Sentiment towards a number of key trading instruments are starting to change ahead of next week’s big Federal Reserve policy decision, where the US central bank is widely tipped to taper its QE program.

Trading sentiment is most effective when retail traders are running counter trend, meaning that they are heavily leaning against established market trends and in increasingly large numbers. Additionally, once big sentiment skews build it can be a powerful sign that the retail crowd are being too one-sided.

Typically, market sentiment readings for an instrument that has reached around 75 to 80 percent is considered to be at an extreme level, while market sentiment readings over 80 to 95 percent is often a strong indication that the trade could be topping or about to reverse at any time.

With that said, I will now look at some the strongest sentiment trades amongst the retail crowd right now, ahead of today’s hugely important and market impacting rate decision from the US economy next week.

US Dollar Index – Sell Signal

According to the ActivTrader Market Sentiment tool traders are starting to become extremely bullish towards the US dollar index ahead of next week’s rate decision. This is a warning sign of a potential greenback squeeze coming.

The ActivTrader Market Sentiment tool shows that 90 percent of traders are expecting more US dollar gains. The huge sentiment skew is a big red flag that the buck could be sold-off ahead of next week’s main event.

Watch out for a big U-turn in the US dollar if weakness under the 93.70 level takes hold. Key pairs to watch are the EURUSD and GBPUSD, as these are great proxies for sentiment towards the greenback.

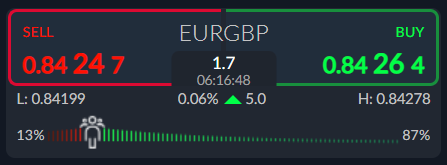

EURGBP – Bulls Fighting Fundamentals

The ActivTrades market sentiment tool shows that traders are 807percent bullish despite the EURGBP pair losing all of its former monthly gains and slumping back towards the 0.8400 support level.

Traders are clearly in a state of disbelief that the EURGBP pair being under selling pressure. We should also consider that they are also fighting the fundamentals, as the Bank of England are tipped to hike rates next week..

While we see sentiment this bullish I feel confident that more heavy losses in the EURGBP are coming, with a break under the 0.8400 level likely to trigger the next big down move in this pair.

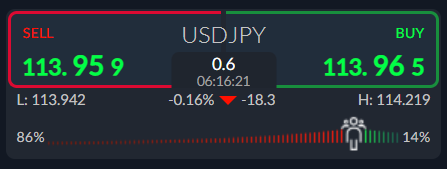

USDJPY – One To Watch

Market sentiment towards the USDJPY pair is ultra-bearish at the moment, which is unusual considering that stocks are rallying, and the pair is struggling to find sellers under the 114.00 support level.

The ActivTrades market sentiment tool showing that some 86 percent of traders currently bearish towards the USDJPY pair, despite its overall inability to sell-off and strong dip-buying interest towards its.

With market sentiment so bearish towards the USDJPY pair, and the fundamentals in favour of Japanese yen cross carry trades, this could be a great trade for trend traders, and entering into USDJPY pullbacks.