Weekly Commodity Analysis

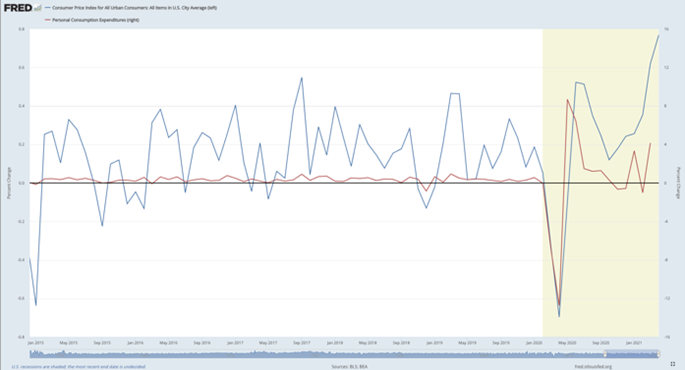

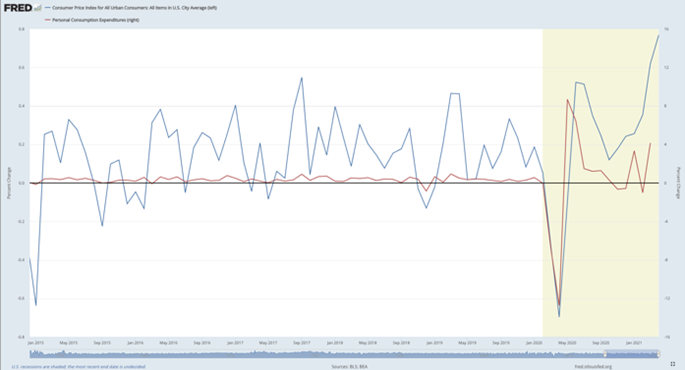

Inflation has superseded the global pandemic as the primary risk affecting every corner of the globe. The Federal Reserve insists that the inflationary pressures are transient, not pervasive, though the CPI / PCE data shows that CPI has jumped month-on-month at the fastest rate in several years.

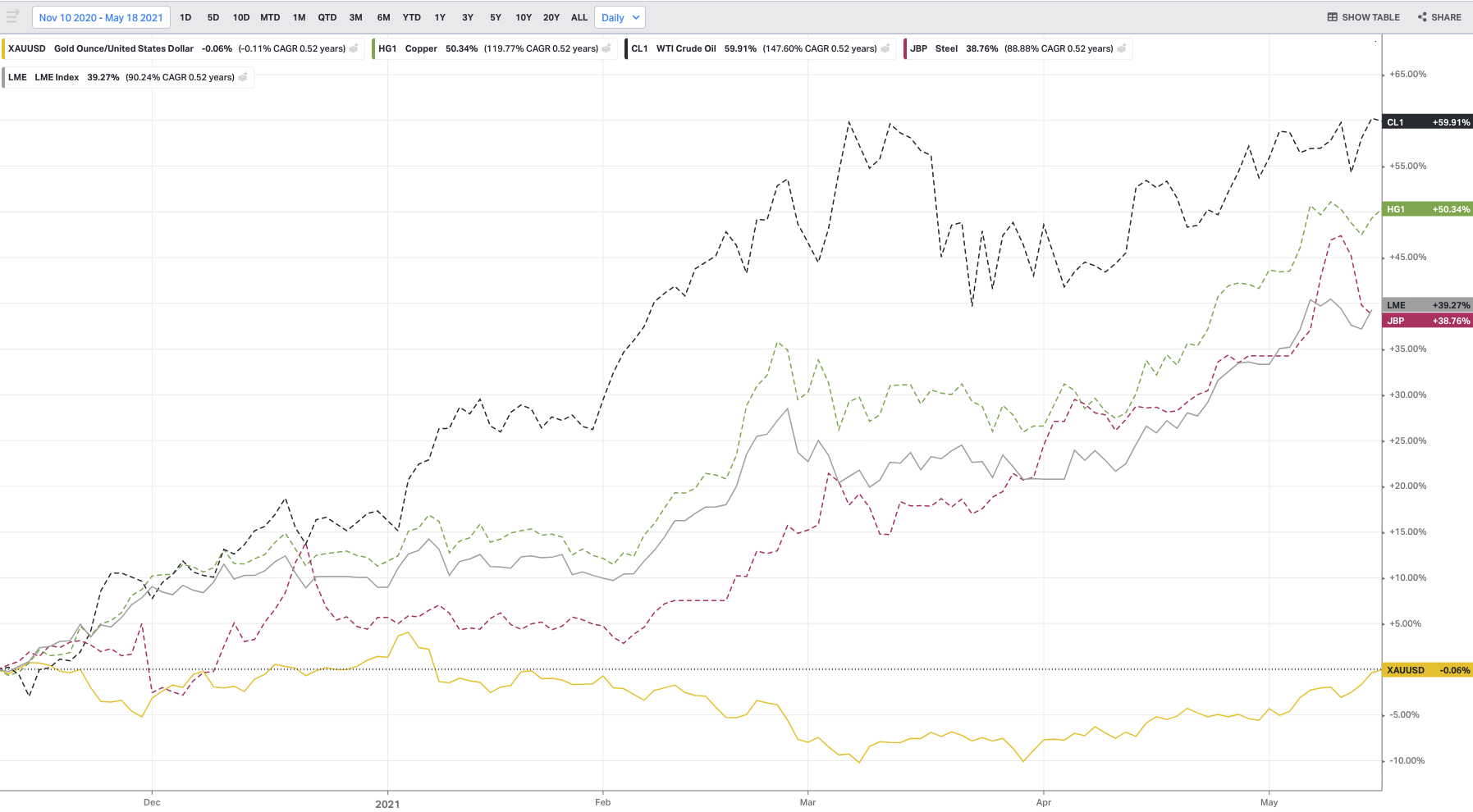

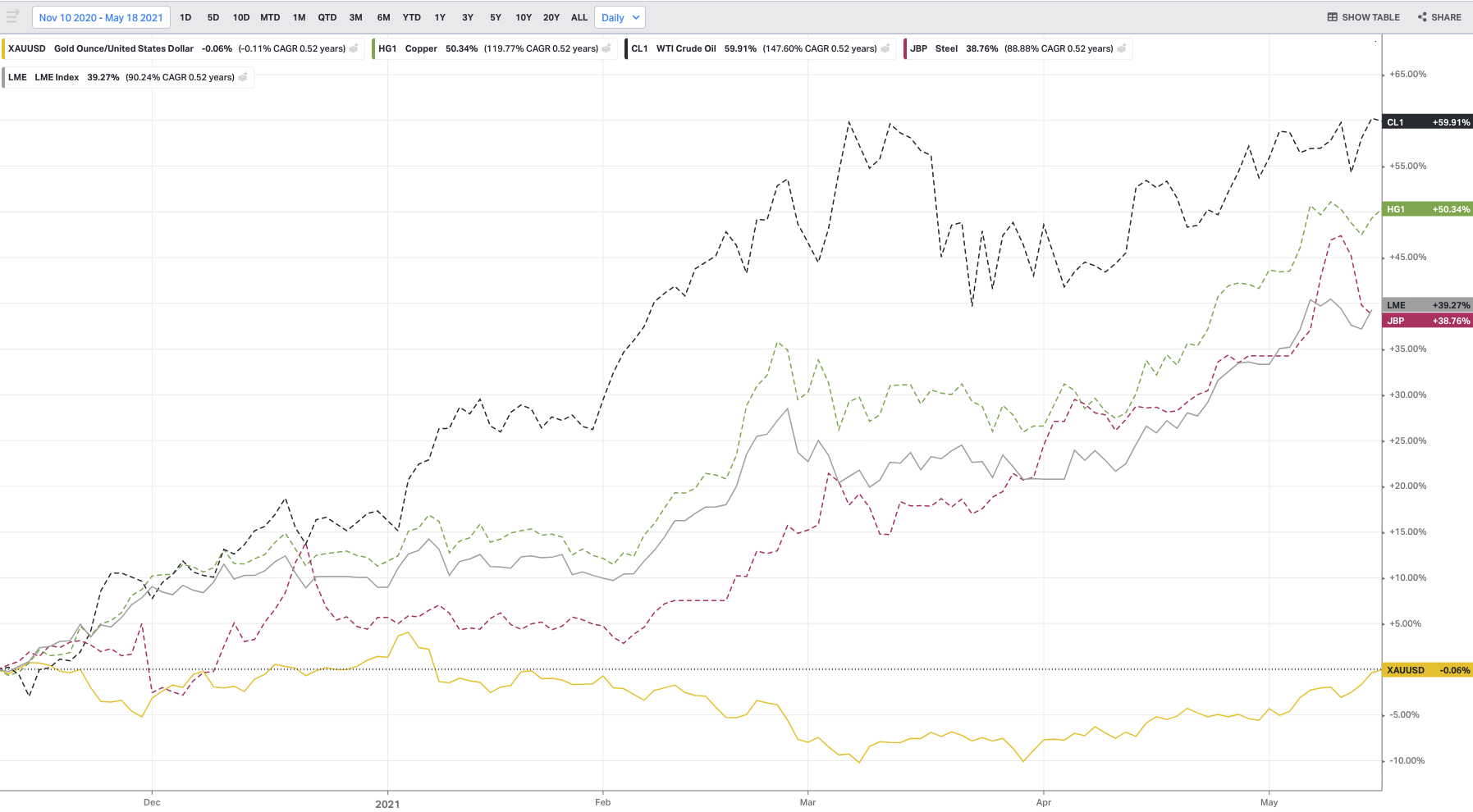

Commodity prices have run up to all-time highs as bottlenecks in supply chains create an imbalance to increasing demand on a year-on-year basis, but we have also seen a massive rise in inflationary pressures from the price of energy, particularly through the price of oil. But to the frustration of the retail investor the price of gold has failed to go parabolic.

The largest economies are looking to spend big on infrastructure, and technologies are pushing towards a global target of net-zero carbon emissions over the next few decades. Gold’s usage within safety-critical technologies and components, fuel cell technology and carbon capture industries are pushing the physical demand at an increased pace with the current industrial/technology markets equating to approximately 7% of total demand.

In the long term, gold serves as a strong strategic component in many portfolios, not only for its diversification benefits but also for its returns. As a store of wealth, protection against diminishing US dollar purchasing power and as a very liquid Tier 1 asset, pension funds and institutional money managers tend to allocate 5%-10% of the portfolio to the precious metal.

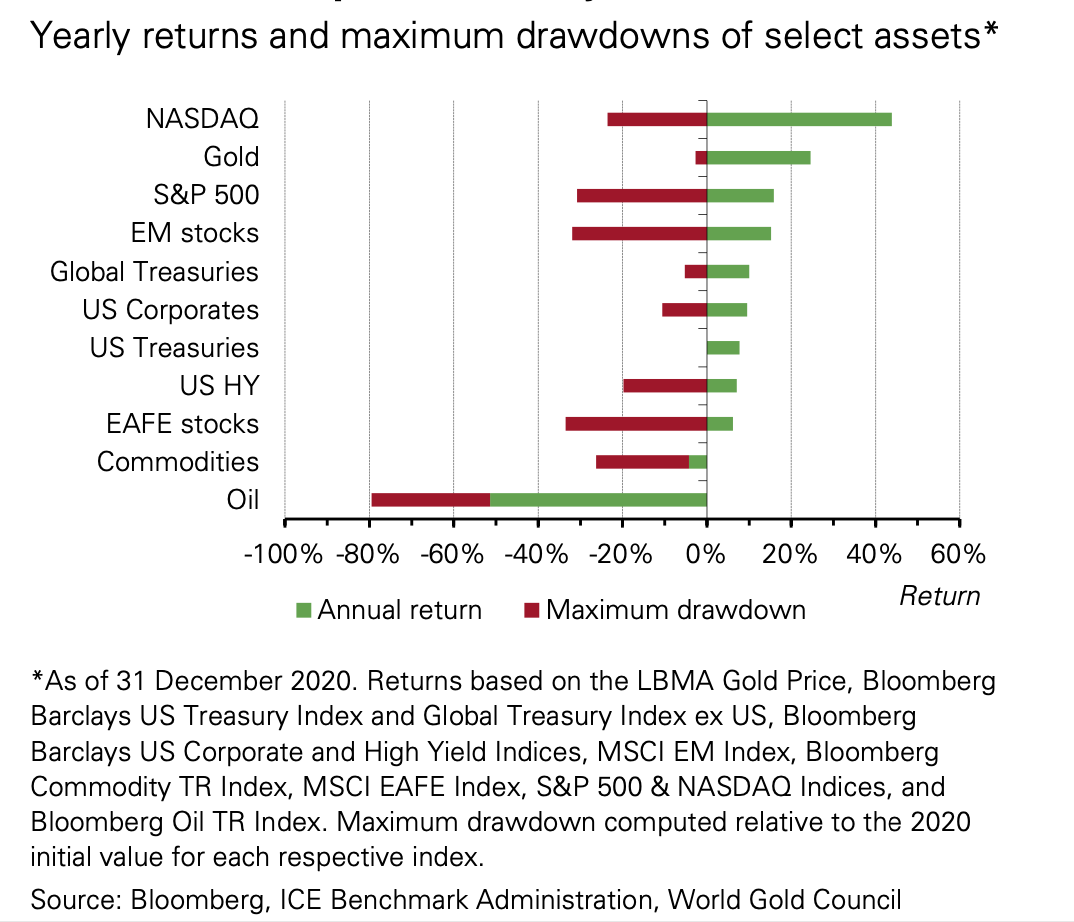

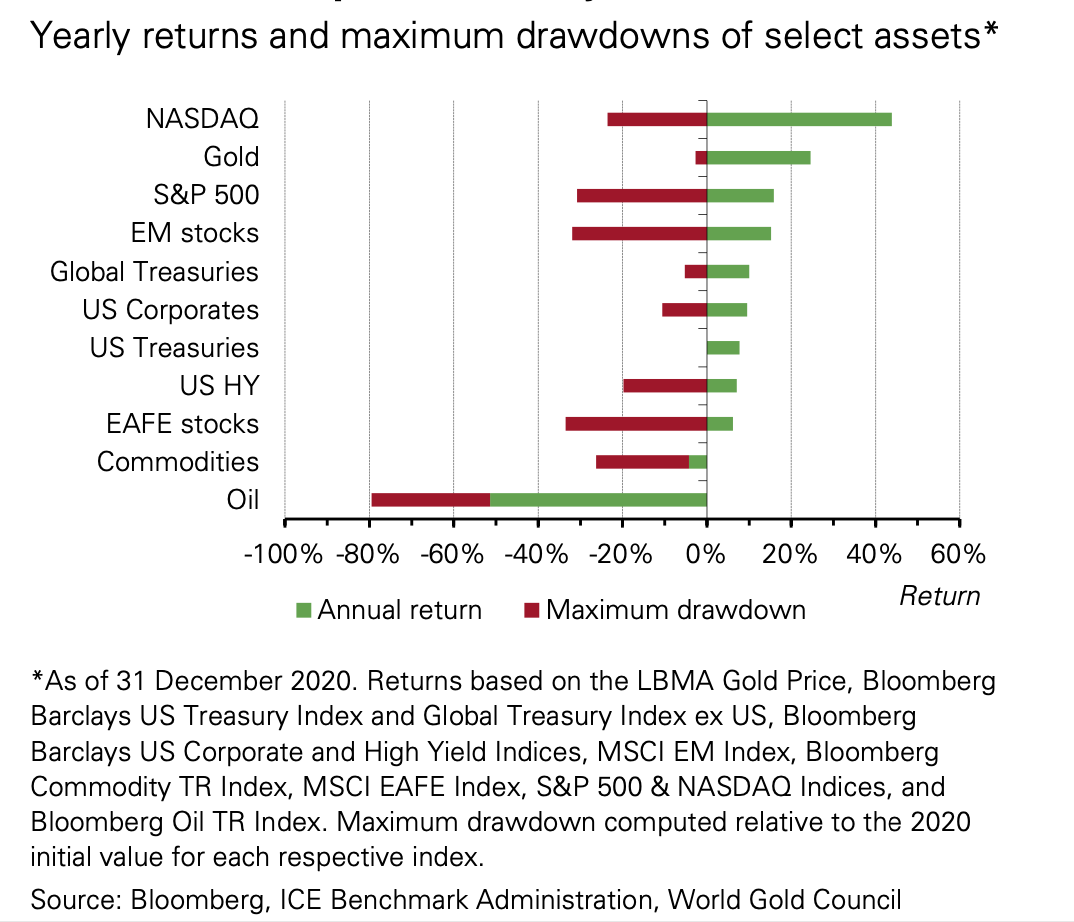

Consumer demand driven by the Indian and Chinese markets is a large proponent of gold jewellery, and the Jewellery markets equate to 34% of the total gold demand. As the overall economic outlook and Risk-On markets do well, these consumers purchase more gold. When times are uncertain, as we witnessed in 2020 during the peak of the COVID-19 pandemic, the consumers reduce their purchases of jewellery, but the institutions step into the market to de-risk their portfolio, as Gold is a safe haven portfolio hedge, which decreases the price volatility during the uncertain times.

The New Regulatory Framework

Gold is a High-Quality Liquid Assets and as of 2019, the Bank of International Settlements (BIS) reclassified physical gold as a Tier 1 asset. Gold was previously viewed as a risky asset, classified as a Tier 3 asset, which meant that gold could only be carried on banks’ balance sheet at 50% of the market value for reserve purposes. Since the Great Financial Crash, a lot has been done within the banking system to try and protect the broader economy from banks blowing up, as Lehman Brothers did.

As part of the regulatory framework, banks have been working under Basel 111 rules and the time is coming for some of the rules to be enforced on the gold markets.

These new regulations are scheduled to be introduced for European banks at the end of June 2021 and in the UK from 1 January 2022, affecting all London Bullion Market Association (LBMA) member banks. The risks to the bullion banks are that they trade in an OTC derivatives market, not holding much, if any, allocated gold. Allocated gold is when an investor is allocated gold and is the outright owner of a certain amount of physical bullion.

There will be a requirement for banks holdings to meet a ratio limit between tangible assets and unallocated assets. The ratio is named Required Stable Funding and the crux of the matter is that if the bullion banks can no longer trade their paper and unallocated gold without holding physical allocated assets, the derivatives market could collapse. The 3 parts of the Basel 111 regulations that affect the paper gold markets are:

- The Available Stable Funding factor (ASF) is applied to the sources of a bank’s funding on the liability side of its balance sheet. Depending on the liability (shareholders’ equity, customer deposits, interbank loans etc.) they are multiplied by a factor, from 100% for the most stable forms of funding, such as Tier 1 bank equity, to 0% for the least stable. Being on their balance sheets, unallocated gold owed to a bank’s deposit customers is to be given a Basel III ASF of 0%, which means it will not be permitted to be a source of funding for any balance sheet assets, which must therefore be funded from other liabilities.

- The Required stable funding (RSF) is to be applied to a bank’s assets. Unallocated gold positions are to be valued at 85% of their market value. Note that allocated gold, being held in custody, is not on bank balance sheets (except where the bank actually owns physical gold in its own right) and is therefore not involved in the calculation.

- The Net stable funding requirement (NSFR) is the ASF divided by the RSF and must be at least 100% at all times.

The bullish scenario is that LBMA member banks have to find a lot of physical gold, increasing the demand and pushing up the price. The second bullish scenario for gold stackers is that with the removal of the paper gold positions that suppressed the gold price from inflating against the M2 money supply / global fiat currency expansion, the physical gold price could adjust towards higher prices in line with inflation.

The Technicals

Currently, the ActivTrader sentiment indicator for Gold has the bulls and bears evenly matched at 46%: 54% bears to bulls. If by the end of June 2021 the price of Gold has breached $2000k, the buying frenzy will be further stoked by news headlines, TV adverts and retail investors jumping in on the hype. In the past, this would have signalled the top in the markets, but this time, it would be different as there would not necessarily be that manipulation through the derivatives markets to get a new all-time.

See real-time quotes provided by our partner.

The daily time frame chart has the 20 and 50 exponential moving average stacked on top of one another. The two faster moving averages are about to cross over the longer-term average of 200 periods. The 50 above the 200 would signal a golden cross and the start of what is usually a longer move higher. Key resistance would at previous swing highs located around $1960 with near term support at the recent breakout level of $1844-$1807.