Market Brief

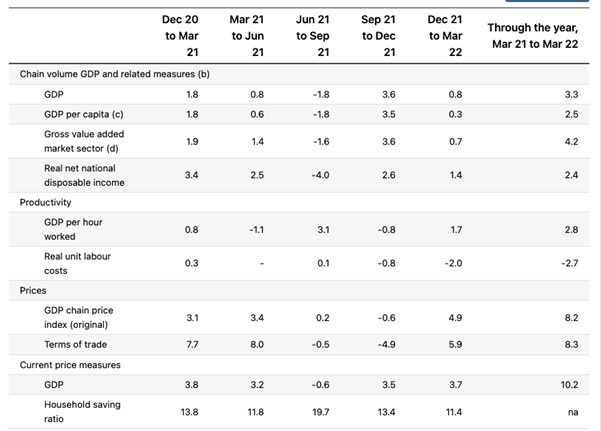

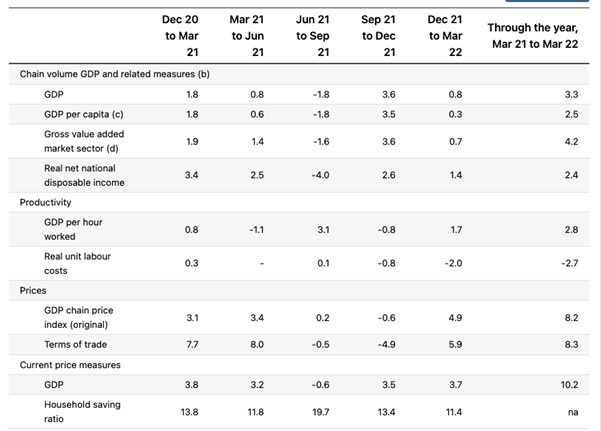

The Australian GDP report released during the overnight session surprised to the upside beating market expectations of a 0.6% increase for the last quarter to come in at 0.8%. The year-on-year reading of 3.3% is relatively healthy and other G10 economies would certainly be happy with that rate of GDP.

See real-time quotes provided by our partner.

The AUDJPY long trade has continued to push higher towards the take profit level and as this currency pair is also my leading indicator for what other risk assets may do, I am expecting an up day for the equities on this first day of the new month.

The AUDJPY is also affected by the general moves of the yen and that plays into what the US benchmark yields are doing too.

The USDJPY yesterday was bid higher as the US 10-year yields also rose. The USDJPY is a great proxy for the divergence in monetary policy between the Bank of Japan and the US Federal Reserve. A rising US yield curve, the higher the USDJPY tends to go.

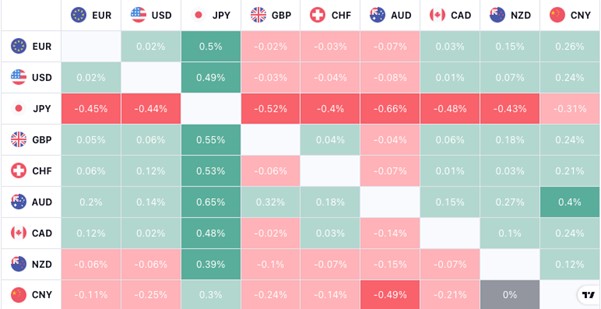

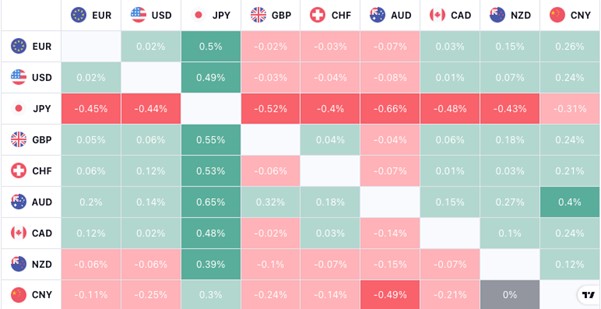

The forex heatmap at the London open today shows that being long the AUD versus short the JP is the way to go. However, there is dissonance within the forex market as the Kiwi is weaker while the Aussie strengthens, and the Swiss franc is relatively strong while the yen is weakest. This is not a great signal for those using the relative strength as a risk-on or risk-off trade bias. The Chinese Caixin Manufacturing PMI dropped below the forecast figure, so I would assume the Aussie would have dropped if had not have been for the good GDP data. European manufacturing PMIs have been mixed but the Final German Manufacturing PMI came in a touch better than expected. We wait to hear what ECB President Lagarde has to say when she gives as speech at the Green Swan Conference at midday today.

See real-time quotes provided by our partner.

The EURUSD is treading water but is showing more signs of weakness than strength. The larger time frame trend is to the downside and even though Deutsch Bank have predicted a 50bps rate hike this summer from the ECB this only sets the market for disappointment, when the ECB come out with a 25bps rate hike and a weaker euro.

See real-time quotes provided by our partner.

Clearly the European Union will have to do something about the rising inflation that yesterday printed a record 8.1%. The price of energy now that the EU have begun to really move away from the Russian oil and gas could go higher on decreased available supply. The US may be pressured into returning to a ban on exports to get the voters on side during the mid-term elections. We just need to see if the producers see this as a cap in the rise and start hedging more aggressively, or whether they believe they can pump more and still command higher prices.

During the US session we have some market moving Tier-1 data, starting with the Bank of Canada rate decision, and then the US ISM Manufacturing PMI and JOLTS Job Openings. There then follows some key Fed speakers so we may have to wait until after they have concluded to see the true direction the market goes with tonight’s close signalling the moves for Thursday.

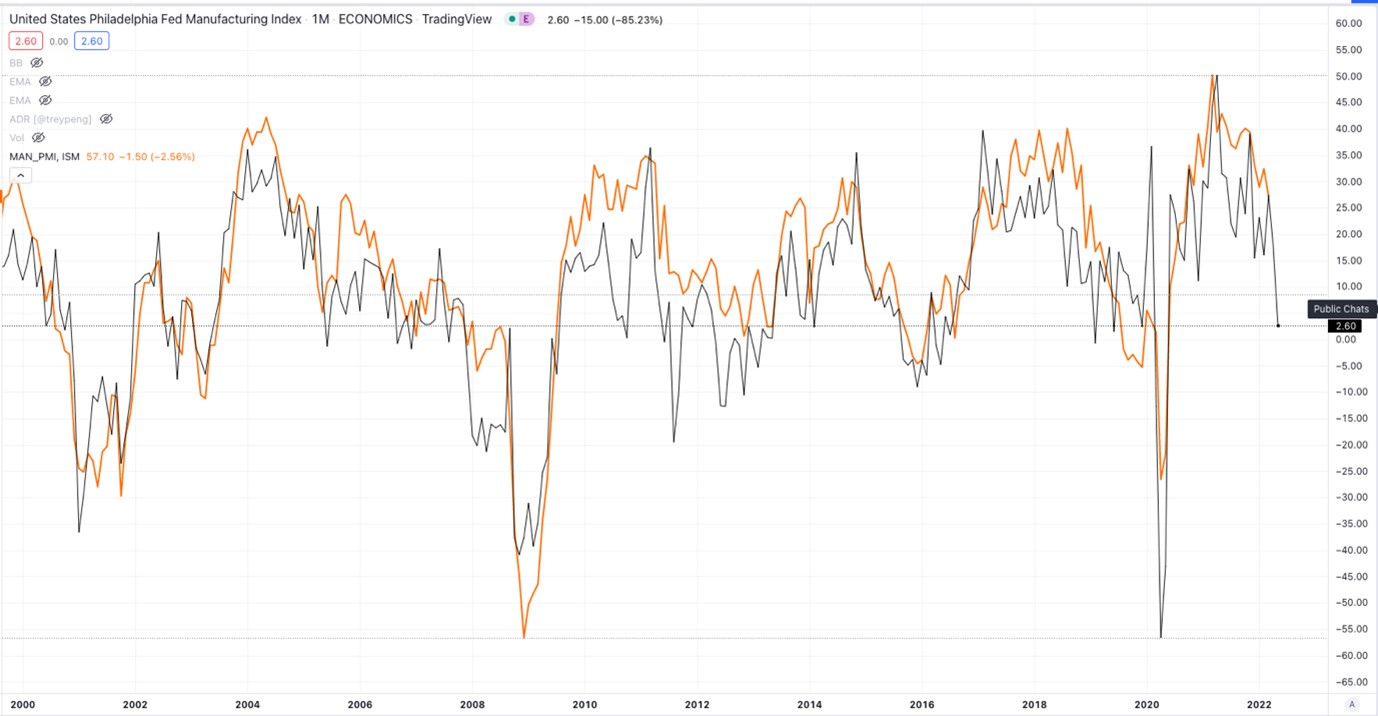

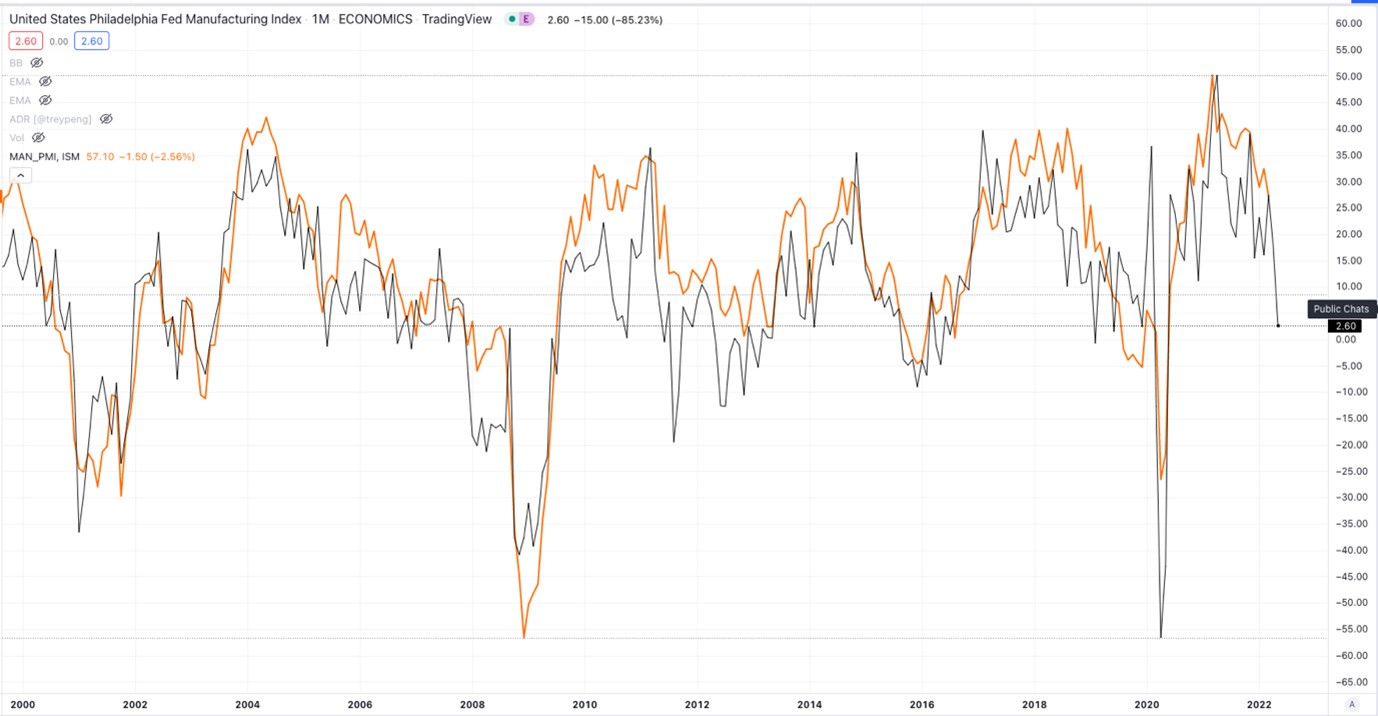

The US Philly Fed Manufacturing data and the US ISM Manufacturing PMI tend to follow a very similar path, and todays US Man PMI is expected to come in 1 point below the previous reading. Personally, I am expecting a larger drop, and this could be a negative for the US dollar tonight.

See real-time quotes provided by our partner.

The US dollar index has not seen the RSI drop below the lower signal line for a very long time, and I just do not think that this correction is truly over until we get some capitulation selling into either the $100 zone or possibly down to the daily 200-period EMA.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |