Market Wrap

See real-time quotes provided by our partner.

Cable closed the London session on a high as traders position themselves for a Bank of England rate hike in December. The price action is nearing in on 1.3500 which will be the first key test for the start of anew uptrend. Only when we get back above the 1.3620 and previous swing high can we get more bullish, but the technical will at least match the fundamentals when that happens. Patience is key unless you really believe the BoE this time.

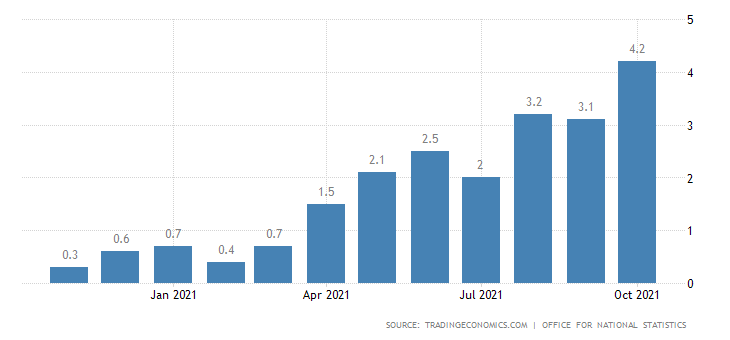

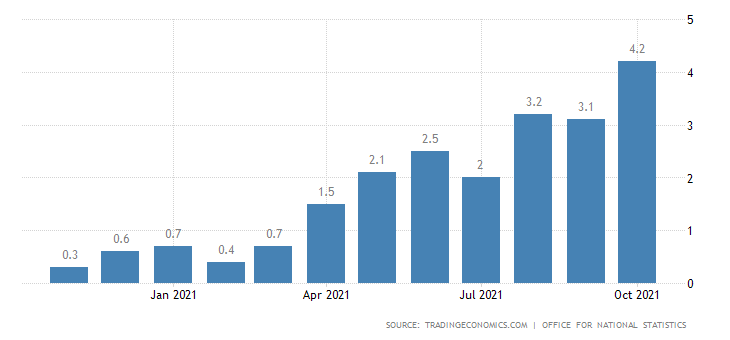

Inflation is escalating as countries across the developed world report rising prices.

This morning, the UK inflation rate surpassed expectations. The UK CPI inflation rate was always expected to increase sharply in October due to the latest increase in Ofgem’s energy price cap. The temporary VAT cut for the hospitality sector was partially reversed and motor fuel prices, as well as everything else related to energy, are continuing to increase.

However, the increase from 3.1% to 4.2% y/y in September was well above expectations; forecasts ranged from 3.9% to 4.1%.

Despite energy prices being the primary contributor to October’s inflation rise, that rise was as expected, so the biggest surprise was the higher-than-expected rise in “core” inflation. Core excludes the more volatile energy and food prices, so we’re seeing rising prices across the board. Wages will have to follow if the Bank of England cannot curb the inflation rise with a rate hike. Though if they do, the mechanics of adding 0.25% to all goods and services could lead to even higher prices being accepted if wage increases jump.

Similarly, the Canadian CPI increased 4.7% year-over-year in October, up from 4.4% in September. It is the largest increase since February 2003. A year-over-year increase of 3.3% was seen in the CPI excluding energy, matching September’s increase.

The CPI increased by 0.7% in October, the most since June 2020 (+0.8%), when energy prices began to rise after steep drops during the early months of the pandemic. On a seasonally adjusted monthly basis, the CPI rose 0.5%.

See real-time quotes provided by our partner.

Unlike the GBPUSD, the Canadian dollar is currently suffering under higher inflation worries and falling oil markets. Which goes to show it is not a given that inflation equals rate hikes and a sovereign currency. You have to weigh up all the macroeconomics and then find a technical level to trade off. 1.2668 could be the last chance for the USDCAD bears to get a good entry for a long term short, if the 1.2600 level drops its resistance potential.

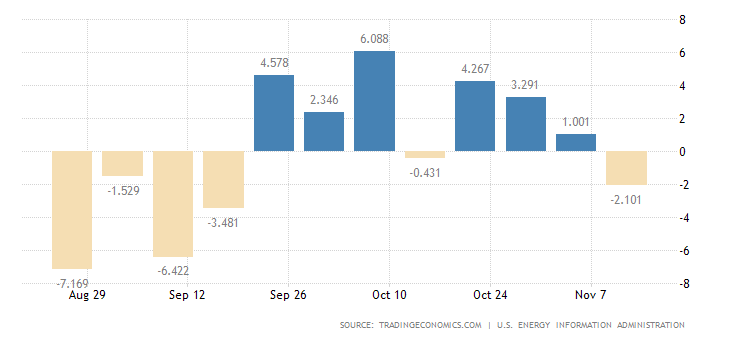

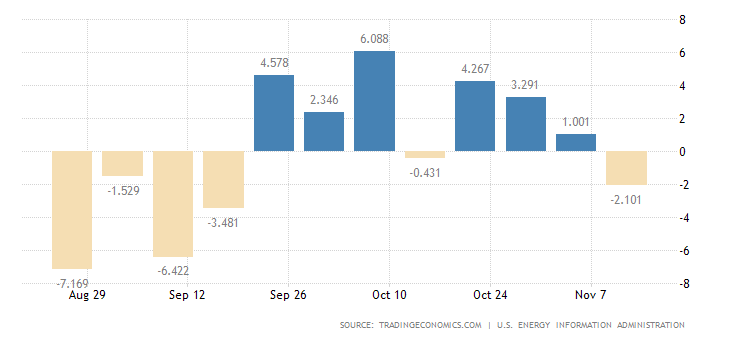

EIA’s weekly energy inventory data this afternoon showed crude oil down -2.101 million barrels against an estimate of +1.398 million barrels. Given expectations and private data, the crude oil drawdown is unexpected.

See real-time quotes provided by our partner.

A draw on Oil inventories is usually good news for bullish oil traders. The worries around rising COVID-19 infections and lockdowns across parts of Europe will be a drag on the demand. The US dollar just recently reversed off a key level, so we may get a turnaround in energy tomorrow. If not the support level around $79 has to hold, or we will be looking for a break lower, retest of old support and then continuation trade lower.

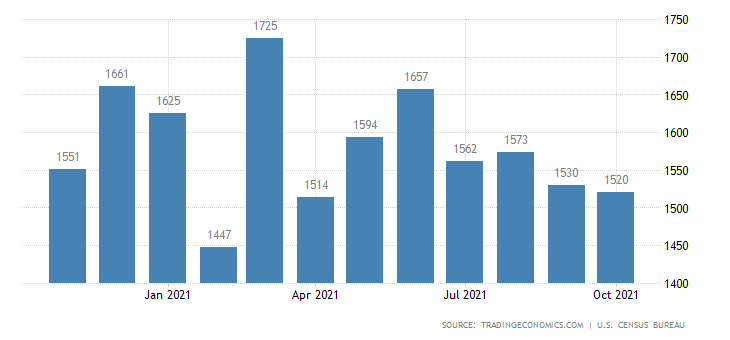

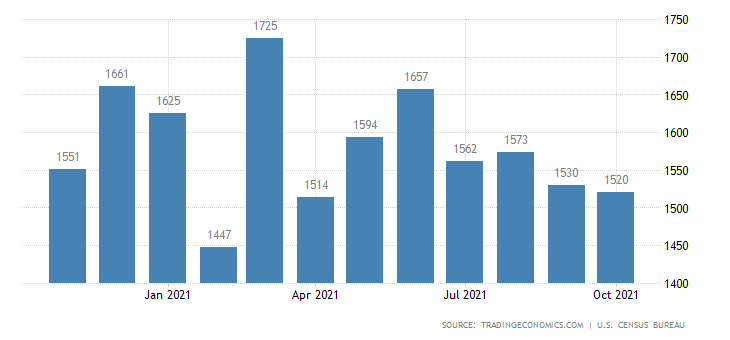

In October of 2021, the number of housing starts in the US declined unexpectedly by 0.7% MoM to 1.52 million from 1.53 million in September and well below expectations of 1.576 million. The number of housing starts fell for a second consecutive month to the lowest level in six months due to rising building material prices, especially lumber and copper, as well as supply constraints and labour shortages caused by the pandemic disruptions.

The rest of the economic calendar is dominated by the Fed speakers, so it will be hard to know how the market reacts to their statements, until the algos have finished doing their work. There is a real possibility that we get a melt up in the US indices.

See real-time quotes provided by our partner.

High inflation is not good for a currency, just ask the Venezuelans and Turkish peoples. The DXY hit the $96 big level today and promptly reversed, which is currently looking like a shooting star candle. Stops will be above the highs, so a quick reversal tomorrow will be extremely bullish as the liquidity would allow the price to accelerate higher. In a couple of days’ time, if the chart pattern is a bearish swing high, this could be the end of the dollar bull run. Especially if the Fed do not raise rates and/or the US Government were to default mid-December due to the debt ceiling not being raised.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |