Weekly Investing Idea

At the end of last week, the market had to digest a massive miss in the expectations for non-farm payrolls (NFP) jobs data. This comes on the back of some serious downturns globally through the manufacturing and services sectors, with the added worry of increasing disruptions due to the covid-19 delta variant.

Prior to the 2020 pandemic job losses, an NFP reading of 235k would have been very welcome, but as it stands, the labour force participation rate is very low, and the US economy could do with a million jobs being added each month for the Federal Reserve monetary policy to be proven effective.

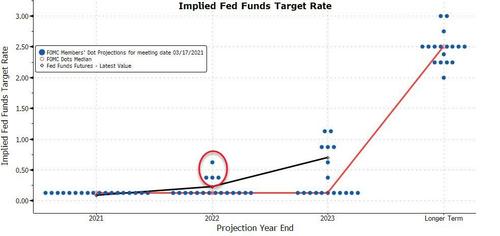

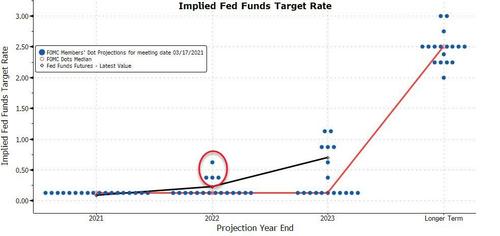

Currently there is a consensus timeline that the market is following based on prior FOMC meeting minutes and Fed speakers. Now that we have had the Jackson Hole symposium, the next 3 FOMC meetings starting in September, become very important. September should have been when the monetary policy committee gives more formal hints of a taper. With November FOMC meeting being the consensus earliest time for a formal announcement.

If there is still a timeline, January would be when the taper starts, with the end of 2022 concluding this action with a view to starting a rate hike in the second half of 2023. Whether or not that timeline is still intact will become more apparent as the markets reposition themselves for a delay (or maybe not).

At the June 2021 FOMC meeting 4 members were expecting the economic conditions to favour a rate hike as early as 2022, with that number increasing to 7 for a rate hike in 2023.

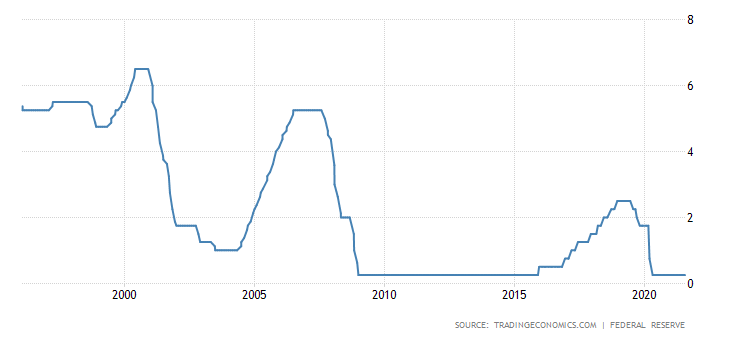

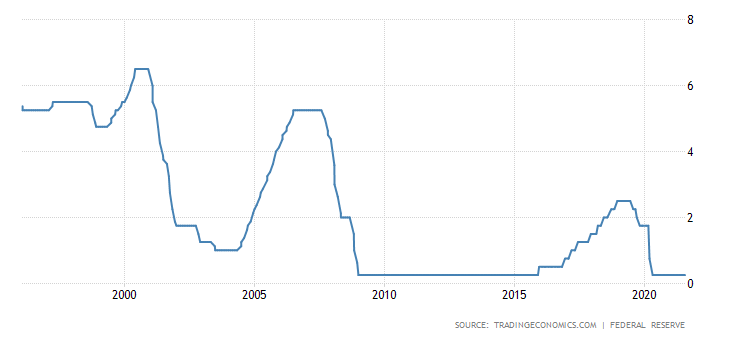

It took the Fed nearly 7 years to begin raising rates after the Great Financial Crisis, so if the economic outlook doesn’t get any better there is a precedent for them to keep rates lower for longer. The big difference between now and then is that during 2020, the central banks were at a loss to how to support the economy without direct intervention from governments and fiscal spending. The US CARES act made sure that US dollar were directly sent to US citizens and for some this is what is now causing the inflationary pressures as seen in the higher readings in the CPI and PCE indicators. Although the Fed would like to get inflation back towards 2% it is holding off from hiking rates as it thinks the inflationary pressures will pass.

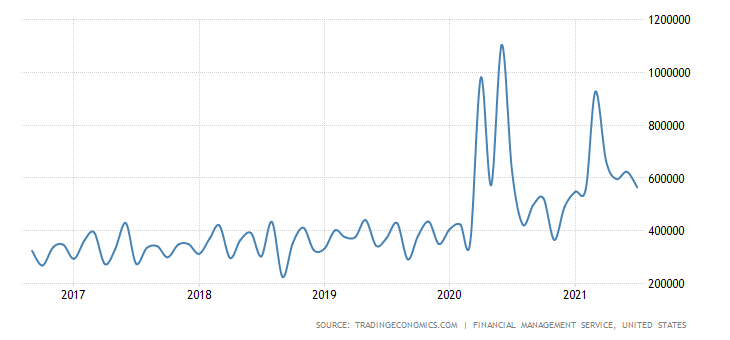

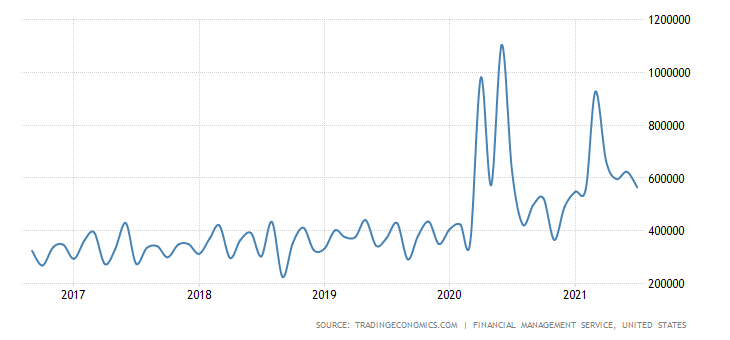

Looking at the US fiscal spending since 2020 it is obvious to see that current levels of spending are still far above the 5-year average by all most 200 billion. This money seeps into the markets both directly and indirectly and has gone a long way in keeping this equities bull run moving higher since March 2020. We now have MEME stocks being pushed by retail traders, running alongside corporations that have been able to buy back stock or directly benefit from a change in consumer culture, like the work from home phenomenon.

See real-time quotes provided by our partner.

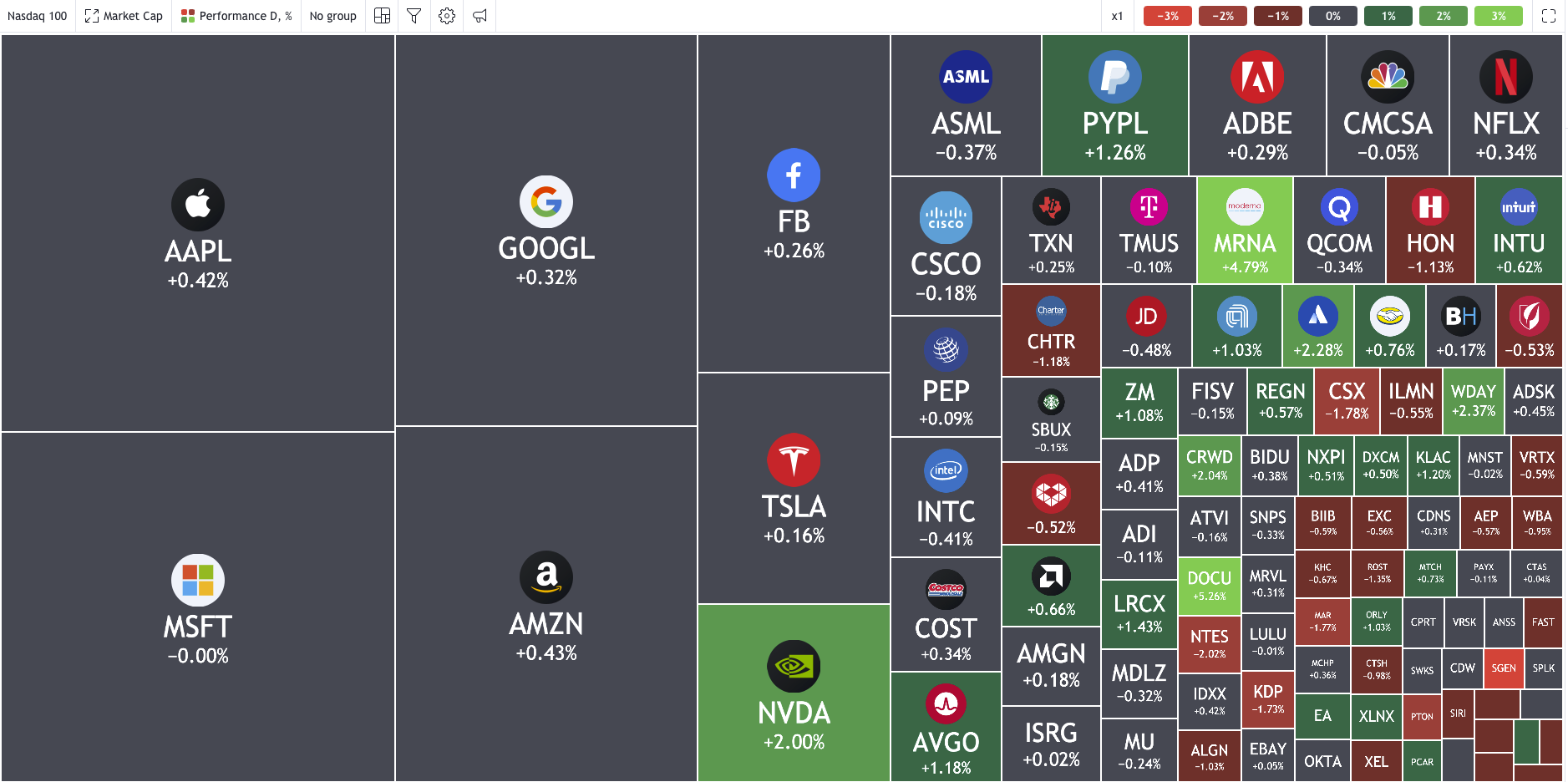

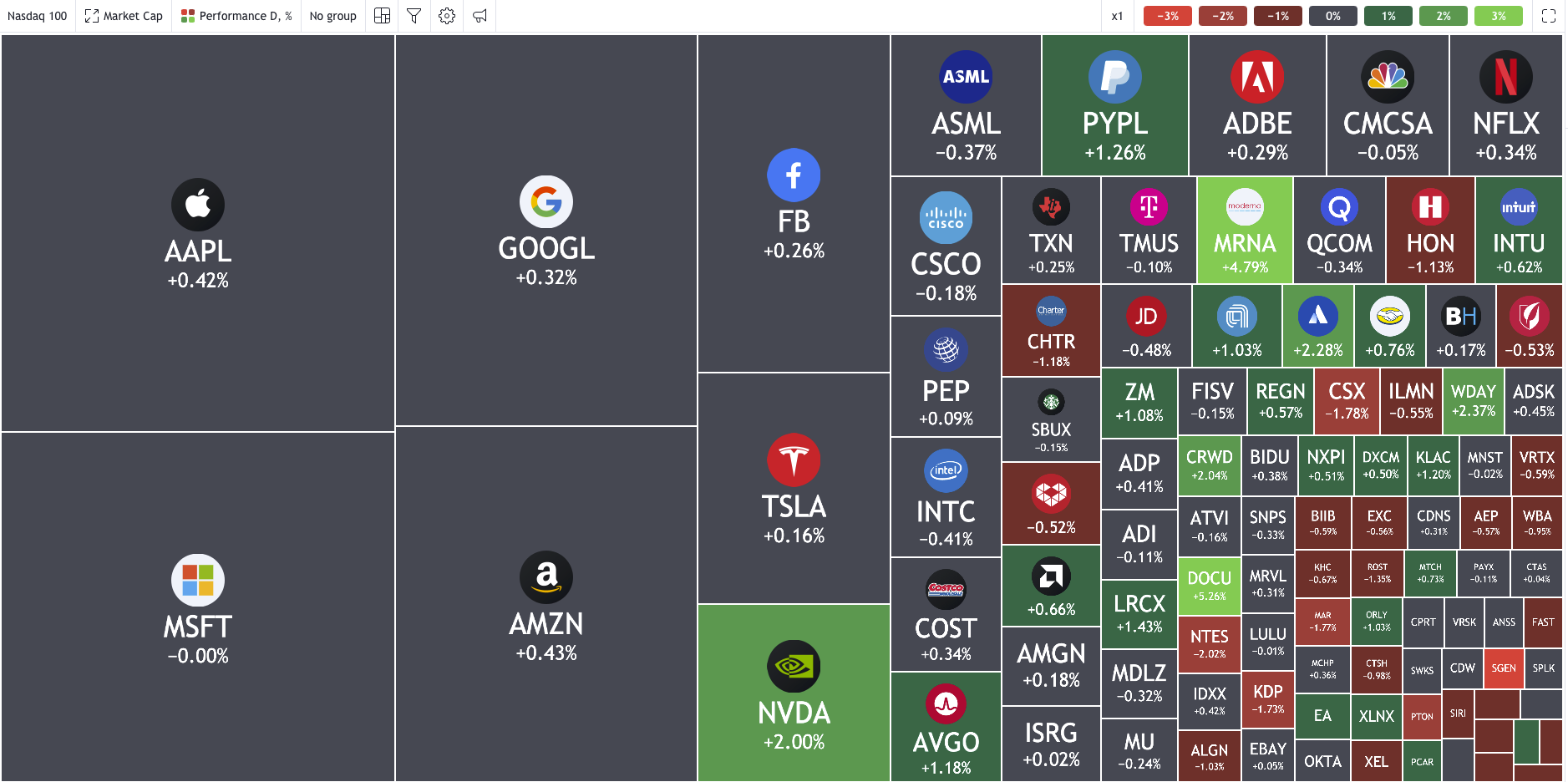

Since the June FOMC meeting the Nasdaq has moved higher by over 1500 points. The momentum and price action look extremely bullish with dynamic support being seen in the 20 and 50 daily exponential moving averages as great buying opportunities. There have been times of uncertainty in the Tech-focused index, with downside pressures coming as investors sold their positions as run-away inflation fears were being stoked by yield curves steepening. Also, there was a moment when the tech stocks looked like they were being ditched in favour of more industrial and materials as investors cycled out of the stay-at-home names as vaccination programmes appeared to be having a positive effect against covid-19. If there were a rate hike cycle it is possible that some companies who service a lot of debt would become less profitable. In an era of low interest rates and low to negative yields, there has been no alternative but to keep ploughing more money into stocks or the crypto verse.

As can been seen in the Nasdaq (weighted) heatmap, the four largest by capitalisation are Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), and Amazon (AMZN). All of whom closed near or at their open on Friday. When these 4 moves in the same direction the Nasdaq can be trending, and for the last year the cumulative gains these companies have created are all positive.

Amazon is clearly the laggard of the group and a deeper dive into why investors are less enamoured with this company would be needed, as the consumers have obviously moved towards an on-demand, on-line shopping experience, forcing bricks and mortar retail to suffer longer than just the lock-down disruptions.

See real-time quotes provided by our partner.

Technically the AMZN ticker is bullish as the daily chart price is above the 200-exponential moving average (ema). Momentum is slow though, as we are on day 248/365 of 2021 and the 200 ema is just poking through the years opening price. In hindsight it would have been a great trade to use the years opening price as a mean regression to trade towards when price moved to the edge of the previous swing high or low.

