Weekly Commodity Idea

About 13 years ago a friend and business partner of mine investigated renting some retail space on a street in London to open a coffee shop. Just prior to this we had noticed that a local coffee chain had over expanded and at the height of the Great Financial Crisis had been forced to close a couple of their coffee shops, which led me and others to think that there would be an opportunity to make our move into the coffee shop retail trade. Within the time we had explored what it would take, someone beat us to it and set up a coffee shop around the corner, which led my business partner and myself to ditch our idea thinking that the gap in the market had been filled.

Roll on a further 5 years and we were proven very, very wrong. Suddenly there were coffee shops on every street corner, competing for retail space with the likes of Tesco Metro and other retail chains. Then all the independent shops in the area, regardless of whether their core business was selling second-hand furniture, vintage clothing, hair salon or cycling had a corner carved out for a coffee machine and pastry stall.

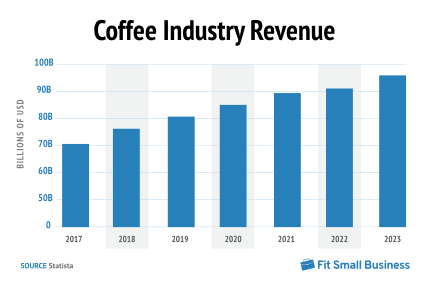

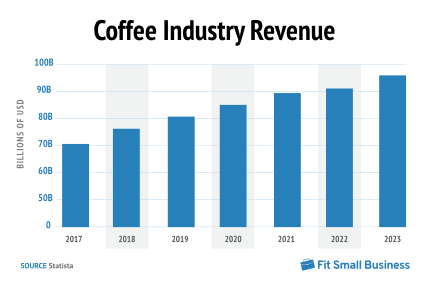

There was literally coffee everywhere and no one seemed to be worse off for having it. The supply could not meet the demand. On the high street, café culture continues to boom, 80% of people who visit coffee shops do so at least once a week, whilst 16% of us visit daily.

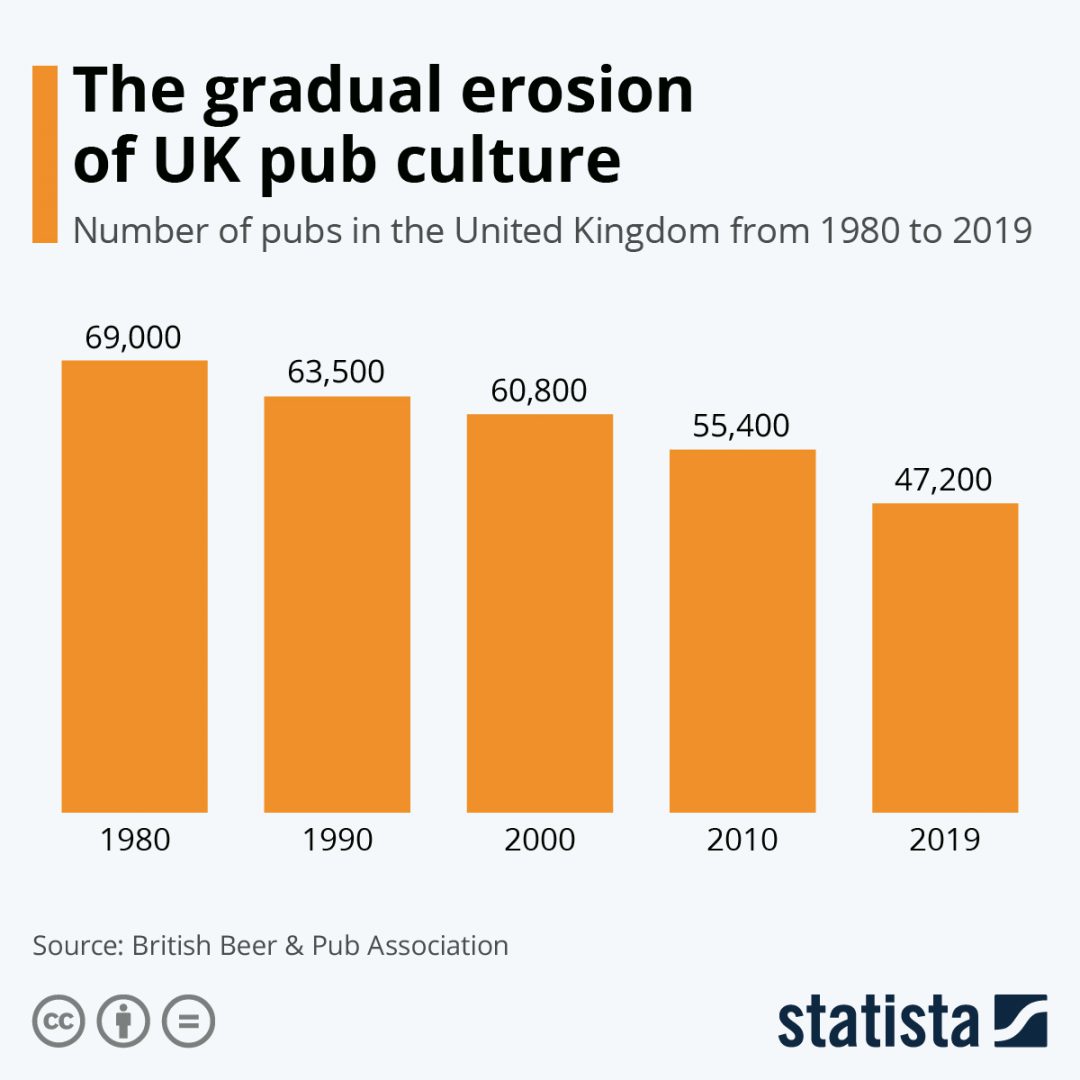

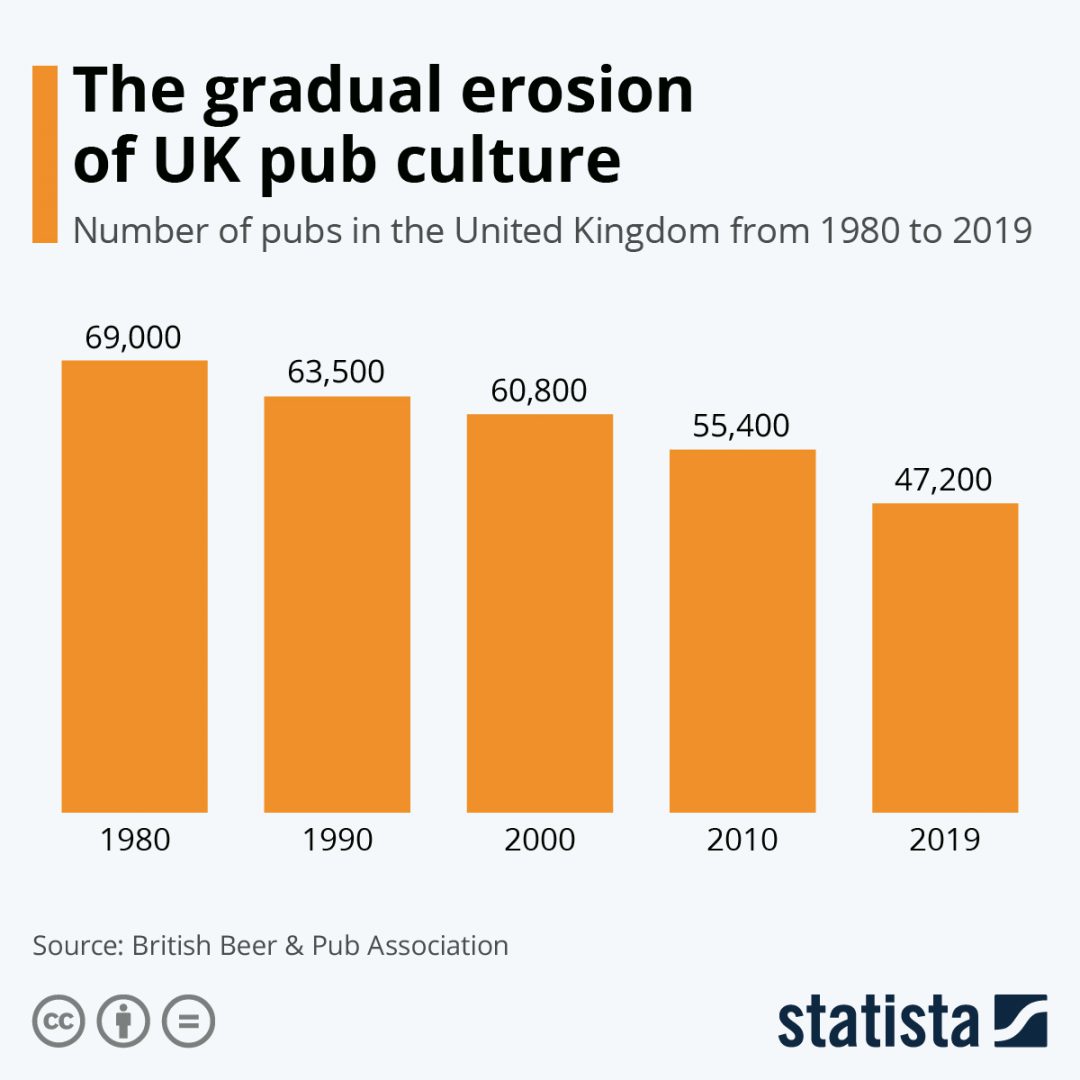

It felt as though the demise of the British pub correlated to the rise of the coffee shop, so maybe where people may have met for a couple of swift halves and a chat they had switched to a cappuccino or flat white. Maybe the caffeine was more addictive than the mix of cigarettes and alcohol which had been outlawed from public spaces like the pub. It could have been a fad but even though smoking is in decline and pubs have been under extreme pressure, the coffee continues to be drunk more and more.

In 2019, 95 million cups of coffee per day were consumed in the UK. Currently there are 66.8 million adults living here, so on average we drink nearly 1.5 cups of coffee a day. Personally, I probably have 3 but maybe I should reduce that. Globally, coffee is the second most drunk beverage, with only water being more widely drunk.

In 2020, the 3 largest coffee companies were Starbucks, Costa Coffee and Tim Hortons. For those who have never heard of Tim Hortons, they are from Canada but have a global reach.

See real-time quotes provided by our partner.

Starbucks were in the financial press today on the announcement that they in South Korea they are selling 17.5% stake in their Joint Venture to their local South Korean partner E-Mart inc. and the Singapore sovereign wealth fund GIC. They are also reporting for their fiscal Q3 2021 results at today’s market close and analysts are expecting good numbers. The company has reported better than expected earnings figures for the last four quarters with the latest revenues beat consensus too. The company’s net income margin fell in 2020 due to much higher operational expenses. The reopening of the restaurants, reduction in restrictions, and lower operational expenses are expected to improve the earnings in 2021.

The future however looks likely to be a bit more challenging for Starbucks and maybe the coffee industry. Over the last couple of months there has been crop devastation in the areas of Brazil where Arabica coffee is grown. Starbucks proudly state that they only use 100% arabica beans, “so you can enjoy the delicious, high quality these beans help to create”.

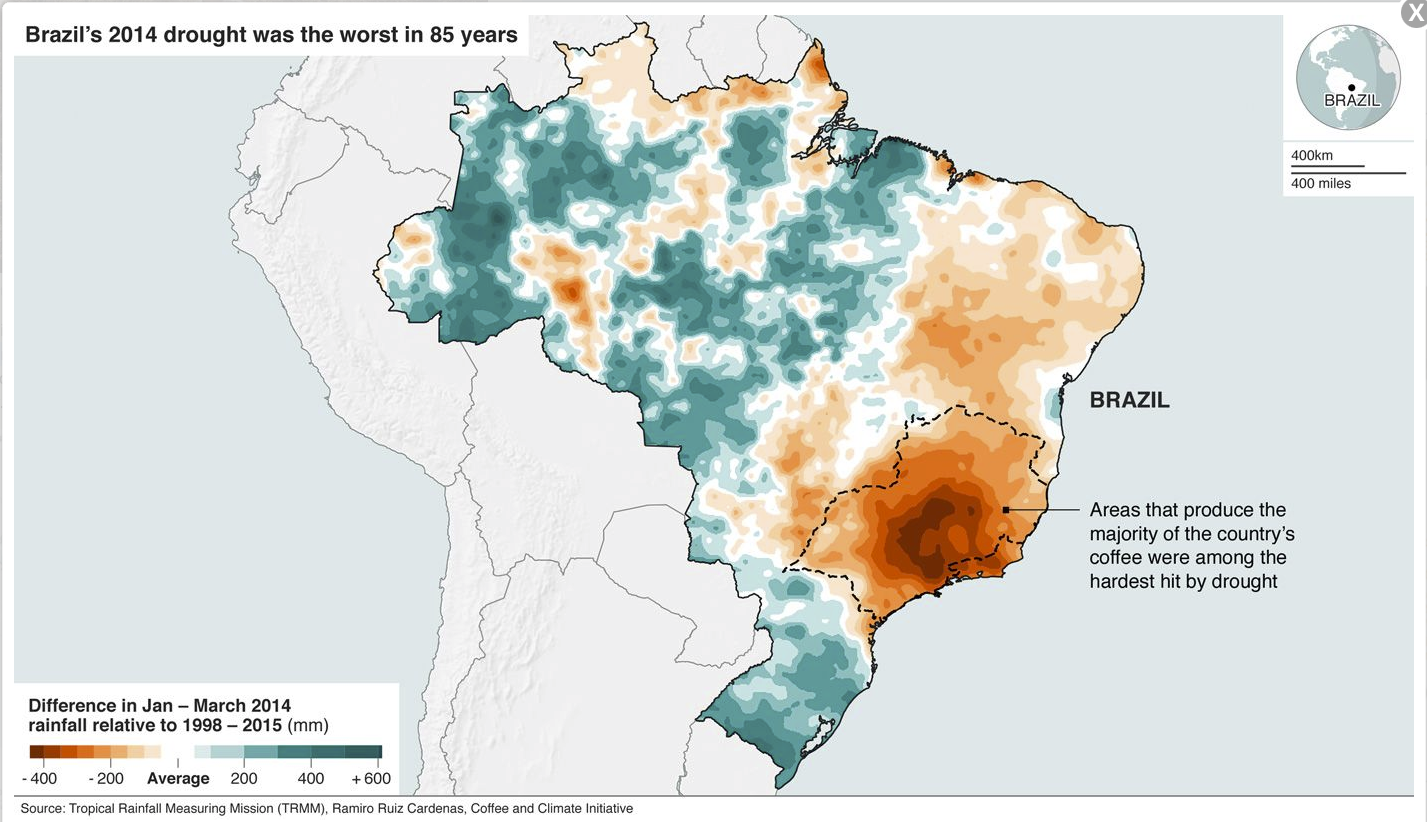

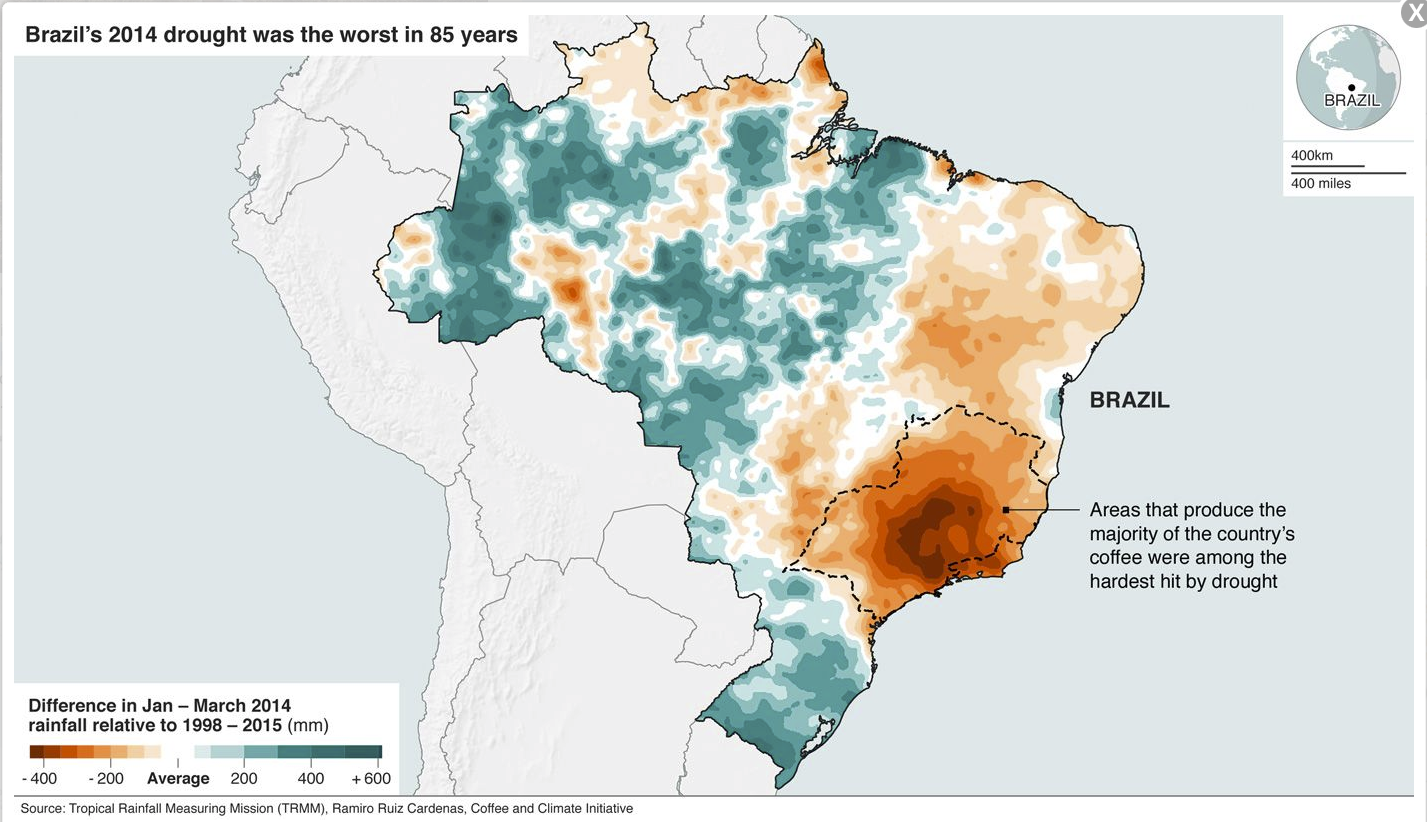

About 70% of Brazil’s arabica coffee is grown in the central Minas Gerais region, which is in the north of the southeast region of Brazil, which also contains the states of São Paulo, Rio de Janeiro and Espírito Santo. It is Brazil’s fourth largest state and has the second largest population, exceeded only by that of São Paulo. Minas Gerais alone produces approximately 50% of Brazil’s total coffee and has thrived since 1727 due to the ideal temperature, heavy rainfall, and a distinctive dry season, which has provided optimum growing conditions.

Climate change is influencing the coffee production of Brazil and the considerable changes in recent years have resulted in higher temperatures, long droughts interspersed by heavy rainfall, more resilient pests and plant diseases. Recently though there has been wide ranging frosts. Today Bloomberg ran a headline story which stated that a crop killing frost is imminent for the Minas Gerais region adding to the previously damaging cold weather from last week.

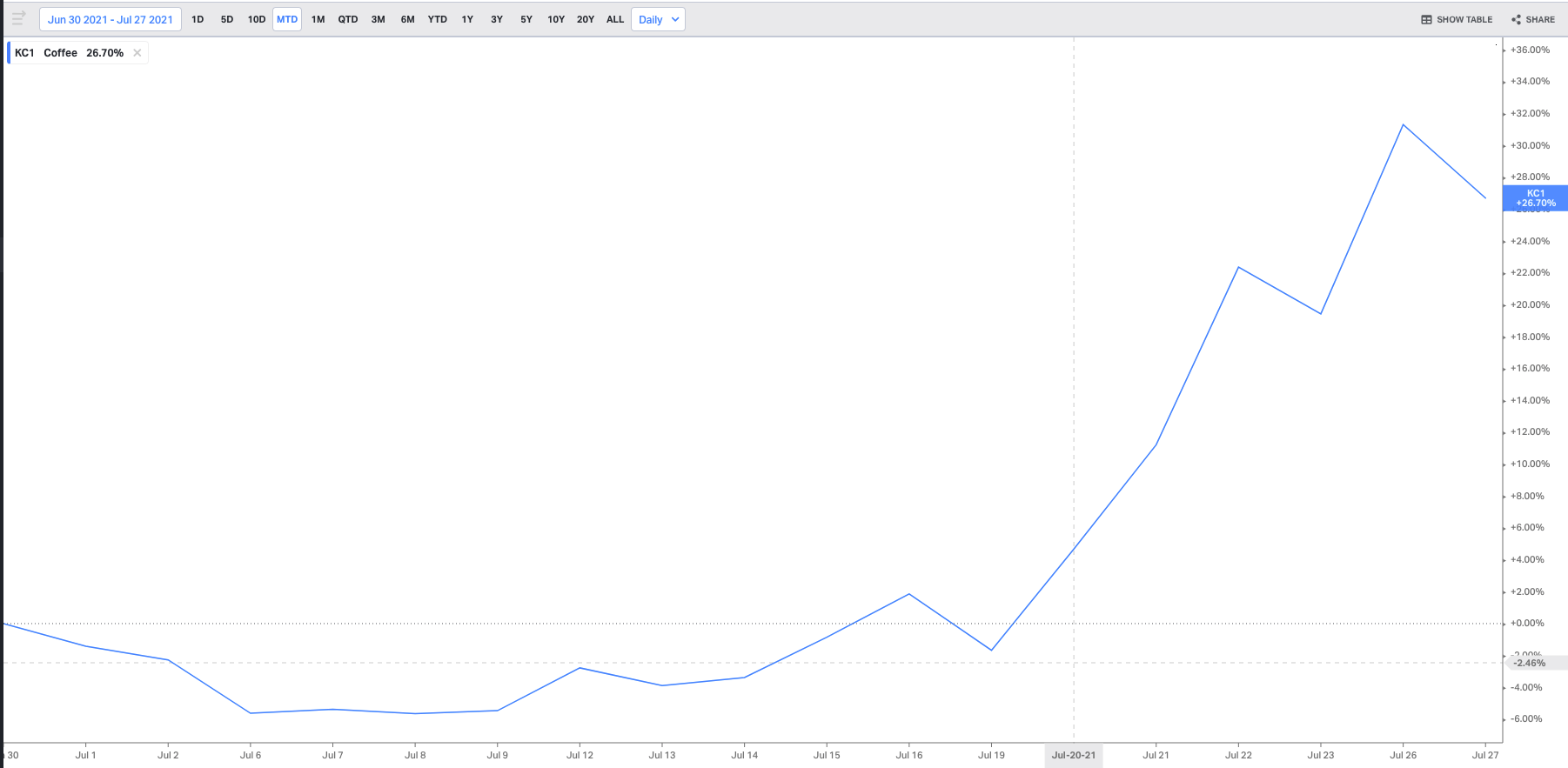

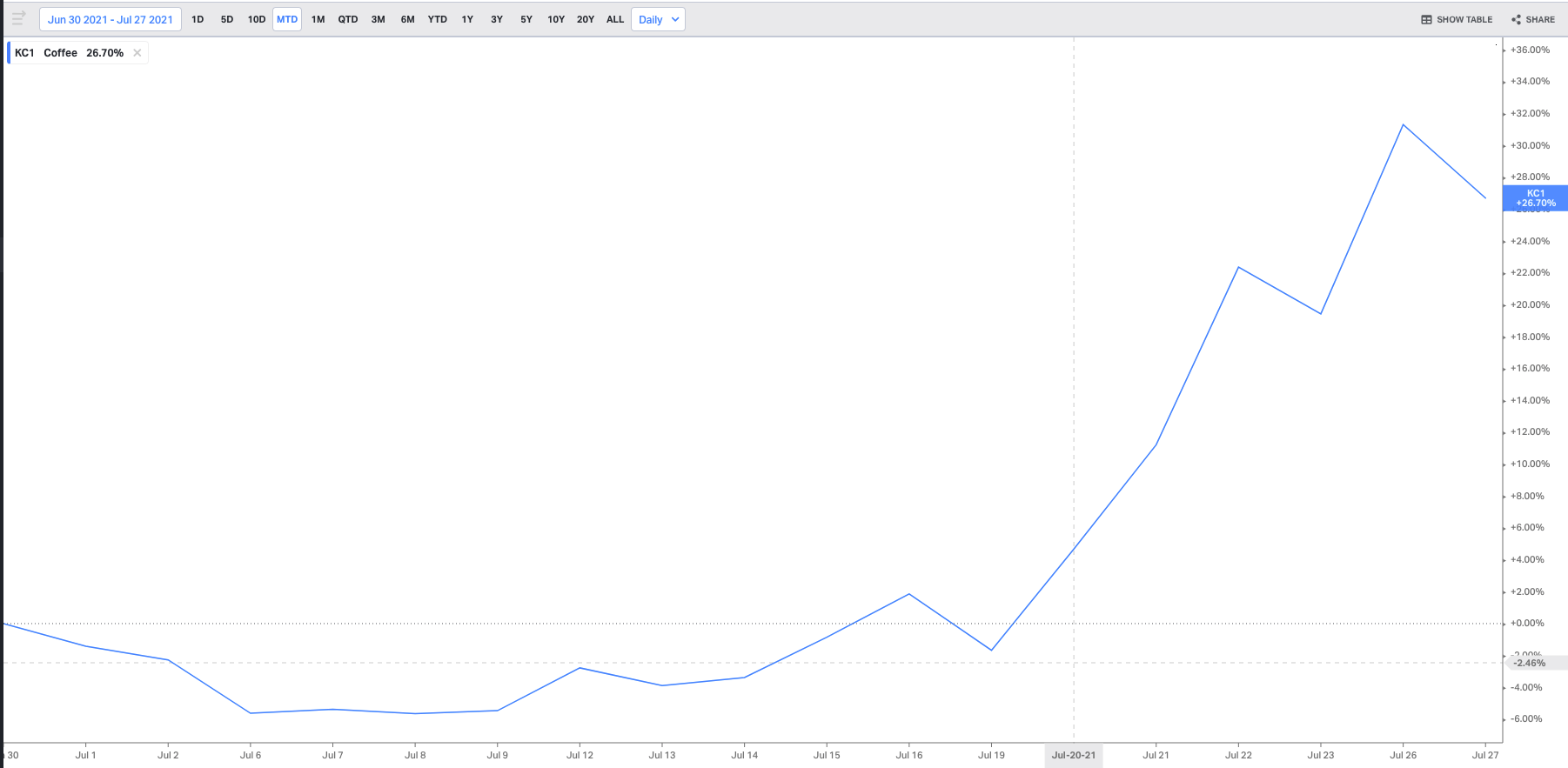

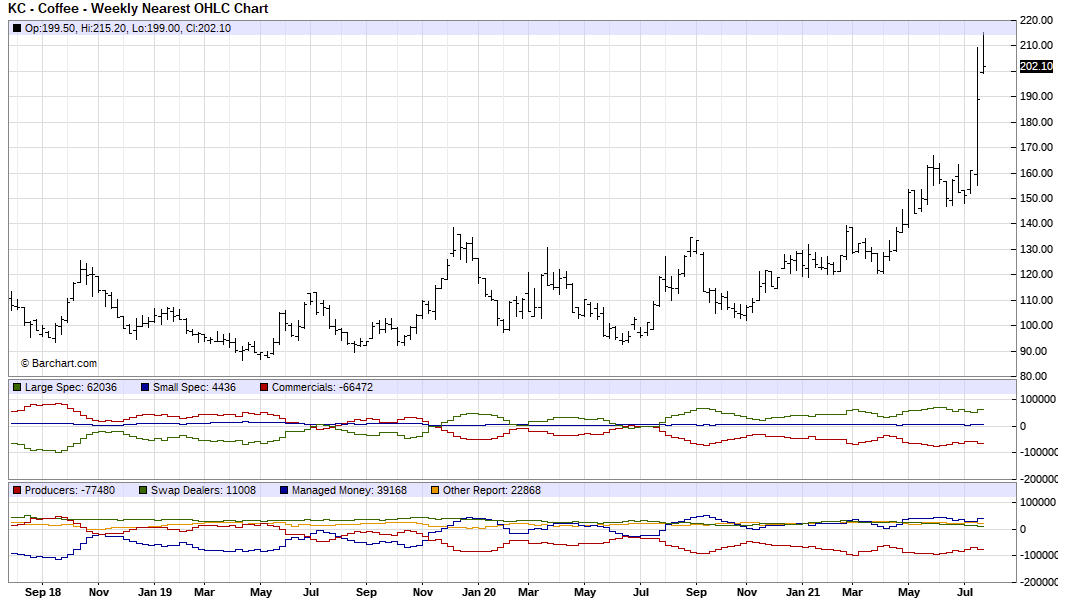

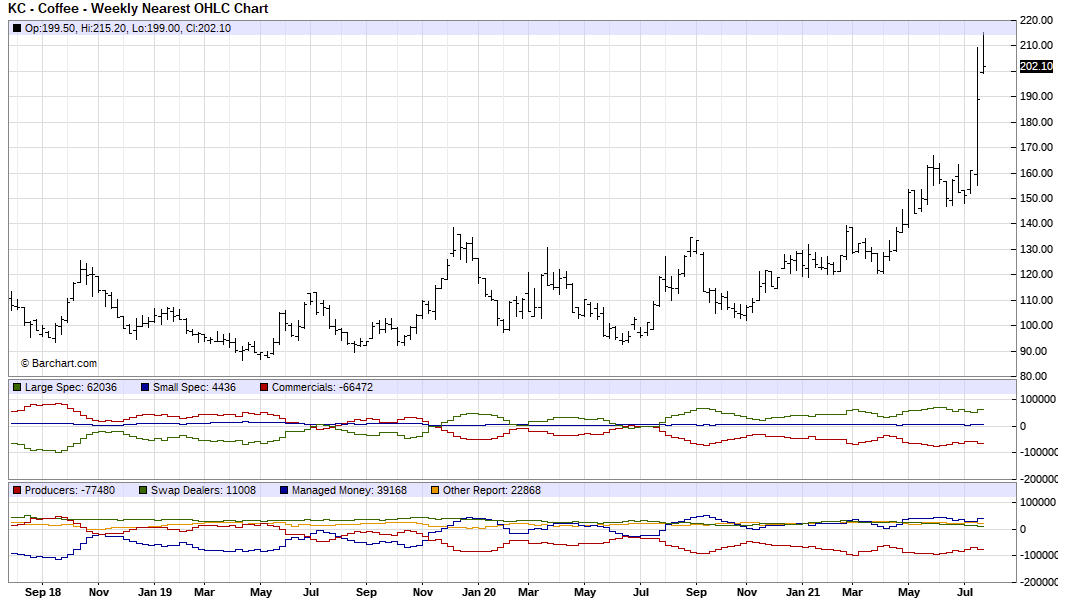

Coffee futures have skyrocketed 26.70% in the last month and that is adding to the year to-date run up of 84.96% returns, but the ActivTrader sentiment indicator shows that 79% of traders are shorting these prices.

Usually when the retail sentiment gets to this extreme, I look for ways to fade them and to see if they get squeezed out of their position. I can only assume that the traders that are short believe the same will happen to coffee prices as it did to lumber. Where a supply shock sent the cost of lumber rocketing higher only to then have prices tumble on lack of demand and oversupply. The difference is there are forests of trees ready to be cut down should there be a supply shortage, and assuming the bottlenecks at ports free up soon, there should be a return to normalcy soon for most commodities. However, if you are reliant on an annual crop and the weather goes against you, there is nothing that can be done about this year’s crop if it fails. The demand will be left unfulfilled, and prices will increase at the consumer end.

Coffee producers can employ a short hedge to lock in a selling price for the coffee they produce while businesses that require coffee can utilize a long hedge to secure a purchase price for the commodity they need.

Following the managed money or going opposite to the producers’ hedges would appear to be a good passive way to follow the trend using the Commitment of Traders report over the long term. The recent data showed that producers added to their short hedges as coffee futures prices increased.

See real-time quotes provided by our partner.

When there is a macroeconomic and fundamental reason for a trade, I find it is always best to go with the trend. Currently that trend is for higher prices. Because the coffee is a soft commodity in high demand, traders will have to keep an eye on the weather forecasts and crop yields. Which makes it a bit more involved than just buying on a moving average cross.

That said, I wouldn’t blindly buy at these elevated levels, any chance of a pullback should be considered a buying opportunity for now, as momentum is to the upside and so is the price action. A lot of the time momentum will lead price. Whether the opportunity can come at the breakout level of 168.00, I don’t know, but if it did, the stops would most likely go below the next swing low as prices continued higher.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |