The euro currency is pushing towards the 1.2300 level against the US dollar again, after the pair found solid buying interest below the 1.2200 level in early-week trading. An improvement in market sentiment is helping riskier currencies, such as the euro, to claw back lost ground against the greenback.

Positive news surrounding Brexit has clearly given investor sentiment towards the European economy a boost this week. This is especially evident in euro specific indices, such as the EURO50, CAC40, GER30.

Speaking of market sentiment, the ActivTrader Market Sentiment tool shows that traders are nearly 60% of traders are short the EURUSD, which suggests that the long trade towards the pair is still not crowded at this time.

Retail traders tend to lean against established trends in the market, and are known for poor market timing. This may suggest that until crowd behavior becomes overly bullish or long the EURUSD pair then the uptrend may continue.

In terms of upcoming bullish or bearish catalysts for the EURUSD pair, the inauguration of President Biden would appear to be the next event that could propel the EURUSD pair higher in the new year. Traders and investors perceive a Trump Presidency to be more bullish for the US dollar, than a Biden administration. This is especially true in terms of fiscal policy, and the likelihood of President Biden imposing stricter COVID-19 lockdowns.

Unless the legal battles for the US Presidency show very real prospects of going to the Surpeme court, and the verdict is overturned, then the euro currency is likely to remain northbound against the US dollar currency.

Additionally, a worsening or more virulent strain of the COVID-19 virus across the globe could cause traders to move back into the US dollar. Markets tend to flee into the greenback during times of uncertainty, as was the case earlier this year. With that said, the market appears to be taking the new mutant strains of COVI-19 in the UK and South Africa in its stride at the moment .

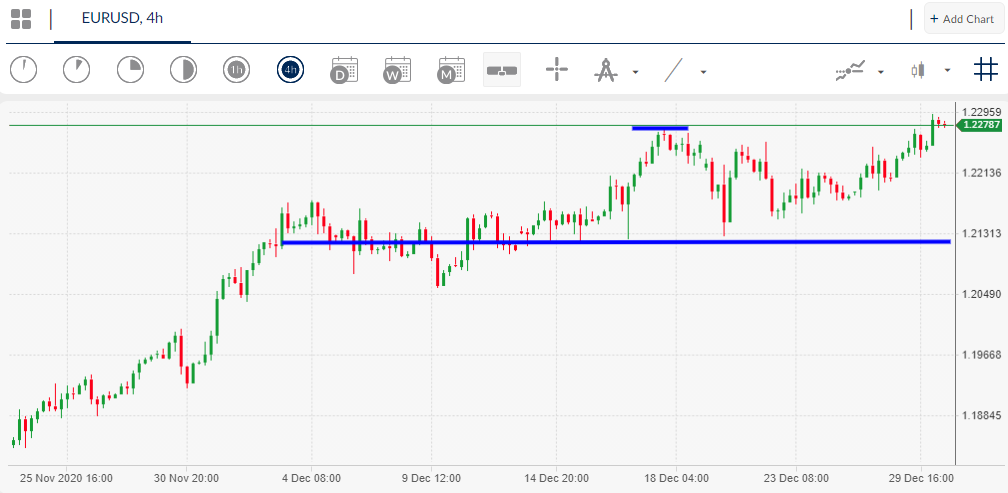

EURUSD Short-Term Technical Analysis

The four-hour time frame shows that sellers failed to ignite a large head and shoulders pattern during the most recent decline in the EURUSD pair towards the 1.2130 area. Once again traders have used the pullback to scale into long positions.

EURUSD bears have reason to be worried in the near-term, as the mentioned bearish pattern will be invalidated if price moves above the 1.2280 resistance area over the coming weeks.

Source by ActivTrader.

According to the size of the mentioned bearish pattern, the EURUSD pair could stage a rally right through to the 1.2400 area if the 1.2280 resistance zone is overcome.

Lower time frame analysis shows that major trendline resistance, around the 1.2330 area, offers the strongest upside barrier for EURUSD bulls, prior to the 1.2400 level. Key support below the 1.2230 level is found a the 1.2200 and 1.2150 areas.

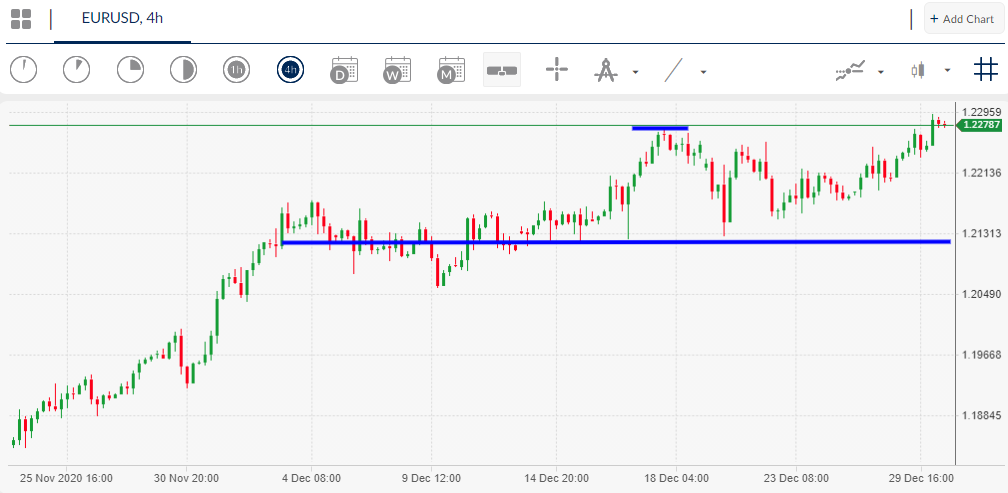

EURUSD Medium-Term Technical Analysis

Looking at the daily time chart, an extremely large bullish reversal pattern will take shape if the EURUSD pair is able to reach the February 2018 trading high, around the 1.2550 level.

According to the size of the bullish pattern, the EURUSD pair could trade towards the 1.4000 area over the long-term. Although this may take sometime to occur, with the time frame obviously being months rather than weeks.

Source by ActivTrader.

In the interim, the daily time frame is showing strong technical resistance around the 1.2290 level, with the April 2018 swing high, around 1.2410, the strongest form of resistance above the 1.2300 level on the daily time frame.

To the downside, a series of upside rejections from the 1.2300 handle could provoke a stronger pullback, with the 1.1960, and 1.1800 levels the likely bearish targets below the psychological 1.2000 level.