Dr. Copper

It’s known as the Doctor as it correlates to the health of the economy, but this relationship is probably going to decouple as copper becomes the #1 critical metal. Tight supply, low-grade resources, of which few can become reserves, an 8-year development timeline for any new project, and a surge in demand, could make copper the trade of the decade.

Recently copper prices have been supported as we head towards the 2011 highs on the back of a strengthening economic recovery spurred on by vaccines and stimulus and the push towards green technologies. The Biden Administration has revealed its infrastructure plan and is determined to rebuild both the old and develop new technologies and infrastructure. The infrastructure built between the 1950s and 1970s is coming to the end of its useful life, whereas the electrification of practically everything incumbent is just getting started it seems.

Copper is up 82.10% in the last 12 months and up 21.68% year to date.

The copper chart shows the front-month contract trading at the highs and well above the Ichimoku cloud. The nearest significant support is the December 2017 swing high down at 330.00 and the rising trend line for nearer-term support.

The 20-year chart of Copper and Oil show that the two commodities have travelled in lockstep but recently the demand for copper has taken prices above the 2018-2019 highs, whereas oil is now stuck in a trading range below the 2018-1029 highs. Such is the demand for copper in the new technologies and the move away from the petrochemical non-green technologies and infrastructure.

Traders are still not 100% convinced that copper prices are going higher as the ActivTrader sentiment shows 27% are still bearish of the commodity.

The tide of copper-intensive electrification continues to rise, while copper supply issues ramp up as countries attempt to navigate the COVID-19 restrictions and meet the Paris Climate Accord numbers. Chile has recently closed its borders as Covid-19 cases are above 1 million and this will have a major impact on the already tight supply. Copper spiked on the news and further price increases should be expected.

China’s copper concentrate imports for March hit a record high at 2.17 million tonnes after delays in shipment earlier this year due to high sea waves at Chilean ports. Chilean copper output also declined by a reported 5% in February to 425,500t. America used to be one of the largest producers of copper, but Chile has pipped them in tonnage in recent decades. Chile and Peru produce 40% of the world’s copper, with China the main importer, so watching the data from these countries gives an indication of the supply v’s demand economic relationship.

China’s March imports of copper and copper products bounced, but Q1 2021 volume continues to fall from the peak seen in late 2020. Analysts are expecting concentrate imports to continue growing for the rest of 2021. With higher imports were also rising smelter productions, with low treatment charges and refining charges still supportive at these levels.

Shanghai Metals Market (SMM) reported refined copper productions are rising continuously and are up 15% year on year but looking across the data in my opinion the demand will outstrip supply.

President Joe Biden is betting that his multitrillion-dollar economic stimulus plan will be a new revolution in technologies and social care but also bolster an American economy decimated by under-investment and the recent coronavirus pandemic. Massive fiscal spending will also help maintain the USA at the #1 spot for the largest economy in terms of GDP growth.

China and America look to be going toe to toe on huge infrastructure spending, as China State Grid is set to accelerate both their green technologies development and the transmission infrastructure of electricity. China State Grid could be using 50% more copper over the next few years, with demand for copper rising by 3 million tonnes as demand increases.

