UK100 Index Analysis

See real-time quotes provided by our partner.

Yesterday halted a market correction across the major indices. The FTSE UK100 had dropped down towards the 6800 level but found the swing highs from March 2021 to be supportive.

July hasn’t been kind to the UK100 as the monthly and weekly performance so far are -1.42% and -1.29% respectively. The year though has been a slow grind higher, with the UK100 year-on-year performance coming in at a respectable 11.98%, with the last 6 months gains amounting to 8.27% of that.

The Northern Ireland protocol, post-Brexit, COVID-19 lockdown and now ‘Pandemic’ has done its best to slow the growth of the nation, and the gains although good, have not resulted in brand new all-time highs like we have seen across the rest of Europe and the USA.

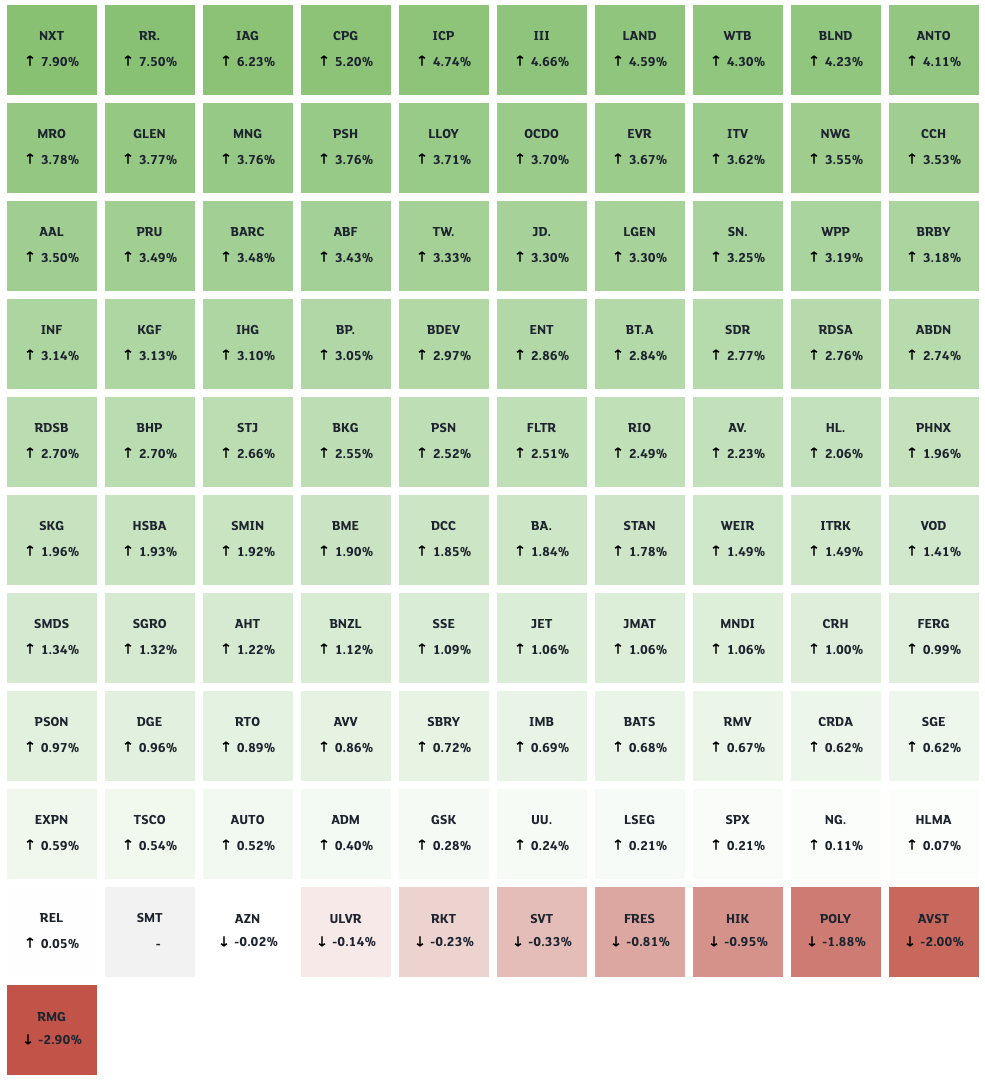

Today’s UK100 heatmap from the London Stock Exchange shows the majority of companies within the index are doing better.

Next plc and Rolls-Royce are leading the charge higher. For Next plc, the last year has been a great year, with a rise in market price of 61.77%, giving the stock a £9.85 billion market cap and a price to earnings ratio (P/E) of 33.17 and earnings per share of £2.23.

See real-time quotes provided by our partner.

Rolls-Royce on the other hand is the complete opposite to Next plc, as they have had a torrid last 12 months, losing 66.34%, of which in the last month has seen the share price drop 12.03%. Based on the size of the company analysts have the current stock price as being 74.8% undervalued with fair value around £3.50. The company are looking to the future and developing battery powered electric planes and will try and become the one-stop shop for electric propulsion after they compete for the worlds speed record in an electric aeroplane.

See real-time quotes provided by our partner.

The bosses of Next have seen higher growth and attribute it to the lack of foreign holidays people are allowed to take and so the extra cash is going on a new wardrobe of outfits and soft furnishings. They have also benefitted from the rise in on-line retailing posting sales growth up 44% over the same period compared with two years earlier. Their UK physical store sales dropped massively due to the lockdowns, but overseas sales grew 61%.

Pre-tax profits for the year are now expected to hit £750 million – an increase of £30 million on previous expectations – after sales in the 11 weeks to July 17 rose 18.6% and because the figures are above expectations, they will return 29m in savings they made from the UK governments business rate holiday.

Traders’ sentiment for the UK100 on the ActivTrader platform is definitely more bullish with 68% of the retail traders long the index. While the price is above the daily 200 exponential moving average, I am inclined to agree with them, as it would be great to get a new all-time high (eventually).

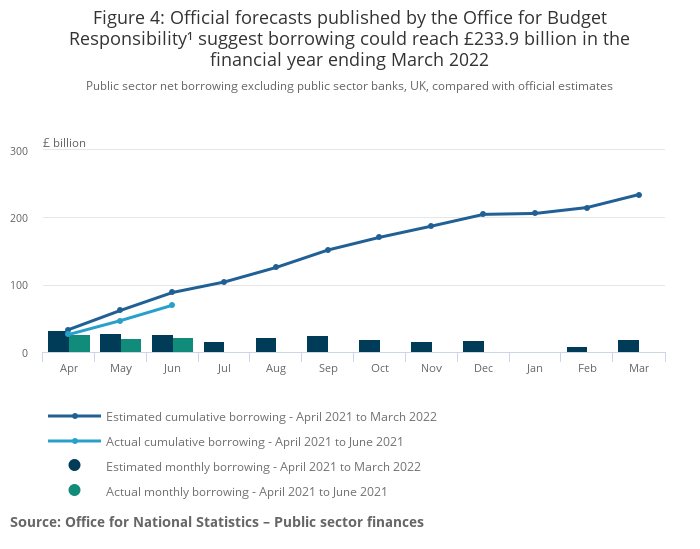

The Office for National Statistics (ONS) today reported on the current net borrowing of the UK government. Public sector net borrowing (excluding public sector banks, PSNB ex) was estimated to have been £22.8 billion in June 2021; this was the second-highest June borrowing since monthly records began in 1993, £5.5 billion less than in June 2020.

Central government receipts in June 2021 were estimated to have been £62.2 billion, £9.5 billion more than in June 2020, while central government bodies spent £84.1 billion, £2.5 billion more than in June 2020.

Expressed as a ratio of gross domestic product (GDP), public sector net borrowing (PSNB ex) in FYE March 2021 was 14.2%, revised down by 0.1 percentage points from last month’s provisional estimate but still the highest such ratio since the end of World War Two, when it was 15.2% in FYE March 1946.

The figures may be higher but the cumulative government receipts are rising compared to this time last year as the lockdowns ease, and businesses attempt to re-open.

Meaning the actual cumulative borrowing is below the official forecasts.

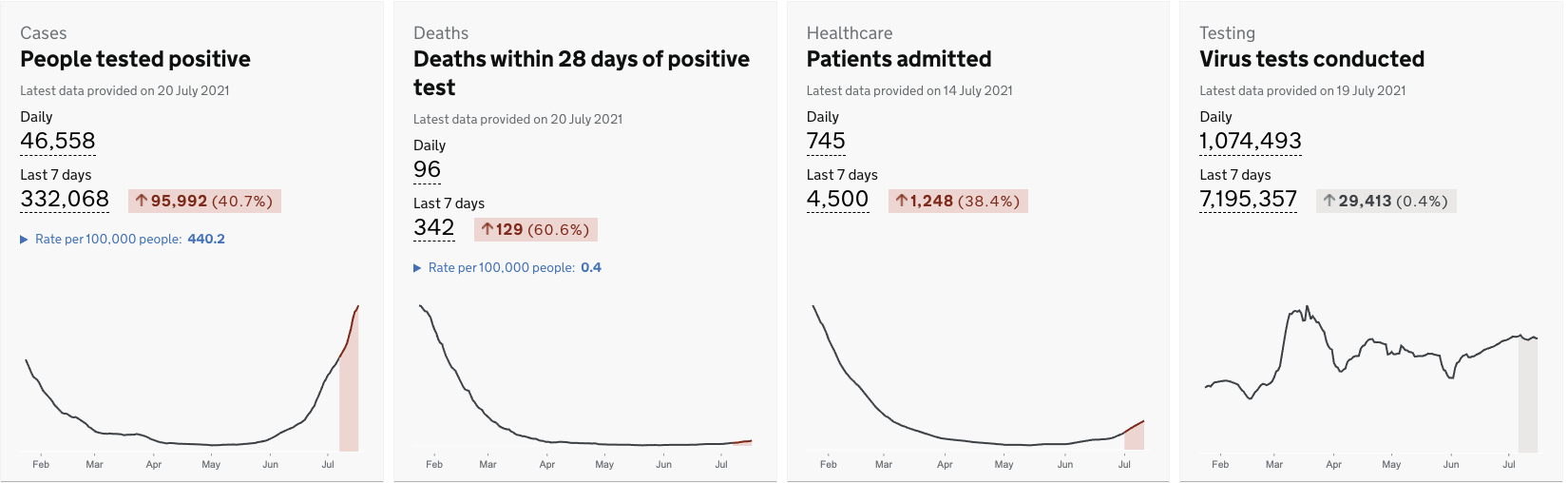

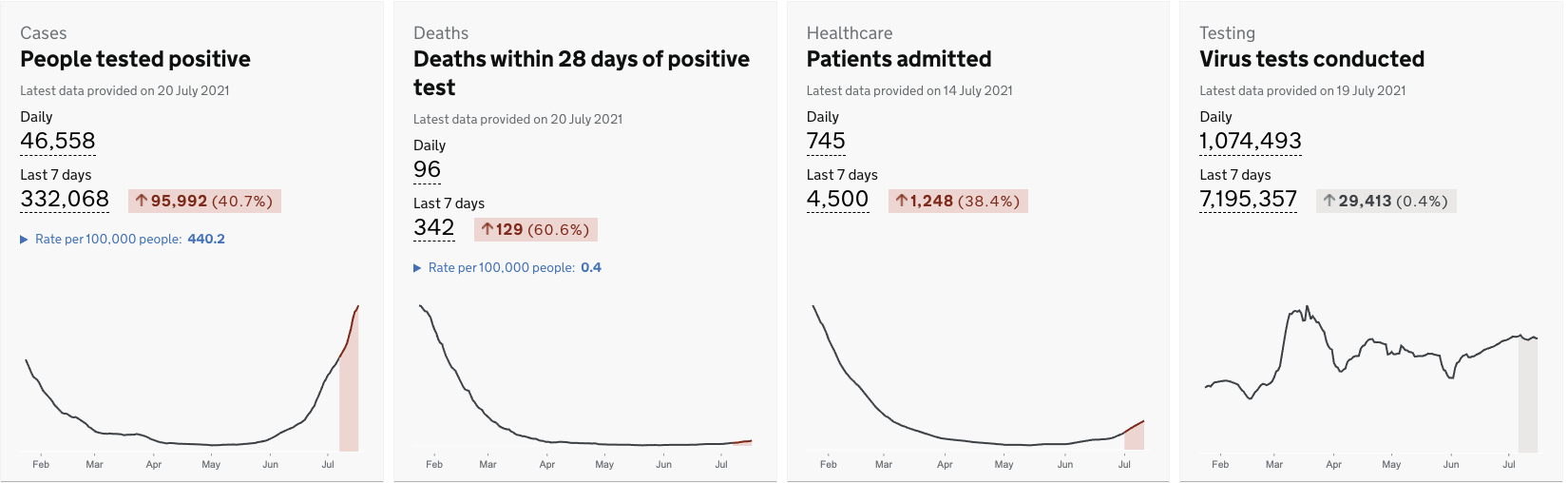

This week was the start of the return to normality, with “Freedom Day” finally arriving. The worry for all is that the rising spike in COVID infections once again leads to greater hospitalisations and deaths, which would cause the UK government to impose stricter controls once more. This would lead to more problems for the UK treasury and an extension to furlough or similar schemes, which would impact the nations finances. Luckily as a sovereign issuer of our own currency we can print without limit and meet all of our liabilities, assuming the political class agree to it.

The UK is one of the most heavily vaccinated countries in the world and we have a real chance of curtailing the advance of covid-19 and to get a jump start on building our economy. The Office for Budget Responsibility warned today that the government needs to be alive to factors that could lead to higher interest and that they need to be nimble if interest rates rise.

See real-time quotes provided by our partner.

Assuming the price gets above the 7000 and the next couple of days shows continued rising prices, I would be keen to get involved with a long position on a retest of the current hourly period 200 ema. The daily chart as I stated earlier is looking bullish whilst price action is above the daily 200 ema and a move above the daily 20 and 50 ema’s would be a huge indicator that momentum and price action were in-line with the overall trend.

Waiting for a break higher and then a pullback to instigate a buy should be in confluence with something like the Stochastic indicator, which I set to 10,3,3 with oversold levels of 30 and below. Buying the dip in an uptrend basically. An aggressive breakout could be taken too, but as we are seeing on the hourly chart now, an impulsive move (big green candle) followed by a short period of consolidation is key. A breakout of this nature would allow you to the place your stop loss tight to the breakout level as the idea is for price to move quickly to the next profit target above.

If 7000 proves to be too much resistance and the markets start to fear the impending doom is rising due to the delta variant, we may have to take intraday shorts on a smaller time frame and be aware that currently we would be going against a higher time frame trend.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |