Sentiment towards a number of key trading instruments is seeing a dramatic shift as the US dollar index goes into hyperdrive and European indices start to move into price discovery amidst fresh all-time highs in local stocks.

Trading sentiment is most effective when retail traders are running counter trend, meaning that they are heavily leaning against established market trends and in increasingly large numbers. Additionally, once big sentiment skews build it can be a powerful sign that the retail crowd are being too one-sided.

Typically, market sentiment readings for an instrument that has reached around 75 to 80 percent is considered to be at an extreme level, while market sentiment readings over 80 to 95 percent is often a strong indication that the trade could be topping or about to reverse at any time.

I will now look at some the strongest sentiment bias amongst the retail crowd right now as the US dollar index cracks the 96.00 resistance handle and stocks hit fresh record all-time trading highs.

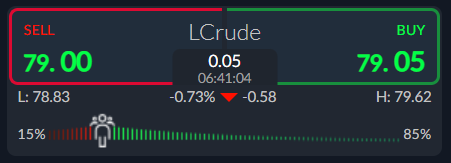

Crude Oil – Still bullish

According to the ActivTrader Market Sentiment tool traders remain worryingly long towards the Crude Oil, despite oil prices dropping by around $3.00 since the start of the week, as crude tests the $79.00 level.

The ActivTrader Market Sentiment tool shows that 85 percent of traders are expecting more upside in Crude oil prices. The large sentiment bias has actually increased since last week as oil prices drop.

If we start to see stocks in the United States correcting lower then oil prices are likely to suffer further. We should also consider the effect that tapering is having on asset price across the globe right now.

EURUSD – Bulls Getting Crushed

The ActivTrader market sentiment tool shows that traders are 81 percent of traders are bullish towards the EURUSD pair, despite its huge 400-point price drop over the last three trading weeks.

Traders could actually be correct about the EURUSD pair long-term, however, retail traders are not known for having deep pockets, and they also do not have the near or medium-term the fundamentals on their side.

While we see sentiment this extremely bullish sentiment we need to consider that the short squeeze could just be warming up, and it could be a warning sign that now is now the time to attempt longs.

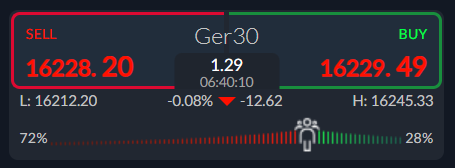

Ger30 – Price discovery

Market sentiment towards the Ger30 or the German DAX is extremely bearish at the moment, which is strange considering that the leading German index is hitting new record trading highs on a daily basis.

The ActivTrader market sentiment tool showing that some 72 percent of traders currently bearish towards the index, despite the index remaining rock solid above the 16,000-support level.

Traders need to consider that the ECB are amongst the most dovish central bank, so traders should be mindful that European stocks may be benefitting from a fresh inflow from capital due to the shift from US to EU stocks.