Market Wrap

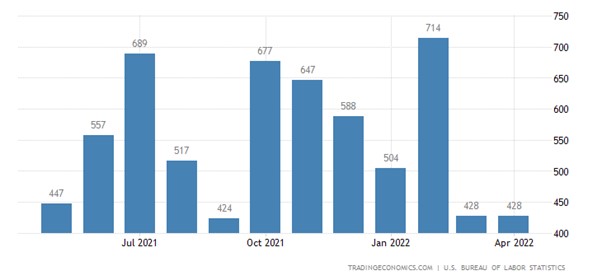

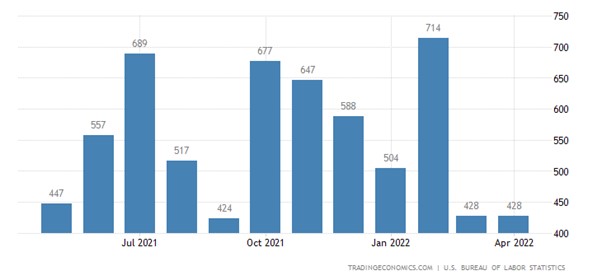

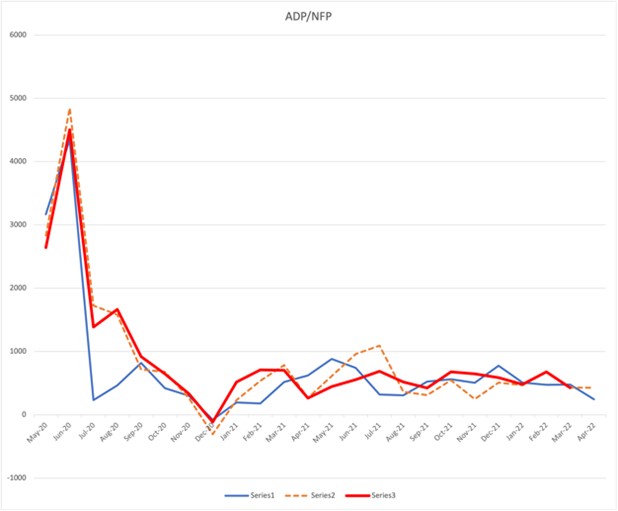

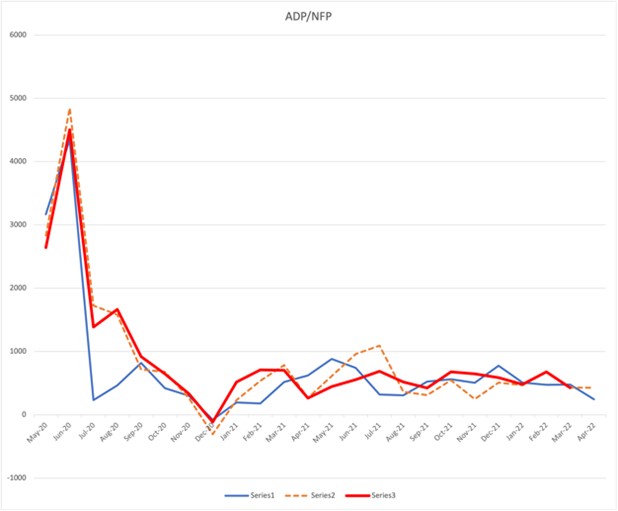

All eyes were on this afternoon’s US non-farm payroll report, which came out with a surprise to the upside for the month of April and a slight revision lower for the previous reading. The March adjustment means that for two consecutive months the number of jobs created hit 428K. The report found “widespread” job growth, led by gains in leisure and hospitality, manufacturing, and transportation and warehousing.

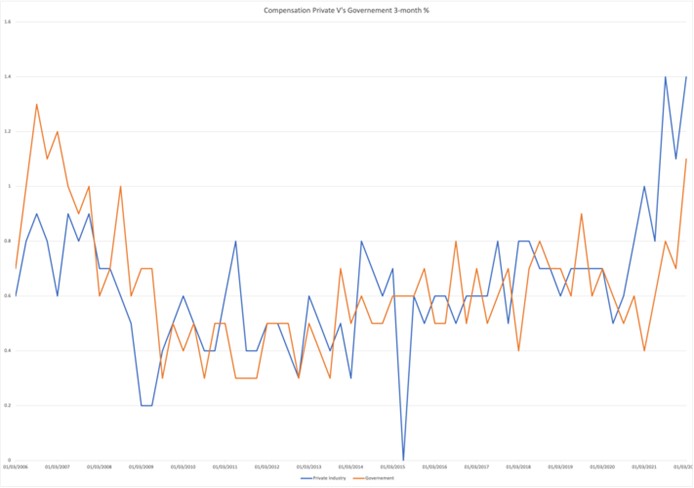

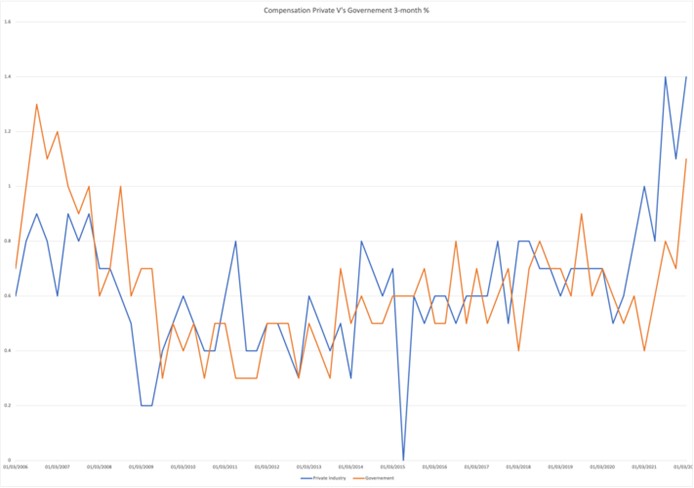

The unemployment rate was unchanged at 3.6% but the concern of wages spiralling higher got squashed with this month’s figure coming in as expected at 5.5% versus the previous 5.6%. In Fed Chair Powell’s press conference, he mentioned the Employment Cost Index that the Fed look to for data on how rapidly the wages are increasing in the private sector versus the government. The wages are rising in both metrics, but private wages have been going up faster. Today’s wage data will help reduce that increase in the ECI data. Earlier this week we saw ADP come in under expectations, so I am assuming that ADP gets revised slightly higher or that this latest NFP number drops a bit. Longer term trends point to 400K being the average monthly jobs creation.

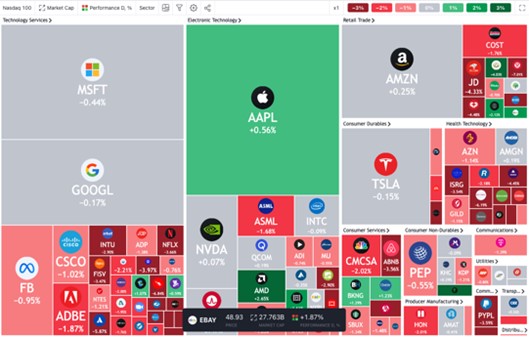

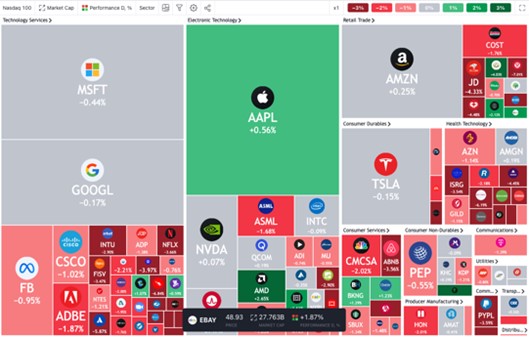

The US stock markets continued to decline following on from yesterday’s drop, though Apple did its best to slow the fall. In today’s video I said 4000 would be a great target to the downside on the S&P500 but if we were to trip the stops above Wednesdays high we could get a rapid increase in price, amounting to a bear market rally. Those stops were not triggered, so the path of least resistance is still to the downside.

See real-time quotes provided by our partner.

The Nasdaq is looking particularly weaker with only 20% of companies within the index trading above their daily 200-period moving average. 12,500 may act as a level of support. But I would only consider selling the rips whilst we’re in this environment.

See real-time quotes provided by our partner.

The EURUSD capitalised on some slight weakness that came into the US dollar following the jobs report, but I am expecting the highs we saw following the FOMC to hold and for a test lower than the range that formed in the preceding days and sessions earlier this week. A break of 1.04500 would signal the market’s intention to keep dropping despite the rhetoric coming out of the ECB and its governing council.

The number of bullish traders on the ActivTrader platform has come lower but the reading is still relatively high. When the final bull is stopped out in this squeeze, then I’ll look for a reason to go long. The moves in the USDCNH are hinting that the US dollar is in great demand, or of short supply. This will keep the US dollar elevated and the Feds rate hikes will support this trend too.

The policy divergence between the ECB and Fed will also help to keep the EURUSD lower, though following comments from ECB member de Galhau, German yields rose. Which helped the EURUSD find the 1.0600 level today.

European Central Bank (ECB) member Francois Villeroy de Galhau said it is “reasonable” to raise interest rates to positive territory by the end of 2022. He added that the neutral nominal rate in the euro area is seen between 1% and 2% and noted that real rates are expected to stay “significantly negative and below neutral for some time.” A weak euro could jeopardize the ECB’s price stability goal, according to the Bank of France governor.

See real-time quotes provided by our partner.

Crude oil prices have broken out of the market contraction as the EU tries to agree on sanctions against Russian oil. Ursula von der Leyen, president of the European Commission, acknowledged that an oil embargo would be hard on Europe, but she insisted that it needs to end its energy dependence on Russia.

Using the chart above, I’ll be waiting for the test of $120 but would rather have seen a break lower rather than higher. Prices can correct over time (sideways range) as well as through price discovery. If Russian oil is now having to find a new home, the Russian wells will be shut in if they can’t export it faster enough. The problem then is, restarting a well can take a considerable amount of time. Supply from OPEC+ is still being managed slowly higher, so if demand stays strong for energy, the missing Russian flows will be a supply shock and will send prices in crude higher.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |