Sentiment towards a number of key trading instruments is seeing big changes after the recent move to risk-off, which saw the US dollar index recovering higher and global stock markets coming under pressure. Now is a great time to check out how traders feel about US dollar crosses from a sentiment perspective.

Trading sentiment is most effective when retail traders are running counter trend, meaning that they are heavily leaning against established market trends and in increasingly large numbers. Additionally, once big sentiment skews build it can be a powerful sign that the retail crowd are being too one-sided.

Typically, market sentiment readings for an instrument that has reached around 75 to 80 percent is considered to be at an extreme level, while market sentiment readings over 80 to 95 percent is often a strong indication that the trade could be topping or about to reverse at any time.

I will now look at some the strongest sentiment bias amongst the retail crowd right now. Some of the sentiment skews suggest that current price trends in FX, stocks, and precious metals are breaking point and big moves may be nearing.

USDJPY- Risk Proxy

According to the ActivTrader Market Sentiment tool traders remain extremely bearish towards the USDJPY pair, despite this week’s rally back above the 1114.00 level, marking a return to Yen strength.

The ActivTrader Market Sentiment tool shows that 78 percent of traders are expecting more losses in the GBPUSD. This large positive sentiment bias could be hinting that more pain for bears is coming.

Traders are negative towards the USDJPY pair could be betting that extreme risk-off is coming. In such circumstances, the US dollar is king, and the USDJPY pair tends to fall alongside the Nikkei225.

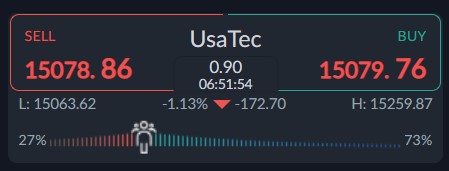

USATec – Wrong Sided

The ActivTrader market sentiment tool shows that 27 percent of traders are bearish towards the NASDAQ, even though tech stocks, and indeed meme stocks, have been getting crushed so far this year.

Traders are clearly betting that downmove in stocks is overextended, and that eventually stocks are going to recover higher, as they have been doing so since QE was announced to fight the COVID-19 pandemic.

In order for the bulls to be right here, we probably need to see a ratcheting down of tension in Ukraine and Omicron fears.

EURUSD – Strangely Neutral

Market sentiment towards the EURUSD pair, despite the fact that the euro has fallen by nearly than 200 points from its recent multi-month high over the last few days.

The ActivTrader market sentiment tool showing that some 48 percent of traders currently bullish towards the EURUSD pair, despite the recent and sharp corrective move to the downside from the 1.1482 level.

Neutral sentiment is consistent with sideways trading. This is the opposite of the EURUSD lately, that has a weekly Average True Range of around 150 points.