Index Analysis

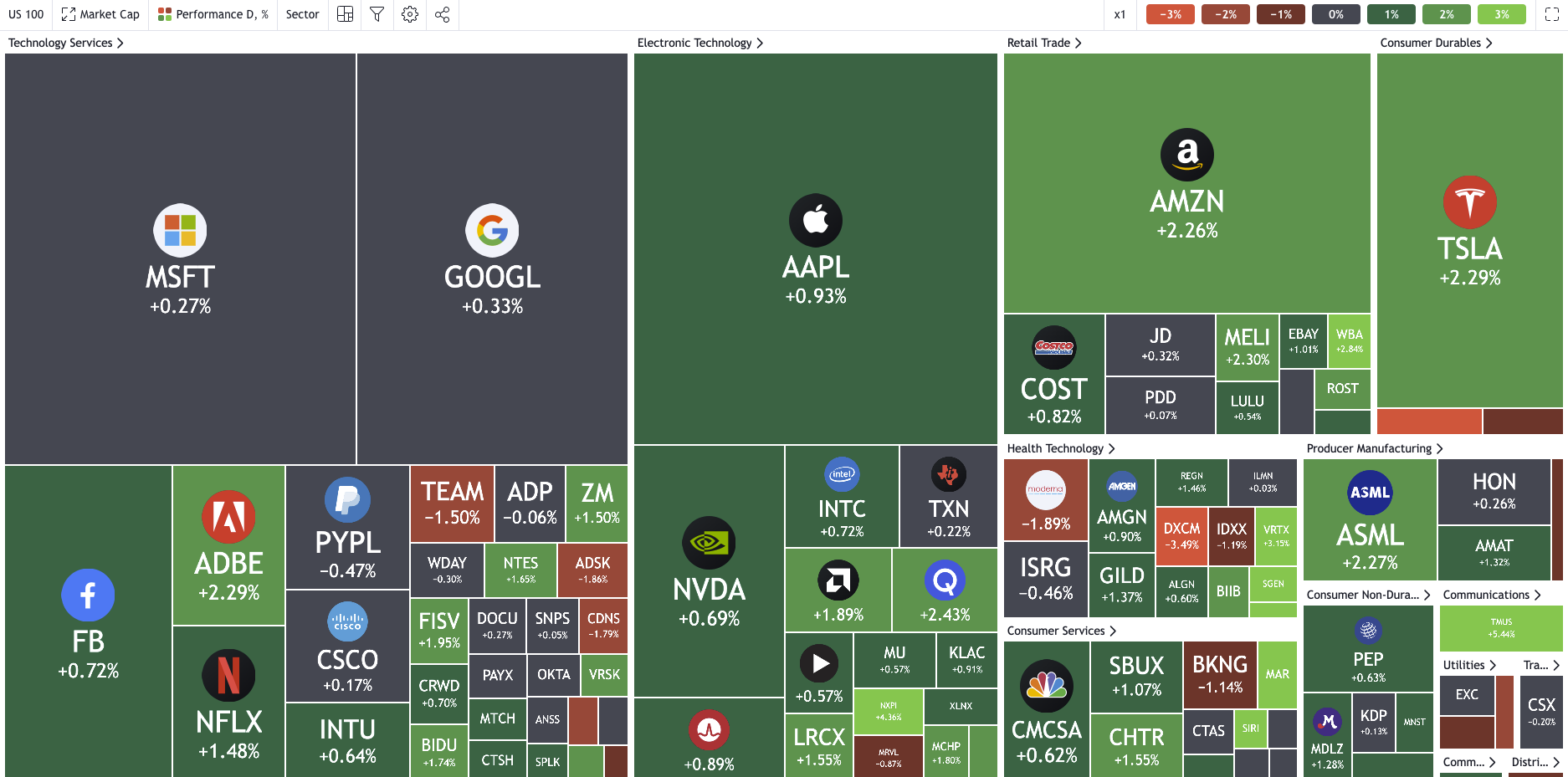

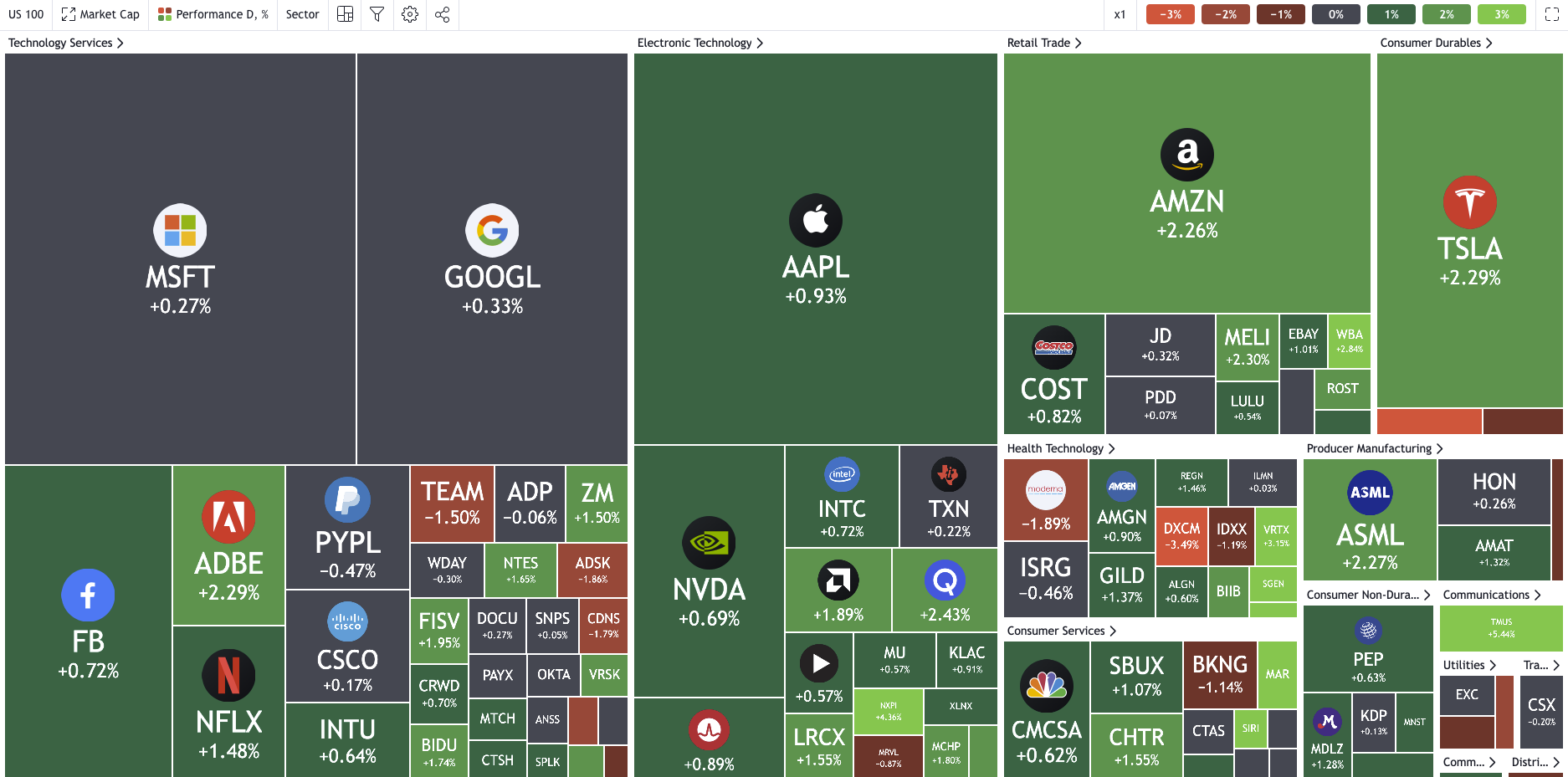

Despite positive ADP and non-manufacturing ISM PMI data, today’s markets were slow until we received the latest statement from the Fed’s Open Market Committee (FOMC). Two consecutive days of gains put the Dow Jones, S&P 500, and Nasdaq on track to advance for a fifth straight week, with NFP on Friday, the next big market moving event. The Nasdaq and S&P 500 are on track to have their longest rally since August and if the rally continues the Dow would post its longest run-up since an eight-week rally in early 2019.

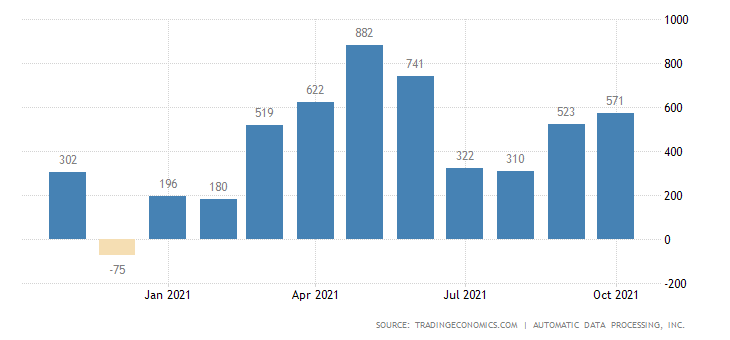

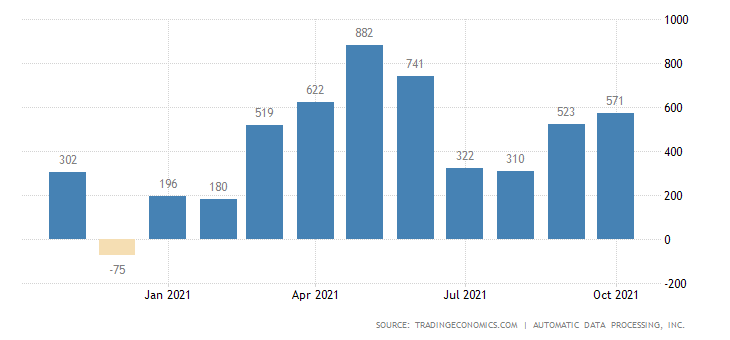

According to the ADP National Employment Report, private employers added 571,000 jobs in October. This figure serves as a precursor to the Labour Department’s monthly NFP report. Today’s ADP came in just above the 568,000 new hires in September, but well above economists’ expectations of a slowdown to 400,000 new employees. 60% of the new hires were from large employers. Most of the new jobs were in the services sector.

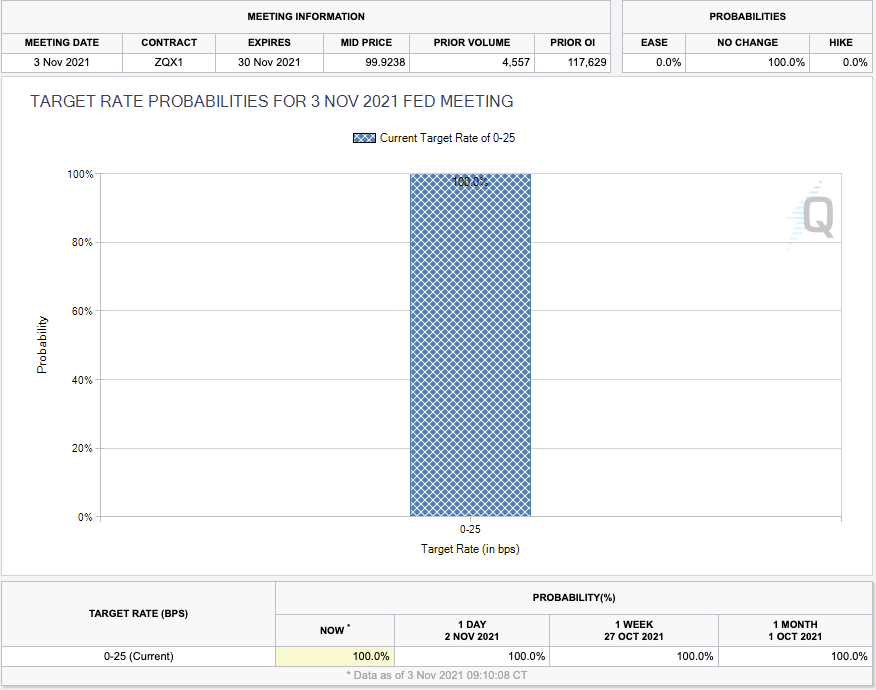

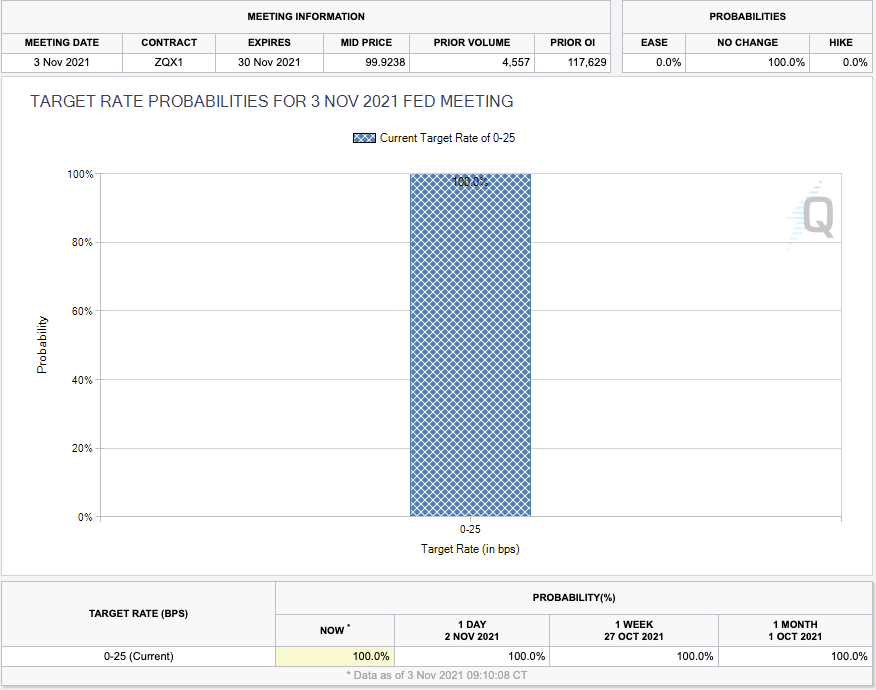

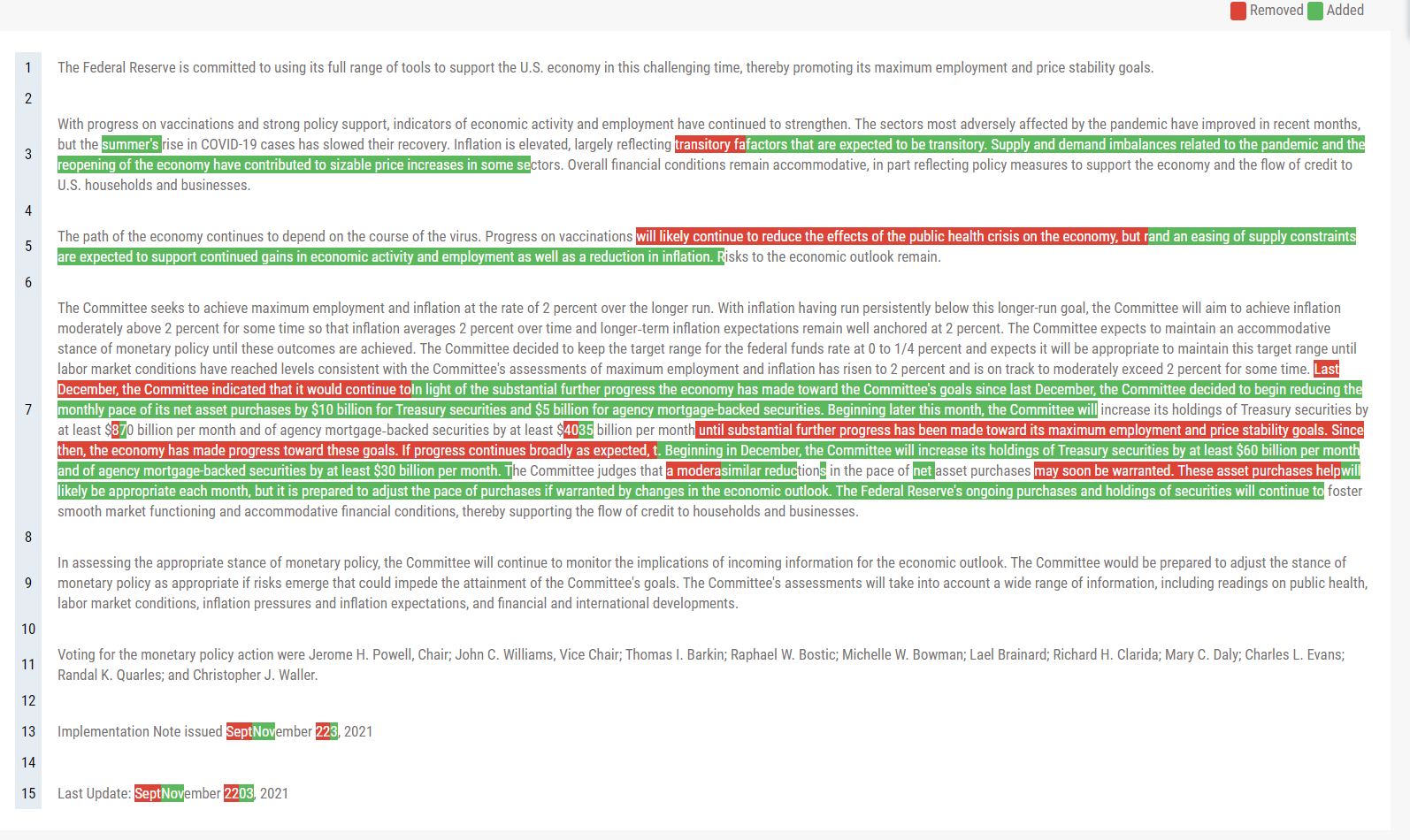

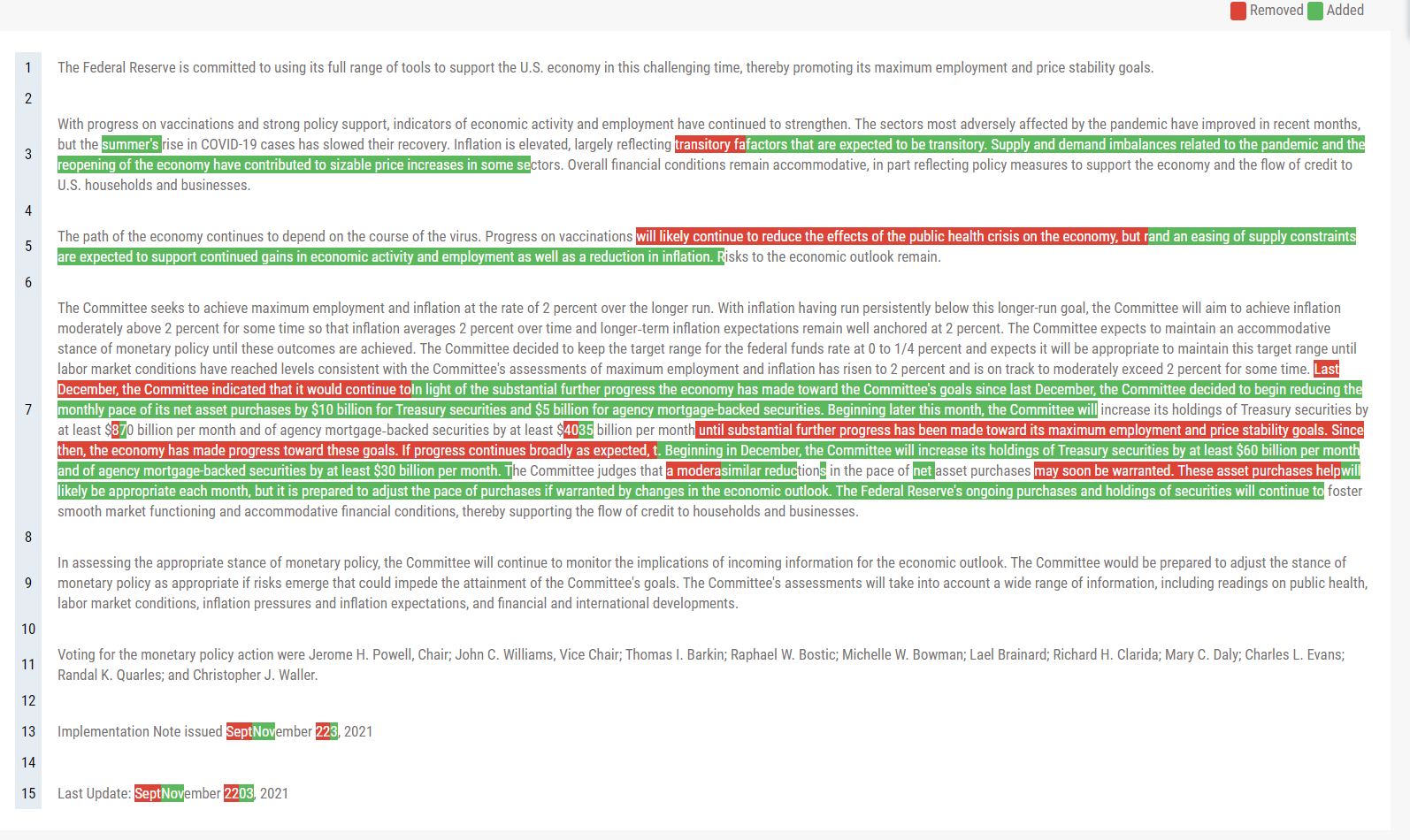

Fed Chairman Jerome Powell spoke during a press conference following the FOMC’s two-day meeting covering questions around the mandate, which is for the Fed to target price stability and maximum employment. What the Fed would like to see is for the inflation to come back down towards the 2% but remain above that level when they deem the economy to be showing maximum employment.

This would then allow them to consider lift off into a rate hike cycle.

Prior to the meeting the CME Fed watch tool had 0% probability of a shift it the Fed Fund Rate (FFR).

Getting to max employment is a judgement call, based on what Powell called a risk assessment. But one that the Fed cannot put into an equation. For economists and journalists this is annoying, because they want to be able to put a number on something. Powell did hint that seeing NFP coming in at 550k to 600k over the course of next several months would get the jobs market on the fast track towards max employment, so that is something to look out for starting from Friday. If the participation rate also starts trending higher that will also be a good sign.

The Fed policy must be able to adapt to disappointing data too, as Powell reiterated that they did not expect the disruptions to continue this long, and the Delta variant took us onto another path. A different variant could do the same again.

Before the FOMC meeting announcement, the market traded within a tight range and waited patiently for the Fed to speak.

Traders who were patient were quick to buy the Initial Balance range highs as the Fed followed through with expectations of a taper.

The Nasdaq especially liked what the statement had to say as it pushed nearly 3% higher as there were no rate hikes signalled in the statement or presser. We may get more opportunities in the next few days based on the bullish move higher, either as a continuation of this trend or as a counter trend trade back to value which will be found in the balance areas formed by the sideways markets.

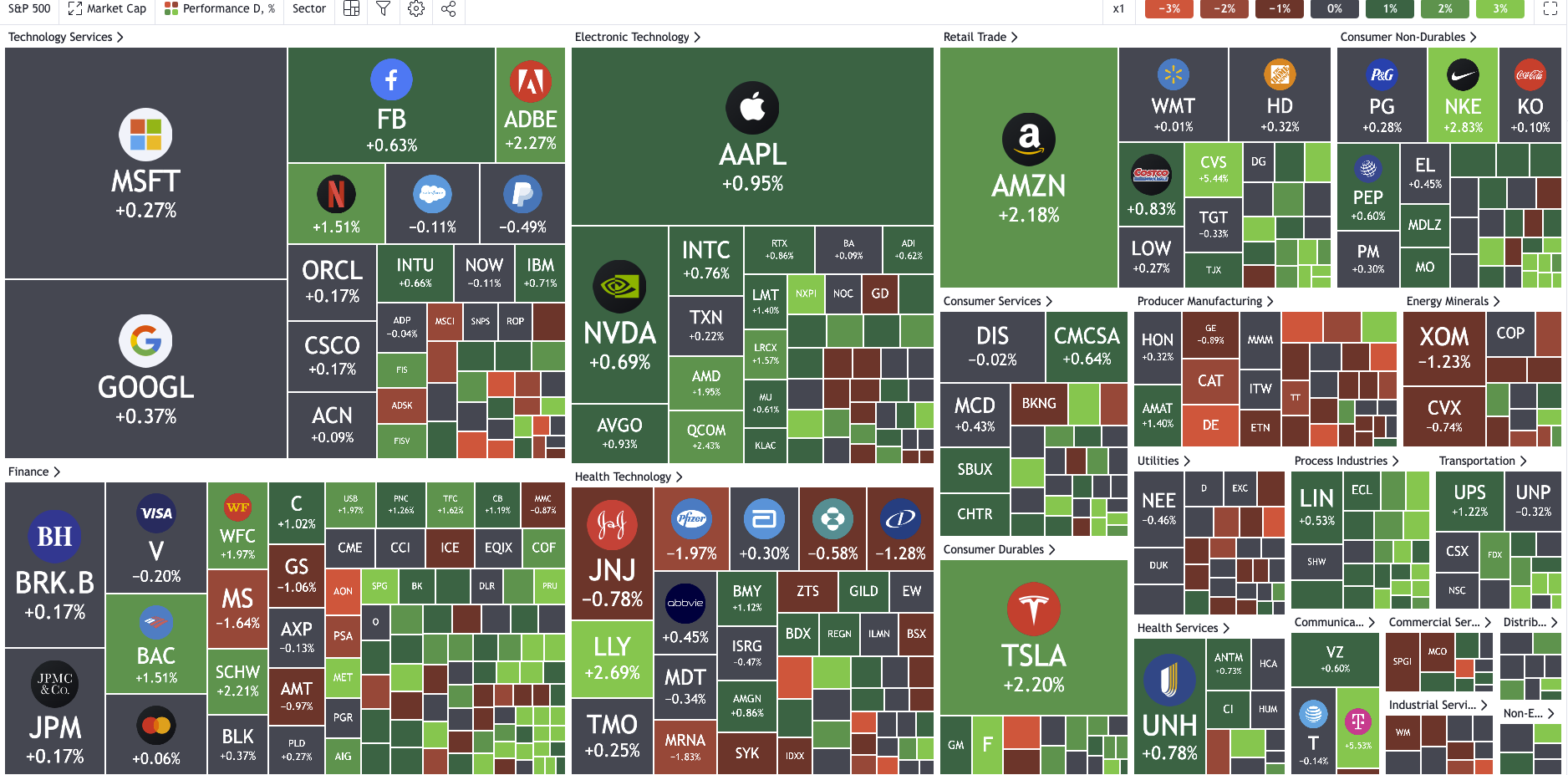

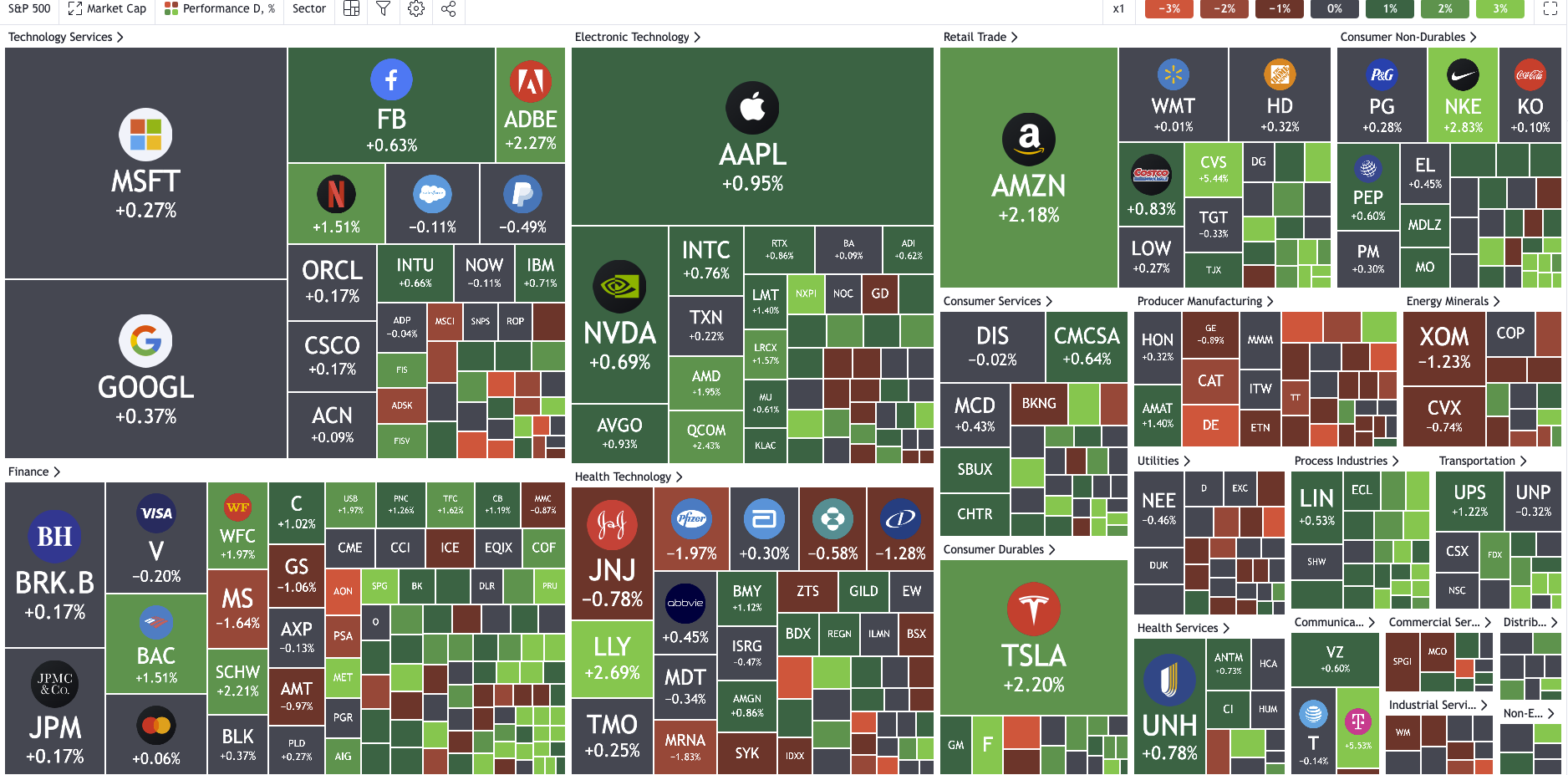

See real-time quotes provided by our partner.

As with the Nasdaq, the S&P 500 has risen in 13 of the last 15 prior sessions. Just a few weeks ago, traders were worried the index would fall to the September/October low and potentially test the 200-day moving average. Now we’re in this trending move and likely to keep pushing for new all-time highs until the next market shock. Maybe NFP?

See real-time quotes provided by our partner.

The S&P 500 has had some of its best months since 1936 in November and December, with December rising more than 80% of the time. We should consider the possibility that the daily chart is not going to collapse any time soon, and we should start considering looking for entries to get long on a shorter time frame like the H1.

In the above chart I propose waiting for a decent dip in price action, back to the 20 & 50 period moving averages. Then if you can identify a descending trend line by placing the line across two swing highs or more to use this as a guide for any potential breakout candles. The bigger the green candle the better as that will hopefully have enough volume in it to prove the bulls are still in control. Risk management would go under the previous swing low, and the idea would be that a break of that swing low would be a signal to get out of any running trades or wait for a new set up in the future. I believe we will see a little more two-way price action in the near term, but I still believe the ES will go up.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |