Market Brief

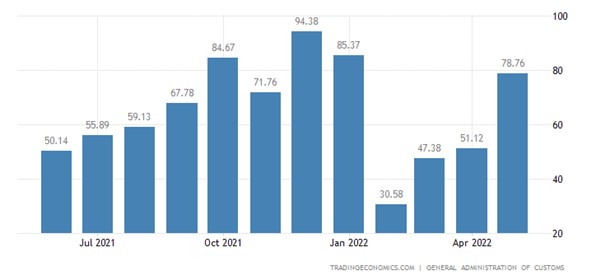

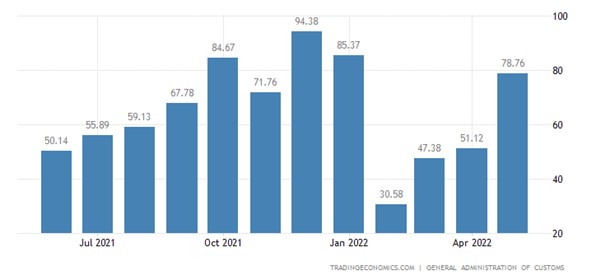

In May, China’s trade surplus reached 78.8 billion dollars, according to official data released this morning. The figure was significantly higher than expected at $58 billion. The exports increased 16.9% on a yearly basis, versus an expectation of around 8%. China’s imports grew by 4.1% as opposed to the expected 2.0%. This is fantastic news in light of the 100 shipping container vessels stuck outside Shanghai during the lockdown in May. The Biden administration may also ease some tariffs imposed by Trump, which could boost exports from China. Considering that the USA is the largest consuming nation and a net importer, there is a possibility that China will export deflation with its boom in exports. This may be confirmed by US CPI data tomorrow.

See real-time quotes provided by our partner.

With the Chinese yuan/renminbi weakening against the US dollar, Chinese exporters have also benefitted, so now we await a further appreciation of the US dollar and a breakout of the bull flag that is developing on the USDCNH daily chart. Two days after lifting the two-month lockdown, new cases of COVID found in Shanghai were mentioned in China’s news. As there is still zero tolerance for COVID, the economic hub may also be closed again because of the policy.

The big focus today will be the ECB monetary policy decision. It is expected that ECB President Lagarde will announce an end to the Asset Purchase Programme and then give the markets a plan for when the central bank will raise interest rates and by how much. The hawks amongst the council want to see the ECB match the Fed with a 50bps rate hike, with positive rates by the end of the year at least. The moderates want smaller steppingstone increases, so most probably around 25bps. The euro is likely to drop if there is no timeline given.

See real-time quotes provided by our partner.

The EURUSD has been asleep for a couple of weeks coiling around the 1.0700 level and as it happens the 9-period EMA on the daily chart. The compression is most likely to be expanded today and my hope is that they test to the downside of the channel first, with the possibility of an extension towards 1.0400. If they test to the upside to take the liquidity there, we may get stopped out of our short and have to re-enter again next week.

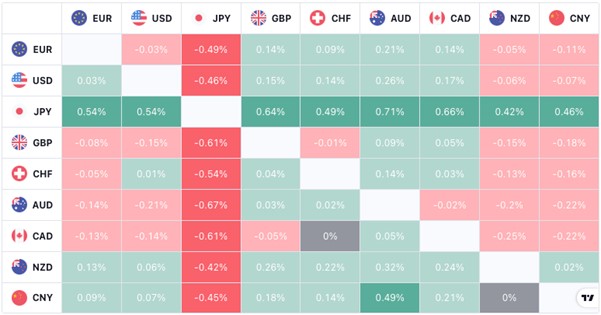

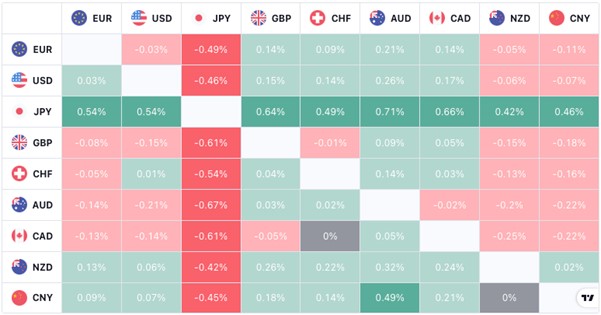

The yen has flipped from being the weakest currency at the start of the week to having relative strength against all the other currencies at the London open today. The US 10-year yields peaked at 3.060% in the Asia-Pac session and as the London session started dropped to nearly 3% at the time of writing. The USDJPY has been tracking the US yields very closely, so we should keep an eye on them too.

See real-time quotes provided by our partner.

Gold compressing at the lower bound of the rising channel looks ominous. The price action to the upside is being capped by the daily 200 EMA and if we do get a strengthening in the US dollar the precious metals group will all come off more than they already have today. Currently gold is lower by just -0.15% but platinum is down -1.74%.

Commodities like WTI and Brent are lower today and one piece of news caught my eye from China which stated that crude imports between January to May were down by -1.7%, even though it is said that China, India, and Turkey have all accepted more Russian oil since the start of the Ukraine invasion. With higher oil prices some energy suppliers turn to LNG as a source, and today the UK natural gas price has risen by a massive 40.08%, taking the weekly rise to 16.90%. The surge is due to a massive fire at a US LNG terminal.

See real-time quotes provided by our partner.

The EURJPY is currently trading back into yesterday’s price range and could possibly backfill a lot of the previous days, should the ECB disappoint.

However, with the ActivTrader sentiment indicator showing an extreme level of bearishness, coming in at a massive 92% of traders short. I am fully expecting another push higher in the EURJPY to stop this cohort out. A pull back to the 140.00 level would be a great test of previous resistance to see if that is where the floor is, though with this much momentum to the upside, it would take a serious disappointment with regards to rate hikes from the ECB to get such a correction.

© 2020 YouTrading UK - Leaders in Trader Training.

| Cookie | Duration | Description |

|---|---|---|

| __cfduid | 1 month | The cookie is used by cdn services like CloudFare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. It does not correspond to any user ID in the web application and does not store any personally identifiable information. |

| _wpfuuid | 11 years | This cookie is used by the WPForms WordPress plugin. The cookie is used to allows the paid version of the plugin to connect entries by the same user and is used for some additional features like the Form Abandonment addon. |

| cf_use_ob | This cookie is set by the provider Cloudflare content delivery network. This cookie is used for determining whether it should continue serving "Always Online" until the cookie expires. | |

| cookielawinfo-checbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-advertisement | 1 year | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Advertisement". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| YSC | session | This cookies is set by Youtube and is used to track the views of embedded videos. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. |

| _gid | 1 day | This cookie is installed by Google Analytics. The cookie is used to store information of how visitors use a website and helps in creating an analytics report of how the website is doing. The data collected including the number visitors, the source where they have come from, and the pages visted in an anonymous form. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to deliver advertisement when they are on Facebook or a digital platform powered by Facebook advertising after visiting this website. |

| fr | 3 months | The cookie is set by Facebook to show relevant advertisments to the users and measure and improve the advertisements. The cookie also tracks the behavior of the user across the web on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website. This is used to present users with ads that are relevant to them according to the user profile. |

| test_cookie | 15 minutes | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | This cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. |

| Cookie | Duration | Description |

|---|---|---|

| _gat_UA-42160853-2 | 1 minute | No description |

| cf_ob_info | No description | |

| CONSENT | 16 years 8 months 3 days 6 hours 2 minutes | No description |