Sentiment towards a number of key trading instruments is starting to shift amongst the retail crowd following the outcome of the FOMC meeting. When one-way trading basis form it often helps give sentiment traders an informed opinion about the directional basis of non-professional traders.

Therefore, the ActivTrader market sentiment tool is so effective as it provides a real-time snapshot of exactly how the average retail traders are positioned. The trading sentiment is most effective when retail traders are running countertrend, meaning that they are heavily leaning against established market trends and in increasingly large numbers.

Typically, market sentiment readings for an instrument that has reached around 75 to 80 percent is considered to be at an extreme level, while market sentiment readings over 80 to 95 percent are often a strong indication that the trade could be peaking, and about to reverse at any time.

Neutral reading typically indicates indecision or point to more range-bound conditions, while sudden shifts in sentiment can potentially mark trend reversals. With that said, I will now look at some of the strongest sentiment trades amongst the retail crowd right now.

CAC40- Correction Warning

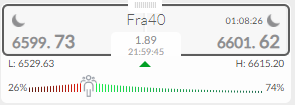

According to the ActivTrader Market Sentiment tool, some 74 percent of traders are currently bullish towards the CAC40 index, despite fears over the Delta variant the threat of new lockdowns in France.

Given that the CAC40 has been struggling to make new highs and stocks are primed for a correction as long as COVID-19 fears linger as we approach the autumn months, bulls need to be careful.

The growing sentiment skew suggests that the leading French index could be due to even more of a downside correction. If bullish sentiment grows and the CAC40 continues to grow I suspect we could see a downside move of between 100 to 300 points.

EURGBP – Long Squeeze

The ActivTrades market sentiment tool shows that traders are worryingly bullish towards the EURGBP pair at the moment, with 93 percent of traders expecting further gains despite the near 200-point plunge in the pair over the last few weeks.

EURGBP has been moving towards breaking into a much lower price range between the 0.8500 to 0.8300 levels, as traders continue to sell into rallies. It is puzzling why traders are so bullish towards this pair.

The overall trend is bearish, not just the short-term trend, this is highly likely to remain the case while the pair is capped under the 0.8680 mark. Overall, beware running counter trend to this pair.

VIX– Short Mistake

Market sentiment towards the VIX is massively one-sided right now, with the ActivTrader Market sentiment tool showing that some 99 percent of traders are bearish towards rising volatility in the market.

It should be noted that volatility has been spiking through earnings seasons and it looks set to increase as COVID-19 fears increase and asset managers and traders start to deploy side-lined capital.

Such a large one-way trading skew rarely ends way, and such is the size of the sentiment bias that a massive, short squeeze could take hold at any moment if market volatility starts to pick-up this summer.