Weekly Index Analysis

See real-time quotes provided by our partner.

Over the course of the last 4 trading days, the S&P500 has not only broken through the dynamic support of the daily 50 ema it has also broken below market structure. To a lot of traders, this is all they need as a signal that the bull market in equities is over.

September hasn’t been a great month for equities, and this could be a seasonal reaction, as quite often the September closing prices are weaker on the S&P500. MSM and Fintwit are all aflutter about a potential default of a Chinese homebuilder with $300bln worth of debt. This could lead to contagion which could itself bring the financial markets down like Lehman Bros, but it is highly unlikely. September is the month where there is a big tax payment along with the end of the fiscal year, so not much spending going through from the US Treasury to push the markets higher in general. This year is worse as we are at the US debt ceiling limit, which I will go into in more detail later.

Today was the all-important FOMC meeting conclusion, where we received their latest decisions on monetary policy based on their assessment of the US economy. During the press conference Fed Chair Powell reiterated that the Fed is getting “closer” to achieving its goals on “substantial further progress” on inflation and employment. “For inflation, we appear to have achieved more than significant progress, substantial further progress. That part of the test is achieved in my view and the view of many others,” he said.

The Federal Reserve work to a dual mandate of price stability and maximum employment, so having exceeded their targets for inflation were they now close to maximum employment? “My own view is the test for substantial further progress on employment is all but met,” Powell added.

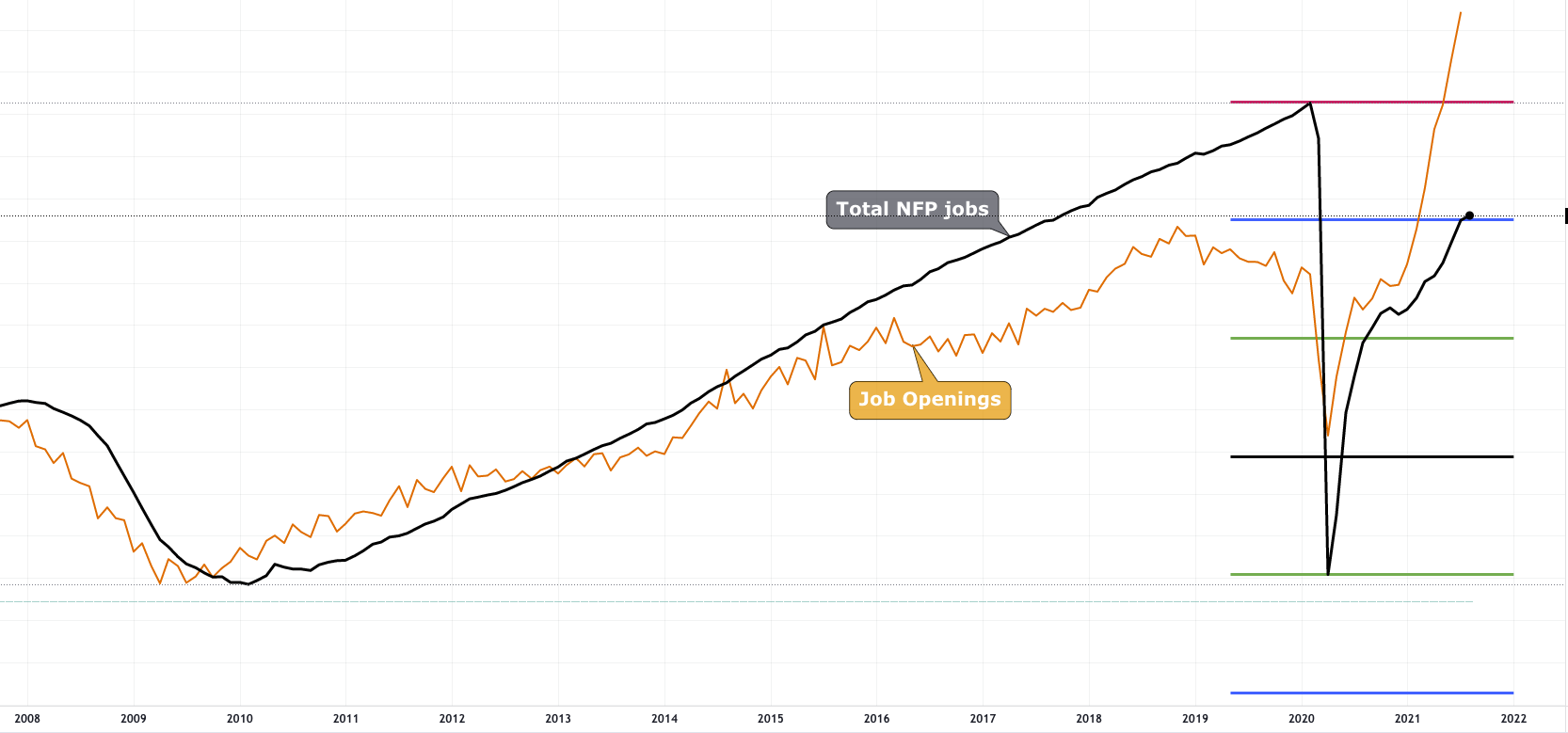

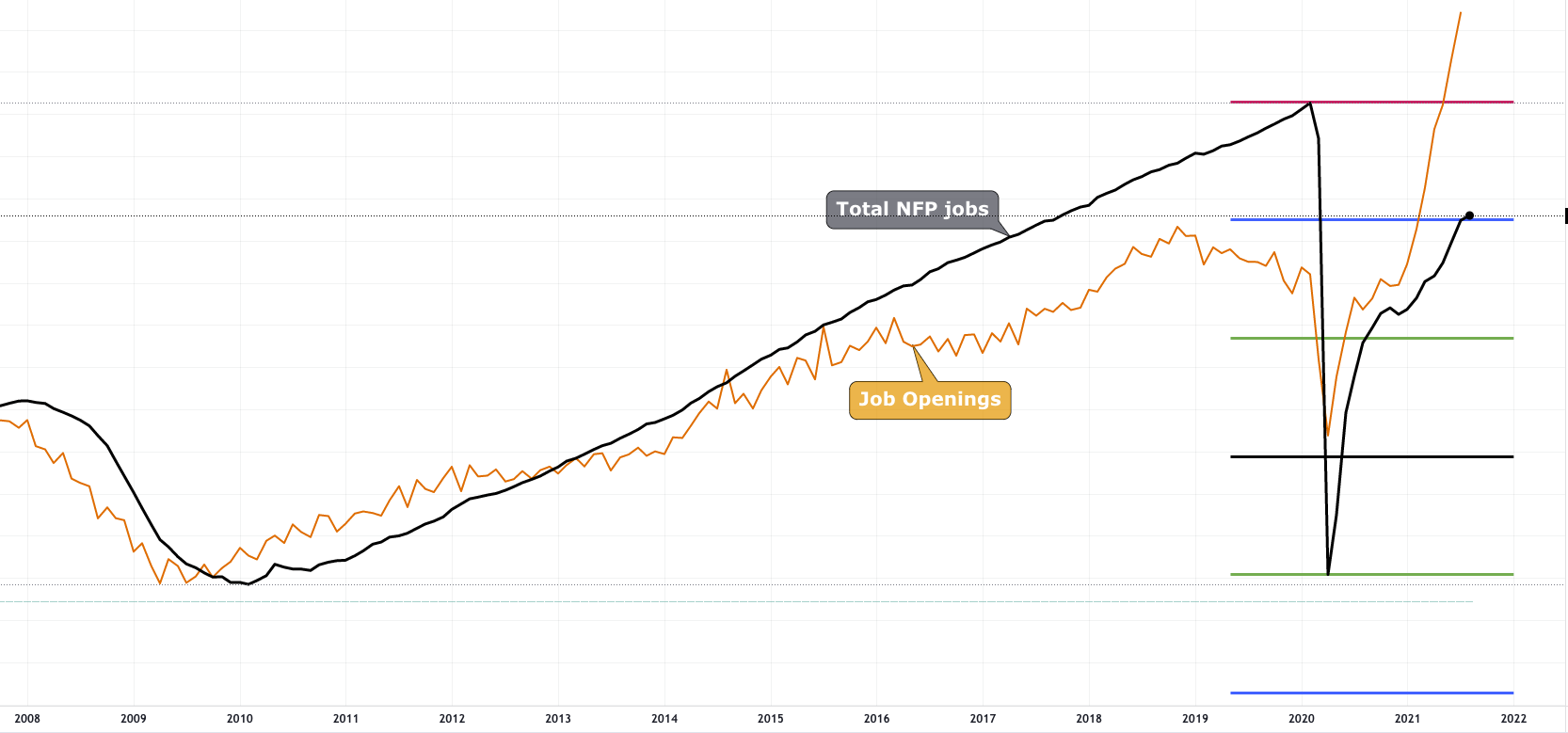

Looking at the chart above the black line is the total employees from NFP and that decline from the coronavirus market shutdown has been reduced by 75% now. The orange line is the amount of job opening available. The FOMC are expecting the parents to take up some of those jobs on offer as kids restart school. As long as the Delta variant doesn’t cause more labour damage with increased absenteeism, layoffs and shutdowns, the employment figure should rise and fill those job vacancies.

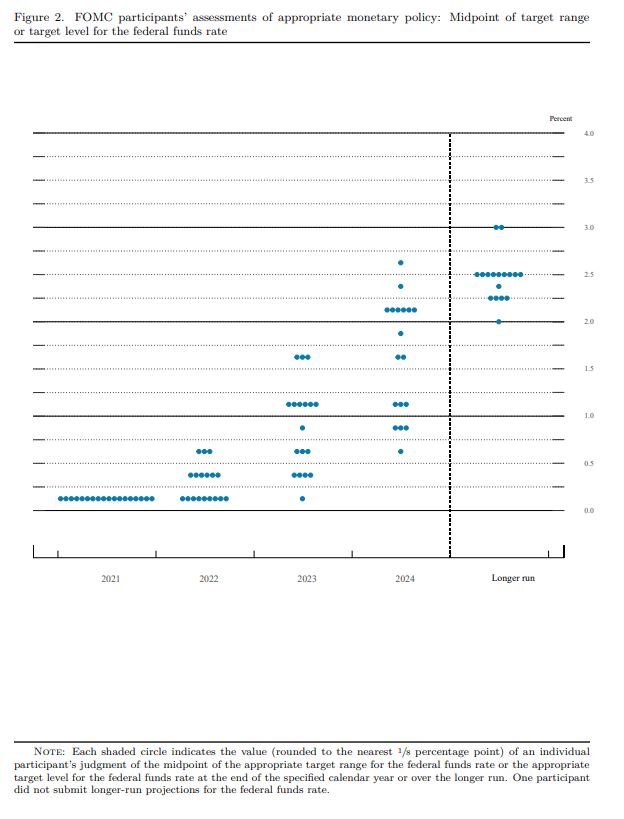

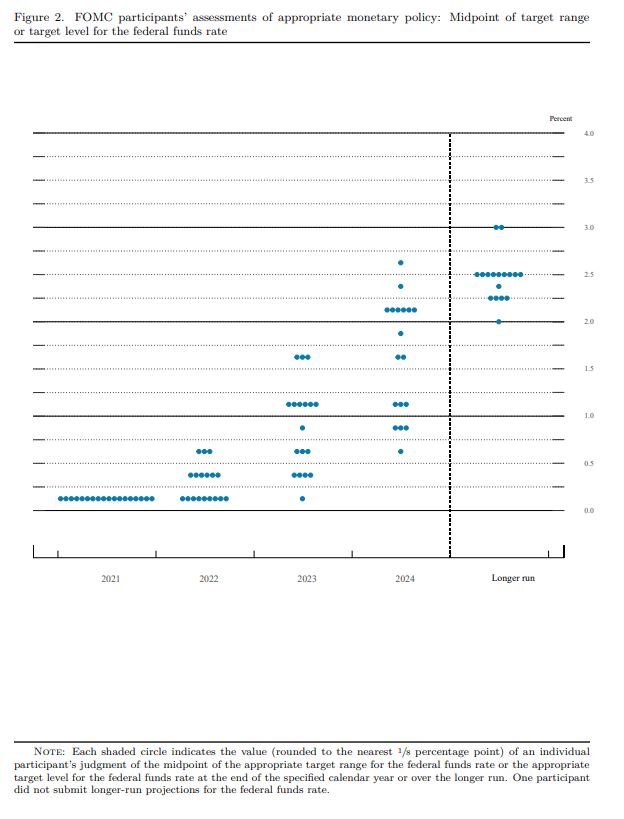

With the Fed Chair ready to pull the trigger on tapering it would stand to reason that the FOMC will begin their asset purchases reduction from $120bln ($80bln Treasuries, $40bln MBS) this year. Powell doubled down on the statement that taper could be “as soon as the next meeting”.

With all the talk of tapering what about raising the policy rate to curb the rising inflation. For that “lift-off” we will have to wait for quite a while longer. The expected hold off on rate hikes resulted in the benchmark US10 year yield dropping and for the treasuries and related assets like the TLT to rise.

See real-time quotes provided by our partner.

TLT had broken out of a corrective triangle following on from the Jackson Hole symposium and with no tapering happening from tomorrow, these Treasury related ETF’s, agency securities and Treasuries are all in high demand. Especially as the Fed is removing so many each month and continue to do so for a while longer it seems.

Something that wasn’t mentioned in the FOMC press conference was the fact that the NY Fed doubled the size of counterparty limits on Reverse Repo Purchases (RRP) from $80bln to $160bln per counterparty. So double? This facility is designed to provide additional breathing room for short-end rate markets, as pressures around a T-bill market imbalance due to the lack of new issuance from the Treasury; Treasury’s dwindling cash pile because they can’t issue more debt and have had to go to extraordinary measures to pay their bills & the US debt-ceiling impasse continuing, which will probably go to the wire. Why the need to double it?

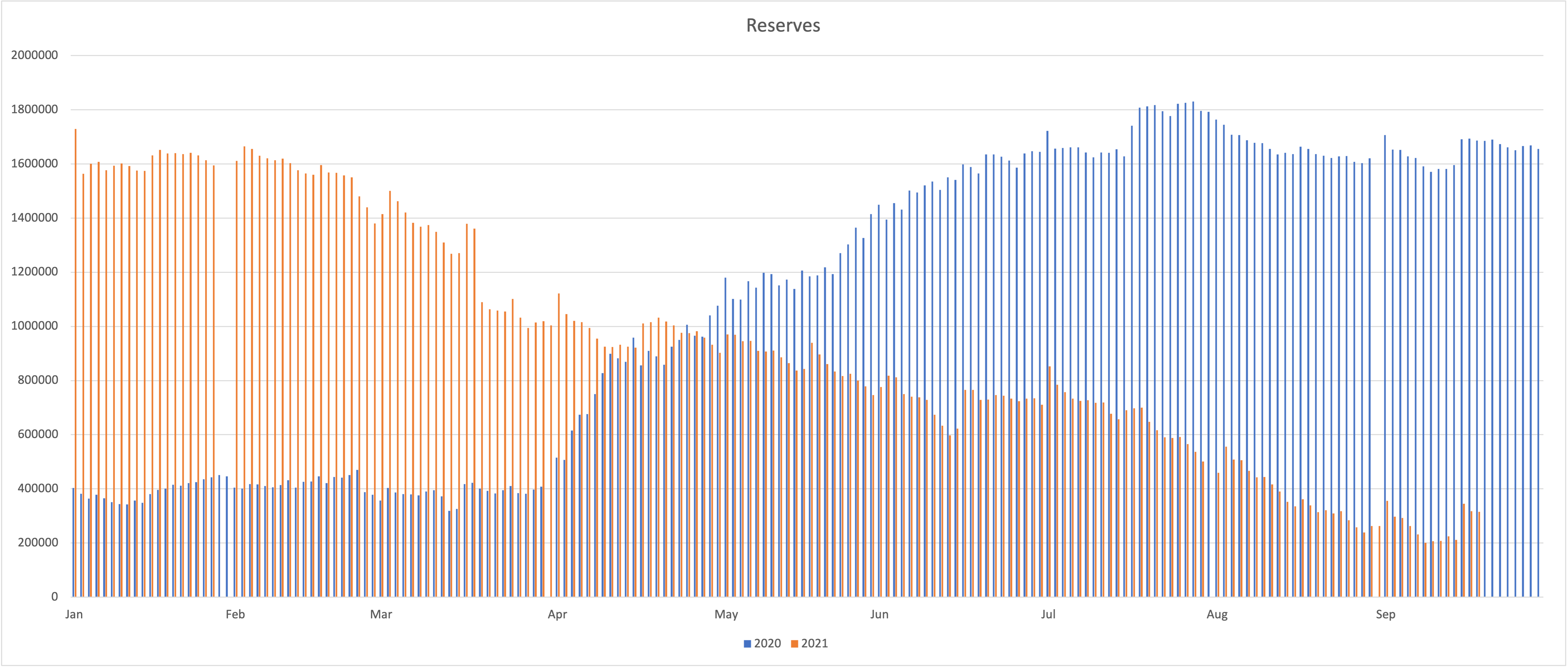

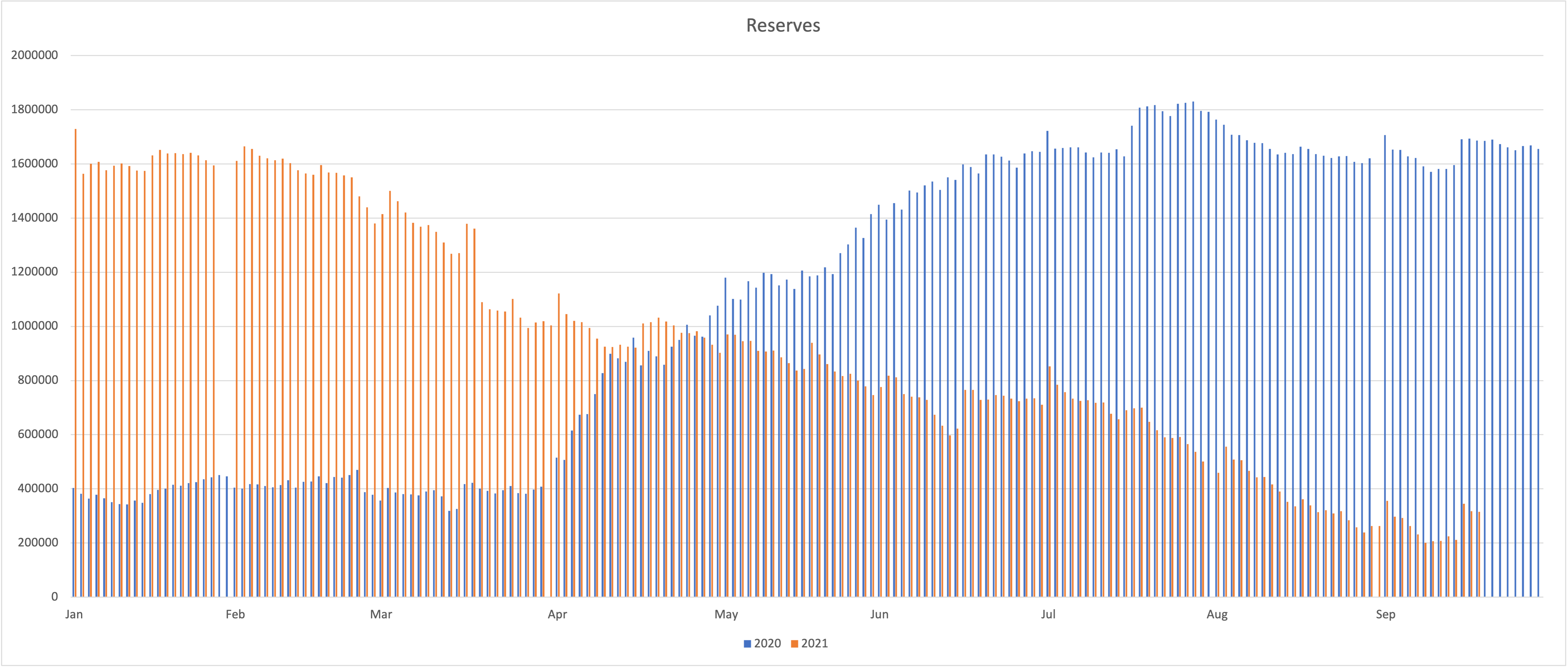

The above graphic is the build-up of the US Treasuries reserves (blue) held at the Fed during 2020 where they peaked at $1.8trln, which US Secretary Mnuchin had built up to pay for the COVID-19 extra expenses. The orange histogram shows how the current Treasury Secretary has had to draw down on the general account and get reserves back to a more normalised level.

These reserves end up mainly on the commercial banks’ balance sheets and here lays reason that the NY Fed has doubled the RRP. The banks are receiving deposits at record levels and reserves which they need Tier-1 collateral to back. The highest form of collateral is the UST’s that the Fed is removing in their QE purchases. The Fed with the RRP swap back the cash held at the bank for the collateral held by the Fed in an overnight transaction, which means the banks meet the required levels of leverage set out in the Supplemental Leverage Ratio (SLR) regulations.

The SLR calculation is Tier1 capital / consolidated assets. Consolidated assets (the denominator) include Treasuries and reserves. The ratio must be 3% or greater. Most banks keep it well above 3% for stress test reasons. As the US treasury drained the TGA in 2021 the denominator in the SLR for the banks increased. Meaning the ratio gets smaller and potentially gets to the 3% threshold or even below. When that happens, the banks must either slow the rate of loan creation, sell liquid assets, or raise capital. The banks hold derivatives like stock options and futures, as well as assets, so it is highly probable that they sold some of their assets over the course of the last few trading days as buyers attempted to buy the dip in equities. Knowing the average retail trader was looking at the 50 ema as well as every asset manager on the planet, was probably too good a liquidity event to miss out on.

This type of market action hasn’t happened for a couple of years because the US debt ceiling was suspended. That all changed in August 2021 when the debt ceiling was reinstated, and the US Treasury was forced to stop selling new debt into the markets. When there wasn’t a debt ceiling to consider, the US Treasury would issue debt, which the banks would buy up, and in doing so this would drain the bank’s reserves and keep them within the SLR. In today’s FOMC press conference Fed Chair Powell said the US should never default on their obligations and liabilities as that would cause almost irreparable damage to the markets, and to an extent that the Fed may be helpless to control.

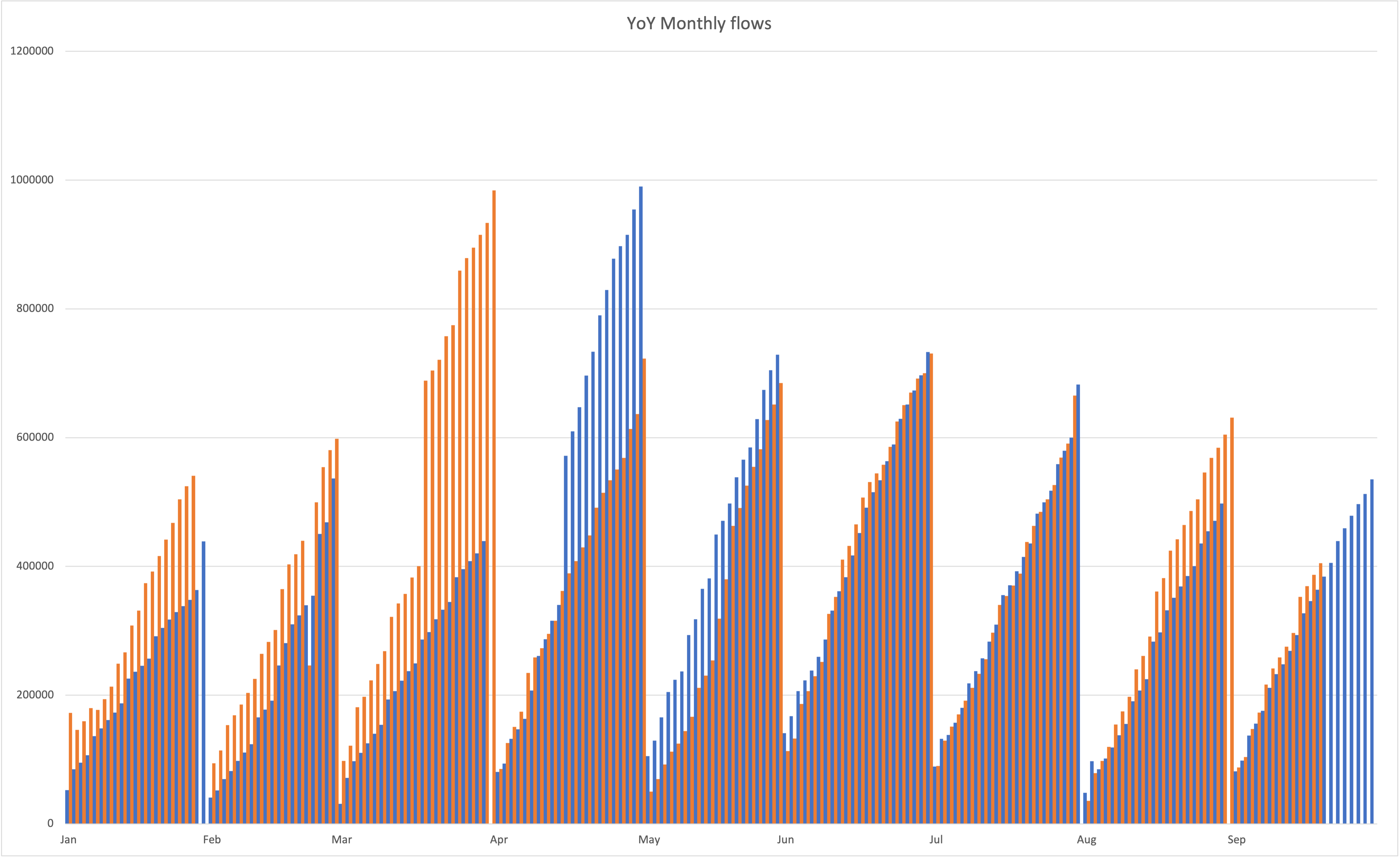

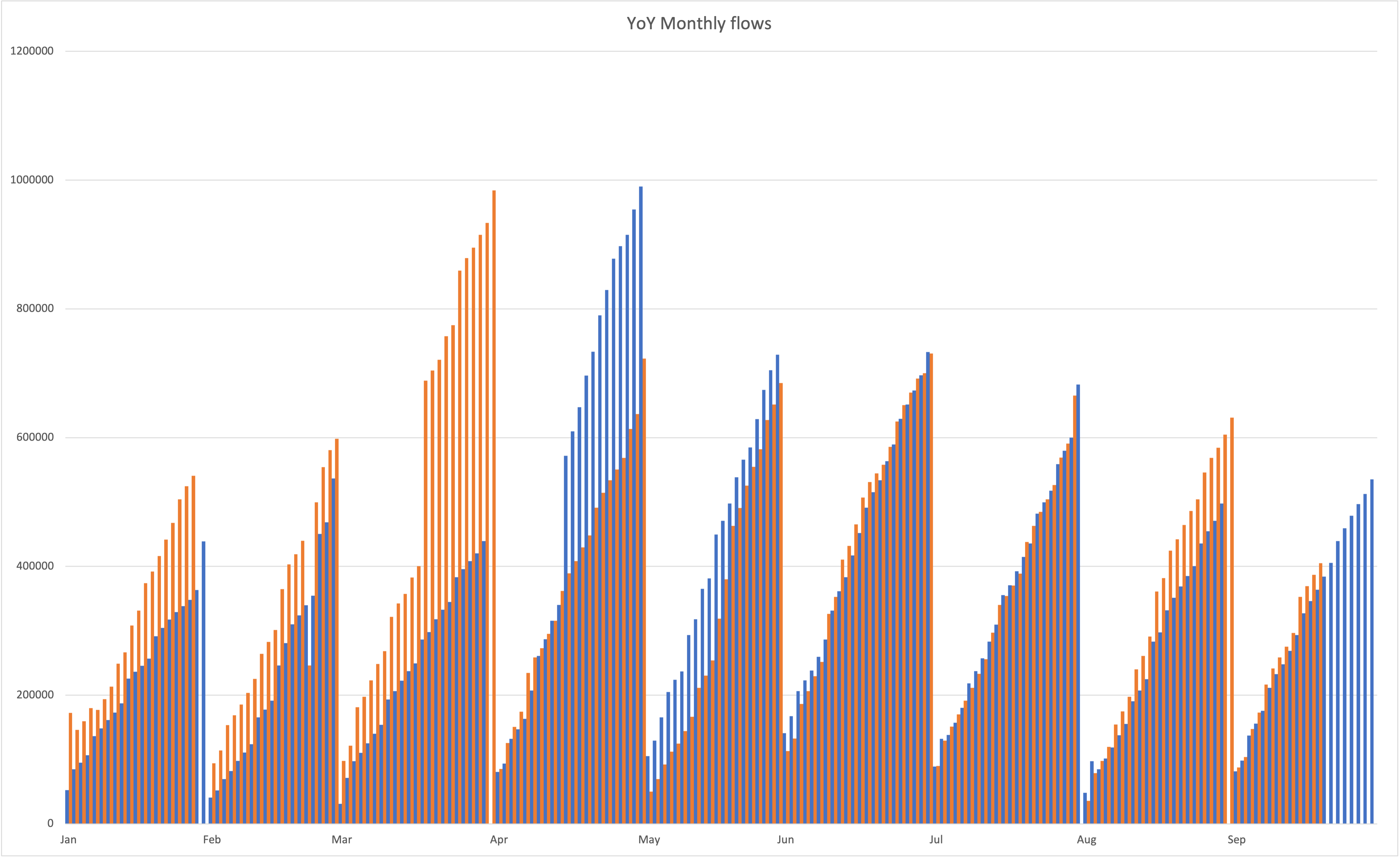

I have been tracking the US government spending and it is a case of the current spending month-on-month reducing from May, which was also the case in 2020. The peaks of each month are getting lower. August YoY was higher than 2020 and when we get to the end of September, we will see whether the flows have diminished further. If they have this could be bad for the markets which will already be expecting the Fed to start removing the free money, QE, and as a lot of commentators like to analogise, are the markets going to cope if they don’t get their fix. Will the taper cause a tantrum?

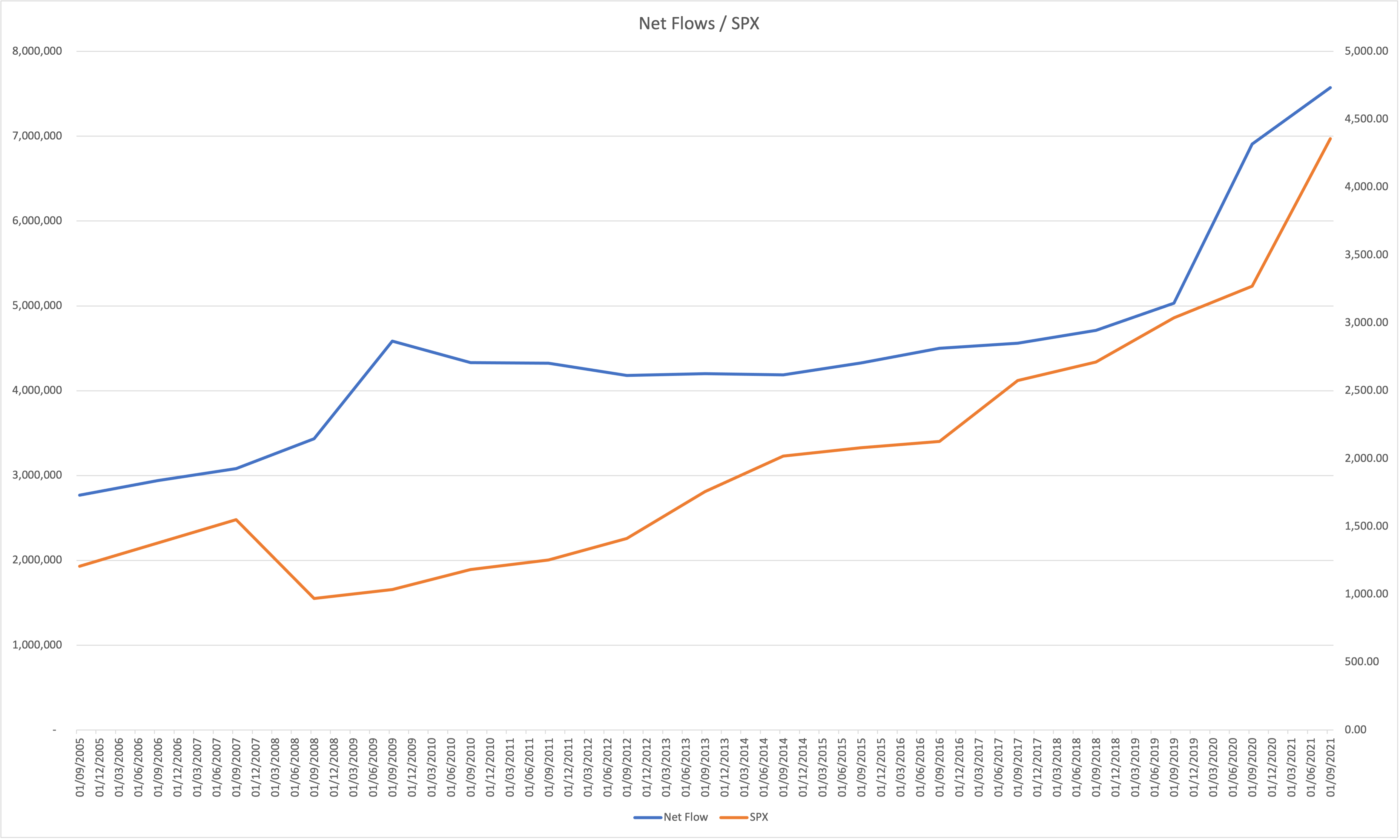

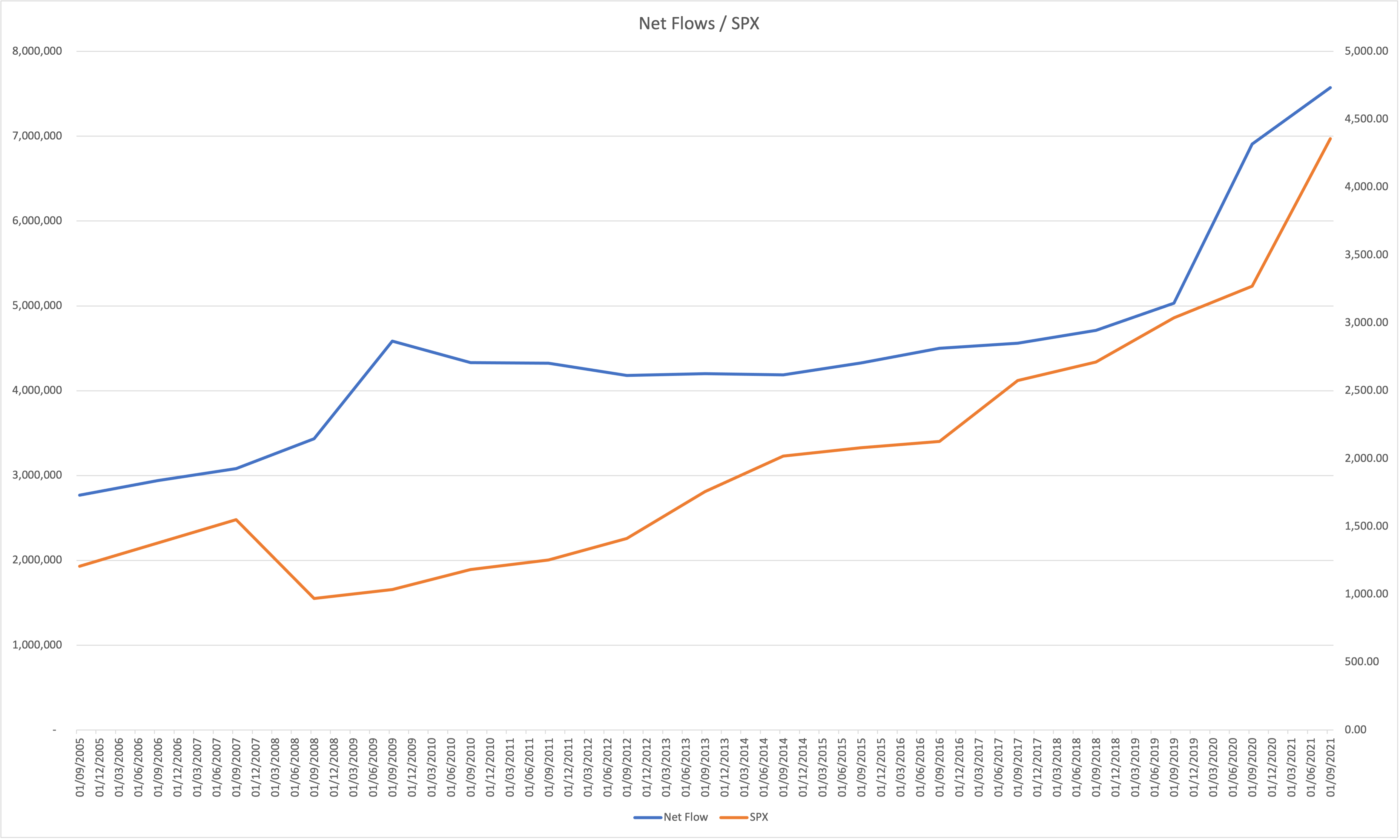

When the US fiscal flows have accelerated higher, this has had the effect of dragging the S&P500 higher. But even a maintained level of flows has been good for the S&P500. Between 2009 and 2014 there were a few times the flows decelerated but maybe because they were over $4trln on a yearly basis that was enough to keep corporates balance sheets healthy. With flows now around $7.5trln annually it’s no wonder the S&P500 is more than double the levels it was at a year ago and much higher than it was in 2005. If the Biden administration can get the $1.2trln & $3.5trln Infrastructure + budget spending bills passed by even half of the total currently proposed, I think the S&P500 will be again higher very soon.

Everyone is focused on what the Fed will do. But they are just a bank regulator who through their asset purchase programme conducts a Monetarism policy that increases the money supply, and who can adjust the interest rates and make goods and services cheaper or more expensive. QE is an asset swap and has no real additional benefits to the GDP of the country and it is proven to be deflationary and a good tool for crushing the short-term rates. The fiscal expenditure was brought to the forefront of the policy when the Fed, ECB etc. couldn’t do any more with the tools they had and required governments to enact fiscal expansionary measures like the CARES act, to solve the COVID-19 crisis. For me, I have switched to watching the fiscal flows as I believe they can give us a heads up of where the S&P500 is going. The mechanics also has a lot to do with credit growth in the banking system but there are so many cogs to that machine it will take more research to get a simple explanation going here.

Based on the Fed not doing anything new tomorrow and the RRP being doubled, I am expecting the market reaction to be bullish this week. What we really need is for the debt ceiling to be suspended until December 2022 as has been proposed. If that fails, I think we are in for that structural decline that the taper tantrum guys will be calling for.

See real-time quotes provided by our partner.

For the bulls, any time I see some market structure form where a significant swing high on the H1 timeframe or above occurs, waiting for a retest and continuation of that level is my go-to strategy now. The same in reverse will be true for the bears should the fiscal flows fall, and the debt ceiling etc. not pass. Waiting for some old support to become resistance would be the level I lean into.