Sentiment towards a number commodity-related currencies is changing fast after the recent Non-farm payrolls jobs. Now is a great time to check out some of the most extreme sentiment traders look for contrarian trading signals via sentiment readings.

Trading sentiment is most effective when retail traders are running counter trend, meaning that they are heavily leaning against established market trends and in increasingly large numbers. Additionally, once big sentiment skews build it can be a powerful sign that the retail crowd are being too one-sided.

Typically, market sentiment readings for an instrument that has reached around 75 to 80 percent is considered to be at an extreme level, while market sentiment readings over 80 to 95 percent is often a strong indication that the trade could be topping or about to reverse at any time.

I will now look at some the strongest sentiment bias amongst the retail crowd right now. Some of the sentiment skews suggest that current price trends in FX, stocks, and precious metals are breaking point and big moves may be nearing.

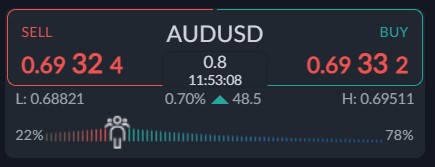

AUDUSD – Bull Bias

According to the ActivTrader Market Sentiment tool continues to show that a strong bull bias has formed for the AUDUSD pair after the recent RBA interest rate hike.

The ActivTrader Market Sentiment tool shows that only 22 percent of traders are expecting more downside in the world’s reserve currency The sentiment has picked up from the previous trading week.

It should be noted that sentiment is very crucial for the AUDUSD and its related pairs as we typically look at it for risk-on sentiment bias.

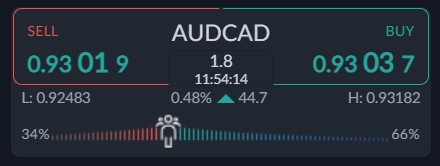

AUDCAD – Strong sentiment

The ActivTrader market sentiment tool shows that only 34 percent of traders are bearish towards the AUDCAD pair as it starts to build upside traction above the 0.9300 level.

The sentiment bias certainly alludes to more upside trading, however, it is important to state that sentiment is reaching extreme levels and an unwinding may soon happen

I think we also have to consider that the AUDCAD pair is an Australian dollar risk-on currency and sentiment is very important for this currency pair to gauge the strength of the AUD crosses intraday.

NZDUSD – Slightly bullish

Market sentiment towards the NZDUSD pair is slightly bullish, due to the fact that a significant correction has taken place and buyers may start to dip their toes into the water.

The ActivTrader market sentiment tool showing that only 56 percent of traders currently bullish towards the NZDUSD right now, which is not a clear signal for a continuation of more upside.

I think it is worth noting that sentiment is not overstretched for the NZDUSD, and we should also consider this when trading the pair it has come too far too fast and a correction could be coming.