Market Brief

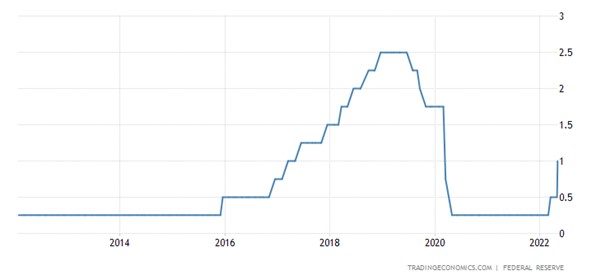

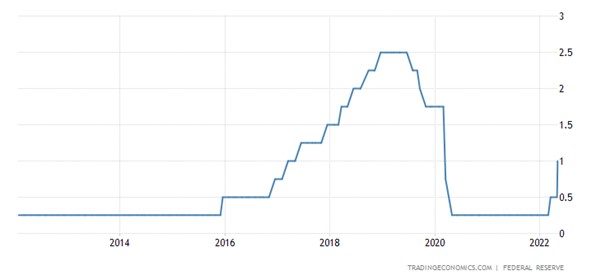

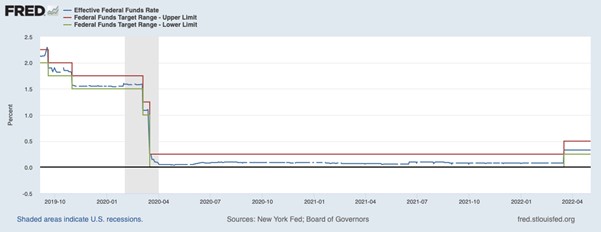

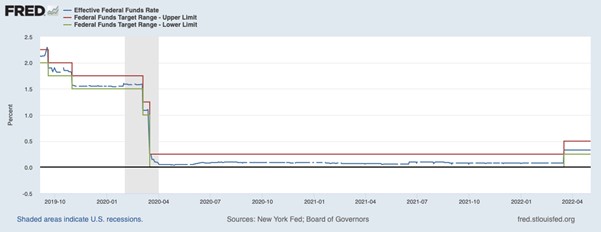

We’re over the hump in terms of waiting for the main event this week and now we’re waiting to see what the money markets are going to do. The Fed raised rates by 50bps as expected and during the questions and answers press conference, Powell stated that the FOMC was not considering a 75bps rate hike soon. That there is likely to be a 50bps rate hike in the next meeting and that they are effectively raising rates expeditiously, that each meeting is live and data dependent. He certainly didn’t want to commit to going into a rate hike cycle on autopilot as they would like to see what the effects of their changes are on the broader economy. But will have to wait 90 days or more to have an idea of how these changes play out and where. So, if the rate set by the FOMC is in a target range of 0.75%-1.00% currently and there are to be 1 or 2 more 50bps rate hikes, that gets us closer to 2.00%, with several meetings after which we could get additional 25bps rate hikes. At the end of the year, we could be looking at 3% interest rates.

Reducing the balance sheet is also to commence but not for a couple of months. The effect of reducing the balance sheet is also deemed to be the equivalent of raising rates by 50bps by the end of the taper.

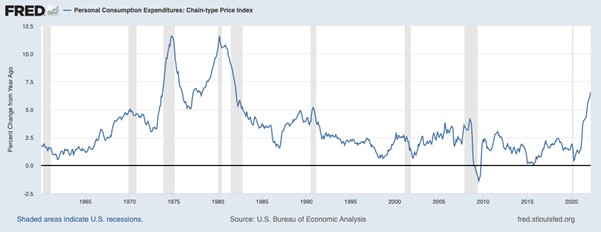

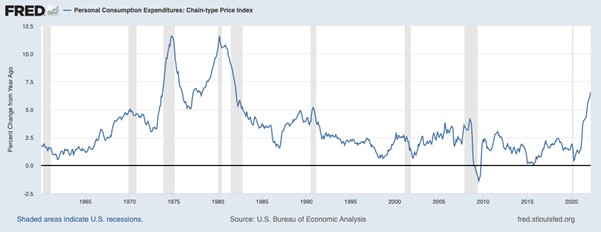

Before the Q&A session, Fed Chair Powell addressed the American people directly, to show that they are working on behalf of them solely and that they understand that it is the Fed’s job to get prices back to be stable. The Personal Consumption Expenditure index shows a level last seen in the 1980s, and the Fed will have to pull policy ideas from that period too. To get the worst off in society on to steady footing, prices need to stabilise, and the Fed can only affect demand, not supply. So, to get prices down, they need to curb demand, which could be by raising prices above what is affordable. Or by encouraging saving rather than spending.

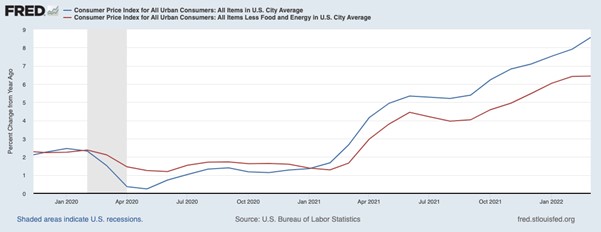

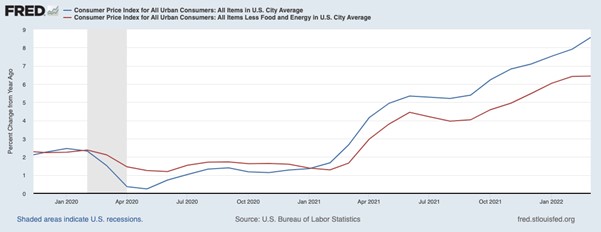

CPI and Core CPI are at elevated levels, but it is only the Core that the Fed can have any influence over. The inflation is being pushed higher by energy and food prices and the Ukraine war, plus the lockdowns in China are going to influence energy prices and supply chains.

The Fed gives out a target range and the blue line is the Effective Federal Funds Rate which is currently towards the lower end of that range.

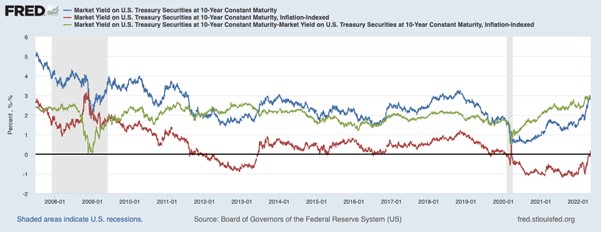

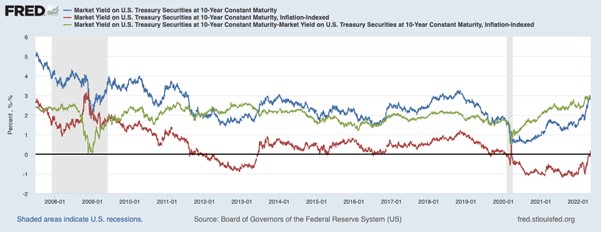

The Federal Funds Rate as it rises will push yields higher, but when questioned about the Fed’s credibility, Fed Chair Powell said that the Fed was very credible and that is demonstrated by what the money markets have done so far. Back in 2021, the 10-year yields were near 0%, in Fed Chair Powell’s delivery of FOMC forward guidance, the money markets have already priced in the majority of what the Fed would like to achieve. Even though there have only been 2 actual rate hikes. Real yields have gotten back into positive numbers and long-term inflation is now at 3%. The Fed needs to get the green line in the chart above back to 2% if they are to stabilise prices.

See real-time quotes provided by our partner.

The initial reaction in the benchmark index was to see a massive pump higher in the S&P500 as market participants had been expecting a possible 75bps rate hike to be considered or even delivered. This did not happen, so in the market’s eyes, this is less hawkish than expected and with the delay in asset runoff until July, this would be good for equities. The S&P500 on the above daily chart did not make a new high to clear the orders above the highs of 28th of April 2022. If we were to get a new higher high, this could signal a further rise in the equities markets. Only 41% of companies within the S&P500 are above their daily 200-period moving average but that was a jump of 14% at the close of yesterday. If we see a figure above 50% this could signal a greater expectation of higher prices in the indices.

See real-time quotes provided by our partner.

The US dollar index traded lower and broke out of the symmetrical triangle that it had formed over the last week. If we see a rise in the US dollar, the stops above yesterday’s highs will be the target. This is the same for all the major crosses. The opposite end of the hourly candle that formed around the rate hike announcement is where my focus is.

The EURUSD cleared stops above 1.0600 and now I am waiting to see if we test below 1.0500.

Later today the Bank of England will deliver its rate decision and the analysts are currently expecting a 25bps rate hike. If we get the +50bps rate surprise, we could see the pound jump higher, though previous rate hikes have been detrimental to the pound since December.

The USDJPY was the most interesting move for me last night as we broke out of the wedge and almost to the tick, backfilled the liquidity gap, and made an intraday double bottom. Because of the massive divergence in monetary policy between the Fed, ECB, and BoJ, I am expecting to see the USDJPY go higher, and the EURUSD come lower. Japan is still on a bank holiday, so any moves will be on lower volume and dollar led.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |