Commodity Analysis – Oil

Negotiators are close to a deal on an Iranian nuclear deal, which would in turn bring significant oil supplies to a tightening market. Both the US and the Iranians have indicated this month that an agreement could come within days. Iranian foreign ministry officials said the negotiations had progressed considerably, and that just two to three issues remained. According to reports, sanctions could be gradually lifted in stages under the deal, and as sanctions are lifted, Iranian exports are expected to increase by 500,000 b/d over the coming months, while a comprehensive agreement could allow 1.5 million b/d of export growth within nine months.

Iran’s crude production and exports suffered a severe blow when the US, under former President Donald Trump, reimposed sanctions against it in 2018. Whether China abided by these sanctions is doubtful, so Iran has been able to sell into Asia. At the time the US President said that the previously negotiated deal was not a good deal. Also, the economic ties between Israel and the USA meant President Trump was finding home support by re-introducing sanctions on Iran and scuppering their ability to continue developing nuclear programmes.

Consumers in the US would benefit most from an agreement that would reduce oil prices as US inflation is rising exponentially. Biden is under pressure to curb the increase in oil prices and bring down record inflation and has called on OPEC+ to raise production more aggressively. Saudi Arabia is the largest member and has so far resisted these calls by refusing to tap its spare production capacity. There has also been supply problems from other members due to bottlenecks, COVID-19 and general disruptions.

Biden needs to come up with some good news before the mid-term elections or risk seeing his majority dwindle and therefore becoming a lame President. His current approval ratings show he is below 43% in 46 states, is in the 30% in swing states Arizona, Florida and Georgia, and only 23% with independents and 16% in Joe Manchin’s West Virginia.

Analysts say tensions between the West and Russia over Ukraine have also contributed to a geopolitical risk premium of as much as $20 per barrel. Now that we are into the Russian sanctions stage, the market may have already priced these premiums in. So, the inflated cost of oil based on risk alone, may now fall foul to oversupply and diminishing demand.

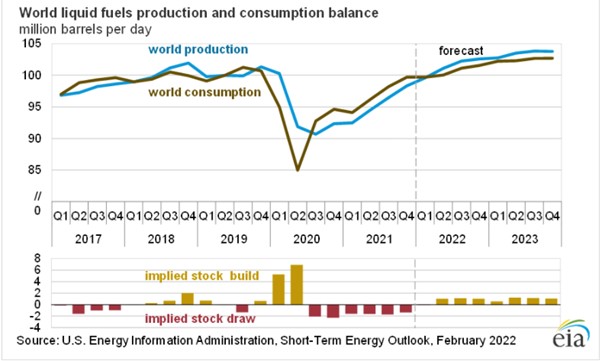

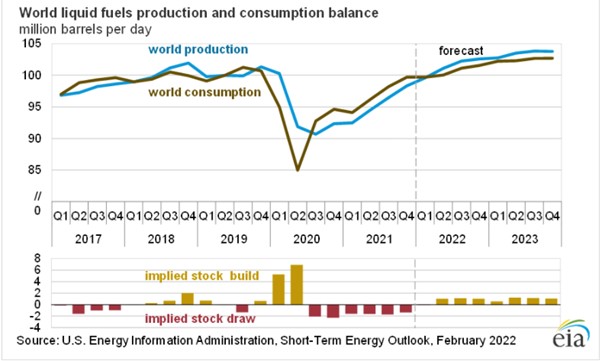

The EIAs short-term energy outlook sees global supply exceeding global demand even as we globally emerge from the constraints of COVID-19.

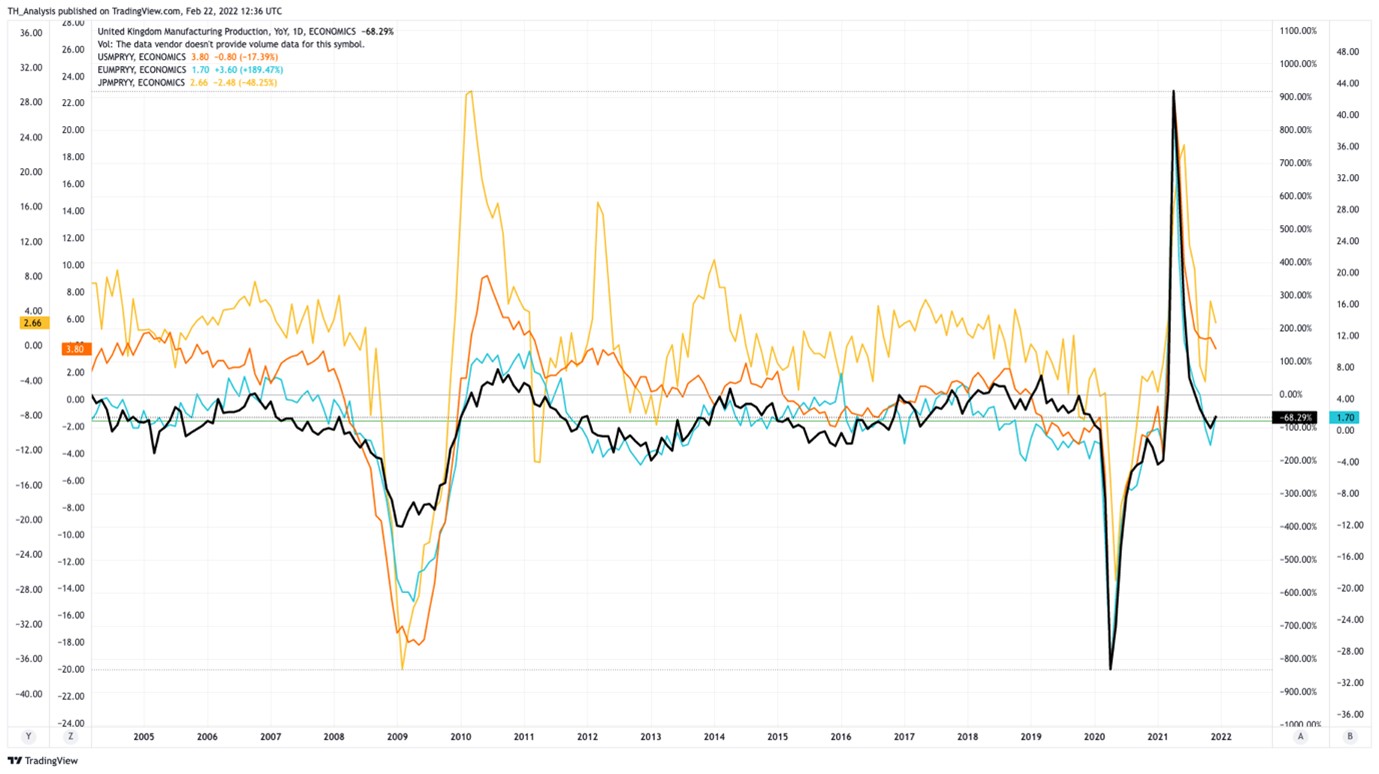

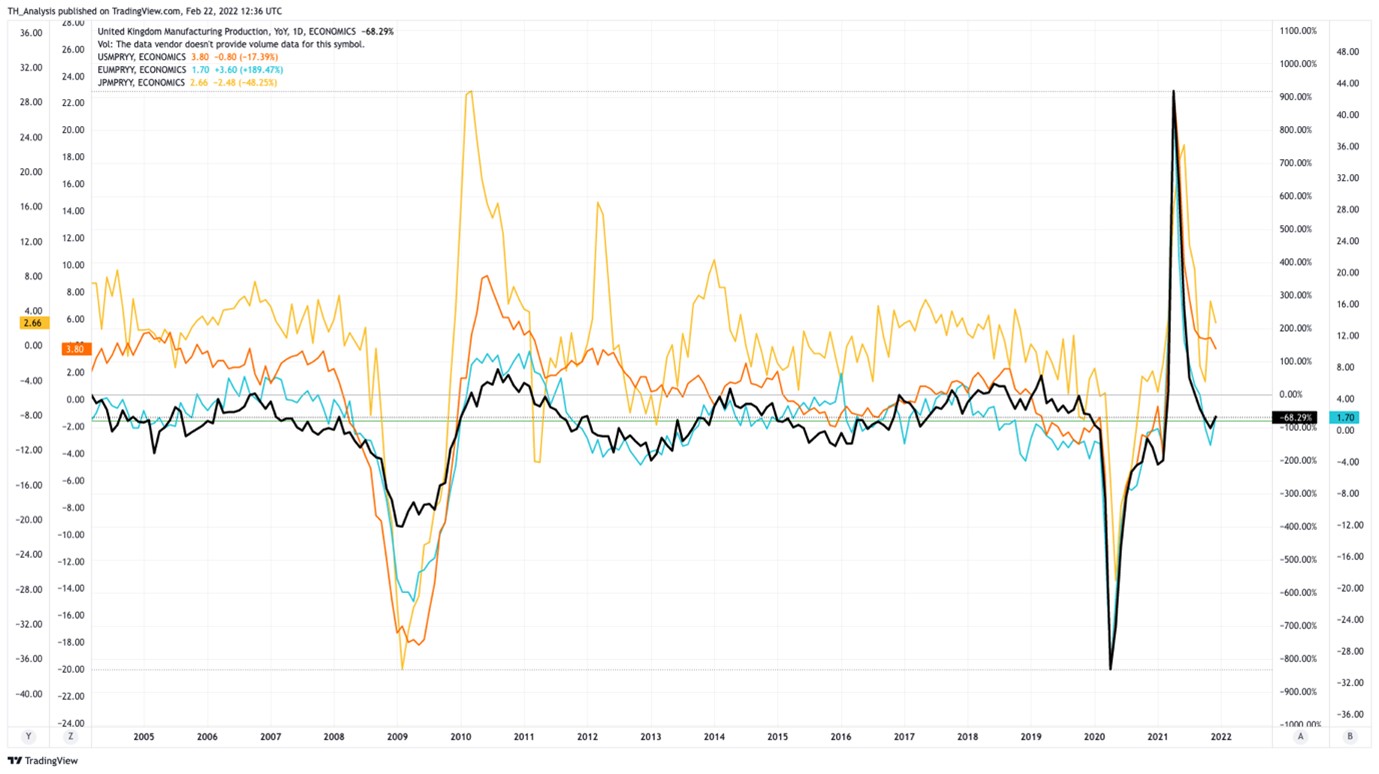

The money markets are predicting some sort of event following the rate hike cycle that is being pushed by most developed countries’ central banks. If the shorter yields rise faster, and the longer-term yields stay as they are or worse start to drop, this will signal investors are not convinced economic recovery and expansion is set to continue. The UK has already done back-to-back rate hikes, and the US is set to aggressively move to try and squash inflationary pressures. Global manufacturing output year-over-year now shows a decline even after base-effects have moved out of the data.

The benchmark US ISM Manufacturing is still in expansionary territory but has declined from the peak in March 2021. March was basically the last month which YoY included the COVID-19 lockdown disruptions and now we’re seeing a lower trending ISM Manufacturing PMI. If it gets below 50, that would be an early warning of a possible recession.

See real-time quotes provided by our partner.

Oil prices are now trading towards the psychological $100 per barrel and as is the game traders like to play, some will be applying pressure to try and get that target. If prices were to overshoot, $108 would be the next level of resistance before we start getting into the old “Peak Oil Price” that we saw at the start of the GFC.

The price of oil drops when there is more supply than demand, so that can come from different areas. Maybe it will be the introduction of Iranian oil, or maybe it will be due to an economic collapse. Looking at the inventories each week helps identify if there is still strong demand and keeping an eye on the fixed income yield curves will signal whether the market is prepping for an economic downturn.

See real-time quotes provided by our partner.

If we do see a drop in the price of oil, there is nothing to do until we see a break of market structure. $88.64 on the daily Brent chart would be the first break of significant support. Getting back below the $85 level would suggest old resistance no longer offered any support and that the bears were in control. Until then we either buy the dip or sit on our hands. The Commitment of Traders report shows that the Commercials/Producers are still not adding to their short position, which is hedge and will lock in a higher price. When these participants start hedging harder it will be so they can lock in these elevated prices. We can then go short with more confidence too.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |