Weekly Index Analysis

According to the January barometer theory, the stock market performance in January (especially in the US indices) is a reliable indicator of market performance for the rest of the year. Therefore, if the stock market rises in January, it is likely to continue to rise by December. The January barometer was first used in 1972 by Yale Hirsch. According to Hirsch, the electoral cycle of the president may also be a key factor determining market performance. It was noted by the Wall Street historian that the worst stock performance occurs in the first two years of a presidential term. This could be a concern to us today since President Biden is in his second year of office.

Between 1950 and 1984, the probabilities were high of both positive and negative results as observed by the hypothesis “that if the S&P falls in January, it will fall for the rest of the year”. There was in that 35-year period a 75% chance of that statement being true. But after 1985, the negative predictive power had been reduced to 50%, or in other words, no predictive power at all.

The data continuing from 1985 suggests that if there had been a correlation, it was now broken. In September of 2005, Michael J. Cooper, John J. McConnell, and Alexei V. Ovtchinnikov published a renewed study on this effect.

In their summary, they state “An argument can be made that January returns just happened to have been correlated with returns over the next 11 months of the year, over the 150-or-so year period preceding the first appearance of the Other January Effect in a published publicly-available document. By virtue of this happenstance, this spurious correlation became street lore.”

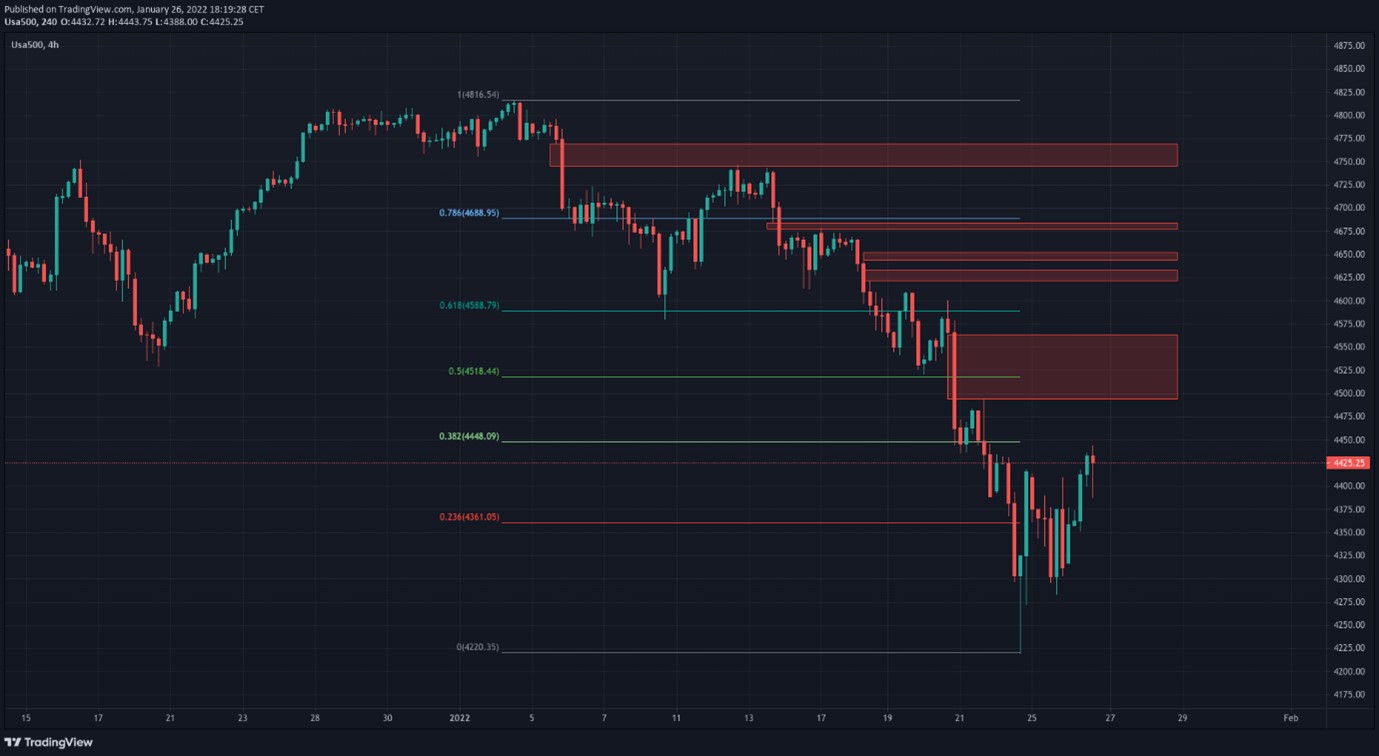

Whether or not there is merit to the lore, we should see if we can build a case for being bullish or bearish on the future market trends in 2022. We’re seeing the major indices crashing several percentage points on a daily basis, only to then see just as volatile moves in the opposite direction. The market structure to the upside remains intact and acts as resistance whereas more support levels are being removed more frequently. If this means there is a chance the rest of the year turns negative it would be great to have the probabilities on our side.

Using the Usa500 chart on ActivTrader from 2009 to the present day, we can try an add to the stat which said, of the 90 years of stock market history there was a 20% chance of the year ending positive after a negative January. Which I interpret to mean that there was an 80% chance it would be flat or down for the year. From my quick visual back test, over the course of the previous 12 years to date, the January barometer had very little predictive power.

See real-time quotes provided by our partner.

A total of seven false positives and six true positives were seen over the 13 complete cycles of the January Barometer since January 2009, with two of those six coming in flat for the year.

A more rigorous back test was conducted by quantopia.com who found that a January Effect strategy which combines the equities index with a bond buying strategy had some merit. “According to the paper, the best usage of this barometer is the combination of equity index and treasury bonds with a simple rule to buy index after a strong January or to buy bonds after weak January. The strategy mentioned above should outperform passive long-only strategy through the whole back testing period, the long/short strategy according to Januarys, and the long leg only of the January barometer strategy.”

With this in mind, we could look elsewhere for what could be affecting the US stock markets in particular.

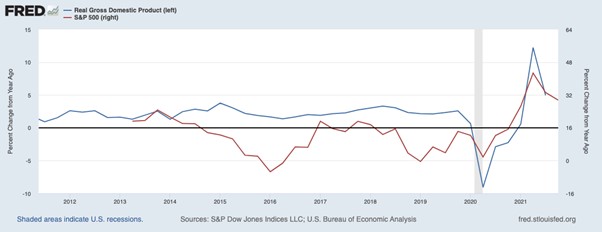

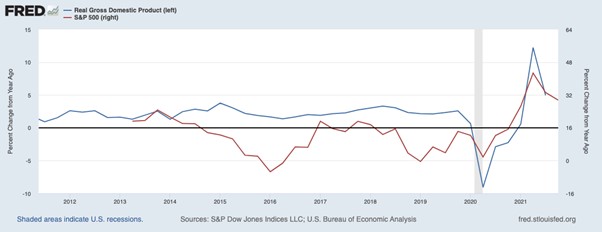

The yearly rate of change in the US CPI (inflation) data would appear to have a relationship with the S&P500 index, as does the US GDP data. But neither is so highly correlated to have causality of index direction.

What about the Presidential Election Cycle Theory vs. Historical Market Performance?

Several factors can impact the stock market performance each year, some of which are unrelated to the president or Congress. From 2019 to 2020 we suffered from the unforeseen COVID-19 world lockdown, during a pandemic. In 2018 the Fed initiated a Taper Tantrum when it tried to reduce the QE purchases. Over the past several decades, however, there has been a general trend for share prices to rise as the US presidential election gets closer.

In 2016, Charles Schwab analysed market data dating back to 1950 and found that, in general, the third year of the presidency coincided with the strongest market gains. During the presidential cycle, the S&P 500 produced the following average returns:

Year after the election: +6.5%

Second year: +7.0%

Third year: +16.4%

Fourth year: +6.6%

The only significant change within the 4-year cycle is within the 3rd year, the other 3 years are basically on par with average yearly returns. The stock market achieved gains in 73% of calendar years between 1950 and 2019. However, during the third year of the election cycle, the S&P 500 scored an increase 88% of the time, demonstrating a decent consistency and possibly a good reason to wait a year and go long the S&P500 next January. Especially if you could get around +16% on your capital.

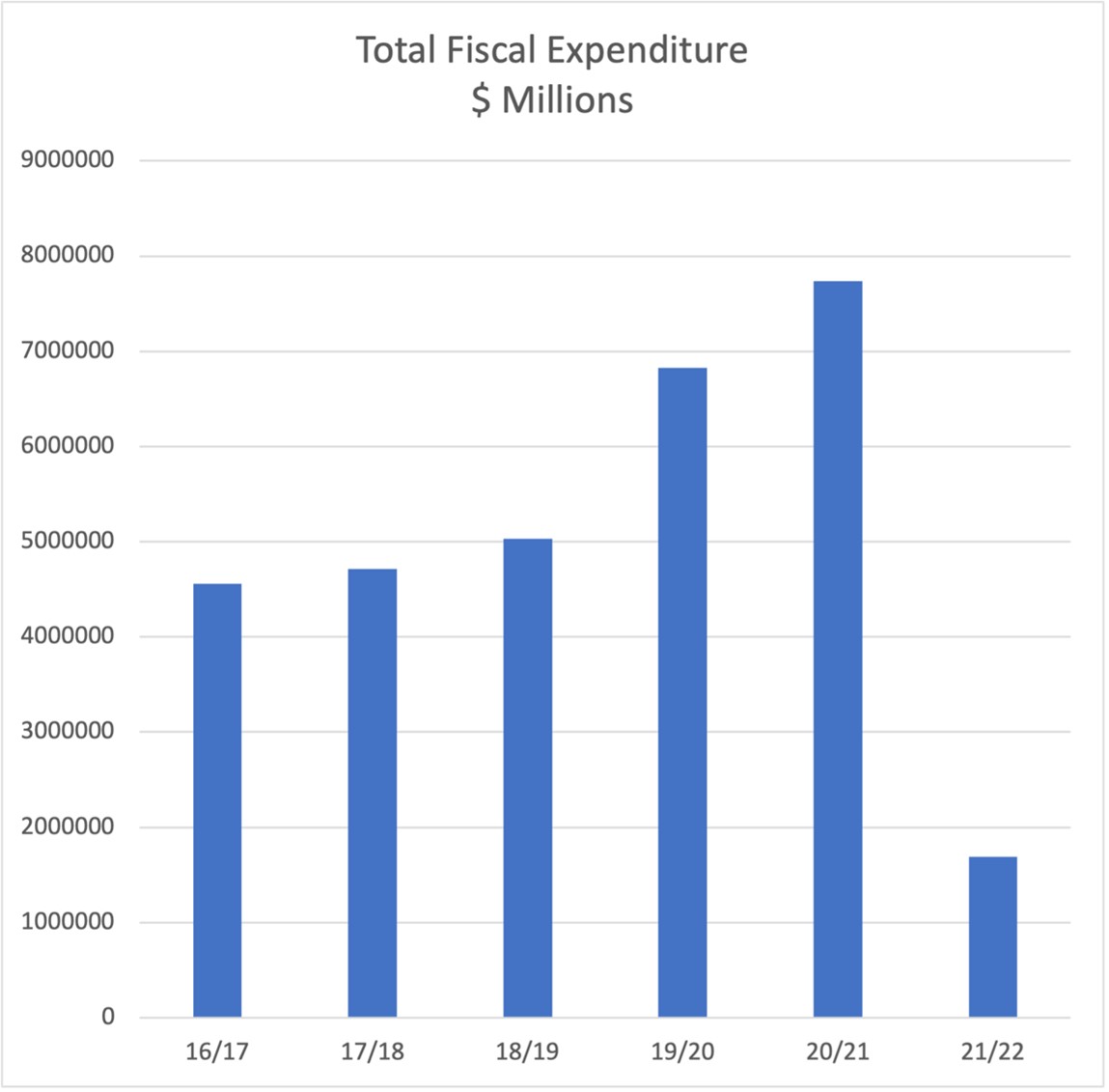

I am following the spending habits of the US government and from the start of October 2016, the annual spending has been jumping at a considerable pace. We’re in Q2 of fiscal year 21/22 and the stock market is starting to fall. If the yearly rate of change in these flows is less than previous years, this could be the predictor for the coming 11 months.

See real-time quotes provided by our partner.

The S&P500 on 26th January 2022, with only 3 trading days left in January has fallen from the years high down to 4220.00. With a couple of hours to go before the FOMC meeting concludes I have highlighted zones that I would like to see tested as the S&P500 does its best to head back up to the opening price. If it fails to get through all of these zones, I’ll look to see whether the bonds are in a good place to buy.