GDX Weekly Investment Idea

Investing in commodity prices as they rise is a really tricky game of musical chairs. The demand versus supply dynamic can pivot ever so quickly as we saw in Lumber futures over the last few months. Reflation trades, infrastructure bills, fiscal stimulus and supply chain disruptions all have an impact on the price of the commodity. If the commodity is grown rather than made in a factory the weather is also a massive factor in the future prices, so an investor always has to have a holistic view of what is happening across the globe currently and with seasonality in mind too. The great thing about the rise in commodity prices is that miners and producers can start to justify expanding their business, rather than making marginal corrections or create efficiencies to cut prices of producing the raw material. Spending money on exploration, discovery and development are all viable when the price of what you are mining is going up.

The supply shock in commodities like copper is largely down to the metal’s prices being suppressed and miners just not looking for new resources to meet the demand that we are seeing today. The demand is coming from not just the traditional infrastructure developments but from new technologies that are needed to combat climate change and to protect the environment. But with these new highs in commodities, miners will go out and look for new future resources that they can develop and as the product comes to market there will become a moment where the supply tips the scales, and we have a glut.

See real-time quotes provided by our partner.

Gold is always in demand but for different reasons. Obviously, when the banks needed it to back a currency there was an additional demand placed on the yellow metal and since the US came off the gold standard the prices in gold have not gone up exponentially but, on an inflation-adjusted basis, the price of gold is higher today than for most of its recorded history and nearly as high as the 1980’s peak, as the purchasing power of fiat money is crushed towards zero.

Gold miners range from being a couple of people out in the middle of the Australian hinterland with a pick and shovel to some massive conglomerates who mine anything and everything. A junior mining company is typically small in size, at the exploration and development stage and has a market cap of less than <$500 million. Mid-tier miners are doing well on some proven ground and making annual revenue above $50 million to $500 million but have a market cap of < $1 billion. The difference in risk profile between these two is massive, as one is a real punt on whether they can get going and the other is going with the added potential for extras. When we get into the major mining companies, these companies are making annual revenue above $500 million and have a market cap greater than $1 billion and more than likely have diversified into many areas to reduce any volatility in the markets that they are involved in with. They become household names like Glencore, BHP, Rio Tinto and AngloAmerican.

See real-time quotes provided by our partner.

See real-time quotes provided by our partner.

The world’s largest gold mining company is Barrick Gold, and they have their HQ in the USD, but China is the largest producer, with Russia and Australia coming in 2nd and 3rd place respectively.

Investing in gold over the last 12 years may have been a bit of war of attrition with patience the key to long term riches. In 2008 at the height of the market crash around Lehman Brothers collapse gold found support at $700 and then pushed higher towards $1950. Quantitative Easing was supposed to bring in hyperinflation, but the hindsight analysis is that it did the opposite, and it took a while for economists to get their heads around why trillions of new fiat dollars were not creating the assumed Zimbabwe or Weimar Republic outcomes.

Currently gold has another narrative to deal with and that is the new supposed store of value that it has compared to the new kid on the block – cryptocurrency. Bitcoin has been put out there as being a new store of wealth, and one to replace physical gold as it is of limited supply and is easy to move around the world, with little cost in terms of delivering bitcoin or keeping bitcoin. Unlike gold which is hard to move around and has to be kept in a fortress at a high cost.

Gold miners though are benefitting from the renewed interest in the yellow metal and the prices that they see gold being sold for are much higher than the costs of production, so they are able to put more money into finding more resources.

See real-time quotes provided by our partner.

One way to invest in gold miners is to trade an Exchange-Traded Fund (ETF). You also get a benefit from having a basket of companies under one ticker, so you do not have to put all of your eggs in one basket. ETF’s are generally cheaper too, as they offer low expense ratios and fewer commissions than if you were to buy all of the stocks individually. On the ActivTrader platform, the GDX is the best ETF that is precious metals focused. The fund’s description is as follows:

The VanEck Vectors Gold Miners UCITS ETF invests in equity securities issued by global producers of gold and silver with a high market capitalisation and trading liquidity.

- Direct access to a broad selection of the world’s leading gold and silver miners

- Historically low level of correlation with traditional asset classes

For long term tax-efficient investing this type of ETF is great, as you have exposure to precious metals and can beat inflation, whilst having a tax-efficient investment if you place it in your Individual Savings Account (ISA).

See real-time quotes provided by our partner.

The GDX ETF has 52 holdings and withing that are some of the big names in mining, these include, Newmont Corp, Barrick Gold Corp & Franco-Nevada Corp. In safe jurisdictions like Canada, United States and Australia. The overall composition of the ETF is that it holds 80.2% in large-cap major mining companies with 19.2% in mid-tier miners. The ETF itself has a weighted average market cap of $23.3 billion and p/e of 19.18 over the last 12 months.

See real-time quotes provided by our partner.

The weekly gold chart shows a clear breakout of the downtrend channel and analysts are expecting gold to rise up to test the $2k and maybe $2,025 rather than for a new correction to test recent swing lows formed around February 2021. Similarly, the GDX chart shows a breakout of the downtrend channel so $47 could be a great target to the upside for the ETF buyers.

Support for the GDX prices looks likely to be at the weekly 20/50 ema’s and previous market structure or if we correct over time at some point the rising 200 ema would be a great place to consider adding to a position. The weekly RSI indicators on both gold and GDX are nowhere near showing overbought/sold conditions, so the bullish momentum could have a way to go before investors start looking to take profits.

See real-time quotes provided by our partner.

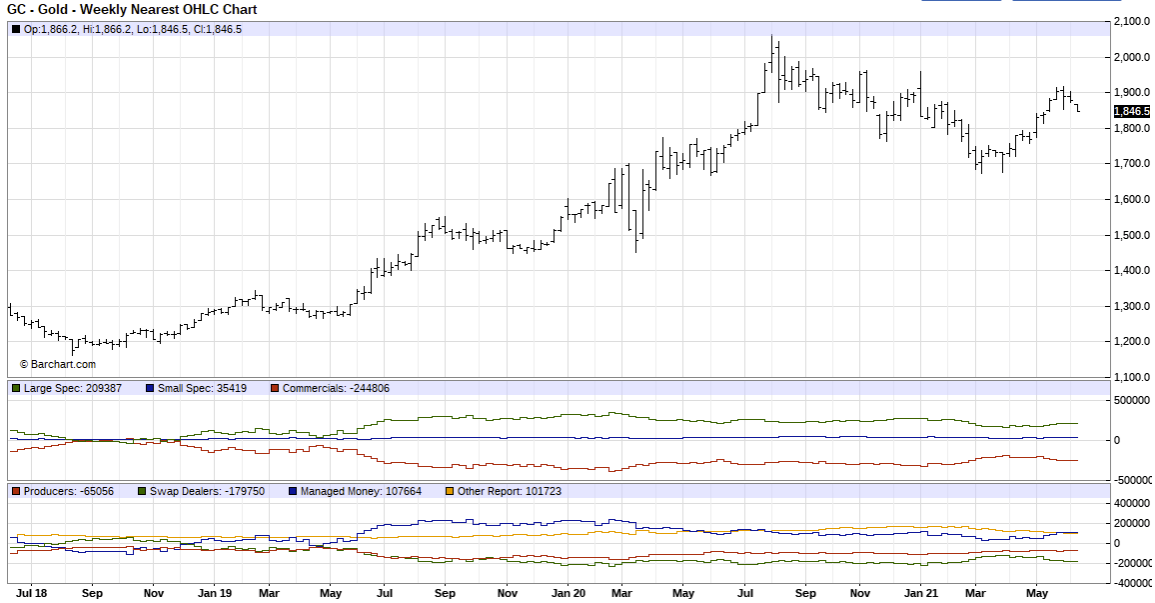

Up until the recent dip in prices, the large speculators as reported by the commitment of trader’s data were increasing their longs, but the last few weeks has seen them ease off from adding to the position. Producers are also flat which to me suggests that the range is $1800/oz-$1900/oz until the US dollar breaks lower or higher out of its most recent trading range. For that to happen we may have to wait for fed policy to change or for inflation to run a lot hotter for longer.

Looking to buy the dip in both gold and GDX is definitely the play in these current market conditions and while the weekly price action is making higher highs and higher lows, the only thing to really concentrate on is the risk and where to place your stop loss. While the momentum is to the upside and the 20,50 and 200 period moving averages are stacked on top of each other, trailing a stop loss under the swing lows is probably the best way to capture these trends as they unfold whilst limiting the risk to the downside.