Sentiment towards the USD currency is changing ahead of a number of key events on the economic calendar this week, such as the US CPI report. Now is a great time to check out some of the most extreme sentiment traders looking for contrarian trading signals via sentiment readings.

Trading sentiment is most effective when retail traders are running counter trend, meaning that they are heavily leaning against established market trends and in increasingly large numbers. Additionally, once big sentiment skews are built it can be a powerful sign that the retail crowd is being too one-sided.

Typically, market sentiment readings for an instrument that has reached around 75 to 80 percent is considered to be at an extreme level, while market sentiment readings over 80 to 95 percent is often a strong indication that the trade could be topping or about to reverse at any time.

I will now look at the strongest sentiment biases amongst the retail crowd right now. Some of the sentiment skews suggest that current price trends in FX, stocks, and precious metals are breaking point and big moves may be nearing.

EURUSD – Bullish sign

According to the ActivTrader Market Sentiment tool we are seeing sentiment remaining extremely bearish towards the EURUSD, which could allude to price gains in the short-term.

The ActivTrader Market Sentiment tool shows that 65 percent of traders are expecting more downside in the euro against the US dollar right now. This reading is in line with the previous trading week.

It should be noted that sentiment is currently in the extreme phase and retail is strangely on the right-hand side of the trade. Sentiment is very crucial for the price of the EURUSD as we typically look to fade extreme sentiment biases.

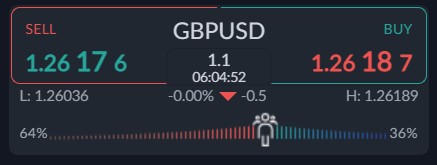

GBPUSD – Still A Buy

The ActivTrader market sentiment tool shows that 36 percent of traders are bullish towards the GBPUSD pair right now as it continues to break to fresh yearly and multi-month highs.

The negative sentiment bias is bas for dip buyers right now, as it certainly alludes to more upside trading eventually, however, it is important to state that the GBPUSD pair is close to breaking from its long-term bear trend technically.

I think we are about to see more gains in the GBPUSD in the near-term, however, the US CPI report may decide the overall fate of the GBPUSD pair this week.

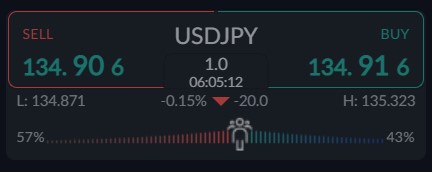

USDJPY – One Way

Market sentiment towards the USDJPY pair is rising, which is a bad sign for bulls in the short-term, especially since the USDJPY is currently retreating.

The ActivTrader market sentiment tool showing that just 43 percent of traders currently bullish towards the widely traded USDJPY pair. Sentiment was overly bullish at the start of the month.

I think it is worth noting that the more traders turn bullish or bearish then we should expect the opposite price effect to happen.