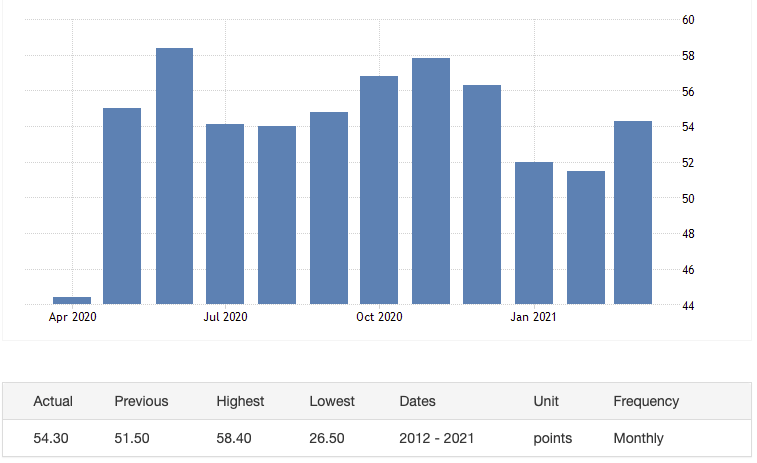

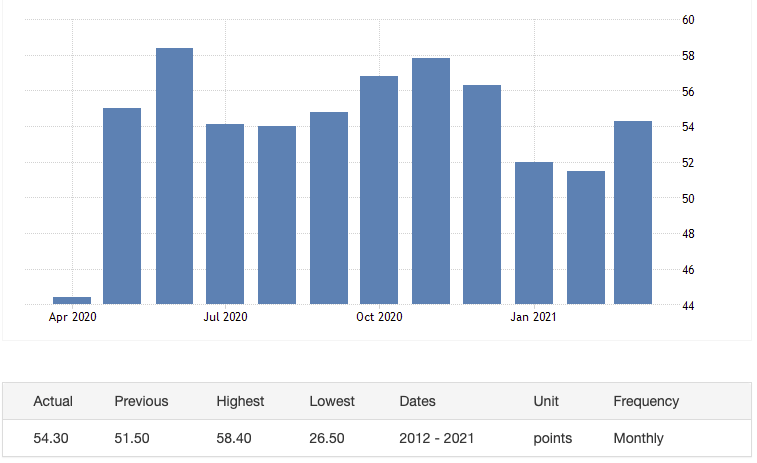

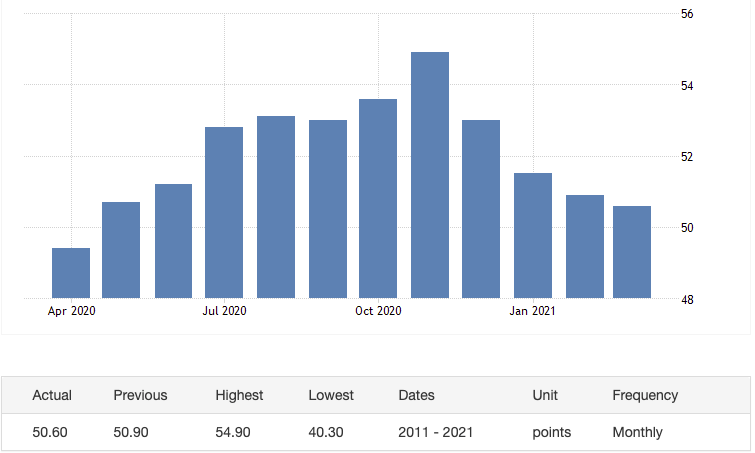

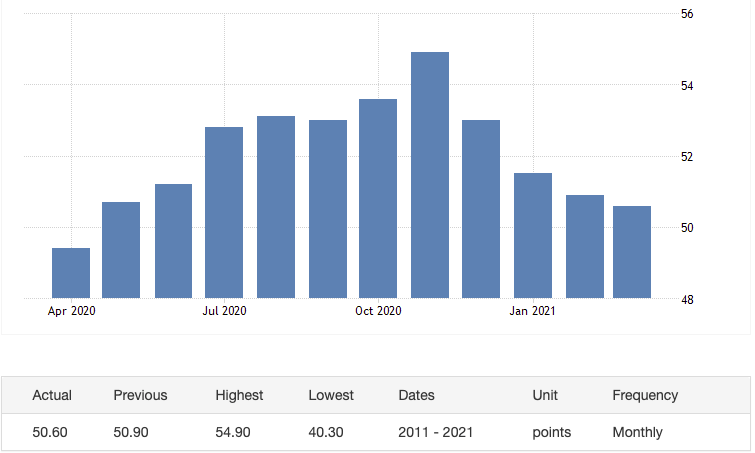

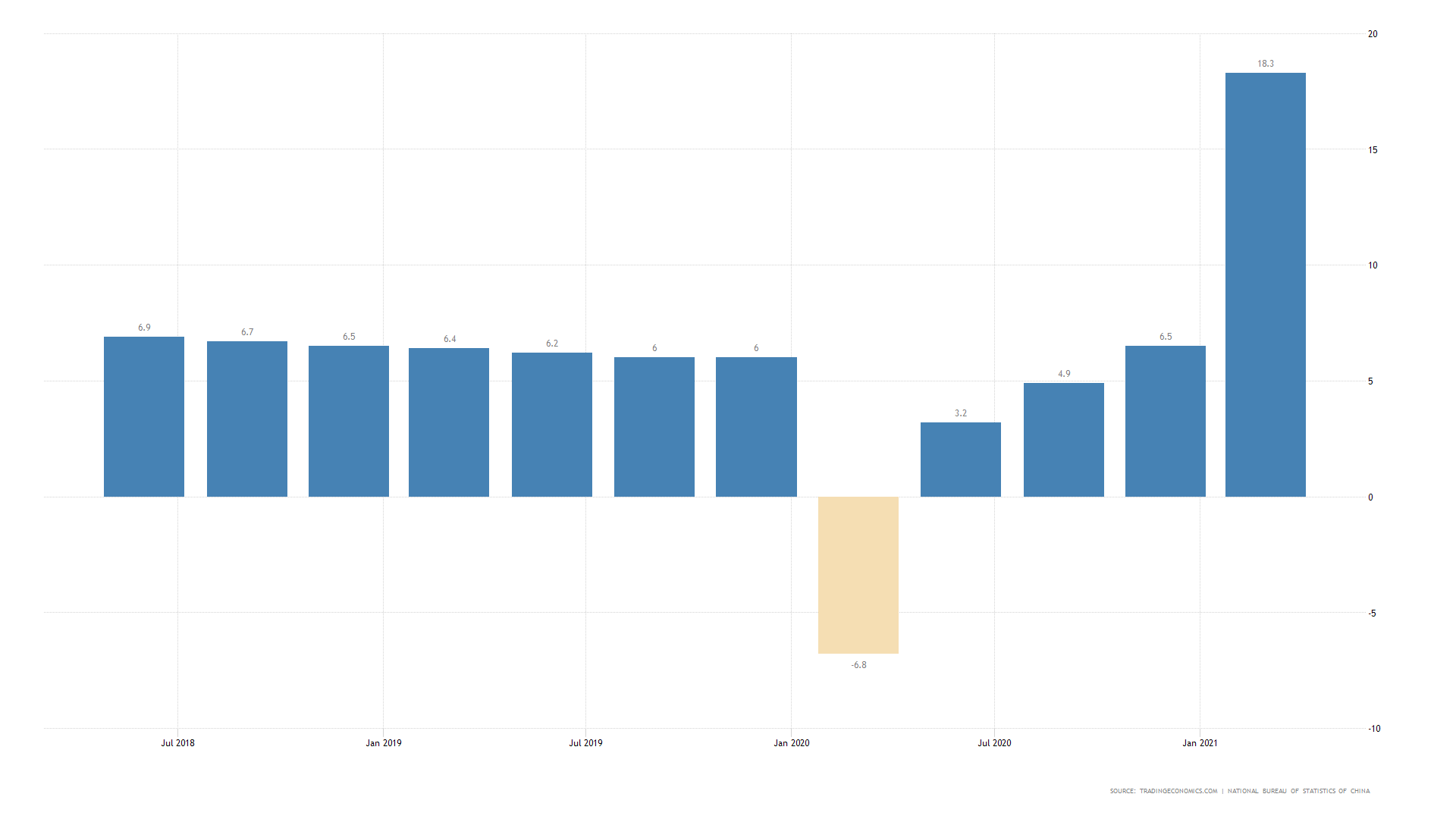

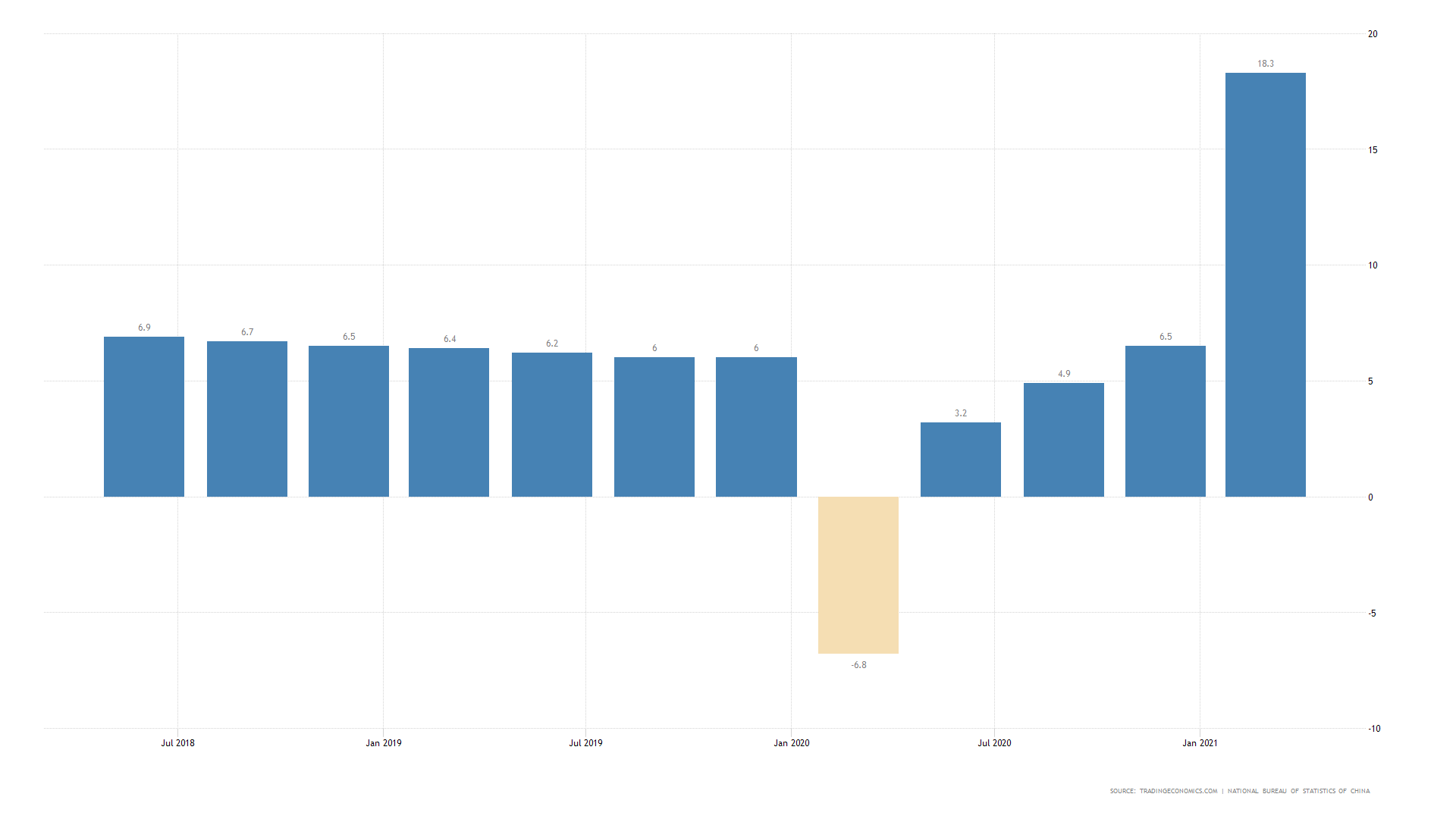

China’s manufacturing sector expanded at the highest level this year in March as factories got put to work to meet improving demand. The official PMI rose to 51.9 last month from 50.6 in February. China’s services sector picked up significantly in March which is providing a positive outlook for copper.

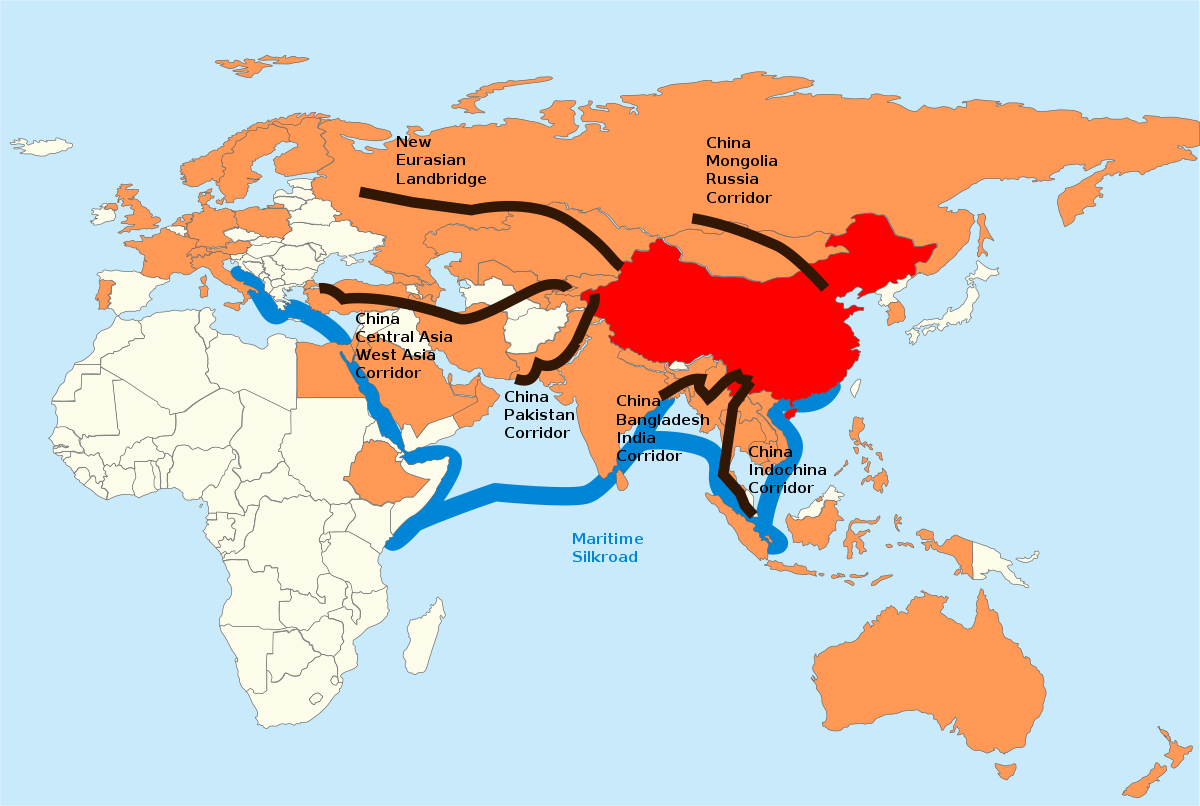

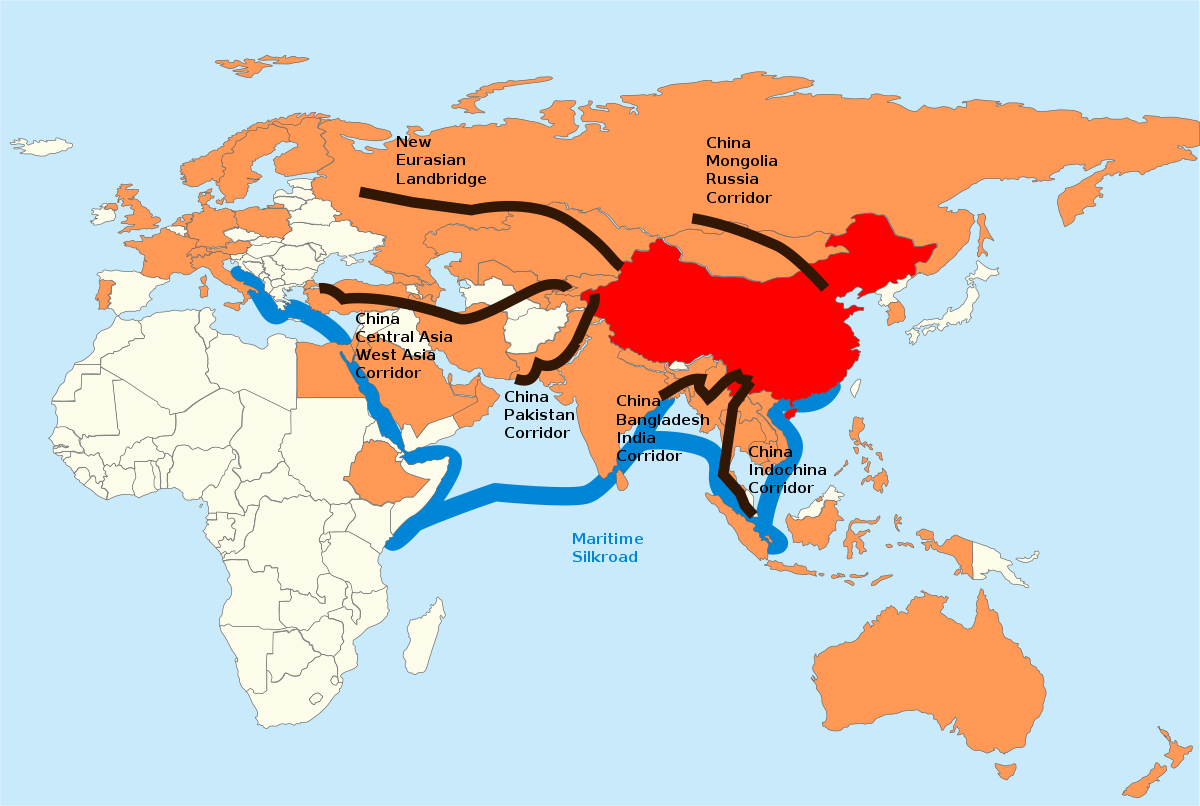

China’s infrastructure efforts are not limited to China’s sovereign borders. In 2013 Xi introduced the so-called ‘Belt and Road’ initiative with China having built or pledged to construct $575 billion in energy plants, railways, roads, ports, and other projects across the globe from Sri Lanka to Greece. This new Silk Road will allow transportation of goods and will give China preferential access to commodities in the future.

This is not the first time China has used its economic power to get the country’s economy growing. After the Great Financial Crash, China’s infrastructure program created the economic boom for the likes of Australia as China built infrastructure, culminating in empty cities and a commodity cycle peak. However, while the copper prices were high, it gave the exploration and producers in the mining sector funds to seek out possible new resources which become economically viable as the price of copper rises.