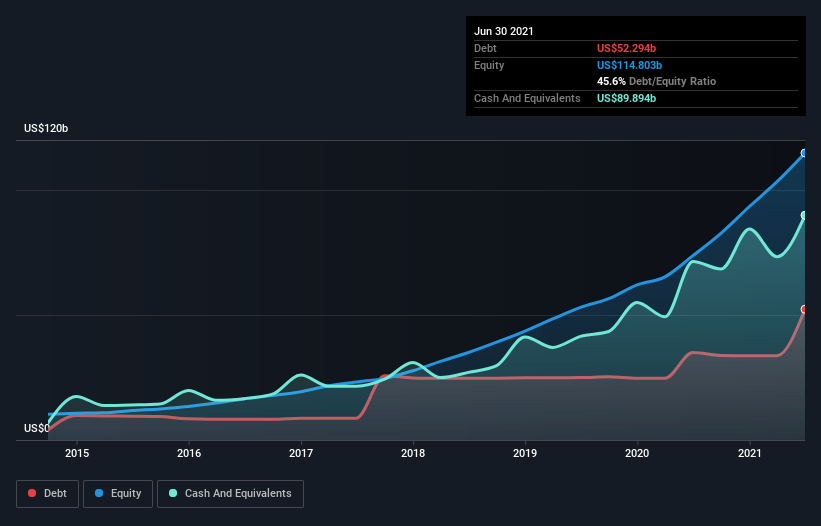

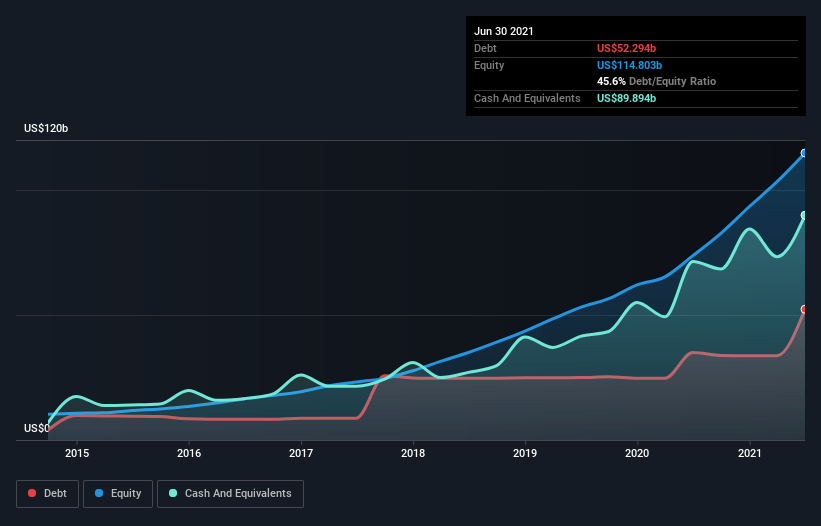

Amazon have a debt pile of $52.3bln with a market cap of $1.76trln so currently in a great place. At $3,482 a share the consensus is that Amazon are trading below fair value at $5,000 and $6000 would be classed as overvalued. This gives investors a lot of potential to the upside considering we could be in an accumulation phase. If we were to get into a rate hike cycle Amazon are in a great place to service their debt so any knee jerk panics should be considered a buy the dip opportunity. While institutional investors are happy holding the stock, retail investors should be comfortable looking for entries too. Currently the largest shareholders of Amazon are Jeff Bezos, with ownership of 10%. The Vanguard Group Inc. is the second largest shareholder owning 6.4% of common stock, and BlackRock Inc. holds about 5.4% of the company stock. Vanguard and BlackRock are not the sort of funds that flip flop, so their holdings are key indicators of when to buy and hold or sell.

From the above chart the debt is expanding along with the equity and cash equivalents, so any change in trend should be quickly identified with an early warning coming from a drop in equity as a red flag for those worried about long term implications on an increasing debt burden. Amazon use their credit line to continuously grow into areas that the world seems to be shifting towards, or maybe Amazon are leading the way and we’re all following? For example, Robotic Fulfilment Centres, Renewable energy projects in Canada, USA, Finland, and Spain. Cloud computing and technologies, entertainment and TV/film distribution. With founder Jeff Bezos now successfully travelling into space.

A new trend to watch for is online reselling and goods arbitrage. SME’s are able to pick up stock at wholesale prices and resell at a premium through Amazon through the Amazon’s “Fulfilled by Amazon” function to store and ship out goods. In some cases, an individual or company can even sell without having the cost of warehousing through drop shipping business models. There will be a consolidation of the smaller businesses selling online as larger companies try and regain market share, but individuals and small start-ups are able to build through the “Fulfilled by Amazon” and will price competitively to control the “buy button”. The net result is more goods priced at value, will be sold through Amazon and we will become more reliant on the company for their distribution channel. For Amazon they will take their cut and build revenues.

See real-time quotes provided by our partner.

The latest intraday price action shows that s previous market structure support acted as resistance on Friday. If we see price travel higher and retest that level of $3531 as support the July swing highs would make for a good upside target. $3780 would be a new all-time high with monthly, weekly and daily momentum signalling this is the most likely scenario.

When traders return to the markets following the Labour Day bank holiday, I am expecting some volatility, so will be interested to see which way the markets melt. I have a feeling the bad news for the Fed watchers is good news for the equities markets and their high growth constituents.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |