Market Brief

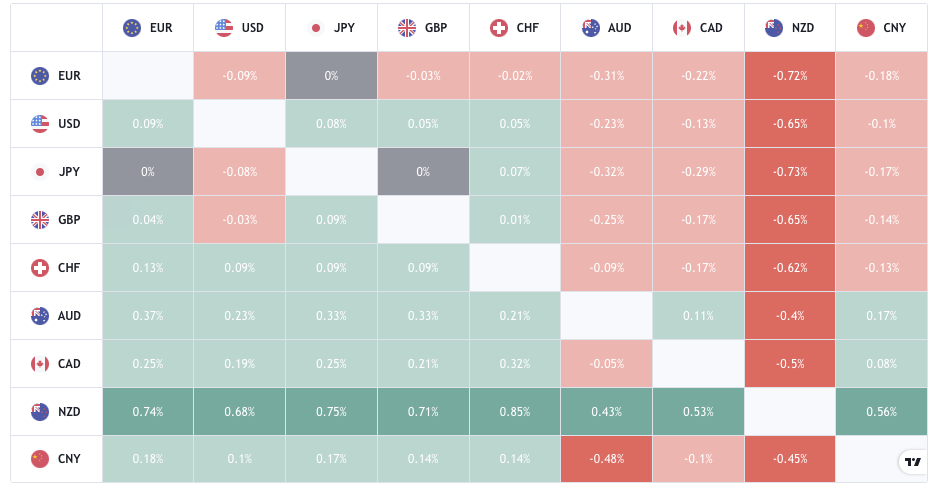

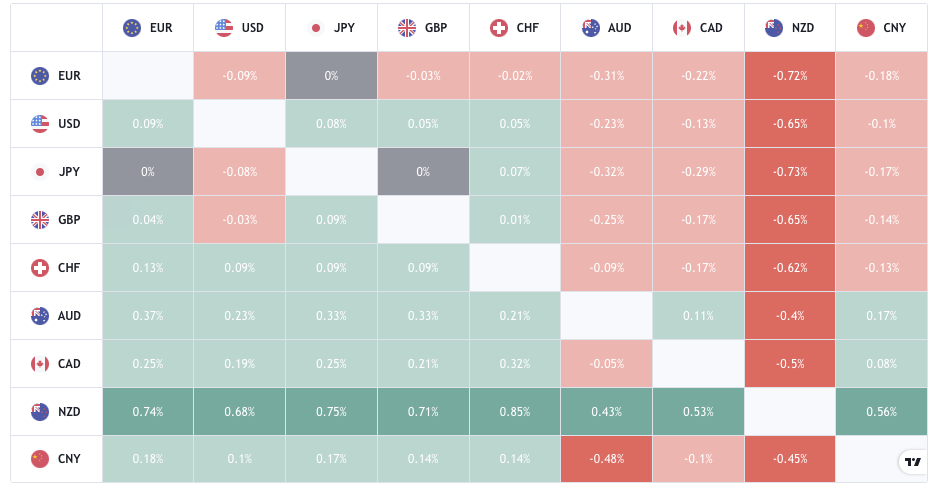

The forex market is nearly evenly split, with the commodity and Risk-On pairs trading more in the green. When we see the CAD, NZD and AUD relatively bullish this is a sign that the speculators are pushing to capitalise on their yields relative to the zero interest and negative interest they would get from other currencies.

See real-time quotes provided by our partner.

New Zealand is currently in lockdown as their COVID-19 positive cases trend higher and looking at a chart, now is not the time to hit the buy button. The NZDUSD has broken down out of a sideways range as traders waited and then were disappointed that the RBNZ didn’t raise the overnight cash rate. The breakdown to 0.6800 was obviously a good but for 100+ pips but now that we’re back to the old support we should consider the possibility that this is just a retest before a continuation lower. For the bulls to really step in, we would need the RBNZ to be more Hawkish, the US dollar to continuing falling and for price action to get back above that sideways range and test from above. Today the RBNZ’s Hawkesby said the central bank had considered raising the OCR by 0.50% at the recent meeting, so when the RBNZ do go, it could be bigger than previously expected.

Today there is no Tier-1 data release, so headlines and momentum are trades to look for. COVID-19, Afghanistan, China, US debt ceiling, and Infrastructure Bill would be market moving should a dramatic headline come out for either of them. So far, we have had some Bank of Japan core CPI y/y data which beat market expectations but was very low, coming in at 0.2% and the German final GDP q/q came in at 1.6% which also beat expectations but only by 0.1%. From the USA today we receive new home sales data and then tonight we get the New Zealand trade data.

Yesterday’s moves in the equity markets are showing that the path of least resistance is to the upside.

See real-time quotes provided by our partner.

The Nasdaq is again at all-time highs and is pushing harder than the rest of the US indices. Currently trading above 15,300 and over 2.0% higher for the week the Nasdaq trader are clearly enjoying buying the dip and now targeting 15,500 and possibly 16,000. The tech industry is up over 1.43% as a whole but the bigger gains are to be found in the Energy Minerals, Consumer Durables and Non-Energy Minerals sectors which are up this last week by 3.64%, 2.23% and 2.10% respectively.

See real-time quotes provided by our partner.

I only follow a few indices and for the last year the only trade you could rely on with hindsight is the buying of the daily 50 exponential average on the S&P500. Whether this trend continues for perpetuity is going to be reliant on the USA coming up with a way to keep spending at current rates or in larger amounts, which will require the debt ceiling to be increased or removed by October 2021. Fiscal spending has meant the US economy is up by almost a trillion dollars this year which filters into the stock markets. So, for now ‘Buy the Dip’ if you get a chance but keep your ear to the ground for the decision regarding the debt ceiling.

See real-time quotes provided by our partner.

The US dollar index may have taken some liquidity above the previous swing high and may come back down to the $90 level but as we have the Jackson Hole symposium this week, there is no way that I am going to trade these thin markets. $94.80 to $94.30 would be a great resistance level to look for shorts at the end of the week should we get there and the floor to this range remains just below the $90 level.

The ActivTrader sentiment indicator for the Brent Crude spot price is showing that an extremely large number of traders are bullish the oil markets. A 92% reading usually gets me looking to be a contrarian trader but it looks like there is still some head room above before we should look for a short.

See real-time quotes provided by our partner.

The breakdown of the rising trendline was quite impulsive when it happened, so stops must have been tripped until we got the climactic sell off around $64 before yesterday’s dead cat bounce. Whether lots of traders are trapped short now I cannot tell, but a lot of this will have to do with the balance of news around COVID-19 and global demand plus the fate of the US dollar. Don’t diddle in the middle is my advice, trade the extremes.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |