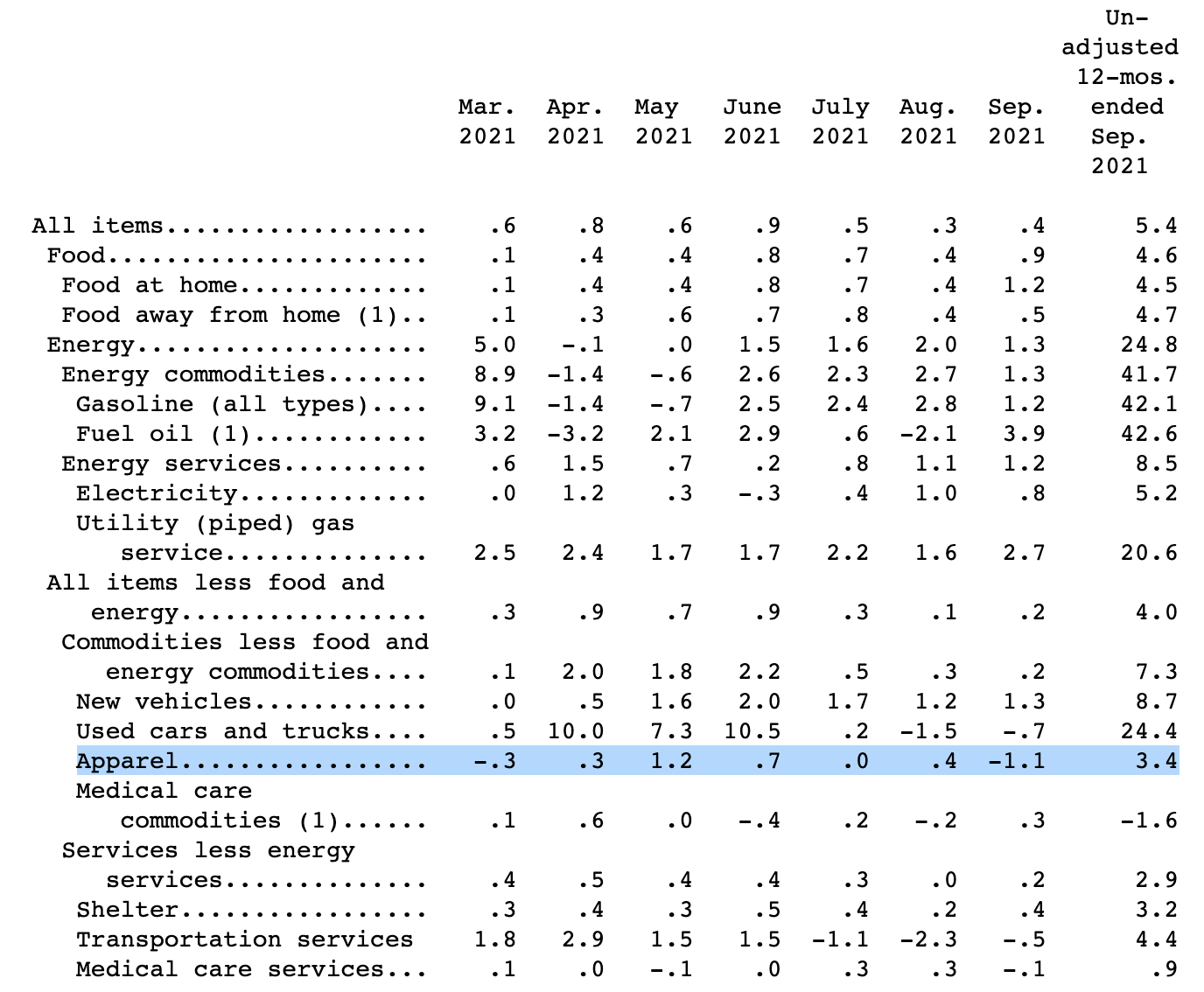

Inflation is permeating through all aspects of daily life and the price of clothing is on the rise. The August Consumer Price Index showed a 3.4% uptick in apparel costs, a price rise largely in line with current core inflation. But the increase in cotton prices could send that notably higher in the next month’s CPI report, especially when transport costs including shipping and energy are factored in.

So far, in the current climate of higher prices for many consumer products, manufacturers and retailers have been able to pass along some of the increases to consumers. At some level the consumer will reject higher prices but that may be some time off as wages are increasing and household levels of savings are still high, meaning there is cash at hand.

The consensus is that we won’t see $2.00 per as per 2011 as cotton is abundant and demand is not rising exponentially, therefore we should be wary of buying the top and be looking out for a peak in prices. The weekly chart shows strong momentum, but the last few weeks cotton has been trading within the first weeks of Octobers price range. A break below that week’s low of $1.0354 per pound would signal a bearish move.

See real-time quotes provided by our partner.

For those looking to follow the hedge funds out of the speculative longs and to try and get in on an early decline in price, back to value, using the H4 chart and waiting for a breakout of the current consolidation pattern may be a good trade. I favour a breakout and retest of the wedge and a more conservative short could be for the swing low that formed on the 13th of October to break. But until we get a lower weekly and daily low, the trend is firmly to the upside and therefore fighting the trend could be costly.

Something else to consider is that retail trader sentiment is still very bearish, which could mean that there is a push higher to stop these participants out. A move back to an even level or a flip to most traders being bullish, could be a timing signal that the market is ready to go lower on a break of a significant low.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |