Commodity Analysis – oil

Gold‘s relative performance versus other asset classes is highlighted by the World Gold Council’s latest monthly report. During periods of high inflation, US treasuries outperformed the conventional wisdom that gold is a great inflation hedge. In terms of investor returns, oil is by far the largest winner on this list, while the Japanese yen is quite understandably the weakest.

The US dollar has also been on the rise as the Federal Reserve is keen to tighten monetary policy in the hope of cooling the overheating market. At some point I would imagine a higher valued US dollar would have some negative impact on the price of oil but that would also rely on there being a balanced to over-supplied energy market. In this week’s oil futures market, investors were buoyed by reports that the Omicron Coronavirus variant only exhibits mild symptoms, so demand may also be on the way back after a little set back.

Following last week’s OPEC+ meeting, there will be an increase in production of 400k BPD from January, much to the delight of the USA. The price of oil is rising even with the proposed coordinated SPR releases and output increase by OPEC+, which indicates that fundamentally we’re still in a tight market. In the current quarter, OECD inventories are likely to fall below 2.8 billion barrels, which corresponds to oil prices over $80, based on the pre-Omicron level.

The ActivTrader sentiment indicator shows that retail traders on the trading platform are overall bullish oil, though these bulls have been slipping out of the WTI contract. If this cohort were to turn overall bearish for some reason, I would expect to see higher prices sooner. As it is, I am looking for technical areas to look for a short to squeeze the remainder of retail traders out.

Omicron won’t go away, and who is to say a new more concerning variant or variants won’t appear soon. Omicron is spreading across multiple regions in the United Kingdom and could become the dominant variant in the next few weeks. To lessen the negative health impact of the fourth wave, a red travel alert has been issued for various countries, and we are seeing cases are rising sharply in some parts of Europe. France is closing nightclubs for four weeks. If Christmas gets cancelled this year, I imagine 2022 will start off very gloomily.

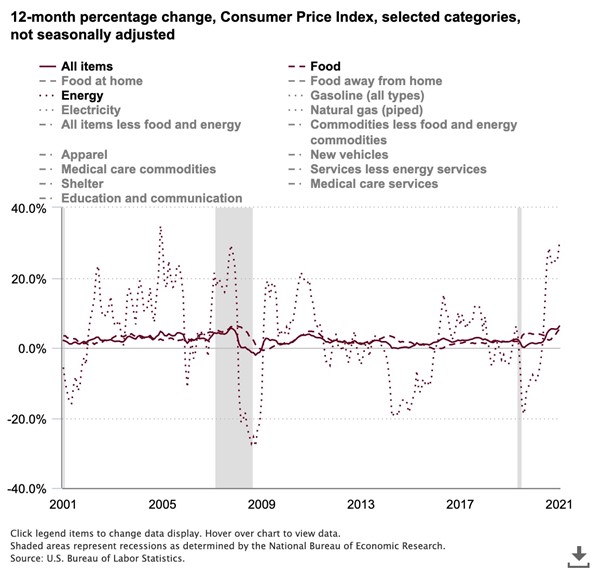

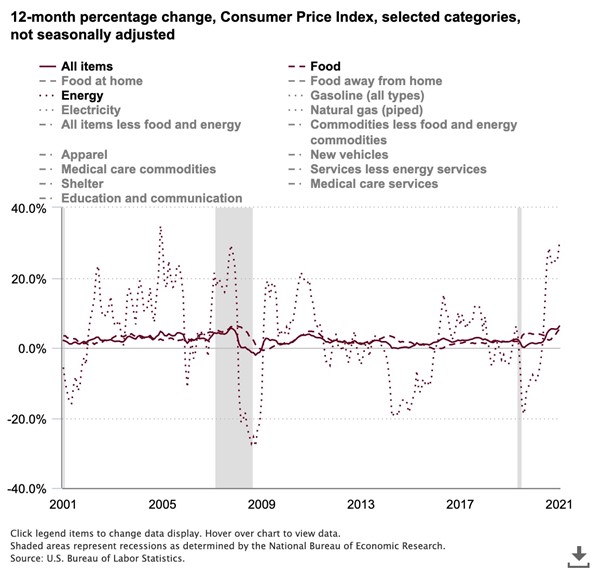

The recovery from the pandemic-induced destruction combined with the shortage of everything resulted in an unforeseen increase in inflation since both consumer and producer prices rose faster than expected. The chart above from the US Bureau of Labour Statistics shows the magnitude in rise of Energy inflation.

The growing Omicron concern has started to weaken the inflation story, yet the Fed decided to accelerate its move to withdraw monetary stimulus and potentially scale back its bond-buying scheme faster than previously announced. More FOMC members are calling for a speedier tapering. With the idea being, a faster tapering will result in a faster rise in interest rates. The intended result? borrowing will be hindered, thereby reducing economic growth, and subsequently reducing oil demand.

See real-time quotes provided by our partner.

The bounce seen in the daily chart looks impressive but we’re about to run into some serious resistance. $77 per barrel will be a crucial line to get back above, though not until $82 does the market structure look bullish again.

See real-time quotes provided by our partner.

See real-time quotes provided by our partner.

Both the Brent and WTI intraday charts show price rebounding off a previous supply zone. There is also a possibility that the rising channel that has been carved out since the beginning of December could break to the downside.

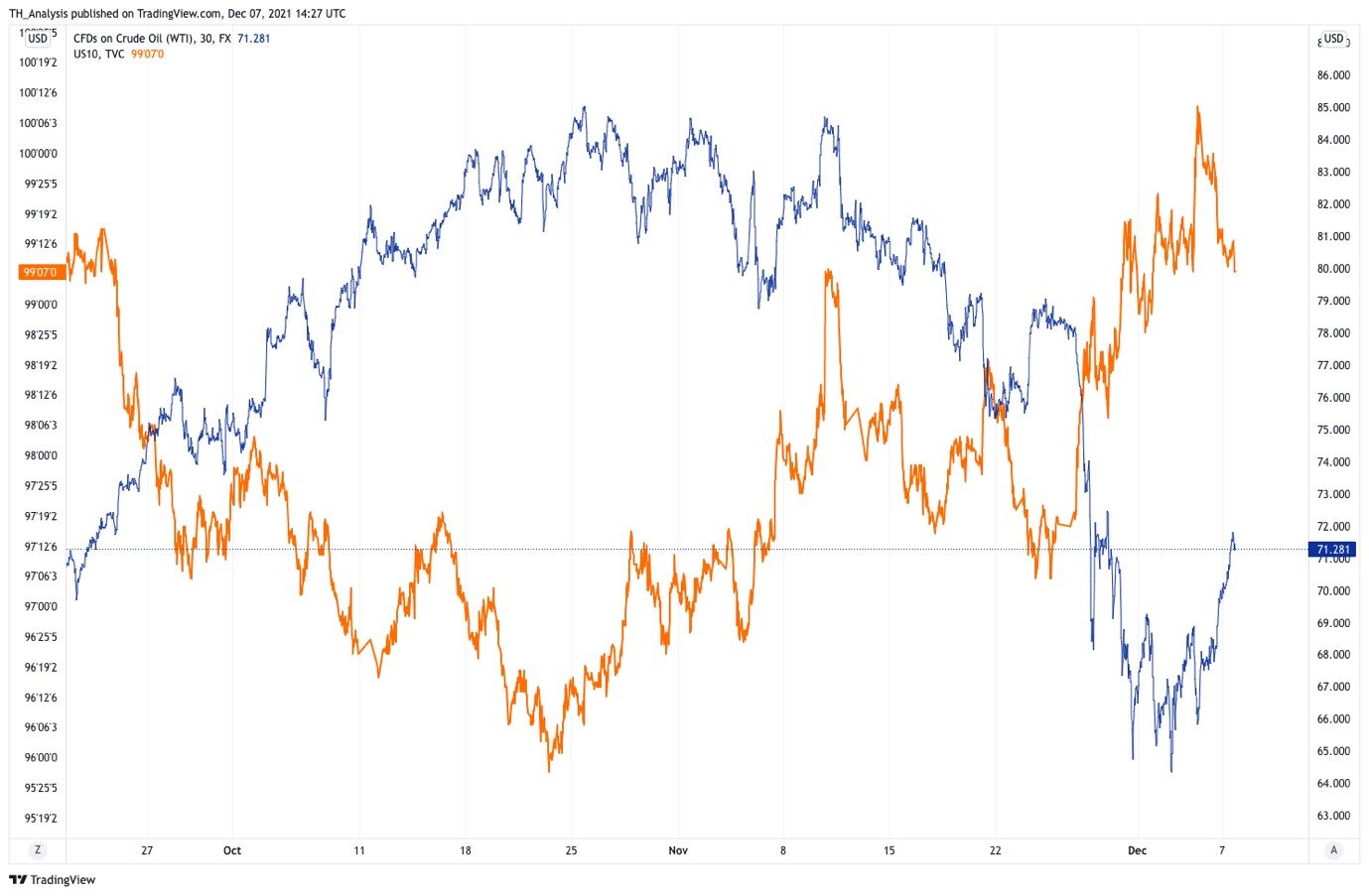

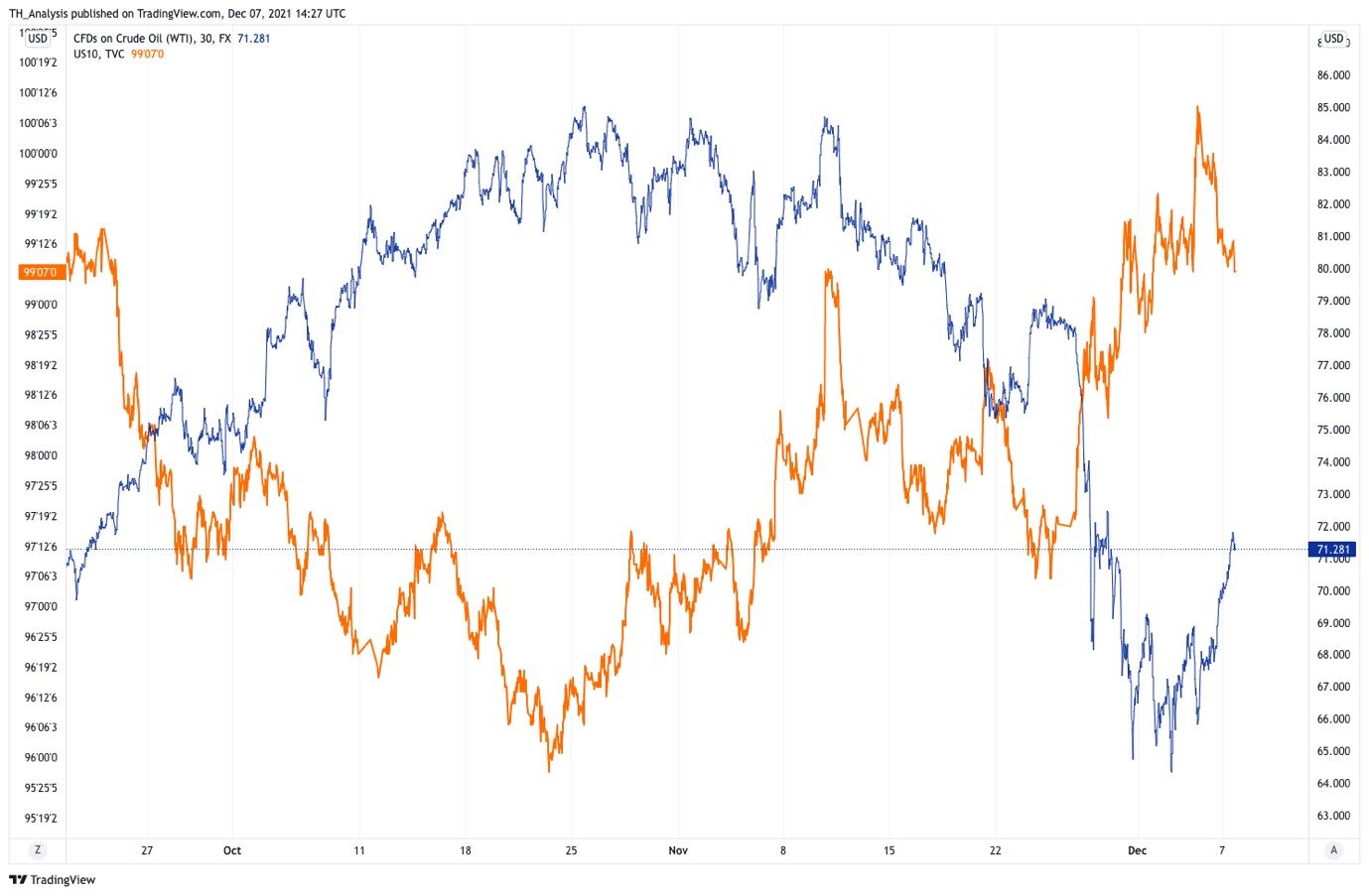

This Friday we receive the latest US CPI figures and having seen oil drop from the years highs in October in line with the rising US Treasury 10 year, it will be interesting to see where we end up at the close on Friday.

If CPI comes in higher than expected the US 10-year notes will drop and we could predict that the price of oil will rise based on the recent price action seen in the chart above. If the US CPI comes in under expectations and the US 10-year notes rise as traders move out of a sooner rather than later rate hike mind set, the price of oil may be allowed to fall.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |